Source: http://www.zerohedge.com/news/2015-07-26/its-not-just-margin-debt-presenting-complete-chinese-stock-market-ponzi-schematic

Late last month in “The Biggest Threat To Chinese Stocks: Shadow Lending Crackdown“, we suggested that the pressure on Chinese equities – which at that point had only begun to build – was at least partially attributable to an unwind in the country’s CNY1 trillion backdoor margin lending edifice.

As we explained, brokerages were only allowed to facilitate margin trading for investors whose account balances totaled at least CNY500K, and even then, traders could only lever up 2X. Brokerages naturally looked for ways to skirt the rules, leading to the development of multiple off-the-books vehicles and creating a situation wherein the official headline figure for margin lending (around CNY2.2 trillion at the time) woefully underrepresented the actual amount of leverage behind China’s world-beating equity rally.

Put simply, precisely measuring the amount of shadow financing that helped China’s legions of newly-minted retail day traders make leveraged bets on the SHCOMP and Shenzhen is virtually impossible, as is determining how much of that leverage has been unwound and how much remains or has been restored thanks to Beijing’s explicit efforts to reignite the margin madness by pumping PBoC cash into CSF.

For our part, we’ve suggested that regardless of what the actual figure is, the important point is that the unwind has probably just begun. In short: it seems unlikely that all of the leverage has been squeezed out of China’s exceedingly intricate shadow financing system.

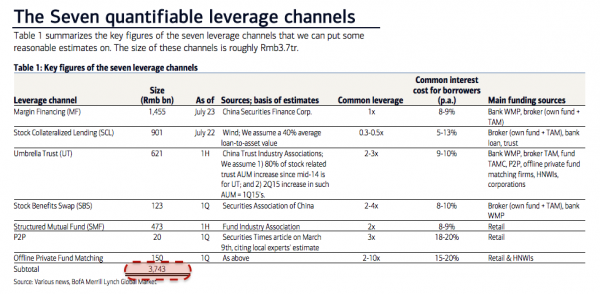

As it turns out, BofAML agrees and is out with a valiant attempt to not only identify each shadow lending channel, but to quantify just how much leverage is built into the Chinese market.

* * *

From BofAML

We estimate that margin outstanding, only from the seven channels that we can estimate reasonably, easily exceeds Rmb3.7tr. Assuming an average 1x leverage, it means that at least Rmb7.5tr market positions are being carried on margin, equivalent to some 13% of A-share’s market cap and 34% of its free float. Meanwhile, A-shares ex. banks are still trading at 36.6x 12M trailing PER. We believe that the government will struggle to hold up the market beyond a few months, unless it is prepared to let go some of its other policy objectives including RMB credibility. When the market ultimately settles at a level that can be sustained on fundamental reasons, we expect that the balance sheet of most financial institutions (FIs) may get impaired and the financial system may wobble, due to high contagion risk.

Leverage means relentless selling pressure.

The seven channels mentioned above are margin financing (MF), stock collateralized lending (SCL), umbrella trust (UT), stock benefits swap (SBS), structured mutual fund (SMF), P2P and offline private fund matching. There are a few other difficult–to-estimate channels, such as banks’ corporate/personal loans that ended up in stocks, brokers’ proprietary desk and funds’ subsidiaries. We suspect that the size of these may be Rmb1-2tr. In addition, China Securities Finance Corp. (CSFC) might have borrowed Rmb1.5tr from banks & PBoC to buy stocks. All the leveraged positions may want to unwind at certain point given the inflated collateral value, in our view. Additional selling pressure may come from hedge funds with compulsory winding-down clauses, when the market heads lower.

* * *

So there you have it – an estimated CNY3.7 trillion in still-outstanding margin via official and unofficial channels. We’ll have much more soon on how each channel is structured, where the biggest risks lie, and the broader implications not only for China’s stock market and economy, but for the renminbi as well.

For now, we’ll leave you with the following rather ominous quote from BofAML:

The risk is that the unwinding of the leverage will be disorderly – due to implicit guarantees behind most shadow banking financial products, investors could easily panic if they suffer from meaningful capital losses, by our assessment.