(This Report is an adaptation of my keynote address to the 2015 Sydney Precious Metals Symposium, held this month.)

“Power tends to corrupt. Absolute power corrupts absolutely.” – Lord Acton

“Monetary power tends to corrupt. Absolute monetary power corrupts absolutely.” –Butler’s corollary

THE ECONOMIST RINGS OUT COGNITIVE DOLLAR DISSONANCE

Two years ago, prior to travelling to Sydney to present at the Annual Precious Metals Symposium, I prepared an article for the Gold Standard Institute Journal titled Cognitive Dollar Dissonance: Why a Global De-Leveraging Requires the De-Rating of the Dollar and the Remonetisation of Gold (see here). This article highlighted the growing inconsistency between those arguing on the one hand that the dollar’s role in international trade and finance was clearly diminishing; yet denying that it was in any danger of losing the near-exclusive monetary reserve status it has enjoyed since the 1940s.

This apparently contradictory yet mainstream thinking about the future of the international monetary system continues to the present day. Indeed, earlier this month the Economist magazine ran a special feature on fading US economic power replete with dollar dissonance.[1] The experts cited note the accelerating trend towards bilateral trade settlement, say between Russia and China, who plan to finance their multiple ‘Silk Road’ infrastructure projects using their own currencies and their own development bank (The Asian Infrastructure Investment Bank or AIIB: See http://www.aiib.org/). They also observe that Russia, China and the other BRICS are no longer accumulating dollar reserves (although curiously overlook that they continue to accumulate gold). They acknowledge that not only the BRICS but many other countries have repeatedly expressed their desire that the current set of global monetary arrangements should be restructured in some way, although they are not always clear as to their specific preferences.

Note the sharp contrast in these two paragraphs, both on the very same page of the Economist feature:

“This special report will argue that the present trajectory is bound to cause a host of problems. The world’s monetary system will become more prone to crises, and America will not be able to isolate itself from their potential costs. Other countries, led by China, will create their own defences, balkanising the rules of technology, trade and finance. The challenge is to create an architecture that can cope with America’s status as a sticky superpower.”

And:

“Today’s world relies on a vastly bigger edifice of trade and financial contracts that require continuity. Trade levels and the stock of foreign assets and liabilities are five to ten times higher than they were in the 1970s and far larger than at their previous peak just before the first world war… China and America are not allies. The greater complexity and risk involved in remaking the global order today create a powerful incentive for current incumbents to keep things as they are.”

Does anyone else hear the clear dissonance, confusion even? On the one hand we have a complex system prone to debt and currency crises, a growing lack of cooperation between the two largest players and a need for a ‘new architecture’. Yet on the other we are supposed to accept that there is sufficient common incentive to cooperate in monetary matters? Really?

Now consider the developing global economic context. Although the mainstream tend to be quiet on these issues, they cannot possibly fail to notice that, seven years on from the 2008 global financial crisis, following unprecedented economic and monetary policy intervention, dollar interest rates are still zero; quantitative easing has failed to achieve its stated objectives; global imbalances have risen to record levels; emerging market balance-of-payment crises are springing up all over; leading indicators in every major global economy have rolled over; and financial markets, in particular the credit markets, are beginning to tell you that another major crisis may lurk in the near future. It is thus entirely reasonable if unfashionable to hold the view that the dollar monetary reserve system has become unstable and is overdue a fundamental restructuring or reset of some kind. None other than IMF Managing Director Christine Lagarde has hinted at this in multiple speeches over the past two years. [2]

THE PERSISTENCE OF DISSONANCE

But let us ask: Why is this cognitive dollar dissonance so persistent? There are several plausible and complimentary explanations. First, much human reasoning, expert or otherwise, is affected by at least some degree of so-called ‘normalcy bias’, that is, a naïve if not necessarily incorrect belief that the future will resemble in whole or part the recent past. The dollar has been the world’s pre-eminent monetary reserve for some 70 years, so the thinking goes. Why should that change now?

Second, and potentially reinforcing the above, is what one might call ‘The Whig view of international monetary history.’ This is a subset of the better known, general ‘Whig view of history’, perhaps best represented by Scottish Enlightenment philosopher David Hume, that history is the evolution of an ever-more perfect world, of constant if not always understood or appreciated progress. Hence the dollar-centric monetary regime of today is superior to those that have come before, because it is that of today, not yesterday. No further explanation is required or desired. (It is worth noting here that German late Enlightenment / early Romantic philosopher GWF Hegel postulated a more subtle, dialectical process of historical progress. Karl Marx would subsequently adapt this particular strain of teleological thought to demonstrate in his unique way the inevitable replacement of Capitalism by Communism.)

We know such thinking is flawed. History shows us it is flawed: Recessions, financial crises, depressions, wars, revolutions, nation-building, nation-busting, tyranny, despotism, etc, feature with some regularity, including in much of North Africa and the Middle East today. But this facile sense of steady (or sporadic) progress is nevertheless surprisingly common across all knowledge disciplines, not only in economic and monetary matters. Indeed, even in the hard sciences, where presumably only hard facts and evidence should matter, there can be tremendous resistance to new ways of thinking. Thomas Kuhn cogently demonstrated this to be the case in his monumental study of the history of science, The Structure of Scientific Revolutions. According to Kuhn, even in hard science, it is not the facts that matter. Rather, it is the ‘paradigm’, as Kuhn chose to call it. Facts that clearly do not fit the existing paradigm are either conveniently ignored, or those proffering them are persecuted outright, such as with Galileo’s observations of Jupiter’s moons. Given the relative subjectivity of the social sciences, including economics, one should wholly expect that the power of the presiding paradigm to misconstrue, ridicule or simply ignore inconvenient facts and their associated theories would be all the more powerful in stifling real understanding, productive debate and progress.

Kuhn also noted that one reason why paradigms were so hard to break down once established was that those in highest regard within the discipline—akin to the high priests of a hierarchical church—had so much to lose if challenged by unorthodox thinking. We laugh at the Papal persecution of Galileo today but to them it was no laughing matter. His observations, plain to see as they were through a telescope, directly contradicted the venerable, geo-centric or Ptolemaic paradigm of the day, thus threatening the very foundations of Church power.

Today we generally pat ourselves on the back that, atheists or not, we tend to treat science as distinct from religion. And yet quasi-faith-based paradigmatic thinking nevertheless still infects science to a great if underappreciated degree. Take the ‘Big Bang’ theory, for example, which has stood for decades but is still mere theory. This is due in part to the fact that, notwithstanding huge investments in research into the origins of the universe, there is still no convincing data to confirm it. Although I am hardly an authority on this matter, I do note that, in my youth, astrophysicists believed strongly that, due in large part to the Big Bang framework, a Grand Unified Theory of the universe was within reach. All they needed for confirmation was a powerful enough supercollider. Today, some 30 years later, against these optimistic expectations, they are nearing exasperation. All the observational and computing power of which they could only have dreamed a generation ago is today at their disposal, yet they haven’t got qualitatively farther than did Einstein a century ago with maths, chalk and slate? Could it be that astrophysics has become stuck in a paradigm that has outlived its usefulness and is now retarding rather than facilitating progress? I don’t have the answer but no doubt Kuhn would agree the question is clearly worth asking.

Given that in today’s dollar-centric monetary world US Federal Reserve and dollar policies comprise the dominant part of global monetary policy generally, should we not fully expect those in power to resist ideas that might expose their policies as unsustainable or outright counterproductive? What of the anointed academics who advise and are, directly or indirectly, funded by them? Yes there are some scholars who are willing to challenge the paradigm, a few of whom are rather prominent. Nobel Laureate Robert Mundell, the so-called ‘Father of the euro’, speaks openly about the dollar’s gradually eroding reserve status (although he stops short of claiming it will lose reserve status entirely). Professor Kevin Dowd, architect of monetary reform plans through the decades, has also expressed this view. But the mainstream financial media have chosen mostly to ignore them.

Intriguingly, however, the International Monetary Fund (IMF) has begun to promote the idea that the dollar might indeed eventually lose its premier reserve currency status. But here, too, we observe a self-serving paradigm at work: the IMF is proposing in no uncertain terms that the ‘solution’ for the erosion of the dollar’s reserve currency status is to replace it with the IMF’s very own ‘Special Drawing Right’ or SDR. And can you guess which essentially unaccountable supranational bureaucracy the IMF suggests could administer an SDR-centric international monetary regime? Yes, the IMF itself is put forward as the institution to control the world’s money supply and, by implication, global interest rates.[3]

CENTRAL PLANNING SOUNDS NICE ON PAPER BUT WHAT ABOUT IN PRACTICE?

This may all sound nice on paper, but as I wrote in my book back in 2011, it is nothing but a bureaucratic pipe-dream. The idea, amid record global economic imbalances and associated historic, unserviceable debt burdens in Japan, the euro-area and arguably the US itself, that somehow China, the other BRICS, oil producers and other creditor nations are going to agree just how the IMF can take over from where the US Federal Reserve has left off is a non-starter. No, as with the US in the 1940s, the creditor nations are going to insist on an international monetary restructuring that favours their economic interests, even if at the expense of others. The requisite international cooperation required for the IMF to implement sustainably a ‘one size fits all’ international monetary policy is just not there, nor should we be at all optimistic that it will be prior to a meaningful global deleveraging and rebalancing which is being resisted by economic and monetary officials at all costs and by all means.

The recent experience of the euro-area should serve as an example in this regard but, as observed above, facts can be quite an inconvenience for those clinging to a flawed paradigm. Here too, we see cognitive dissonance in the fashionable belief that what demonstrably does not work at the regional level can work miraculously at the global one. The fact is, monetary central planning does not work. It didn’t work for Europe in the 1920s and 1930s, as currency devaluations and outright hyperinflations were used as weapons in the so-called ‘currency wars’ of that era. It didn’t work in the 1960s, as the London Gold Pool struggled to hold the Bretton Woods conventions together. It didn’t work in the 2000s, when the so-called ‘Great Moderation’ in business cycles merely disguised colossal misallocations of capital, exposed as such in 2008. And seven years on from that spectacular crisis, as the global economy again enters a steep downturn, it is not working still.

There is good reason to believe that what is already underway is going to be more severe than 2008-09. This time around, interest rates are already at zero, or outright negative. QE has failed. Confidence in economic officials’ general ability to restore healthy, sustainable growth has weakened considerably. Indeed, at a recent roundtable event at Chatham House I attended, multiple prominent international economists suggested that with ‘conventional QE’ having failed, the next logical arrow in the monetary policy quiver is that of direct money injections into corporations or households, in effect a Friedmanesque ‘Helicopter Drop’ of money. This conversation would not be taking place at all were the macroeconomic outlook not so poor.

Prolonged economic weakness has now fostered the growth and migration of previously fringe parties to what may eventually become a new political centre, attesting to deep discontent with the status quo in many countries around the world. In some places, such as where I now reside, in the UK, the major opposition party borders on advocating socialism. Senator Sanders in the US, a possible Democratic nominee for President, sings a similar socialist tune. Such developments increase the political risks to global financial markets, potentially further destabilising the now-fragile dollar-centric system. In this regard we should take note of a recent article in the Financial Times:

“Investors have long known that markets reflect better than they predict. By nature they are better at pricing existing information than pricing the probability and scale of an unexpected event. But they can fail at both.” [4]

For those who generally prefer free market commerce to socialistic central planning, this can all seem rather frightening. A glance back at history can reinforce these fears. But if one looks carefully between the clouds of the gathering global monetary storm one can discern a distinct silver lining, or rather a golden one as it were.

THE INTERNATIONAL MONETARY FUTURE

If the dollar is indeed losing pre-eminent international monetary reserve status and the requisite cooperation required for the IMF to simply replace it with the suprantional SDR is lacking, then what on earth is going to happen in international monetary relations? Without stable international money, countries will find they cannot trade as easily with one another. What currencies will be held as reserves against external trade (or capital) imbalances? Chronic net importers such as the US have the incentive for the world to hold their currencies as reserves whereas chronic net exporters have the opposite, that is, to keep their currencies artificially cheap in order to maintain or grow their global export market share. But as the imbalances accumulate, as they have today to a record level relative to global GDP, beyond a certain point there is insufficient trust in the importing countries’ currencies as reliable stores of value.

But then if distrustful exporters insist on invoicing for exports strictly in their own currencies, trade will grind to a halt: It is by definition the importing nations, not exporting nations, which must provide the net balance of circulating media for international trade, as these media represent the international ‘IOU’ that must eventually be repaid through a reversal in the trade (or capital) balance or otherwise liquidated (eg via a default).

We all know global trade is hugely beneficial for consumers, who benefit from the associated, evolving global division of labour and capital. A contraction in global trade, ‘globalisation in reverse’ as it were, would thus be highly damaging to global economic growth, implying a general ‘stagflation’ of both weaker growth and higher real goods prices. No politician, socialist or otherwise, wants that; it will force them from office in short order. So absent demonstrably unworkable central planning, how can future international monetary arrangements nevertheless facilitate international commerce with exporters and importers at loggerheads over which currencies to use?

Why, the same way they did so in the 1800s: Just re-monetise gold. While gold may have retreated backstage for a time, it is about to make a spectacular reappearance. For gold is the only international monetary asset that can resolve the exporter/importer dilemma of a lack of trust on the one hand; yet a deep, essential need to trade on the other. Gold is not itself a national liability. It can be neither arbitrarily devalued nor defaulted on. It is real international money, not bureaucratic fiat scrip.

But wait, one might protest, why on earth would governments willingly give up the power to devalue and inflate their way out of debt? Because if their essential trading partners so demand it, they simply have no choice. What if Russia, concerned about the future of the euro, were to demand its European customers pay for imports of oil and gas in gold instead of euros? What if China, concerned about the dollar, made a similar demand vis-à-vis the US? How about the Gulf oil producers? What if they were to insist that China pay for imports of their oil in gold? The fact is, if just one exporting country, even a relatively small one, begins to demand payment in gold, then their trading partners must supply the gold. For each incremental move in this direction gold’s share of international monetary reserves grows exponentially due to the ‘network’ or ‘node’ effect. Conversely, the dollar’s share exponentially declines. And as those familiar with game theory will note, while there is no doubt a ‘first mover disadvantage’ associated with demanding trade settlement in gold—a possible loss of market share—there is a far larger ‘last-mover cost’, that is, the last exporter to switch from dollars to gold will find they have accumulated the residual dollar reserves from the rest of the world at a greatly reduced if not worthless value.

GOLD IS THE NATURAL INTERNATIONAL MONEY FOR A MULTIPOLAR WORLD

As Nobel Laureate Mundell wrote a few years back:

“We can look upon the period of the gold standard as being a period that was unique in history, when there was a balance among the powers and no single superpower dominated.”

The Economist and the IMF recognise that the US is no longer the sole global economic superpower that it once was, able to dictate terms in monetary matters. A new, multipolar balance of power is forming. Gold, the only internationally-recognised non-national money provides the game-theoretic international monetary solution to an economically multipolar, globalised, competitive world. It represents the Nash equilibrium. Whether or not this is ever formalised in a de jure ‘gold standard convention’ or not is beside the point. The classical 19th century gold standard was never de jure formalised as such. As renowned monetary historian Guilio Gallarotti observes, it arose spontaneously from below, catalysed by the rise to economic power of the United States and the German Zollverein in the late 19th century, thus transforming what had been, following the Napoleonic wars, a nearly unipolar British imperial world into a clearly multipolar one. [5]

As gold again begins to circulate in order to settle cross-border balance of payments, it resolves the perennial floating fiat currency (ie Triffin’s) dilemma of ever-growing imbalances and the associated ever-growing debts to finance them. As gold moves physically, from place to place (or simply from vault to vault in London or New York, as it did once upon a time) imbalances are settled, then and there, at whatever price gold commands at that location and time. No arbitrary monetary expansion or contraction is necessary; no central planning required.

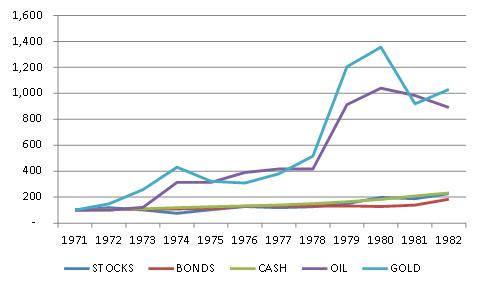

By implication, as the demand function for gold shifts due to de facto remonetisation, the price of gold is going to rise. By how much depends largely on the degree of confidence in the dollar and other currencies that circulate alongside gold. As long as the global imbalances and associated debts remain large relative to incomes, confidence will be low, implying a far higher gold price than that observed today. One way to benchmark the order of magnitude price increase for gold would be to allow the price to rise to a level that would back a substantial portion of the narrow or perhaps even broad money supply of major currencies. At current prices gold only backs about 5% of the narrow major currency global money supply and barely 2% of broad money. A substantial price increase would thus be required to restore gold backing to where it was under the Bretton Woods system, for example, when it exceeded 20%.

Not only will gold rise in price. Once gold is remonetized in some way at the international level, there will be an international interest rate imputed from the price of gold forward contracts or swaps. While gold itself pays no interest, these derivatives will, and that rate of interest will be as close an approximation as one can come to a ‘risk-free’ interest rate, the purest possible expression of the time value of money. Henceforth, no national or supranational central bank will be required to tell the international marketplace what the time value of money should be at any given point. Rather, the international money (gold) market will determine spontaneously what interest rate clears the market for gold delivery today, or tomorrow, or next year. This information will then flow into international commerce generally, where it will provide a robust basis for the sensible allocation of international capital in all forms, financial and real, across both time and space. The escalating boom and bust cycles of modern times will become a thing of the past, and the natural, occasional recessions that do occur will allow for the Schumpeterian ‘creative destruction’ required to qualitatively re-order the capital stock so as to clear malinvestments and incorporate new technologies.

GOLD AND THE INFORMATION THEORY OF FREE-MARKET (NOT CRONY!) CAPITALISM

As George Gilder demonstrates in his masterful work on economics and information theory, Knowledge and Power, “Capitalism is not primarily an incentive system but an information system.” Prices are the information. And the price of time itself is the single most valuable piece of information. Time, as we intuitively know, is money; they are two sides of the same coin. Mess with time and money, and you mess with everything else. Yet as with central planning in general, the central planning of either money, or time, cannot possibly work. Hayek warned the economics profession of precisely this in the 1970s. They didn’t listen, ensconced as they still remain within their interventionist Keynesian paradigm. Well that paradigm is about to be blown apart, time and money are about to return to the market, where they belong, and real, sustainable economic progress is about to restart once again.

Having begun with a timeless quote from Lord Acton, it would seem apposite to so conclude. He also once wrote:

“The wisdom of divine rule appears not in the perfection but in the improvement of the world.”

At first glance, this might seem a teleological Humian or Hegelian statement. Yet when juxtaposed to Acton’s eponymous dictum on the corruption of power, it provides for further understanding of both retrograde socio-economic cycles and of hope, that with each such setback eventually comes a great, qualitative improvement in the human condition. If I may be so bold, I predict we are on the cusp of precisely this today. If it requires a global monetary crisis as a catalyst, then bring it on.

[1] “The Sticky Superpower,” The Economist, 1 October 2015. Link available here.

[2] For example see “A New Multilateralism for the 21st Century,” Link available here.

[3] There is a related and less formal discussion taking place at the Official Monetary and Financial Institutions Forum (OMFIF), a global think-tank, which embraces the idea of a potentially IMF-led global monetary restructuring. The OMFIF, however, advocates the explicit inclusion of gold in the SDR basket in some way as a useful credibility-building measure. See this link here.

[4] “Markets Struggle to Quantify Risks of Historic Shocks,” Financial Times, 29 September 2015. Link available here.

[5] For a detailed explanation of this view, please see Gallarotti’s paper linked here.