By Pater Tenebrarum

Chopper Pilot Descends on Nippon

Readers are probably aware of recent events in Japan, the global laboratory for interventionist experiments. The theories of assorted fiscal and monetary cranks have been implemented in spades for more than a quarter of a century in the country, to appropriately catastrophic effect. Amid stubbornly stagnating economic output, Japan has amassed a debt pile so vast since the bursting of its 1980s asset bubble, it beggars the imagination.

A bridge to nowhere near Kyoto (there is a second, similar bridge nearby, which for differentiation reasons has been dubbed “the bridge from nowhere”). We hasten to stress that such monuments to bureaucratic insanity are by no means unique to Japan – they can be found all over the world (just not in a similar density). The one question etatistes always ask and which supporters of a free society have no satisfactory answer for is: “If there were no government, who would build the bridges to nowhere?” :)

A bridge to nowhere near Kyoto (there is a second, similar bridge nearby, which for differentiation reasons has been dubbed “the bridge from nowhere”). We hasten to stress that such monuments to bureaucratic insanity are by no means unique to Japan – they can be found all over the world (just not in a similar density). The one question etatistes always ask and which supporters of a free society have no satisfactory answer for is: “If there were no government, who would build the bridges to nowhere?” :)

Photo credit: Jeffrey Friedl

Here is a brief summary of what just happened: first, contrary to the global trend of incumbents falling from grace nearly everywhere, Shinzo Abe and the LDP achieved a resounding election victory. This victory inter aliaallows Abe to proceed with his militaristic agenda unhindered and to keep promoting his economic program that is best described as a mad-cap flight forward.

Secondly, an estimated five seconds after the votes were counted, Abe announced that he would indeed continue to follow the Keynesian playbook by doing even more of what hasn’t worked in over 25 years. His government plans to launch a major new “stimulus” program, rumored to cost 10 trillion yen (approx. $100 billion). Stimulus is the euphemism for shifting taxpayer funds to various favored political cronies. In the process taxpayers will be left with even more bridges to nowhere, so they will at least get a few new eyesores out of it.

Financial market participants immediately assumed that the central bank’s printing press would also be involved in this effort to create prosperity by bureaucratic fiat and consequently decided to lean on the yen (which was slightly overbought anyway). They also bought Japanese stocks, on the theory that they offer at least a small modicum of insurance against the monetary debauchery that is certain to be in train.

The markets decide to sell the yen following Shinzo Abe’s election victory. So here we have a blustering militaristic prime minister, whom the markets routinely associate with currency debasement. The shoe certainly fits – click to enlarge.

The markets decide to sell the yen following Shinzo Abe’s election victory. So here we have a blustering militaristic prime minister, whom the markets routinely associate with currency debasement. The shoe certainly fits – click to enlarge.

Thirdly, famous helicopter pilot, alleged “depression expert” and (as we think) certified monetary crank Ben Bernanke made landfall in Nippon shortly thereafter, reportedly to dispense his invaluable – and bound to be very costly – advice. A Bloomberg report on the event inter alia contains this little gem of unintended hilarity:

Japan has a long history of tapping foreign advisors.

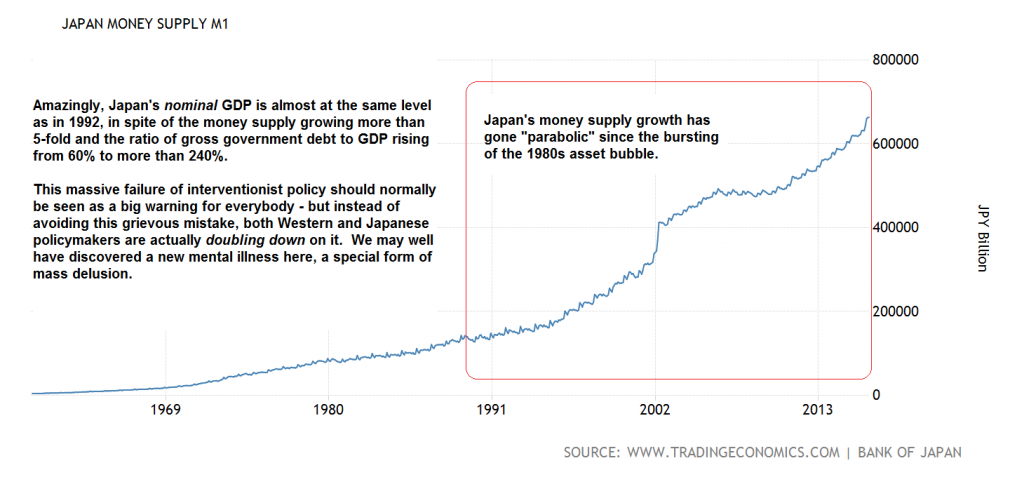

Indeed, it has – and it has followed their advice to a T. The outcome is depicted below. This goes to show that it can sometimes take really long before a befuddled patient realizes his doctors are complete quacks. In this case it has taken 26 years and the patient’s befuddlement has yet to dissipate.

These are precisely the long term effects sound economic theory suggests one should expect as a result of the policies adopted in Japan over the years (we will happily concede that GDP isn’t a particularly useful measure of economic wealth, but it serves to show long term economic trends). The problem is that sound economic theory has never been put into practice in Japan. The main reason for this is that sound economic policy would make “policymakers” completely superfluous – click to enlarge.

These are precisely the long term effects sound economic theory suggests one should expect as a result of the policies adopted in Japan over the years (we will happily concede that GDP isn’t a particularly useful measure of economic wealth, but it serves to show long term economic trends). The problem is that sound economic theory has never been put into practice in Japan. The main reason for this is that sound economic policy would make “policymakers” completely superfluous – click to enlarge.

Chopper Ben has been invited to Tokyo by Etsuro Honda, a life-long bureaucrat and one of Shinzo Abe’s closest economic advisors. Bernanke’s task was to help persuade Mr. Abe to essentially go full retard on the Keynesian/ monetarist intervention cocktail. Honda has been conspicuous as a major importer of foreign economists to Japan in recent years. According to Bloomberg, they add “star power” to his own misguided policy prescriptions:

“Honda, though, has taken the practice [of inviting foreign advisors, ed.] to a new level, bringing prominent overseas economists into the inner circle of Japanese policy making. The objective: adding star power to the weight of his own views on pivotal economic decisions.

Honda is a former Finance Ministry civil servant who has known Abe since they met at a wedding reception more than three decades ago. He was among the key people who persuaded the premier to adopt his program of reflation in 2013.

In 2014, Honda set up a meeting for Abe with Nobel laureate Paul Krugman, who successfully made the case for delaying a sales-tax increase. When the same issue confronted the Abe administration this spring, Joseph Stiglitz, another Nobel recipient, was brought in. A visit with Krugman followed.”

In short, Honda has invited the most deluded enemies of civilization he could find in order to “help” Japan (again, this is just our opinion; others think more highly of said gentlemen).

In spite of boosting the money supply by an astonishing multiple and burying the country up to its eyebrows in debt, Japan’s interventionists have not even been able to boost nominal GDP since 1992, which is quite a feat. It seems like a textbook example of what not to do – and yet, policymakers around the world insist on essentially doubling down on this madness. We believe this could be a new mental illness that is only waiting to be appropriately named. Keynes’ syndrome perhaps? Morbus grapheocraterum (bureaucrats’ disease)? We are open to suggestions – click to enlarge.

In spite of boosting the money supply by an astonishing multiple and burying the country up to its eyebrows in debt, Japan’s interventionists have not even been able to boost nominal GDP since 1992, which is quite a feat. It seems like a textbook example of what not to do – and yet, policymakers around the world insist on essentially doubling down on this madness. We believe this could be a new mental illness that is only waiting to be appropriately named. Keynes’ syndrome perhaps? Morbus grapheocraterum (bureaucrats’ disease)? We are open to suggestions – click to enlarge.

So what did Bernanke’s advice consist of in detail? Bloomberg informs us that he recommended a specific variant of “helicopter money” to the Japanese, which would involve overt central bank financing of deficit spending by the government. Allegedly the topic didn’t come up this time, but it has definitely come up previously (it should be noted that very little of what was actually discussed was made public):

Etsuro Honda, who has emerged as a matchmaker for Abe in corralling foreign economic experts to offer policy guidance, said that during an hour-long discussion with Bernanke in April the former Federal Reserve chief warned there was a risk Japan at any time could return to deflation. He noted that helicopter money — in which the government issues non-marketable perpetual bonds with no maturity date and the Bank of Japan directly buys them — could work as the strongest tool to overcome deflation, according to Honda. Bernanke noted it was an option, he said.

Though Honda said he thought Japan was already engaged in a strategy that involved helicopter money, he wanted to convey the idea to Abe and asked Bernanke to meet with the premier in Japan. While this didn’t happen in the spring, Bernanke joined central bank chief Haruhiko Kuroda over lunch this Monday and on Tuesday he attended a gathering with Abe and key officials, including Koichi Hamada, another influential economic adviser.

Bernanke at the Tuesday meeting said Japan should carry on with Abenomics policies by supplementing monetary policy with fiscal stimulus, according to Hamada. Bernanke told Abe that the BOJ still has instruments to further ease monetary policy, said Yoshihide Suga, Japan’s top government spokesman. The central bank didn’t reveal what Kuroda and Bernanke discussed.

Hamada said helicopter money wasn’t mentioned with Bernanke on Tuesday. Suga denied an earlier report in the Sankei newspaper that officials around Abe were considering helicopter money as a policy option. [That doesn’t mean anything at all given that Kuroda denied he would introduce negative interest rates two weeks before introducing them, ed.]

(emphasis added)

Reading between the lines, in spite of all the denials, helicopter money was what they discussed and what Japanese policymakers are now seriously considering.

Shinzo Abe’s economic advisor Etsuro Honda – importer of foreign “star economists”, all of which are best known for their central planning proclivities and for favoring the very policies that have landed Japan in its current quandary.

Shinzo Abe’s economic advisor Etsuro Honda – importer of foreign “star economists”, all of which are best known for their central planning proclivities and for favoring the very policies that have landed Japan in its current quandary.

Photo credit: Tomohiro Ohsumi / Bloomberg

Weimar Bed Pans for Rich People

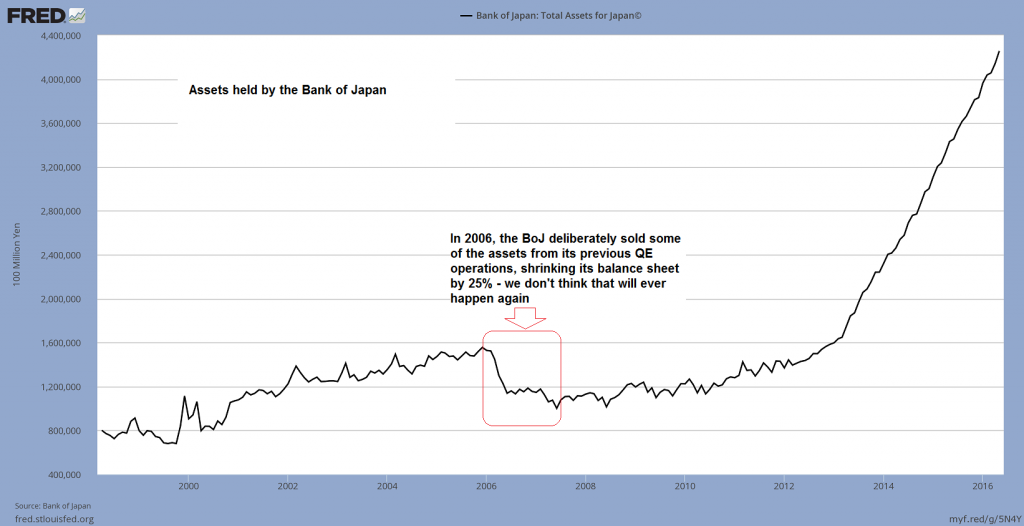

It could well be argued (as Honda apparently did) that what the BoJ is doing now already constitutes a “helicopter money” policy – especially if one believes that the bonds bought by the BoJ will never be sold back into the market. Frankly, we doubt that they ever will be. It seems far more likely that proceeds from maturing bonds will be perpetually reinvested – a policy adopted by the Fed with respect to the assets it has amassed during its QE operations as well.

Assets held by the BoJ: in 2006 it actually did take some of its previous “QE” back, by decreasing the size of its balance sheet by roughly 25%. Other central banks were also tightening policy at the time, raising rates in baby steps. Not coincidentally, US house prices actually peaked in 2006. A global financial and economic crisis followed in short order, providing evidence that a mere slowdown in money supply growth is all it takes to bring the entire system to the brink of collapse – click to enlarge.

Assets held by the BoJ: in 2006 it actually did take some of its previous “QE” back, by decreasing the size of its balance sheet by roughly 25%. Other central banks were also tightening policy at the time, raising rates in baby steps. Not coincidentally, US house prices actually peaked in 2006. A global financial and economic crisis followed in short order, providing evidence that a mere slowdown in money supply growth is all it takes to bring the entire system to the brink of collapse – click to enlarge.

In light of this, a friend of ours recently wondered whether it would actually make a difference what the BoJ did. Wouldn’t a “perpetual bond” purchased by the BoJ as proposed by Bernanke simply be an accounting operation of sorts that doesn’t really alter the already established facts on the ground? And wouldn’t the same apply to the theoretical case of “debt cancellation” by the central bank?

If we agree that the government debt the BoJ has bought must already be regarded as permanently sequestered on its balance sheet, then it seems at least superficially that this is indeed little more than an accounting detail. And if/ when it is actually done, the initial market reaction may well be muted.

However, underneath this simple accounting entry there is actually an intricate and complex web of interrelations. A few factors one needs to consider:

Public confidence; the very nature of money; the difference between money and credit; and related to all of these: the connection between money (the medium of exchange) and the “real things” it can be exchanged for and the coordination of production, consumption and saving through time, as well as the distribution of wealth.

We plan to discuss all these points in more detail over time (specifically, we plan to soon discuss the possibility of the emergence of “trust money” as a result of a consequent implementation of helicopter money policy. The topic was raised in this year’s “In Gold We Trust” report, which readers who haven’t done so yet should definitely check out).

For now we want to focus on the question of confidence though, on which much of this ultimately rests. There are many reasons to believe that this confidence – as firmly established as it appears to be at the moment – is steadily undermined. At some point the authorities are likely to take “one step too many”, which will tip it over the edge.

So far, the most obvious sign that confidence in money itself is diminishing is the indiscriminate surge in asset prices (note that recently, stocks, gold and bonds have all risen in unison, a very rare sight). In other words, the confidence in the purchasing power of money appears to be increasingly doubted among those who are actually rich, or who manage large amounts of money for others.

Their conscious awareness of this fact may vary, and fears over the health of the banking system may also be in play to some extent. After all, holding large amounts of electronic deposit money can be dangerous – the events in Cyprus and Greece serve as recent examples.

And yet, whoever paid $58 million for Jeff Koons’ “Balloon Dog, orange” strikes us as a rich man’s version of the famed housewife during the Weimar era who exchanged her entire salary for bed pans right after she got paid, because she couldn’t get rid of the government’s scrip fast enough.

Weimar bed pans for rich people… We actually think the balloon dog is not bad at all as an artwork – it undoubtedly has a certain je-ne-sais-quoi. We are only questioning its valuation, or rather, we are wondering whether the $58 million price tag is telling us something about inflation psychology of some of the main beneficiaries of monetary inflation.

Weimar bed pans for rich people… We actually think the balloon dog is not bad at all as an artwork – it undoubtedly has a certain je-ne-sais-quoi. We are only questioning its valuation, or rather, we are wondering whether the $58 million price tag is telling us something about inflation psychology of some of the main beneficiaries of monetary inflation.

Photo credit: Noel Y. Calingasan

The Unknown Threshold

Of course, as long as the general public’s confidence in government issued money remains firm, a great many crazy policy decisions will appear entirely reasonable, and will be rationalized ad nauseam in academe and the financial press. It is a bit like a mass hallucination and quite fascinating to watch.

Central banks have had great leeway in pushing “inflationary experiments” – partly because the manufacturing sector’s productivity has for a long time increased at such a strong pace that it offset the price pressures of monetary inflation, and partly because the nature of the monetary system has created a deflationary undertow – most recently exemplified by the troubles of Italy’s banking system.

For a retail depositor of Monte dei Paschi or a grandmother holding subordinated Monte dei Paschi bonds (which her bank advisor has talked her into buying – “perfectly safe, signora, the government will never allow our storied house to go under”), the foremost consideration is not the exchange value of the euro. Rather it is the question whether their share of the euro pie is about to disappear and go back to whence it came from – namely thin air.

Courtyard of the Monte dei Paschi di Siena bank HQ in the Toscana. Monte dei Paschi is the world’s oldest bank, founded in the 15th century, not long after the bankruptcy of the Medici Bank (which was found to hold only 5% in reserve against its deposit liabilities at the time it went under).

Courtyard of the Monte dei Paschi di Siena bank HQ in the Toscana. Monte dei Paschi is the world’s oldest bank, founded in the 15th century, not long after the bankruptcy of the Medici Bank (which was found to hold only 5% in reserve against its deposit liabilities at the time it went under).

Photo credit: Tango7174

However, the public’s confidence in money is mainly based on the idea that these inflationary experiments are temporary in nature. They are seen as emergency measures that will eventually give way to “normalcy” again once the exigencies of the moment have been overcome.

So a problem will arise if/ when an unknowable threshold is crossed – the point at which a critical mass of people begins to doubt that these measures are temporary and becomes convinced that the inflationary policy is deliberate and will never stop. This is the moment when the “genie gets out of the bottle”, as they say.

And now consider what Ben Bernanke said on this particular point in his recent article on “helicopter money” at the Brookings Institute website:

“As I’ve stressed, MFFPs (helicopter money) differ from ordinary fiscal programs by being money-financed rather than debt-financed. In my illustrative fiscal program, government spending and tax cuts are paid for by the creation of $100 billion in new money. To have its full effect, the increase in the money supply must be perceived as permanent by the public.”

(emphasis added)

An image from Tokyo TV: Ben Bernanke and Shinzo Abe discuss “deflation” (we are using quote marks in light of the chart of Japan’s money supply shown further above).

An image from Tokyo TV: Ben Bernanke and Shinzo Abe discuss “deflation” (we are using quote marks in light of the chart of Japan’s money supply shown further above).

Convincing the public that increases in the money supply are “permanent” is quite risky. Emboldened by the Volcker experience, today’s central bankers seem absolutely certain they will be able to handle the problem of a sudden increase in inflation expectations with ease. There are numerous examples of the likes of Bernanke, Yellen, Draghi, et al. voicing this conviction.

It seems to us they greatly underestimate the amount of “potential energy” already stored up in the system by what they have done so far. They don’t seem to fully grasp of the extent of the time lags involved (which can be very large). They are seemingly not fully aware that a possible loss of confidence will be a highly non-linear event, which may well prove intractable when it happens (and at the very least will give them extremely little time to react or ponder what to do). Lastly, they overestimate their own ability to withstand political pressures.

So the question is really: which seemingly harmless accounting entry on a central bank balance sheet might end up shaking the public’s confidence? We cannot be certain, but the above mentioned “unknowable threshold” certainly does exist.

It is of course unlikely that while a deflationary mindset still permeates the “market mind” and official measures of price inflation remain low, people will suddenly lose confidence in the purchasing power of money just because a central bank implements yet another inflationary policy measure (as a friend recently pointed out to us in this context, one must also not forget that a great many people don’t fully understand these extraordinary central bank policy measures).

In terms of a possible sequence of events, we should expect price inflation to initially increase slowly. At present this is mainly due to base effects – the rise in oil prices since the beginning of the year is bound to affect headline inflation measures. We don’t want to dwell on these purely arithmetic effects though (although we do think traders need to be aware of them, as they are likely to affect bond yields in the near term, so it is something worth mentioning).

We are more interested in the fact that logic dictates that when too many resources have been allocated to the higher stages and too few to the lower stages of the production structure (while concurrently nothing has actually changed in terms of time preferences and consumer demand), relative prices will eventually have to go the other way again, as the output of consumer goods is at some point no longer going to be adequate relative to actual demand.

Neither money printing nor deficit spending can create any additional real capital. They merely distort prices and influence the allocation of already existing capital/ factors of production (inter-temporal in the case of monetary pumping, intra-temporal in the case of deficit spending). In short: the shift in relative prices caused by monetary pumping is not permanent.

Consumers will then be faced with a kind of late stage “forced saving” situation (readers may want to check out our in-depth discussion of the concept for additional background information here: “Forced Saving”), as they will no longer be able to afford as many consumer goods as they would like to buy (particularly the types of consumer goods they want to buy, as capital has previously been malinvested, i.e., invested in the wrong lines).

The ratio of capital vs. consumer goods production in the US – this ratio provides evidence of the fact that higher stages of the production structure have bid away resources from the lower stages in the current environment of extremely low interest rates – click to enlarge.

The ratio of capital vs. consumer goods production in the US – this ratio provides evidence of the fact that higher stages of the production structure have bid away resources from the lower stages in the current environment of extremely low interest rates – click to enlarge.

This is when the so-called “impossible” may actually happen: economic weakness, combined with rising consumer prices, a.k.a. “stagflation”. In the beginning it will be mild. What happens then depends on how the monetary authorities react to such a development – will they ignore rising prices on the idea that economic weakness ensures they are a temporary phenomenon and adopt loose policies anyway? Or will they discover their inner Volcker? Given that central bankers have all become one-note Johnnies in recent years, it certainly seems to us that the former is more likely.

At that point, decisions by central banks to adopt extreme policies may well affect the inflationary expectations of the broader public far more strongly than before. The monetary inflation of the past is then likely to spill over rapidly from asset prices to consumer prices. This is also when the danger that a non-linear trend acceleration develops becomes acute.

We have to interpose here that we acknowledge of course that one cannot rule out a deflationary outcome – e.g. a situation in which bankruptcies become so overwhelming that a part of the money supply is eventually wiped out due to banks going under. We will discuss this possibility in a follow-up post – let us just say that we currently believe this to be the more remote threat. However, it is clear that the eventual outcome is not predetermined.

Ludwig von Mises addresses both of the above points in a passage in Human Action that discusses the price premium (a.k.a. the inflation premium) embedded in gross market interest rates:

[T]he price premium is the outgrowth of speculations having regard for anticipated changes in the money relation. What induces it, in the case of the expectation that an inflationary trend will keep on going, is already the first sign of that phenomenon which later, when it becomes general, is called “flight into real values” and finally produces the crack-up boom and the crash of the monetary system concerned.

As in every case of the understanding of future developments, it is possible that the speculators may err, that the inflationary or deflationary movement will be stopped or slowed down, and that prices will differ from what they expected.

(emphasis added)

Mises had a thing or two to say about inflation and how it progresses.

Mises had a thing or two to say about inflation and how it progresses.

Photo vie Mises Institute

Mises also discusses the “crossing of the threshold” and the non-linear nature of a breakdown in the public’s confidence in state-issued money. The important point that has to be stressed here is that the money supply can be inflated for a very long time without causing an undue increase in all prices. As long as the public expects that inflationary policies are going to be reversed, its actions will in fact work against price increases (such as decisions to increase cash balances in order to wait for prices to decline). Only when the public’s expectations finally change will the trend get out of hand:

The course of a progressing inflation is this: At the beginning the inflow of additional money makes the prices of some commodities and services rise; other prices rise later. The price rise affects the various commodities and services, as has been shown, at different dates and to a different extent.

This first stage of the inflationary process may last for many years. While it lasts, the prices of many goods and services are not yet adjusted to the altered money relation. There are still people in the country who have not yet become aware of the fact that they are confronted with a price revolution which will finally result in a considerable rise of all prices, although the extent of this rise will not be the same in the various commodities and services. These people still believe that prices one day will drop. Waiting for this day, they restrict their purchases and concomitantly increase their cash holdings. As long as such ideas are still held by public opinion, it is not yet too late for the government to abandon its inflationary policy.

But then finally the masses wake up. They become suddenly aware of the fact that inflation is a deliberate policy and will go on endlessly. A breakdown occurs. The crack-up boom appears. Everybody is anxious to swap his money against “real” goods, no matter whether he needs them or not, no matter how much money he has to pay for them. Within a very short time, within a few weeks or even days, the things which were used as money are no longer used as media of exchange. They become scrap paper. Nobody wants to give away anything against them.

(emphasis added)

Conclusion

It seems increasingly likely that some form of “helicopter money” (i.e., outright and explicitly permanentmonetary financing of government spending) will be adopted by central banks as the next step in their misguided “fight against deflation” – or even simply in order to prevent a recession. Given that Japan is about a decade ahead of other developed countries in terms of monetary and fiscal experimentation, it is a likely candidate for going down this path first.

Obviously, it doesn’t have to happen, and if it does, it may not happen in the near future just yet. However, Mr. Abe’s threat of more stimulus spending indicates that an opportunity presents itself here. Let us not forget, the markets expect Mr. Kuroda to “do something”, given that the BoJ keeps missing its absurd inflation target by miles.

Almost no-one expects price inflation to become a problem. Does anyone still remember the late 1970s? At the time almost no-one believed that disinflation and potentially even deflation would ever again become an issue. Allowing for this possibility was the most contrarian stance one could take at the time. And yet, money supply growth had been slowing for a few years already and was about to go negative (this finally happened in 1981).

Today the situation is the exact opposite. The money supply keeps growing by leaps and bounds in every major currency area, and “deflation” is the greatest fear. Not only is price inflation not considered a potential problem, policymakers are actually pining for it and are actively pursuing policies aimed at promoting it. This should certainly give everybody pause.

Addendum: The Bridge From Nowhere

Since we mentioned it above: here is the bridge from nowhere, also near Kyoto.

The counterpart to the “bridge to nowhere” – the bridge from nowhere.

The counterpart to the “bridge to nowhere” – the bridge from nowhere.

Photo credit: Jeffrey Friedl

Charts by: BarChart, TradingEconomics, St. Louis Federal Reserve Research.

Source: http://www.acting-man.com/?p=45886