Eighty years go, on February 4, 1936, one of the most influential books of the last one hundred years was published, British economist, John Maynard Keynes’s The General Theory of Employment, Interest and Money. With it was born what has become known as Keynesian Economics.

Within less than a decade after its appearance, the ideas in The General Theory had practically conquered the economics profession and become a guidebook for government economic policy. Few books, in so short a time, have gained such wide influence and generated so destructive an impact on public policy. What Keynes succeeded in doing was to provide a rationale for what governments always like to do: spend other people’s money and pander to special interests.

In the process Keynes helped undermine what had been three of the essential institutional ingredients of a free-market economy: the gold standard, balanced government budgets, and open competitive markets. In their place Keynes’s legacy has given us paper-money inflation, government deficit spending, and more political intervention throughout the market.

It would, of course, be an exaggeration to claim that without Keynes and the Keynesian Revolution inflation, deficit spending, and interventionism would not have occurred. For decades before the appearance of Keynes’s book, the political and ideological climate had been shifting toward ever-greater government involvement in social and economic affairs, due to the growing influence of collectivist ideas among intellectuals and policy-makers in Europe and America.

Before Keynes: Wise Free Market Policies

But before the appearance of The General Theory, many of the advocates of such collectivist policies had to get around the main body of economic thinking which still argued that, in general, the best course was for government to keep its hands off the market, maintain a stable currency backed by gold, and restrain its own taxing and spending policies.

The free market economists of the eighteenth and nineteenth centuries had persuasively demonstrated that government intervention prevented the smooth functioning of the market. They were able to clearly show that governments have neither the knowledge nor the ability to direct economic affairs. Freedom and prosperity are best assured when government is, in general, limited to protecting people’s lives and property, with the competitive forces of supply and demand bringing about the necessary incentives and coordination of people’s activities.

Lessons Learned: Gold Money and Balanced Budgets

During the Napoleonic wars of the early nineteenth century, many European countries experienced serious inflations as governments resorted to the money printing press to fund their war expenditures. The lesson the free market economists learned was that the hand of the government had to be removed from the handle of that printing press if monetary stability was to be maintained. The best way of doing this was to link a nation’s currency to a commodity like gold, require banks to redeem their notes for gold on demand at a fixed rate of exchange, and limit any increases in the amount of bank notes in circulation to additional deposits of gold left in the banks by their depositors.

They also concluded that deficit spending was a dangerous means of funding government programs. It enabled governments to create the illusion that they could spend without imposing a cost on society in the form of higher taxes; they could borrow and spend today, and defer the tax cost until some tomorrow when the loans would have to be repaid.

These free market economists called for annually balanced budgets, enabling the electorate to see more clearly the cost of government spending. If a national emergency, such as a war, were to force the government to borrow, then when the crisis passed, the government should run budget surpluses to pay off the debt.

Keynes’ Thinking on Markets, Wages and Government

These were considered the tried and true policies for a healthy society. And these were the policies that Keynes did his best to try to overthrow in the pages of his book, The General Theory. He argued that a market economy was inherently unstable, open to swings of irrational investor optimism and pessimism, which resulted in unpredictable and wide fluctuations in output, employment, and prices.

Only government, he believed, could take the long view and rationally keep the economy on an even keel by running deficits to stimulate the economy during depressions and surpluses to rein it in during inflationary booms. He therefore attacked the notion of annual balanced budgets; instead, government should balance its budget over the “business cycle,” that is, deficits during recessions and surpluses during full employment and economic growth years.

But to do this job, Keynes said, the “barbarous relic” of the gold standard should not hamstring governments. Wise politicians, guided by brilliant economists like himself, had to have the flexibility to increase the money supply, manipulate interest rates, and change the foreign-exchange rates at which currencies traded for each other. They required this power so they could generate any amount of spending needed to put people to work through public-works projects and government-stimulated private investments. Limiting increases in the money supply to the quantity of gold would only get in the way, Keynes insisted.

Keynes believed not only that the market economy could not keep itself on an even keel he also believed that it would be undesirable to allow the market to work. He once said that to have the market determine prices and wages to balance supply and demand was to submit society to a cruel and unjust “economic juggernaut.” Instead, he wanted wages and prices to be politically fixed on the basis of “what is ‘fair’ and ‘reasonable’ as between the [social] classes.”

During the Great Depression years of mass unemployment, he argued that the level of wages imposed by trade unions were to be viewed as sacrosanct, even if many workers were priced out of the market because the level was higher than potential employers thought those workers were worth. The government, instead, was to print money, run deficits, and push up prices to any level needed to make it again profitable for employers to hire workers. In other words, perpetual price inflation was to be the means to assure “full employment” in the face of aggressive trade unions demanding excessive wages.

The “Austrian” Alternative to Keynesian Economics

What Keynes completely discounted and, in fact, rejected was the alternative “Austrian” interpretation of the causes and cures for the Great Depression, as formulated by Ludwig von Mises, Friedrich A. Hayek and others. For the Austrian Economists, monetary expansion and interest rate manipulation had set in motion serious and distorting imbalances between savings and investment that resulted in mal-investment of capital, and misdirection of resources and labor – even though this happened in the United States under the seeming non-inflationary circumstances of a relatively stable price level.

Keynes’s new “macroeconomics” of focusing primarily on economy-wide statistical averages and aggregates – such as “aggregate demand,” “aggregate supply,” output and employment “as a whole” – hide from view all the real “microeconomic” relationships and interconnections between numerous individual supplies and demands that were being thrown out of coordination and balance due to the monetary policies of central banks.

When the financial and economic crisis of 1929-1930 began to snowball into wider and wider circles of falling output and rising unemployment, the Austrians had emphasized that a rebalancing throughout many parts of the economy required price and wage adjustments, and labor, capital and resource reallocations to restore coordination between those interconnected supplies and demands.

But this was the explanation and solution to the Great Depression that John Maynard Keynes rejected and refused to understand.

Deficit Spending and Special Interest Politics

In addition, when the balanced-budget rule was overthrown there was no longer any check on government spending. As economists, James M. Buchanan, and Richard E. Wagner pointed out in Democracy in Deficit (1977), once government is freed from the restraint of making taxpayers directly and immediately pay for what it spends, every conceivable special-interest group can appeal to the politicians to feed their wants. The politicians, desiring votes and campaign contributions, happily offer to satisfy the gluttony of these favored groups. At the same time, the taxpayers easily fall prey to the delusion that government can give something for nothing to virtually everyone at no or little cost to them.

Indeed, politicians can now play the game of offering more and more dollars to special interests, while sometimes even lowering taxes. The government simply fills the gap by borrowing, imposing a greater debt burden on future generations. Either taxes will have to go up in the years ahead or the government will turn to the printing press to pay what it owes, all the while claiming that it’s being done to generate “national prosperity” and fund the “socially necessary” programs of the welfare state.

And no need to worry about all this in the present, Keynes assured us, after all “in the long run we are all dead,” as he famously once said. Our problem, of course, is that we are increasingly living through the long-run consequences of Keynes’ short-run policies.

Enduring Wisdom of the Free Market Economists

The free market economics that preceded Keynes had been founded on two insights about man and society. First, there is an invariant quality to man’s nature that makes him what he is; and if society is to be harmonious, peaceful, and prosperous, men must reform their social institutions in a way that directs the inevitable self-interests of individual men into those avenues of action that benefit not only themselves but others in society as well.

They therefore advocated the institutions of private property, voluntary exchange, and peaceful, open competition. Then, as Adam Smith had concisely expressed, men would live in a system of natural liberty in which each individual would be free to pursue his own ends, but would be guided as if by an invisible hand to serve the interests of others in society as the means to his own self-improvement.

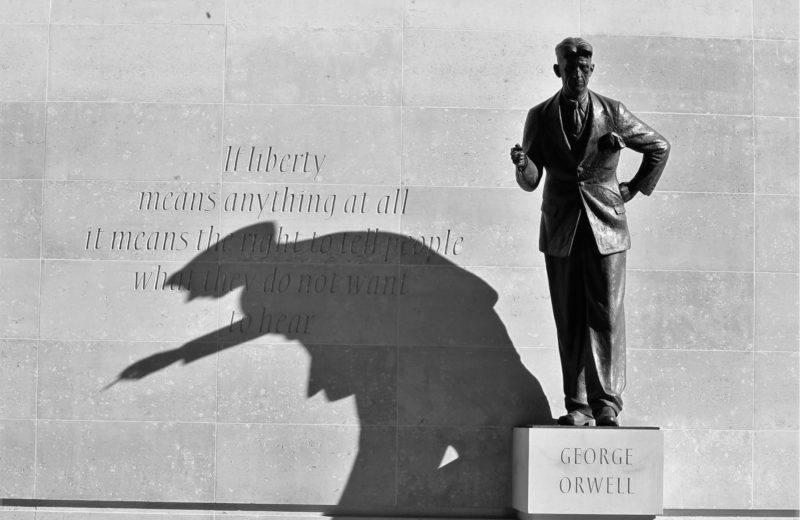

Second, it is insufficient in any judgment concerning the desirability of a social or economic policy to focus only upon its seemingly short-run benefits. The laws of the market always bring about certain effects in the long run from any shift in supply and demand or from any government intervention in the market order. Thus, as French economist Frederic Bastiat emphasized, it behooves us always to try to determine not merely “what is seen” from a government policy in the short run, but also to discern as best we can “what is unseen,” that is, the longer-run consequences of our actions and policies.

The reason it is desirable to take the less immediate consequences into consideration is that longer-run effects may not only not improve the ill the policy was meant to cure, but can make the social situation even worse than had it been left alone. Even though the specific details of the future always remain beyond our ability to predict fully, one use of economics is to assist us to at least qualitatively anticipate the likely contours and shape of that future aided by an understanding of the laws of the market.

Keynes’s assumptions deny the wisdom and the insights of those free market economists. The biased emphasis is toward the benefits and pleasures of the moment, the short run, with an almost total disregard of the longer run consequences.

Keynes’s economics of the short-run, led Austrian economist, F. A. Hayek, to lament in 1941:

“I cannot help regarding the increasing concentration on short-run effects . . . not only as a serious and dangerous intellectual error, but as a betrayal of the main duty of the economist and a grave menace to our civilization . . . It used, however, to be regarded as the duty and the privilege of the economist to study and to stress the long run effects which are apt to be hidden to the untrained eye, and to leave the concern about the more immediate effects to the practical man, who in any event would see only the latter and nothing else. . . .

“It is not surprising that Mr. Keynes finds his views anticipated by the mercantilist writers and gifted amateurs; concern with the surface phenomena has always marked the first stage of the scientific approach to our subject . . . Are we not even told that, “since in the long run we all are dead,” policy should be guided entirely by short-run considerations. I fear that these believers in the principle of ‘après nous le deluge’ [‘after us, the flood’] may get what they have bargained for sooner than they wish.”

Keynes’s Ideology of Ethical Nihilism

On what moral or philosophical basis, it is reasonable to ask, did Keynes believe that policy advocates such as himself had either the right or the ability to manage or direct the economic interactions of multitudes of peoples in the marketplace? Keynes explained his own moral foundations in Two Memoirs, published posthumously in 1949, three years after his death. One memoir, written in 1938, examined the formation of his “Early Beliefs” as a young man in his twenties at Cambridge University in the first decade of the twentieth-century.

He, and many other young intellectuals at Cambridge, had been influenced by the writings of philosopher G. E. Moore. Separate from Moore’s argument, what are of interest are the conclusions reached by Keynes from reading Moore’s work. Keynes said:

“Indeed, in our opinion, one of the greatest advantages of his [Moore’s] religion was that it made morals unnecessary . . . Nothing mattered except states of mind, our own and other people’s of course, but chiefly our own. These states of mind were not associated with action or achievement or consequences. They consisted of timeless, passionate states of contemplation and communion, largely unattached to ‘before’ and ‘after’.”

In this setting, traditional or established ethical or moral codes of conduct meant nothing. Said Keynes:

“We entirely repudiated a personal liability on us to obey general rules. We claimed the right to judge every individual case on its own merits, and the wisdom, experience and self-control to do so successfully. This was a very important part of our faith, violently and aggressively held . . . We repudiated entirely customary morals, conventions and traditional wisdoms. We were, that is to say, in the strict sense of the term immoralists . . . We recognized no moral obligation upon us, no inner sanction to conform or obey. Before heaven we claimed to be our own judge in our own case.”

Keynes declared that he and those like him were “left, from now onwards, to their own sensible devices, pure motives and reliable intuitions of the good.”

Then in his mid-fifties, Keynes declared in 1938, “Yet so far as I am concerned, it is too late to change. I remain, and always will remain, an immoralist.” As for the social order in which he still claimed the right to act in such unrestrained ways, Keynes said that “civilization was a thin and precarious crust erected by the personality and the will of a very few, and only maintained by rules and conventions skillfully put across and guilely preserved.”

Thus, the decisions concerning the affairs of society are to be made on the basis of the self-centered “state of mind” of the policymakers, with total disregard of traditions, customs, moral codes, rules, or the long-run laws of the market. Their rightness or wrongness was not bound by any independent standard of “achievement and consequence.”

Instead it was to be guided by “timeless, passionate states of contemplation and communion, largely unattached to ‘before’ and ‘after’.” The decision-maker’s own “intuitions of the good,” for himself and for others, were to serve as his compass. And let no ordinary man claim to criticize such actions or their results. “Before heaven,” said Keynes, “we claimed to be our own judge in our own case.”

Here was an elitist ideology of nihilism. The members of this elite were self-appointed and shown to belong to this elect precisely through mutual self-congratulations of having broken out of the straightjacket of conformity, custom, and law.

For Keynes in his fifties, civilization was this thin, precarious crust overlaying the animal spirits and irrationality of ordinary men. Its existence, for whatever it was worth, was the product of “the personality and the will of a very few,” like himself, naturally, and maintained through “rules and conventions skillfully put across and guilely preserved.”

Society’s shape and changing form were to be left in the hands of “the chosen” few who stood above the passive conventions of the masses. Here was the hubris of the social engineer, the self-selected philosopher-king, who through manipulative skill and guile directed and experimented on society and its multitudes of individuals.

Keynes’s arrogance and self-confidence in his ability to manage and manipulate public opinion and public policy was expressed shortly before his death in 1946. Friedrich Hayek once recounted a conversation he had with Keynes in the immediate post-World War II period.

Hayek asked Keynes if he was not concerned that some of his own intellectual disciples were taking his ideas into dangerous and undesirable directions.

“After a not very complementary remark about the persons concerned he proceeded to reassure me: those ideas had been badly needed at the time he had launched them. But I need not be alarmed; if they should ever become dangerous I could rely upon him that he would again quickly swing round public opinion – indicating by a quick movement of his hand how rapidly that would be done. But three months later he was dead.”

Politicians Hear Keynes’ Defunct Voice in the Air

In one of the most famous passages in The General Theory, Keynes said,

“The ideas of economists and political philosophers, both when they are right and when they are wrong, are more powerful than is commonly understood. Indeed the world is ruled by little else. Practical men, who believe themselves to be exempt from any intellectual influences, are usually the slaves of some defunct economist. Madmen in authority, who hear voices in the air, are distilling their frenzy from some academic scribbler of a few years back.”

Eighty years after the appearance of The General Theory, many practical men of affairs and politicians in authority remain the slaves of defunct economists and academic scribblers. The tragedy for our times is that among the voices they still hear in the air as they corruptly mismanage everything they touch is that of John Maynard Keynes.

– See more at: http://www.epictimes.com/richardebeling/2016/02/the-follies-and-fallacies-of-keynesian-economics/#sthash.fxja4tXV.dpuf

Did Mr Keynes ever meet Aleister Crowley, because the tone of Mr Keynes’ quotes is not a little satanist in their content?