Vishal Wilde is a finalist studying for a BSc (Hons) in Philosophy, Politics & Economics (Economics major) at the University of Warwick. He wishes to spend his life fighting for and defending freedom. He is a Freelance Journalist (writing, most recently, for the Market Mogul), he writes Poetry, Science-Fiction and Fantasy and conducts independent academic research in Economics, Political Science and Philosophy. He is a Research Consultant for Fantain Sports, Pvt Ltd. (a tech startup based in India). He has previously written research articles and blogged for the Adam Smith Institute.

Summary

- After considering the alternative scenarios of Grexit, debt renegotiation, transferring of debt, a deflationary spiral and so on, it is concluded that this will either result (ceteris paribus) in an increase in sovereign debt yields or a decrease in the volume of sovereign debt issued. This is worrying; not only due to the events in Greece and the ripples it has sent throughout the Eurozone but also because elections are approaching in other peripheral countries.

- The effect that this has on Repo market rates (where “government bond collateral” accounted “for almost 80% of EU-originated repo collateral” in the European repo market) would then have a subsequent, significant impact on EURIBOR rates (EURIBOR being a key rate for unsecured lending which many derivatives – OTC interest rate derivatives especially – are linked to).

- Given that EURIBOR has remained relatively low in recent years and governments have sought to keep interest rates low in an effort to stimulate a recovery, this would be a sudden shock to a vulnerable, sensitive system.

- It is further argued (using Keynes’ theoretical analysis) that the sharp increase in liquidity preference and the depression of the marginal of efficiency of capital is, in general, far greater than that which occurred during the Great Depression and that, due to the especially uncertain climate of monetary policy, this means that Central Banking has been the reason why the OTC Interest Rate Derivatives market has been systemically primed for a crisis.

- I further argue that the potential scale of the OTC Interest Rate Derivatives crisis dwarfs both the Credit Default Swaps and Collateralised Debt Obligations positions that were associated with the Great Recession.

- It is also argued that the risks are greater than the Great Depression and that, if the money and banking system remains unreformed, the world could be plunged into a crisis that belittles the Great Depression itself.

Introduction

It’s initially argued here that, depending on the outcome from the current acute phase of the Eurozone Sovereign Debt crisis, it could culminate in the Eurozone plunging into a far more severe financial crisis related to the OTC interest rate derivatives market.

Keynes’ theory of crises combined with observations from and during the contemporary financial crisis as well as from the Great Depression is used to support the argument that the OTC interest rate derivatives market has been systemically primed for a crisis and that the current politico-economic situation in Greece and, more widely, the Eurozone, could be the trigger.

Premising that yields will increase or that there will be a future decrease in the volume of sovereign debt issued if certain outcomes materialise

It’s worth considering several alternative scenarios. Suppose Greece defaults on purpose but is allowed to remain in the Eurozone. It is the government debt that is seen by the public (in Greece and in Spain, Italy and Portugal, for example) to be the direct cause of austerity – this will lead other governments come under pressure from taxpayers and voters to default as well, whilst remaining in the Eurozone. This will lead to a decrease in the expected future credibility of debt issued by these countries.

Similarly, if Greece is allowed to further renegotiate the debt (though this seems highly unlikely), then this will prompt protests for further debt renegotiations across Southern Europe and, again, the expected future credibility of Eurozone Sovereign Debt is dealt yet another blow. This will lead to reduced demand for Eurozone sovereign debt and, therefore, increased yields.

Furthermore, Germany and/or other Creditor countries won’t take the debt because their electorates simply won’t stand for it. If Germany did, however, decide to transfer some of the debt burden onto itself in a desperate attempt to keep the Eurozone together (to the dismay of the German taxpayer), this would increase the German government’s credit risk and increase the German Bund yields.

If Greece defaults on purpose but exits the Eurozone and returns to the drachma, this will lead to their having created a national currency which will have far lower credibility than the Euro and, simultaneously, a government which will have limited access to the credit markets (having previously defaulted on a large debt) – if they do issue bonds, they’d have to have incredibly high yields to even make investors think twice about it.

If Greece exits the Euro and other peripheral countries follow (protestors are already gathering in Spain, the Portuguese and Italians are watching intently – but it’s not just them, many in Northern Europe want to leave the Euro as well), a return to their national monies will be accompanied by the expectation of competitive devaluation of that new money with respect to the Euro.

The problem here is that, in addition to these new governments facing the problem of higher yields, the devaluation with respect to the Euro will work to harm Germany since it is an export-led nation (one of the main advantages Germany has in maintaining the Eurozone is that it prevents that devaluation with respect to German money and, therefore, protects its exporters).

The expectation then is that there will be mutual devaluations and a ‘zero-sum game’ will ensue where all parties, in an effort to devalue their monies, will end up losing total revenue in the end. If Germany loses export revenue, this would call into question its creditworthiness and thereby raise its yields.

Additionally, if Germany tries to devalue the Euro in response to this, the value of German government bonds will decrease and, therefore, yields will increase (unless it is offset by a corresponding increase in foreign demand for German bonds – though this is unlikely in such a scenario due to the uncertainty).

Most harrowingly, there is the prospect of constant deflation that looms over Europe. One might argue that deflation increases the real value of debt and, therefore, it should work to decrease bond yields. However, there is a sentiment that the ECB’s QE has come too late to prevent deflation across the Eurozone and one of the greatest dangers of deflation is the possibility for a deflationary spiral wherein prices decrease and, therefore, wages decrease which feeds back into further price and wage decreases.

Both an actual deflationary spiral and fears of it would work to severely limit national incomes and tax revenues; therefore, the increasingly questionable creditworthiness of countries suffering from (expected) deflationary spirals corresponds with upward pressure on government bond yields. It could be further argued that deflation is merely a temporary phenomenon that has been brought about by oil price falls – this implies that, once it passes, the initially depressing effect it has had on yields will evaporate into upward pressure on yields.

Alternatively, if (former) Eurozone governments wanted to continue with their previous yields, they would have to issue less sovereign debt to improve their creditworthiness (thereby being not excessively indebted).

The problem here is that since government bonds are widely used as collateral for secured lending (such as short-term cash loans, in the repo market, for example), this may lead to a liquidity crisis since it would severely restrain the supply of collateral available for secured funding and this is precisely what QE is looking to prevent since a liquidity crisis can trigger a Depression.

Additionally, we have the prospect of further political instability across the Eurozone since, in addition to Greece, the Spanish general elections are due to take place in 2015, as are the Portuguese general elections. Also, one should note that there are many people in ‘Northern’ Europe who sympathise with the plight of those who protest against austerity and this might also help reinforce the climate of political uncertainty.

Couldn’t more QE just supress bond yields?

Theoretically, yes. However, a sudden revision to the recent announcement of QE signals anxiety and panic to the markets and, therefore, this signal could entirely offset the depression of bond yields via QE through its effect on the state of expectations. Furthermore, there is the historically ingrained fear in Germany of hyperinflation (despite the current threat of deflation) and, hence, Germany would continue to vehemently oppose further proposals.

The Repo Market and secured lending

Increases in or expected increases in the sovereign bond yields due to a (expected) decrease in their price deals a blow to the important EU repo market – the majority of collateral here is sovereign debt, after all.

The Repo market is the market for ‘repurchase agreements’, which are short-term cash loans secured against some form of collateral and, on which, the borrower pays a fixed rate of interest. The ICMA’s (International Capital Market Association) “semi-annual survey of the European repo market estimates government bond collateral to account for almost 80% of EU-originated repo collateral.” This government bond collateral used includes German bunds, French bonds, Italian bonds, Spanish bonds, etc.

It follows that, if the value of collateral decreases then, ceteris paribus (i.e presuming that the same amount of collateral is posted for the same amount of cash loan), the rate of interest paid on that loan will increase. Furthermore, if the rate of interest charged for secured lending increases, then the rate of interest charged for unsecured lending will likely increase (since unsecured lending is generally more risky for creditors).

Considering the alternative scenario where the amount of sovereign debt issued by the affected governments is reduced in order to maintain yields and/or bolster their creditworthiness in the face of adversity, the Repo market would have to compensate for this by switching to other forms of collateral (due to the shortfall in supply of government bonds); these forms of collateral are used less than sovereign debt for the reason that they are not considered as high-quality or as liquid as sovereign debt (it can include corporate debt and commodities such as gold) – this would, again, increase the general level of interest charged in the repo market.

However, if the repo market participants cannot find suitable, alternative collateral, it could simply lead to a contraction in secured lending and, therefore, precipitate in a liquidity crisis.

EURIBOR, unsecured lending and OTC Interest Rate Derivatives

EURIBOR is the Euro Interbank Offered Rate on unsecured lending and this determines the amount to be paid on the floating leg of various interest rate swaps, forward rate agreements and, therefore, it determines the payments made by those entities that are legally bound to pay floating, variable rates.

Thus, since the increase in sovereign debt yields or the decrease in overall sovereign debt volumes that can be used as collateral would increase repo market rates and, therefore, EURIBOR (because the repo market rates are for secured lending whereas EURIBOR is the rate for unsecured lending), there would be significant pressure on those who are affected by these contracts; most interest rate swaps and forward rate agreements, for example (these are types of interest rate derivatives, which make up the majority of the OTC global derivatives market), have the floating payments linked to EURIBOR for Euro-denominated securities and LIBOR for dollar and pound-denominated securities.

Also, since the EURIBOR rates have remained relatively low in recent years, the significant change in EURIBOR required to trigger a crisis does not have to be of a great magnitude in order to lay waste to vulnerable entities due to their miscalculations, unstable expectations and relatively thin margins for error. Below is the EURIBOR 1 month (top left), 3 month (top right), 6 month (bottom left) and 1 year (bottom right) charts that reflect this reality.

Comparing the Great Depression and the Great Recession: Keynes’ Marginal Efficiency of Capital and Liquidity Preference

Green (1970) wrote of the 1929 stock market crash that “all the responsible estimates show that only a small minority (8 percent) of the population actually owned stock, and that within this minority the substantial holdings were heavily concentrated in the hands of the wealthy few, with 500,000 to 600,000 individuals owning between 75 and 85 percent of the out-standing stock.” On the other hand, homeownership rates in the US have, since as far back as 1965, remained firmly above 60%. So, the wave of foreclosures associated with the Great Recession directly affected a greater proportion of households than the slide of stock prices during the Great Depression.

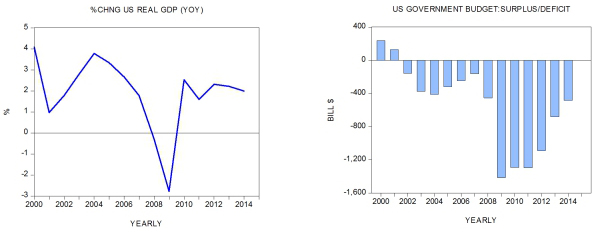

Furthermore, the fall in house associated with the Great Recession was a smaller percentage than the drop in stock prices; the Dow Jones Industrial Average dropped from 381.17 in 1929 to 41.22 in 1932 (a nearly 90% drop). Of course, this is far less than what the US experienced in terms of the drop in house prices (reflected below by the Case-Shiller Index):

On a Keynesian perspective, both the Great Depression and the Great Recession were caused by collapses in the marginal efficiency of capital that, in turn, were accompanied by “dismay and uncertainty” that precipitated in a sharp increase in liquidity preference. He defined “the marginal efficiency of capital” as “being equal to that rate of discount which would make the present value of the series of annuities given by the returns expected from the capital-asset during its life just equal to its supply price.”

On an initial analysis, the fact that house prices did not fall as much as stock prices did during the Great Depression may seem like a good thing. However, the problem is that this means that the decrease in house prices did not offset the fall in the “present value of the series of annuities given by returns expected from the capital-asset” and, when compared to the larger price correction of stocks during the Great Depression, the net effect on the marginal efficiency of capital was more depressing during the Great Recession than it was during the Great Depression (and still remains depressed, which is why this ‘recovery’ is so slow).

Compounded with the fact that households in the modern era were increasingly over-indebted in the run-up to, during and following the Great Recession, the magnitude of the collapse of the marginal efficiency of capital must have been greater than that which occurred during the Great Depression since so many more households’ wealth was depressed (the homeownership rate being higher than the stock ownership rate) and, therefore, the depressing impact on the state of expectations in the economy has been greater.

Commensurately then, we must expect the magnitude of increase in liquidity preference to be greater in the case of the Great Recession. Keynes wrote that “a more typical, and often the predominant, explanation of [crises] is… a collapse in the marginal efficiency of capital” and that “the dismay and uncertainty” which accompanies this collapse “naturally precipitates a sharp increase in liquidity preference”. Also, the fact that that increased liquidity preference has not yet been fully satisfied (despite interventionist measures such as QE) would help explain why this has been the slowest recovery on record.

This was further exacerbated by the fact that the government mistakenly believed that increasing homeownership (which led to a premature increase in house prices) and bailing out the banks that had made risky loans and which were exposed to Credit Default Swaps would improve confidence in the economy and, though this might have been partially true, the problem is that the gains in confidence were more than offset by the increase in the house prices (i.e the net effect on the marginal efficiency of capital was negative and this further exacerbated the increase in liquidity preference).

Friedman & Schwartz (1963) further suggested that a sudden contraction in the money supply made the Great Depression far more severe than it needed to be since it occurred at a time when liquidity preference had sharply increased and, therefore, a liquidity crisis was triggered by restricting liquidity whilst it was acutely preferred.

In the contemporary case, since houses are relatively illiquid, there are many avenues through which liquidity preference can be satisfied and this is reflected in the bullish stock and sovereign bond markets (both securities being relatively liquid when compared to real estate in that they can be sold quickly at a certain price interval). However, there is a crucial avenue through which the sharp increase in liquidity preference has sought to be satisfied (which is is often overlooked) and that is the OTC interest rate derivatives market.

Why an OTC Interest Rate Derivatives crisis?

The most major avenue through which liquidity preference is currently being satisfied in the financial markets is in the OTC Interest Rate Derivatives market. After all, it is not purely the uncertainty of illiquidity expectations that agents have to manage but also the increasingly uncertain, unconventional and desperate monetary policy that is being implemented by Central Banks across the world.

The European Central Bank, for example, has come under particular fire from many commentators for being insensitive to the conditions of particular member-states. The fact is that everybody knows that interest rates have to increase at some point but few can confidently claim to know by how much, when or how quickly; compounding this uncertainty is the uncertainty with respect to just how much more unconventional monetary policy can get (thereby altering market interest rates) and even the possibility of interest rates going even lower.

OTC Interest Rate Derivatives are specifically designed to manage the risk associated with changes in the interest rate and since they are also a relatively liquid market, this means that they are a major, preferred avenue in financial markets for satisfying the acute increase in liquidity preference since it simultaneously helps manage the risk associated with uncertain monetary policy (which stocks and bonds do not directly purport to do).

Taking turnover to be a proxy for liquidity, we observe a 37.4% growth in turnover from 2010-2013 in EUR OTC Interest Rate Derivatives (versus a 14.1% growth in turnover across all currencies for OTC interest rate derivatives):

Attempting to give some perspective on the potential scale of such a crisis, the total credit default swap (notional) outstandings was $62.2 trillion in 2007 before declining to $38.6 trillion (2s.f) and $30.4 trillion (2s.f) in 2008 and 2009, respectively. These were positions that lead to Lehman Brothers and AIG collapsing, banks being bailed out etc.

However, by June-end 2014, the (notional) amount outstanding for the global OTC interest rate derivatives market stood at $560 trillion (2s.f). This is especially worrying when we consider that the exposure to these contracts is spread out amongst a wider variety of financial and non-financial institutions than was the case with Credit Default Swaps in the subprime mortgage crisis, that they are further linked to various industries (via corporations’ usage of them) and that there is an expectation that interest rates have to rise at some point (but no-one knows exactly by how much, when or how quickly).

The above bar chart depicts the Global OTC Interest Rate Derivatives market according to the Bank of International Settlements. Furthermore, the Bank comments:

“The interest rate segment accounts for the majority of OTC derivatives activity. For single currency interest rate derivatives at end-June 2014, the notional amount of outstanding contracts totalled $563 trillion, which represented 81% of the global OTC derivatives market (Table 3). At $421 trillion, swaps account for by far the largest share of outstanding interest rate derivatives.

Developments in the interest rate segment were a key driver of the global trend in recent years of declining market values. The gross market value of interest rate derivatives declined to $13 trillion at end-June 2014, from $14 trillion at end-December 2013 and its most recent peak of $20 trillion at end-2011.”

The exposure to these interest rate derivatives is spread across financial and non-financial institutions alike – everyone is vulnerable. Whether they be investment banks, retail banks, pension funds, mutual funds, governments, people paying variable-rate loans, large and medium-sized corporations that use them to manage risk and increase profits etc. and even if one is not directly or even obviously indirectly exposed to these interest rate derivatives, the fallout will have a major, depressing impact on their life, nonetheless, due to the increasingly interconnected and complex nature of our global economy.

Although gross market value has declined, this is still a cause for concern because “the gross market value represents the maximum loss that market participants would incur if all counterparties failed to meet their contractual payments and the contracts were replaced at current market prices.”

If even a portion of these were to materialize in such a way, it would be a substantial blow to the global economic system whilst it is in such a fragile state and, that too, it would be more painful than what we felt from the fallout of Credit Default Swaps since the notional amounts outstanding are far greater.

There is, quite simply, not enough money available to bail us out from such a mess even if we wanted there to be. The global economy would experience an unprecedented, dismal crash and a seemingly perpetual slowdown, which would be worse than the Great Depression unless Free Banking is allowed.

Adding to this headache is the fact that public sentiment, academic opinion and political actors have overwhelmingly voted to clamp down on the OTC derivatives market (by implementing Basel III, for example) by 2019 and the very fact that there has been reluctance by traders to move to exchanges (amongst other things which Basel III outlines) from OTC trading suggests that there are perceived costs in doing so.

Thus, Basel III is clamping down on an avenue for liquidity preference in an analogous way to how the Fed’s contraction of the money supply did so and caused the Great Depression; furthermore, the expectation that Basel III will be implemented has meant that this has fed back into current expectations and further contributed to making the recovery so sluggish.

The idea of transferring counterparty risk onto a suitably ‘well-capitalised’, ‘well-managed’ and liquid central clearing house that has been authorized by certain regulatory institutions essentially means that, though the intention is to reduce the risks associated with default(s) (and thereby limit the possibility for catastrophic contagion), these central clearing houses would become ‘too-big-to-fail’.

Some market participants may, rather understandably, prefer to be exposed directly to counterparty risk rather than prop up and possibly suffer the potential fallout from a ‘too-big-to-fail’ central clearing house; given the previous fallout from ‘too-big-to-fail’ institutions, it is clear to see why the perceived risk from imposed, artificially incentivised central clearing for some would be greater than the status quo.

Of course, one could counter-argue that managing this risk would simply involve imposing a combination of standards (on default fund requirements, for example, amongst other things) and limiting the amount of transactions that can be cleared by any one particular central clearing house; however, this naturally entails limitation of the size of the OTC interest rate derivatives market – given what was previously argued regarding liquidity-preference satisfaction and that limiting it is akin to the monetary contraction that caused the Great Depression, it is plausible to see why such policy prescriptions would be disastrous.

What is most worrying about higher capital requirements is that this means that the calculation of risk-weighted assets will become even more important. This is especially alarming given the fact that the sought risk reductions are merely according to particular methodologies that will become less adequate and are, indeed, replaced and modified over time. The problem here is that certain risk-calculation methodologies become entrenched and privileged, thereby leading to discouragement and distortion of innovation commensurate with our constantly evolving, increasingly complex world. This mismatch of ill-adapted risk-management strategies naturally primes markets for gross, grave and potentially devastating systemic imbalances.

The impact on the global economy

Now, one might be tempted to believe that people would simply substitute European bonds for American and/or British government bonds (for example) in their portfolios and that, therefore, American and British taxpayers would benefit from this. However, since the Eurozone is a major trading partner for both the UK and the US (not to mention China, India, Brazil and many Emerging Markets), a worsening financial crisis in the Eurozone would have profound global implications and a slowdown would negatively impact the credit risk of trading partners also.

References

Friedman, Milton & Schwartz, Anna J. 1963. A Monetary History of the United States, 1867-1960. Princeton University Press.

Green, George D. 1970. “Speculation on Speculation: The Economic Impact of the Stock Market Boom and Crash of 1929.” Seminar: Dinner meeting of the Friends of Economic and Business History, Harvard Faculty Club.

Keynes, John M. 1936. The General Theory of Employment, Interest and Money. Barnes & Noble.

Wilde, Vishal. 2014. “Co-operative, Competitive National Currencies: An alternative Eurozone currency arrangement?” Adam Smith Institute (Research). Web.

Wilde, Vishal. 2014. “Competing monetary rules: modern free banking possibilities.” Adam Smith Institute (Blog). Web.