The earliest signs are developing of hyperinflation, more correctly described as a collapse of the purchasing power of all the major government currencies. Central bankers are almost certainly unaware of this danger, partly because their chosen statistics fail to capture it, but mostly because conventional monetary economic theory is lacking in this regard.

This article draws on the evidence of extreme overvaluations in equities and bonds worldwide, and concludes the explanation lies increasingly in a greater perception of risk against holding cash, or bank deposits. Risk relationships between cash and assets are inverting, due to failing monetary policies and escalating counterparty risk with the banks.

There are of course subplots involved, such as the real and imagined rigging of markets by central banks, and the bullish confidence that that gives to buyers and holders of investments. Then there is the unanimous assumption that interest rates must not and therefore will not be permitted to rise.

Extreme one-way bets aside, the overriding reason for valuation disparities is becoming more consistent with the downgrading of cash, rather than a revaluation of assets. If this was happening to money’s relationship with goods and services, economists would begin to worry about inflation, stagflation, and even hyperinflation.

Why asset inflation matters

Because today’s price inflation is mainly confined to assets, no one worries. Instead investors rejoice in the wealth effect. Assets are excluded from the consumer price indices, so the danger of a fall in the purchasing power of money in respect of assets does not appear to exist. This does not mean that the problem can be ignored. But if the reason behind rising markets is a flight from cash, we should begin to worry, and that point in time may have arrived. If so, we should stop rejoicing over our increasing wealth, and think about the future purchasing power of our currencies.

Confining the estimation of price inflation to selected finished goods and services is a myopic mistake. It was originally for econometric convenience that consumer purchases became so categorised, but it is misleading to assume that for the consumer there is any such clear categorisation between the purchase of different items. In pure economics there can be no distinction between the purchase of an item of food, a capital good, or the lending of money which is used by someone else to purchase capital assets and use as working capital. The exclusion of partially depreciated second-hand goods is equally illogical. All purchases are purchases, full stop.

Not only do the neo-Cambridge economists and econometricians of today ignore this fundamental error in their attempts to construct measures of price inflation, central bankers and the whole investment community make a further omission without even realising it, and that is to assume that money has a constant value in all transactions. This is hardly surprising, because we account in money, and we pay our taxes on profits measured in it.

These two important errors distort all economic analysis and can have serious consequences.

Asset inflation is increasingly spilling over into commodities, the feedstock for final goods. It has also been inflating services, for example driving up the wage rates in building trades and raising agency commissions. This effect has been developing since the last financial crisis began to recede, and has accelerated with the reversal of falling commodity prices. The official line, that there is almost no price inflation, is misleading markets, the general public, and economic planners themselves as well.

Investors act rationally

It is becoming clear that some investors are showing a growing preference for investment assets over bank deposits. Analysts unquestioningly believe that this preference is not a vote against money, but is driven by a desire to profit from investment. This is correct for regulated managers of mutual funds, who are required by their mandates to generate valuation profits in absolute or relative performance terms.

Others, particularly the very rich with a close eye on their own finances, are beginning to take a different view. They observe the share prices of the banks that owe them money, and worry. Private bankers in Europe are reportedly trying to persuade their very-rich customers not to withdraw substantial funds. Anyway, transferring deposits from one bank to another doesn’t protect you against systemic risk, so you must buy something, such as a short-dated government bond or gold, to get rid of your money and transfer the risk to others.

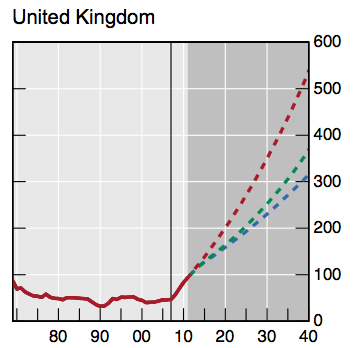

The principal danger to these wealthy investors is a pick-up in the inflation rate, but at the moment, talk is exclusively of deflation and systemic risk, not inflation. However, raw material prices have been rising noticeably this year, reversing the trend of the last few. Unless commodity prices start falling materially and soon, they are certain to drive up recorded price inflation, despite the lack of economic activity in the advanced economies. Eventually, central banks will have to respond by raising interest rates, undermining government bond markets and the valuation of all asset classes that refer to them.

The flight from cash, for the moment at least, reflects in large part systemic risks. However, we cannot say that a collapse of the banking system will definitely happen unless interest rates rise to reflect the falling purchasing power of fiat currencies. Only then can we be much more certain of a general financial immolation, accelerating the flight from bank deposits.

For the moment, markets have gone nap on deflation. Deflationary conditions are necessary for the future monetary expansion required to rescue the banks, the economy, or both. Most investors appear to be as sure of this outcome as they were that the UK would choose to remain in the EU. The error here is to have little or no understanding that price inflation can coexist with contracting business activity.

Monetary inflation, particularly when it becomes extreme, actually guarantees a contraction in economic activity, because it withdraws purchasing power from the masses. This is why the early warning signs of asset price inflation from a declining preference for money should be taken very seriously. And as the effect spreads into the consumer price index, so too will a wider rejection of money in favour of goods.

It could easily develop into what the Austrian economist, Ludwig von Mises, described as a crack-up boom, the final flight out of money in preference for goods. We are not yet hoarding toilet paper and baked beans, but the prospect that we will be driven to do so has already been signalled to us.

I have already started hoarding baked beans…but then I am in South Africa where the value of the currency has been in free fall till recently.

The points made by the writer are the same ones which I have been making about the measurement of inflation / the rate of devaluation of money.

I write about this kind of thing often on this site as comments.

The points made about the difficulties which lie ahead are also the same.

I invite readers to read my web pages more often.

http://macro-economic-design.blogspot.com

For the difficulties which lie ahead please read the page on the LOW INFLATION TRAP.

What the writer has so far seemed to miss is that QE is very important in the sense or reducing our reliance on debt for the injection of liquidity into the economy.

To have an economy in need of this much debt just to provide liquidity is outrageously stupid.

What the central banks have missed is using the creation of base money to create a stimulus to spending. They have started to look at this but have missed the main point on the practical way of doing that – reduce VAT and subsidise non VAT-able spending using the new base money to balance the books.

A first principle of monetary policy is (in my book but not theirs) to keep spending in balance.

Another is to feed the economy with the right balance between fiat money and base money to achieve the liquidity needed.

Another is to create a market in credit so that interest rates find their own market price.

But then they will run into higher interest rates or hyper-inflation so they need to read my website. See above.