“Hell, there are no rules here – we’re trying to accomplish something.”

– Thomas Edison.

Operating outside of a rule book may be advantageous for entrepreneurs. But it is likely to be hazardous for central bankers and for the markets that trot, for the time being, obediently behind them. Since central bank activity is now the swing factor behind prices in all markets, unprecedented actions in monetary policy run the risk of unprecedented consequences.

US Treasury bond yields began their slow, stately descent from the mid-teens in the early 1980s. Newly installed at the Federal Reserve, Paul Volcker was determined to squeeze inflation out of the system, and he succeeded. Fed funds stood at 11% when Volcker entered office in 1979. By June 1981 he had hiked them all the way to 20%. Corporate America was not impressed. Indebted farmers blockaded the Eccles building.

But the pain was relatively short-lived. And as Volcker’s victory over inflation became more apparent, markets applauded. As bond prices started to rise, stock prices joined them. Both credit and equity markets began a multi-decade bull run.

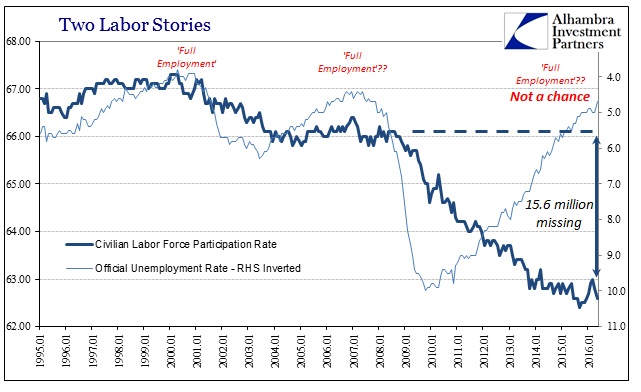

As far as US interest rates are concerned, we appear to have reached the end of the line. Janet Yellen is widely expected to announce a modest tightening next month. How the bond and stock markets react will be, if you’ll pardon the pun, interesting.

Over here in Europe, zero has not marked the lower bound for rates. The ECB’s deposit rate stands at -0.2%. Unlike Janet Yellen, Mario Draghi is widely expected to cut its deposit rate even further, and to approve more quantitative easing.

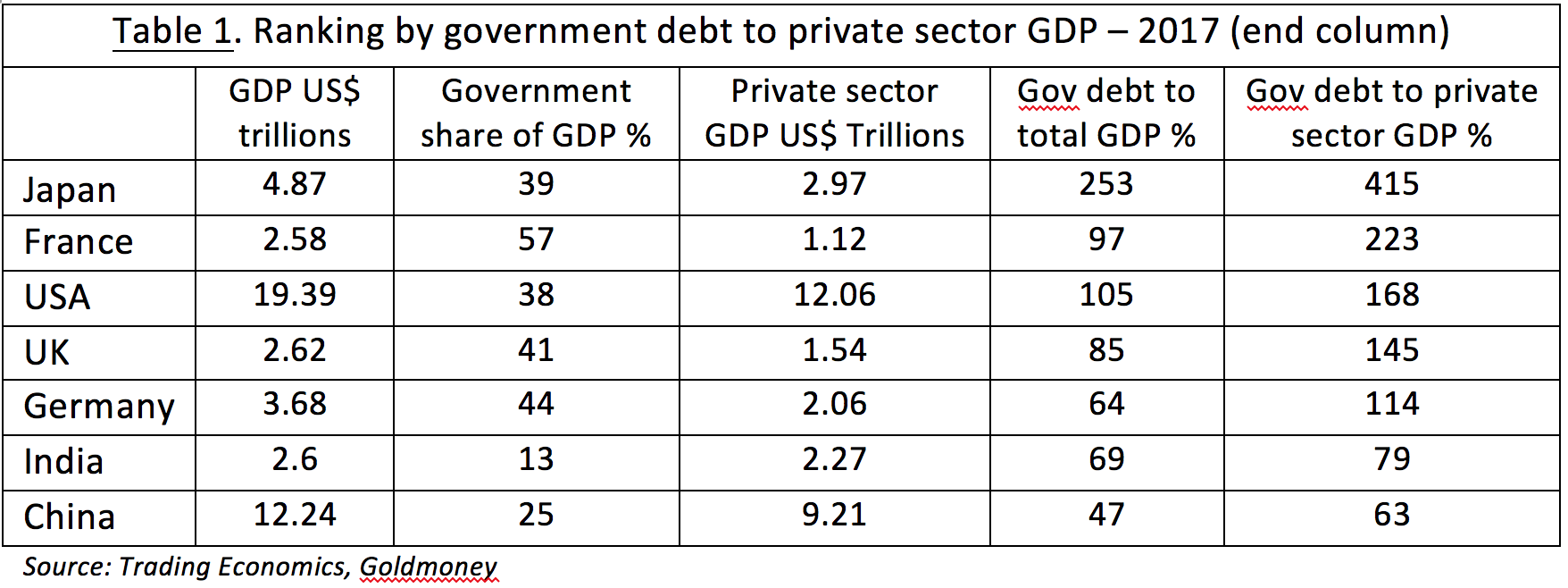

ZIRP, NIRP and QE have consequences. One of those consequences is that government bond yields throughout Europe have gone negative. Out to two year durations, government bond yields are now negative in Switzerland. And Germany. And Finland. And the Netherlands. And Austria. And Belgium. And Denmark. And France. And Ireland. And Sweden. And Italy. And Spain. Irrespective of the credit quality of those borrowers, bond investors in all of those countries are guaranteed to lose money if they hold that short-term paper until it matures. That is quite odd.

The weirdness has spread from bonds to cash. From January, depositors in Alternative Bank Schweiz in Switzerland will earn -0.125% for lending their money to the bank. Depositors of over 100,000 Swiss francs will earn -0.75%. Which is certainly an alternative to traditional banking.

If you wanted to trigger a bank run, this is certainly how you might go about it. Drive interest rates down to zero. Then cut them some more. At the same time, start floating trial balloons about banning cash altogether. And if you’re in the euro zone, make sure you squander seven years doing precisely nothing to restructure your banking system after the near-death experience of 2008.

Could QE be causing deflation ? It’s a valid question. By suppressing interest rates, central banks are making it impossible for market prices and bad economic actors to clear. (The world, in other words, has turned into 1990s Japan.) With otherwise insolvent businesses – zombies – remaining operational, supply is rising. Assuming no change in demand, prices are falling. That is either disinflation or outright deflation. And Mario Draghi is determined that the beatings will continue until morale improves.

What should the rational investor do in an environment of ongoing financial repression ?

To know the answer, we need to know whether central banks will be successful in their increasingly quixotic efforts to vanquish deflation. We think the ultimate outcome will be an inflationary mess on a scale perhaps unprecedented in financial history, but not, perhaps, before a deflationary crisis happens first.

Either way, western market government bonds no longer offer any margin of safety, only the prospect of guaranteed loss. They have once again become certificates of confiscation.

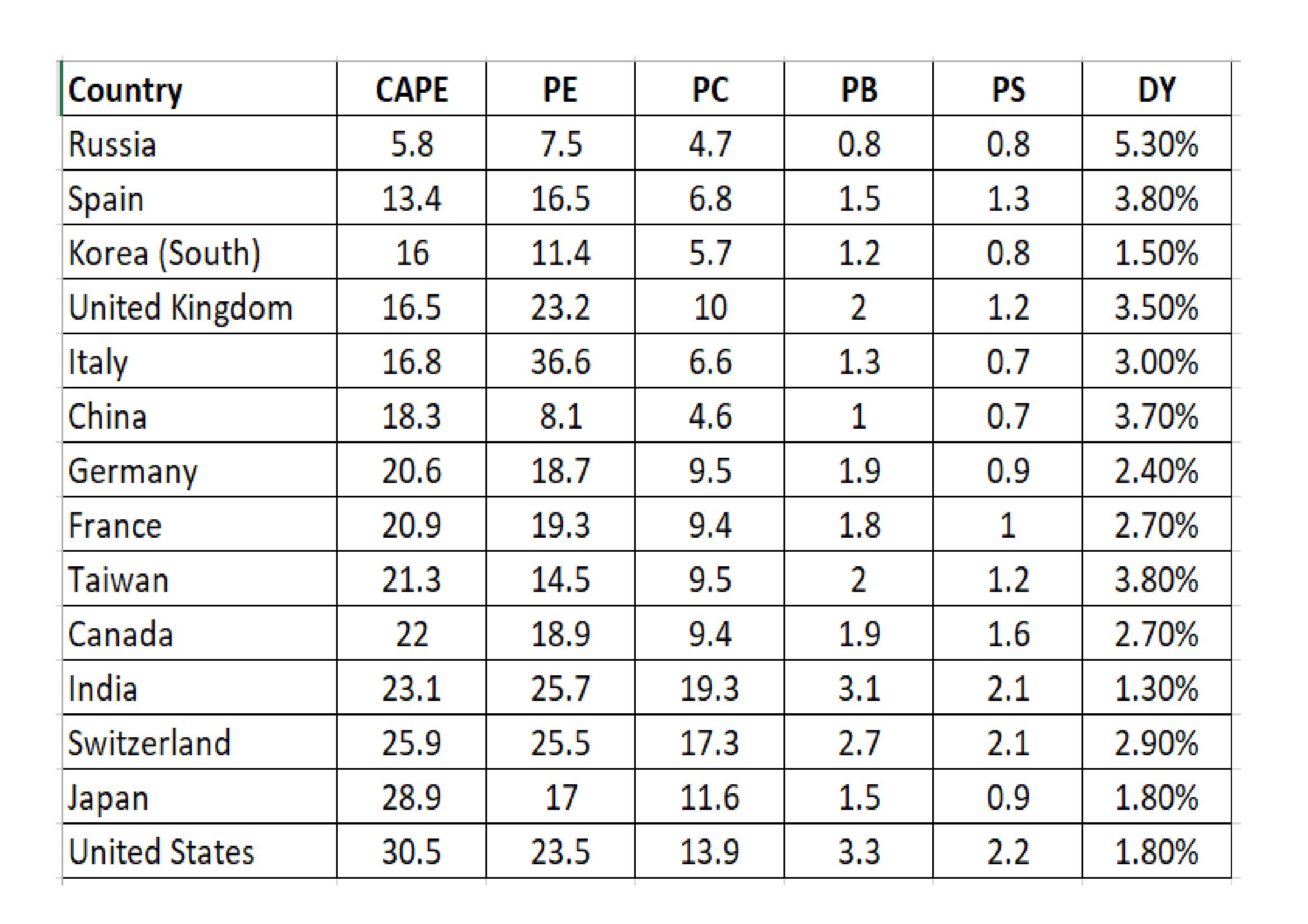

The attractions of common stocks are more nuanced, given the extent to which they are dependent on ongoing monetary expansion (not easily forecastable – “Don’t fight the Fed” has been the appropriate response since 2008, but it will not be forever). For us, the logical solution is to focus only on the highest quality businesses trading at the lowest possible multiples – which invalidates most western markets, notably those of the US, from consideration.

We find price momentum strategies (i.e. long term systematic trend-following) appealing on two fronts – a historic lack of correlation to stock and bond markets first, and a proven ability to generate strong positive returns during market shocks.

And notwithstanding the price action of the last four years, we continue to see merit in precious metals. Think of gold, for example, not as a commodity per se (gold is rarely if ever consumed), but as a special type of bond. In the words of Charlie Morris, a zero coupon irredeemable bond. With no credit risk. And where the issuer is God.