Source: http://bawerk.net/2015/08/22/that-70s-show-episode-3/

In the first episode we showed how the US became an unsustainable service sector based economy from the 1970s onward when service sector employment diverged from manufacturing without a corresponding boost in productivity. In the second episode we laid out the consequences that transition has had on labour in terms of lower wages and benefits. In addition, we reiterated our argument that monetary policy has become slave to the service sector as it has become linked to the much touted wealth effect (capital consumption) that is now an integral part of the American business cycle.

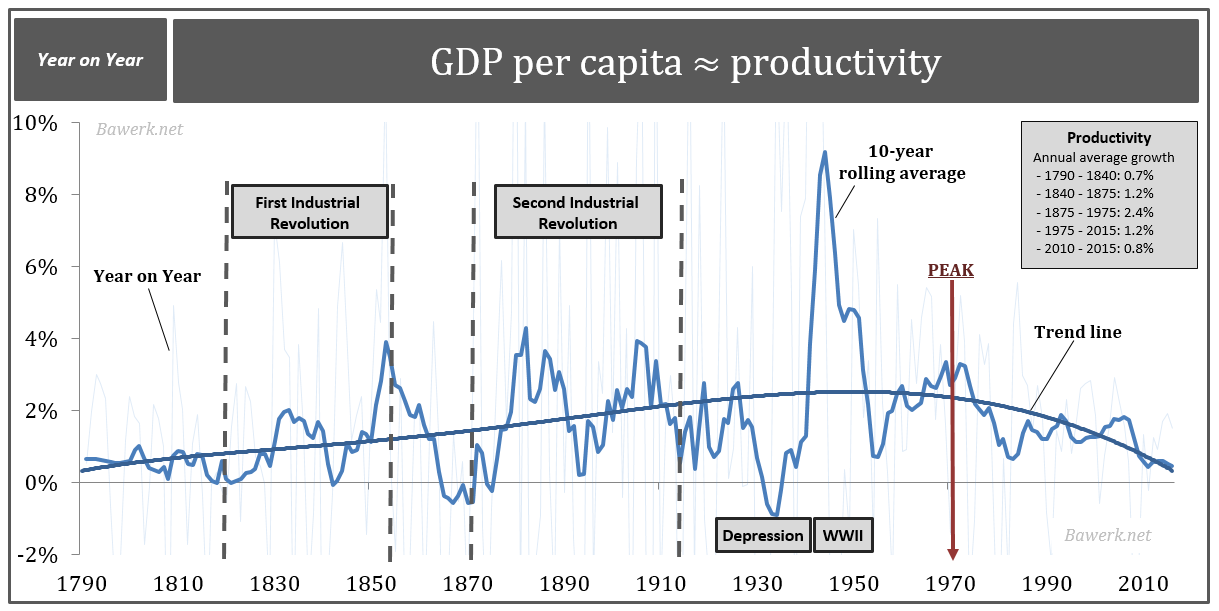

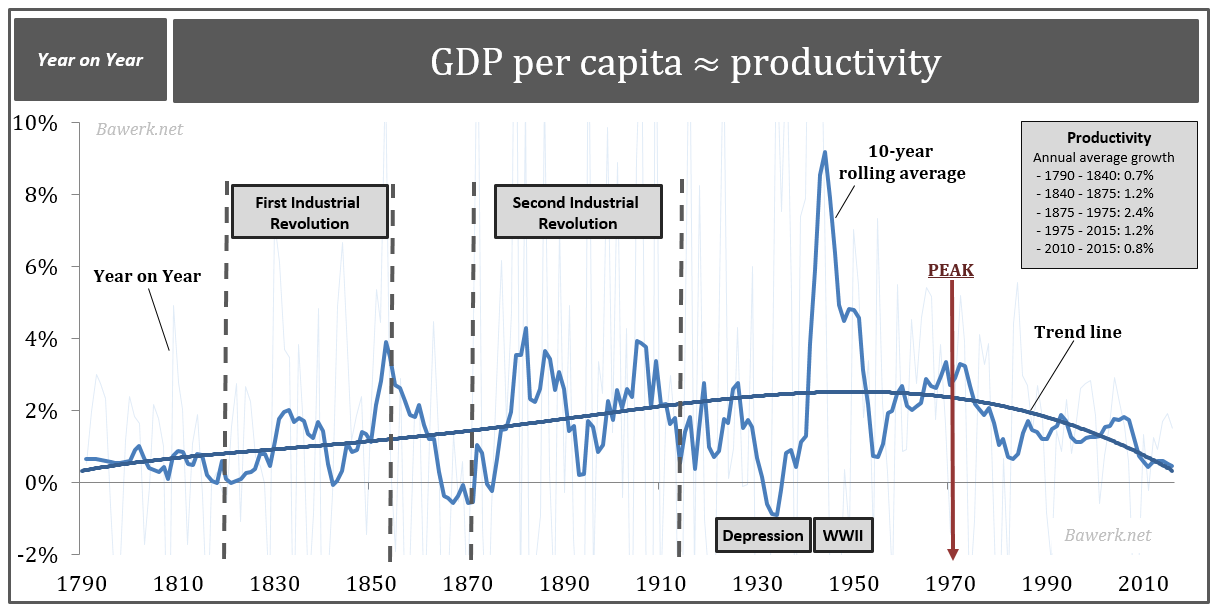

Now it is time to take a closer look at productivity measured in terms of GDP per capita. While this is not an entirely correct way to measure productivity, it does adhere to new classical growth model theories which posit that in a developed economy, reached steady state, the only way to increase GDP per capita is through increased total factor productivity. In plain English, growth in GDP per capita equals productivity growth. The reason we use this concept instead of more advanced productivity measures is to get a long enough time series to properly understand the underlying fundamental forces driving society forward.

In our main chart we have tried to see through all the underlying noise in the annual data by looking at a 10-year rolling average and a polynomial trend line.

In the period prior to the War of 1812 US productivity growth was lacklustre as the economy was mainly driven by agriculture and slaves (slaves have no incentive to work hard or innovate, only to work just hard enough to avoid being beaten). From 1790 to 1840 annual growth averaged only 0.7 per cent.

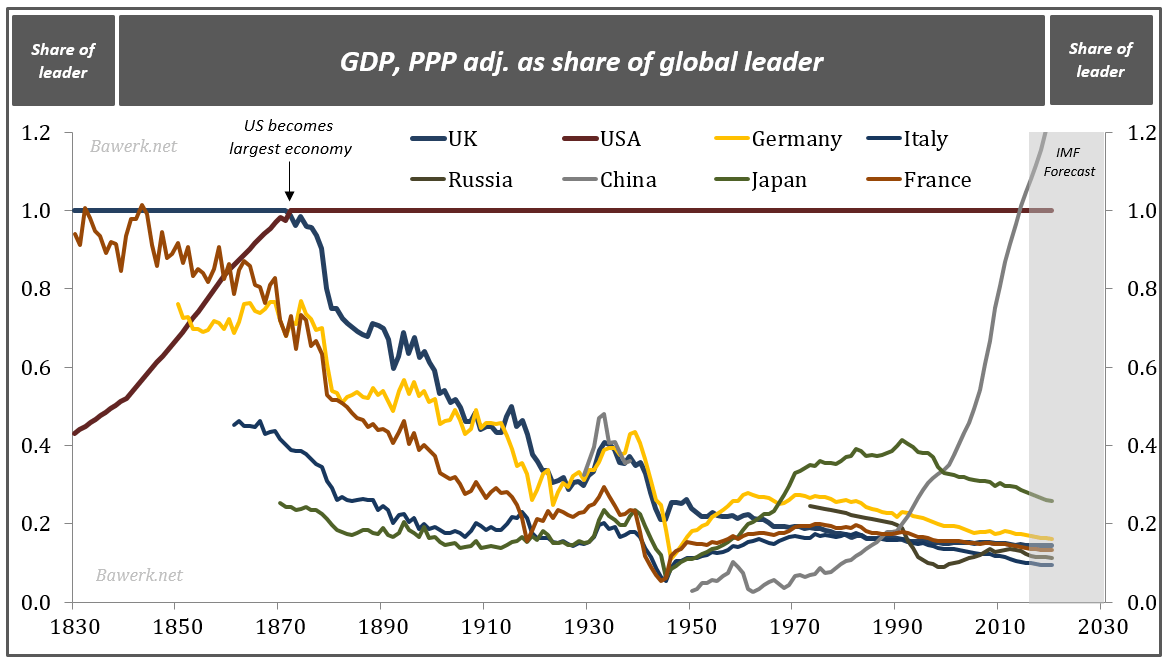

As the first industrial revolution started to take hold in the north-east, productivity growth rose rapidly, and even more during the second industrial revolution which propelled the US economy to become the world largest and eventually the global hegemon (see bonus chart at the end).

As a side note, it is worth noting that while the US became the world largest economy already by 1871, Britain held onto the role as a world hegemon until 1945. Applied to today’s situation in light of the fact that China is, by some measures, already the largest economy on the planet, it does not mean it will rule the seven seas anytime soon. In our view, they probably never will, but that is a story for another time.

Source: Historical Statistics of the United States, Bureau of Labor Statistics, Bureau of Economic Analysis, Bawerk.net

Adjusting for the WWII anomaly (which tells us that GDP is not a good measure of a country’s prosperity) US productivity growth peaked in 1972 – incidentally the year after Nixon took the US off gold. The productivity decline witnessed ever since is unprecedented. Despite the short lived boom of the 1990s US productivity growth only average 1.2 per cent from 1975 up to today. If we isolate the last 15 years US productivity growth is on par with what an agrarian slave economy was able to achieve 200 years ago.

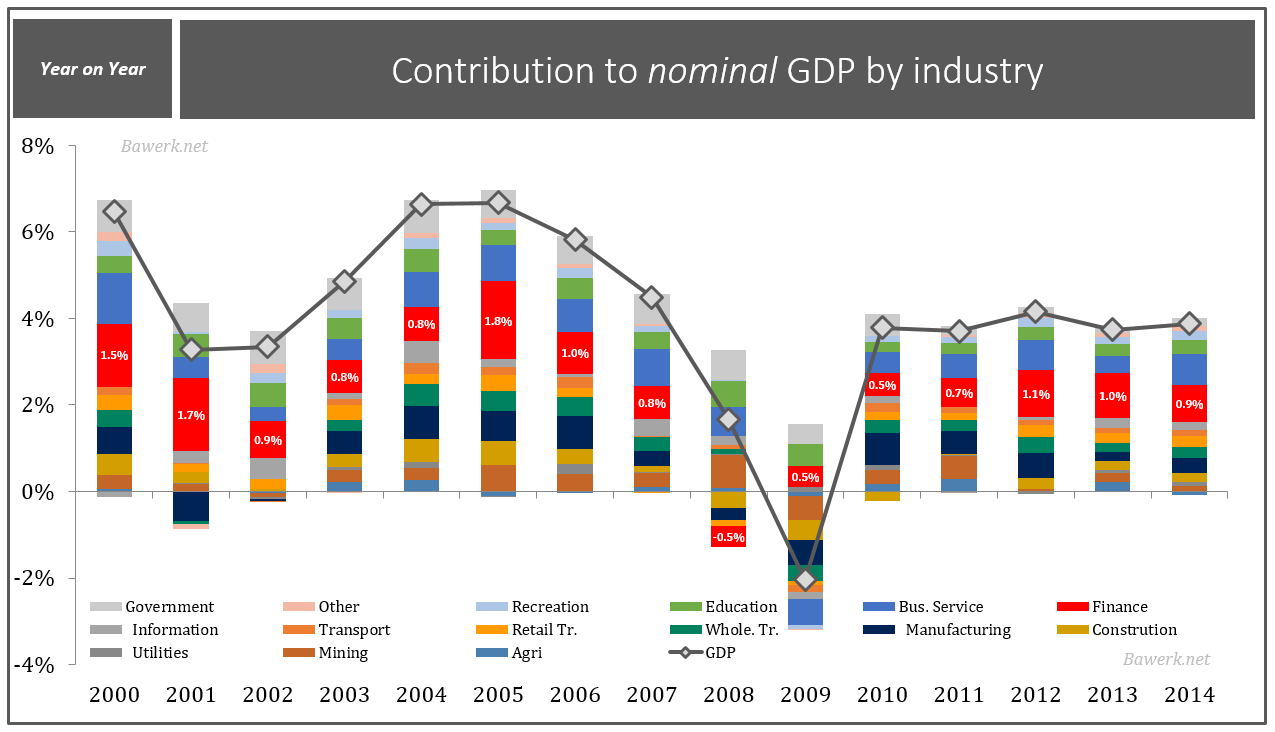

In addition, the last 15 years also saw an outsized contribution to GDP from finance. If we look at the US GDP by contribution from value added by industry we clearly see how finance stands out in what would otherwise have been an impressively diversified economy.

Source: Bureau of Economic Analysis, Bawerk.net

With hindsight we know that finance did more harm than good so we can conservatively deduct finance from the GDP calculations and by doing so we essentially end up with no growth per capita at all over a timespan of more than 15 years! US real GDP per capita less contribution from finance increased by an annual average of 0.3 per cent from 2000 to 2015. From 2008 the annual average has been negative 0.5 per cent!

In other words, we have seen a progressive (pun intended) weakening of the US economy from the 1970s and the reason is simple enough when we know that monetary policy broken down to its most basic is a transaction of nothing (fiat money) for something (real production of goods and services). Modern monetary policy thereby violates the most sacred principle in a market based economy; namely that production creates its own demand. Only through previous production, either your own or borrowed, can one express true purchasing power on the market place.

The central bank does not need to worry about such trivial things. They can manufacture the medium of exchange at zero cost and express purchasing power on the same level as the producer. However, consumption of real goods and services paid for with zero cost money must by definition be pure capital consumption.

Do this on a grand scale, over a long period of time, even a capital rich economy as the US will eventually be depleted. Capital per worker falls relative to competitors abroad, cost goes up and competitiveness falls (think rust-belt). Productive structures cannot be properly funded and the economy must regress to align funding with its level of specialization.

In its final stage, investment give way for speculation, and suddenly finance is the most important industry, pulling the best and brightest away from every corner of the globe, just to find more ingenious ways to maximise capital consumption.

As the slave economy got perverted by incentives not to work, so does the speculative fiat based economy, which consequently create debt serfs on a grand scale.

I grow very weary of these breathless screeds that, while loosely faithful to Austrian principles, are so long in unexamined assertions that they are tiresome to read. I long for the “good old days” when “The Cobden Centre” filled its pages with the writings of the authors who are still listed in the blog roll at right.

The complete lack of comments to the posts of the new regime suggest to me that others agree. Webmaster, are you listening?