“Sir, Martin Wolf writes: “It may be hard to avoid crises but it is vital to make them both small and rare.” (“In the long shadow of the Great Recession”, November 11.) It is precisely this line of thinking that resulted in the Great Recession in the first place. Although advanced economies have managed to decrease the frequency of recessions since the early 1980s, they inadvertently increased their severity, i.e. the Great Recession itself.

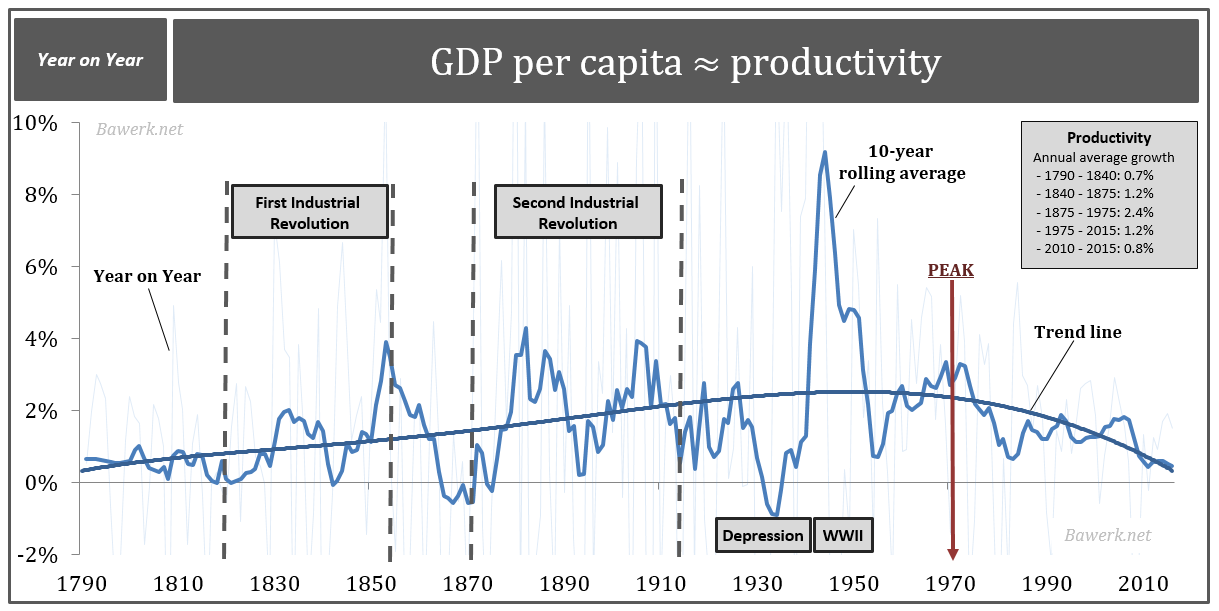

“The more governments and central banks want to smooth the business cycle, the more risk and debt people and businesses are willing to accept, because they are less fearful of any economic downside. Such misplaced confidence will result in increased leverage in the economy and malinvestment (the misallocation of capital and labour). And the longer periods of malinvestment last, the more painful and difficult the inevitable future corrections will be.”

– Letter to the editor of the Financial Times from Reza Ladjevardian, Washington, DC, US.

“I was very impressed by the fact that the Bank of England has a view on inflation in the fourth quarter of the year 2018. I wonder if the Bank knows if it’s going to rain a week from Thursday ?”

– James Grant discusses central bank behaviour on Bloomberg News.

Léon Walras is the patron saint of modern economics. In other words, he was a clueless failure who hijacked immutable principles from the world of physics and misapplied them to the economic realm. The result, predictably enough, is that modern economics doesn’t work. It doesn’t work because it masquerades as a science when it is really just a combination of dogma and very crude modelling. The modelling doesn’t work because garbage in equals garbage out. Sadly, this doesn’t stop the Financial Times’ chief economics correspondent, or the governor of the Bank of England, advocating overly simplistic policies in a highly complex world. There is something to behavioural economics, however (the economy is not a model, it is us) – so don’t expect that to get taught seriously on university campuses any time soon.

The conventional narrative has it that the financial crisis was caused by commercial bankers. This is not precisely true. Central bankers also played their part. What is alarming today is that almost nobody dares challenge the mandate or even ongoing existence of central banks as prime fixers of prices in the financial markets. (Spoiler warning: price fixing doesn’t work.)

“Attempts to control and fix prices and wages span most of recorded history,” writes David Meiselman in the foreword to the definitive history of economic hubris, ‘Forty centuries of wage and price controls’ (Robert Schuettinger and Eamonn Butler).

“Price and wage controls cover the times from Hammurabi and ancient Egypt 4,000 years ago to this morning..

“The experience under price controls is as vast as essentially all of recorded history, which gives us an unparalleled opportunity to explore what price controls do and do not accomplish. I know of no other economic and public policy measure whose effects have been tested over such diverse historical experience in different times, places, peoples, modes of government and systems of economic organization..

“The results of this investigation would merit attention for the light it sheds on economic and political phenomena even if wage and price controls were no longer seriously considered as tools of economic policy. The fact that wage and price controls exist in many countries and markets and are being seriously considered by others, including the United States, compels attention to the historical record of wage and price controls this book presents.

“What, then, have price controls achieved in the recurrent struggle to restrain inflation and overcome shortages? The historical record is a grimly uniform sequence of repeated failure. Indeed, there is not a single episode where price controls have worked to stop inflation or cure shortages. Instead of curbing inflation, price controls add other complications to the inflation disease, such as black markets and shortages that reflect the waste and misallocation of resources caused by the price controls themselves. Instead of eliminating shortages, price controls cause or worsen shortages.”

Interest rates across the developed markets have been kept at emergency levels (and all time historical lows) for seven years. Do we think that allowing banks to access essentially free money is more or less likely to give rise to the sort of malinvestments that caused the financial crisis in the first place ? If you believe that the answer is ‘less likely’, there is a job at the Bank of England’s Financial Policy Committee with your name on it. (It will help secure the position if you have previously worked at Goldman Sachs, like our current central bank supremo, Mark Carney. Or the head of the ECB, Mario Draghi. Time was when unaccountable private banking cartels made some attempt to hide their origins. Now they flaunt them in plain sight. That’s how much they respect taxpayers.)

“Despite the clear lessons of history, many governments and public officials still hold the erroneous belief that price controls can and do control inflation. They thereby pursue monetary and fiscal policies that cause inflation, convinced that the inevitable cannot happen. When the inevitable does happen, public policy fails and hopes are dashed. Blunders mount, and faith in governments and government officials whose policies caused the mess declines. Political and economic freedoms are impaired and general civility suffers.”

Another question. Does central bank interference in the price mechanism make financial markets more or less volatile ? We think the answer is less volatile in the short term, and hugely more volatile in the longer run.

Benoit Mandelbrot reminded us that markets are volatile. Or at least they should be. If they actually reflect a price graph that rises serenely from the bottom left to the top right of the page, they are either frauds, or they are about to blow up.

Markets are also risky. (Note that we distinguish between volatility and risk. Unlike the regulator.) Mandelbrot and Hudson:

“According to the standard model of finance, in which prices vary according to the bell curve, the odds of ruin are about.. one chance in ten billion billion. With odds like that, you are more likely to get vaporized by a meteorite landing on your house than you are to go bankrupt in a financial market. But if prices vary wildly, as [we] showed in the cotton market, the odds of ruin soar: They are on the order of one in ten or one in thirty. Considering the disastrous fortunes of many cotton farmers, which estimate of ruin seems most reasonable ?”

Market timing also plays a role. Big gains and losses concentrate into small packages of time. The “clustering” effect of outbreaks of volatility is well known. The scale of such clustering sometimes beggars belief. Mandelbrot cites the exchange rate of the US dollar against the Japanese yen between 1986 and 2003 – a period of steady decline for the dollar.

“But nearly half that decline occurred on just ten out of those 4,695 trading days. Put another way, 46 percent of the damage to dollar investors happened on 0.21 percent of the days. Similar statistics apply in other markets. In the 1980s, fully 40 percent of the positive returns from the Standard & Poor’s 500 index came during ten days – about 0.5 percent of the time.”

Conventional wisdom has it that “time in the market” is more important than “timing the market”. For investors with long enough time horizons, that may be broadly true. But if one senses, for whatever one believes to be sufficiently robust reasons, that significant downside volatility is a realistic near-term outcome, it is surely only sensible to take some form of ameliorative action.

Prices often leap, not glide – that adds to the risk. Mandelbrot forcefully suggests that the mathematics of Bachelier, Markowitz, Sharpe and Black-Scholes, inasmuch as they assume continuous changes from one price to the next, are flawed. Markets are wilder than much conventional economics theory indicates (surprise !).

In markets, time is flexible.

“Time deformation is a mathematical convenience, handy for analyzing the market; and it also happens to fit our subjective experience. Time does not run in a straight line, like the markings on a wooden ruler. It stretches and shrinks, as if the ruler were made of balloon rubber. This is true in daily life: We perk up during high drama, nod off when bored. Markets do the same.”

Markets are inherently uncertain, and bubbles are inevitable. Again, notwithstanding the self-serving pronouncements of former Fed chairmen, not only are bubbles in financial markets inevitable, but identifying them may be down to simple pragmatism. This argument gets confused by the noise created by the investment media when any dramatically rising market gets tarred by the bubble brush. Because of the scaling characteristics of financial markets widely discussed throughout the book, making investment decisions is difficult. Making sensible predictions about financial markets is difficult. Bubbles are an inevitability.

The financial markets today resemble some kind of unwieldy Heath Robinson contraption, contrived, wobbling unnervingly, and held together by spit, sawdust and the prayers of the central bankers whose hands are on the levers.

We elect out. So we’re not macro tourists in the bond market. We’re not blithely tracking stock indices or surfing overpriced mega-cap consumer brands that, one by one, are being taken to the woodshed and shot, courtesy of some rather painful Chinese-led deflationary pressure. Since our central banker friends are working hard to discredit cash, we see unusual merit in only the highest quality, most inexpensive listed businesses (Japan and Vietnam being among the cheapest sources of such companies), and in healthy amounts of portfolio protection (systematic trend-followers in terms of uncorrelated insurance, and precious metals in terms of systemic and inflation insurance and, yes, we know where their prices in money terms currently are).

It would make sense for investors today to reduce their exposure to speculative investments. Unhappily, dogmatic central bankers with too much misplaced confidence in flawed economic theories have made virtually all investments speculative. David Meiselman again:

“First-hand experience of most of us with wage and price controls in our own lifetimes in addition to the lessons of history and of validated propositions in economics so skilfully catalogued in this book would seem to be more than sufficient to convince the public and government officials that price and wage controls simply do not work. However, the unpleasant reality is that, despite all the evidence and analyses, many of us still look to price controls to solve or to temper the problem of inflation. Repeated public opinion polls show that a majority of U.S. citizens would prefer to have mandatory controls. If the polls are correct, and I have no reason to doubt them, it must mean that many of us have not yet found out what forty centuries of history tell us about wage and price controls. Alternatively, it raises the unpleasant question, not why price controls do not work, but why, in spite of repeated failures, governments, with the apparent support of many of their citizens, keep trying.”

In the aftermath of this weekend’s horrible events in Paris, religious dogmatism is rightly condemned. If only dangerous economic dogmatism could be similarly repudiated.

Reza Ladjevardian in commenting on Martin Wolf’s article claims that if government artificially irons out business cycles, the more “risk and debt” will everyone take on, all else equal. Thus the “iron out” efforts might be self-defeating.

However, there is a weakness in RL’s argument, as follows. One of the ideas supported by Martin Wolf as a means of ironing out business cycles is a bank system where there is no government support at all, under any circumstances, for banks which make silly loans. It’s called “full reserve” banking.

I doubt full reserve would put an end to all booms and busts, but at least it gives a sharp rap on the knuckles to those making some of the “malinvestments” referred to above.