Another month, another flight to Hamad international airport for 17th April after initial agreement to hold ‘upstream horses’ in February 2016. While it’s no doubt great fun getting back into the OPEC ‘masters of the oil universe’ routine, second time round, the stakes are rapidly rising in Doha given another supposed ‘freeze’ announcement would actually be read as outright OPEC / Russia failure without clear signals the market will see actual cuts. That opens a very complex can of worms for what’s at stake here. We’ll do OPEC politics first, followed by market ‘realities’ second. On both counts, timing is crucial. And bluntly put, OPEC couldn’t have picked a worse window for another ad hoc meeting.

Leading up to Doha, market expectations will inevitably grow for some kind of cut that’s likely to put a few dollars on the barrel. Ironic given this remains a classic case of OPEC / non-OPEC heavyweights ‘talking peace, but preparing for war’ in terms of longer term volumes strategies. Obviously it’s all bluff for now, but the fact Kuwait claims it can do 3.2mb/d, Iraq has inched up to 4.8mb/d, Venezuela is holding firm at ‘2.6mb/d’, while Russia is full steam ahead at 10.9mb/d serves as a reasonable proxy for where everyone is likely to go in a low price environment; volumes plays. Iran has certainly made clear it’s insisting on pre-sanction production levels before it’s even willing to sit at the OPEC table. Nobody was ever realistically going to hold that against Iran given market problems everyone else has got themselves into this far down the line. But in the interim, the key space to watch on 17th April is whether the market’s been asking all the wrong questions over cuts to date. Forget Russian ‘honey-potting’ OPEC to try and announce collective supply cuts purely to gloss over deep-seated Russian depletion problems, where Moscow can’t keep 10.9mb/d pace indefinitely. Rather, if any cuts are announced, the smarter market analysts won’t read this as a ‘pro-active’ GCC measure, but start asking whether the GCC has potentially played Russia at their own ‘honey-potting’ game. Just as Russia is pumping for all it’s worth, a number of ‘MENA’ players are probably struggling to maintain January 2016 production levels as well. Depletion ‘necessity’ gets sold to the market as ‘virtuous’ cuts in Doha. The smaller the cuts, the greater the suspicion that OPEC is taking a leaf out of Russia’s book to try and cover depletion problems with supply side action. While that’s certainly an outside possibility, our overall take is unless things are far worse than anyone’s currently letting on upstream, the Doha meetings are far more likely just to see ongoing ‘freeze agreements’ remain in place. If so, prices will very quickly unravel after the 17th meeting given it’s basically just a license to pump whatever producers have. For all the political smoke, the market will see straight through the Doha haze, with highly reflective mirrors.

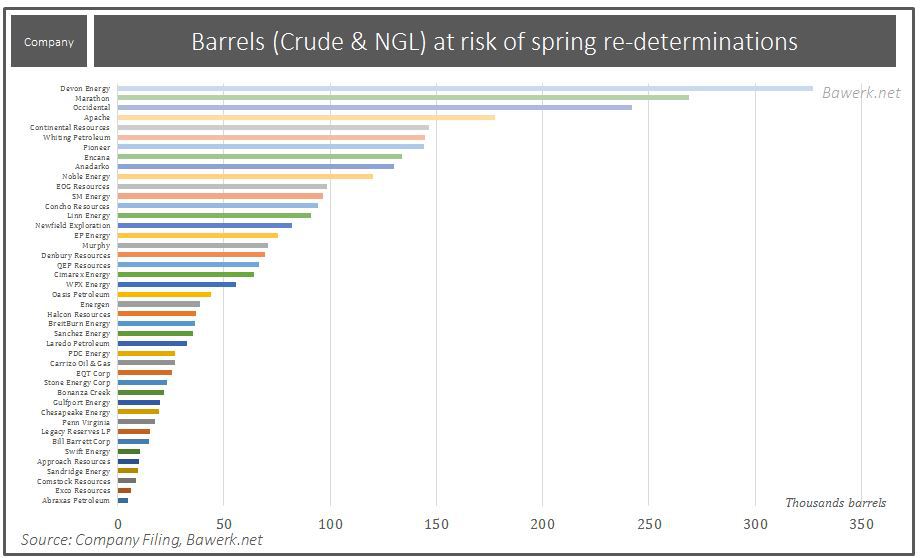

That’s fair enough if the entire exercise basically amounts to a waste of OPEC-Russian geopolitical time, but the problem is it’s far from a ‘no regrets’ option when it comes to market realities. Again, that’s based on two very clear time distinctions before and after the meeting. Both of which could prove costly for the producer group. Leading up to Doha, this is the worst possible time for OPEC to be talking a record short oil market up to $45/b given it’s one of two vital ‘redetermination’ windows in April and October when vast tranches of US shale production comes up for refinancing / access to credit facilities for smaller independent players. With longs unconvinced OPEC is serious, all it takes is for shorts to have booked enough profit for oil to resume its decline.In ballpark terms, it accounts for around 3.2mb/d worth of total US production. Production that would stand absolutely no chance of getting new credit lines if prices were hovering around $30/b at this stage of the cycle, given $34bn of previous loans (aka 15% of the $276.5bn total lent in 2015 to US players) was already deemed ‘substandard or doubtful’.

Reserve Based Lending

In a world where debt is subsidised and equity penalized capital intensive industries like oil exploration and production are naturally drawn toward debt products to fund their operations. In the new brave world of shale oil production frontier companies with limited access to bond markets rely more on traditional bank credit in the form of standing facilities to secure ample cash flow.

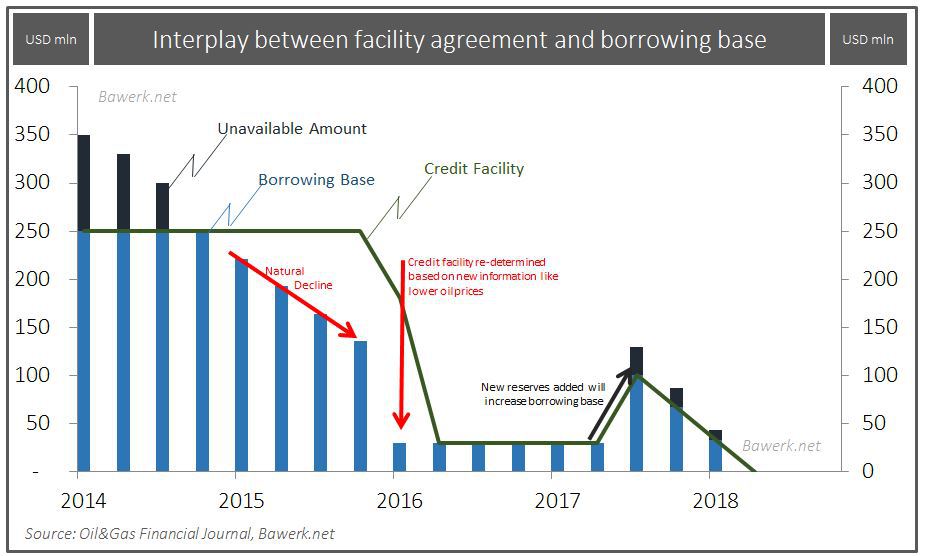

Banks obviously want unencumbered collateral to back up such credit facilities hence the concept of reserve based lending. In other words, banks use a company’s reserve report, independently approved by third parties, as basis for their credit lines. Needless to say, reserve valuation can be hard to determine with accuracy, so to guard against committing to a changing market environment most credit facilities are re-determined twice a year.

The net present value of a proved developed producing reserve (PDP) can be pledged as collateral for credit facilities. This valuation obviously depends on discount rates, production volumes, expected prices and other costs. If any of these input variables changes between re-determination periods the value of the collateral changes accordingly and banks can change the credit facility.

As the stylized example below depicts, the borrowing base will decline with production (natural decline rate of the field) and grow as new reserves are added. The fear nowadays is that the creeping perception of ‘lower for longer’ will prompt banks to reduce standing credit facilities just when the shale complex is most at risk of running out of cash.

Our analysis show that more than 3 mb/d of liquid production helped by US$55.5bn in credit facilities may be at risk as the spring re-determinations starts in April. It all comes down to the price deck used for reserve valuations. A 50 per cent increase in oil prices from mid-February thus provide ample ammunition for shale companies arguing their credit facilities should not be cut too much.

Acreage would have to be shut in; producers would have to consolidate or fold; with impairments felt across the US board. However, at $45/b (probably nudged above $50/b on forward expectations), not only will these players get another six months credit lifeline prolonging the ‘market rebalancing’ agony, the Fed / White House will be pressing banks / lenders extremely hard again to keep the tight oil party going given that gets them all the way to November 2016 US Presidential polls. In the so called ‘shale vs. sheikh’ battle, OPEC is talking the market up at the exact time when it should be letting prices collapse. Make no mistake, the race to put shale pen to refinancing paper before 17th April is now categorically on in the US, before the creaky Doha floor potentially collapses. By looking at speculative positions in the WTI market it is clear the recent rally has been unconvincing. Long positions hardly budged as prices rallied; coincidently with shorts being covered at an unprecedented pace. This was nothing more than the worst possible timed short squeeze. As the rally now comes to an end, expect prices to drop conspicuously, just as banks make their redetermination decisions on US$40 – 50 oil as compared to US$20 – 30 one month hence. Adding insult to OPEC injury, a flattening contango (we did say longs were unconvinced didn’t we) is destined to flood the market with stored crude, pushing prompt price down just enough to incentivize renewed inventory builds repeating the pattern ad infinitum. Killing shale softly is not the way to go. Aim for $10 /bbl and get the V-shaped recovery that just might save marginal OPEC countries from internal havoc.

And that brings us to the final point which ultimately leads us onto longer term OPEC post-Doha ‘strategy’. On the one hand, OPEC already showed its interim hand from February meetings that it’s largely unwilling (or unable) to decimate prices below $20/b by increasing volumes to kill US shale. It’s the only chance the group has to orchestrate a classic ‘V shape’ recovery; buying more time to get fiscal houses in order back at elevated prices. Rather, what the freeze discussions essentially do, is make sure if US shale won’t ultimately budge at $40/b, it ensures a long and painful ‘U shape’ recovery where more fragile OPEC producers start blowing out instead on the back of depressed prices. Whether the likes of Venezuela, Nigeria and Iraq understand that’s exactly what they’re signed up for, or whether they start to apply far more pressure on KSA and Russia to ‘put up or shut up’ on actual cuts, remains to be seen. For the very biggest OPEC players, backing US shale out remains plan A. But the longer supply side discussions go on, the more likely it is ‘plan B’ will have to do; killing smaller OPEC states / production. For those able to stay the course, quietly building up volumes in the background, then the eventual returns could be very lucrative when the time’s right. But Doha doesn’t make for a quick kill. It merely prolongs the agony far deeper and far longer. Perhaps for some, that’s the redemptive point from US redetermination…

Source: http://bawerk.net/2016/03/29/opecs-doha-dilemma-3mbd-us-lock-in/