The Bank of England has recently announced a new round of quantitative easing alongside an interest rates cut, pushing £100 billion into banks, with the prerequisite they use this money “to pass on the low interest rate to households and businesses”. This could, potentially, reinvigorate business lending and lead to new firm creation as well as existing firm expansion. At least, this is the hope. Unfortunately, it seems that this is purely hope over expectation.

The last round of quantitative easing seems to have entirely concentrated in inflating underlying asset prices as well as fuelling housing and mortgage demand. According to Standard & Poor’s in 2015, “the central bank’s gilt-buying £375bn ($546bn, €485bn) quantitative easing programme… fuelled a rise in financial asset prices as investors poured money into stocks, driving up prices and making the rich richer”. Alongside unprecedentedly low interest rates, this has contributed to house price increases of 7.7% across the UK, and a 9.8% increase in London alone. An acute housing crisis has followed, with rents and house prices increasing exponentially. Even with a Brexit vote in late June, house price increases have dropped but continue to grow generally.

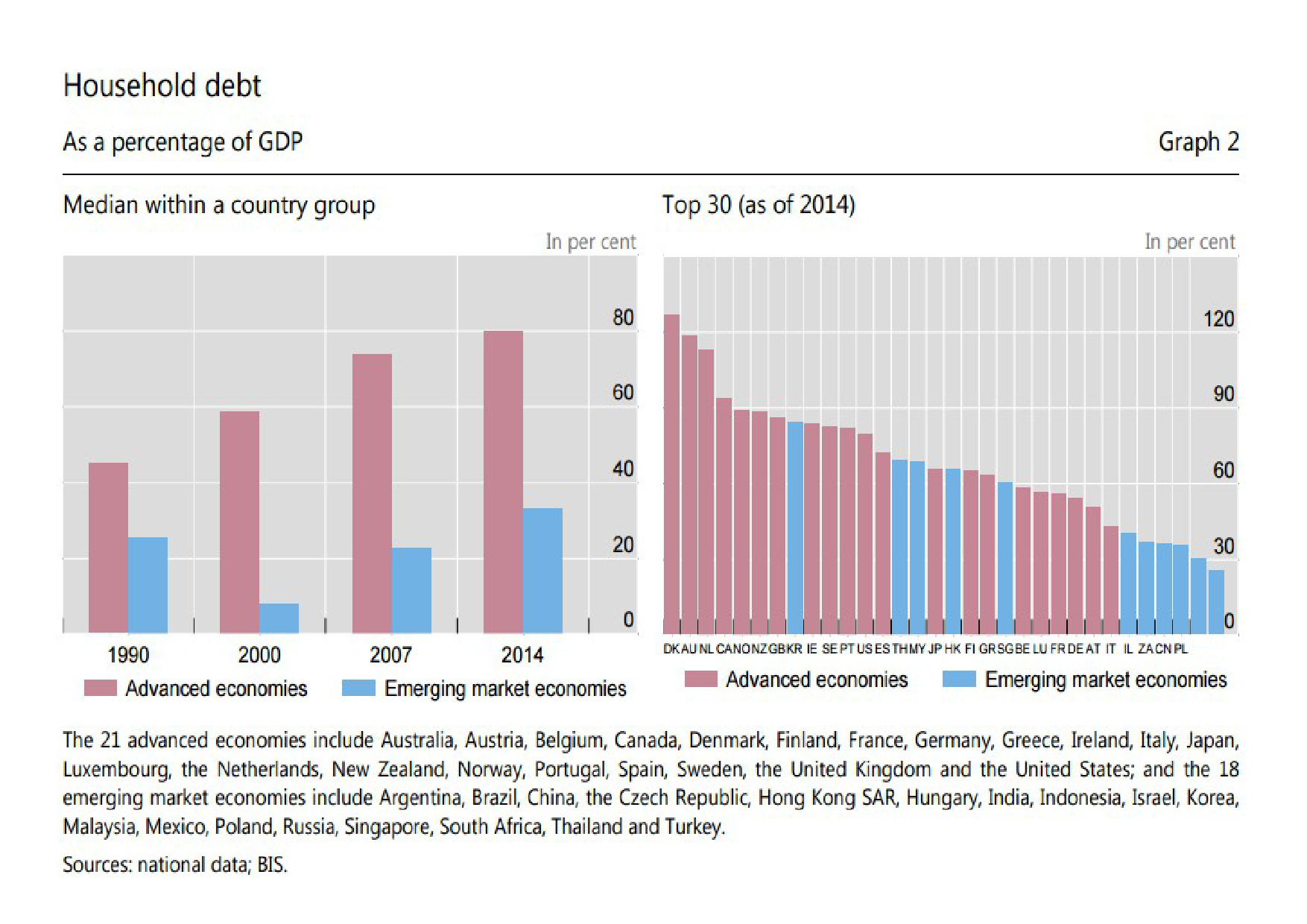

Rather than QE reinvigorating the economy with flows of cheap credit, it has moved money and investment back into fragile asset markets, fuelling a potentially new crisis in the near future. Combined with UK growth mainly created through consumer spending, as business growth and trade stagnate, we see increasing levels of private debt, as well as the taking of housing debt by governments looking to create more home ownership. For example, the UK government has begun to effectively nationalise Housing Association debts, and involve themselves in mortgage markets through help-to-buy schemes. Increasingly, this is becoming unpayable, creating the cyclical effect of encouraging more debt to afford rents and mortgages, as well as to grow the economy through more unstable consumer spending.

And all of this was during the first round of QE and state-encouraged spending. This new round has apparently come from the necessity of combating the risks of Brexit. But of course this is a just convenient proxy for the need to encourage investment and capital movement into the real economy, which has been dying within the UK as well as internationally since the Great Recession. Instead, money has flown into the housing markets, with “home prices now exceeding the 2005 peaks in most major markets“. “Commercial real estate is also at bubble levels. Every asset class is overvalued”. In US markets alone, “valuation measures most reliably correlated with actual subsequent market returns pushed to the third most offensive extreme in history at the May 2015 market high, eclipsed only by the 2000 and 1929 peaks”. Money is flying into asset prices, allowing for overvaluation. Low interest rates and credit pumping are only fuel to fire, with black swans like Brexit being catalysts for a crash at best rather than a major turning point in financial markets.

In this sense, QE is reactionary. It is the attempt by central banks to rescue a dying system of financialisation and the pure monetisation of debt. Banks, through their regulatory mechanisms (such as the Basel Accords), have increasingly favoured asset and land investment. Central banks, unwittingly, have allowed this to continue and develop, financialising house prices and mortgage debts into tradable commodities and allowing for new capital flows which are provided with signals of misallocation in the form of artificially low interest rates and the provision of subsidies and guarantees, such as deposit insurance and bank bailouts. The Geo-Austrian business cycle theory, as theorised by Fred Foldvary, encapsulates this issues succinctly. “The cause of cyclical fluctuations is that because of the elasticity of the value of money, the rate of interest is not always equal to the equilibrium rate, but is in the short run determined by banking liquidity”. The main part here is the interest rate, the effective valuation of monetary flows and credit. In a free market economy, where money production is left (at least to an extent) to market forces and private actors, interest rates for monetary valuation spontaneously appear. Such interest rates allow for investment decisions and time preferences to be developed in the realm of the production of capital goods. “The level of the natural rate of interest is limited by the productivity of that lengthening of the period of production which is just justifiable economically and of that additional lengthening of the period of production which is not justifiable”.

A natural rate of interest developed through price discovery and forms of competitive currencies (provided by political units or private actors) can allow for the efficient allocation of capital goods and the development of proper flows of production and consumption in economies of dispersed knowledge. However, when political interests through the money monopoly of central banks and treasuries artificially lowers interest rates to generate more consumption or investment, the market must respond by trying to increase production outputs and consumption flows by other means than the general purpose of value creation and wealth generation. Upsetting this balance means altering time preferences and changing the dynamics of market exchange.

Land plays an important function in these business cycles of artificial credit creation. As land is an integral part to all economic activity, credit creation affects the ways in which land is valued and used. Credit creation artificially inspires new time preferences and the encouragement of increased production and investment over and above the market clearing rate of such products and stocks. As a result, land must be used to both allow for this production and better create new forms of distribution and consumption which satisfy. The construction industry acts as a “‘transmission mechanism’ by which the land market impacts ‘the factory, office and corner retail store'”. Forms of transport infrastructure are invested in and built to accommodate these above-market rises in production, thus facilitating both more consumption and the need to increase production to meet the increasing costs and debts of new infrastructure. Again, we see a cyclical nature, as this increase in infrastructure subsequently increases land values and with it speculation, fuelling further needs to fill in the gaps of this increase in investment and speculation.

“Integrating the two theories, the geo-Austrian theory of the business cycle is as follows. At the beginning of the expansion, the banking system expands credit by an amount greater than in is warranted by available savings. This artificially reduces interest rates; the skewed market rate is lower than the normal natural rate. Low interest rates induce investment in higher-order capital goods, much of it consisting in real estate construction, related infrastructure and durable goods.

As the expansion turns into a boom, land speculation sets in, fuelled by still cheap credit. Land rent and prices then rise higher than is warranted by current use. Meanwhile, since consumer time preference has not changed, the demand for consumer goods continues as before, and prices rise. When the money expansion providing cheap credit ceases and when inflationary expectations affect the market for loanable funds, interest rates rise, especially affecting the interest-sensitive real-estate market. Higher costs (which can include higher taxes and labor costs along with higher interest rates and more expensive land) now reduce the rate of increase of new investment. The higher-order investments, chief among them real estate, turn out to be malinvested, as there is insufficient demand for the extra capacity, with vacancies in shopping centers, hotels, office buildings, and apartments.”

Say’s law gets thrown out the window as the market is infected with cheap credit and altered time preferences. Productive capacity and new investment cannot keep up with this new rise in cheap credit, thus fuelling speculative bubbles and the need for quick returns on investment to meet new supply-demand ratios. This is, in effect, what central banks are currently doing with QE. They are attempting to encourage new time preferences and productive capacities in an economy that just has not got this. QE is an attempt to paper over the cracks rather than tackle the political and economic decisions and consequences which have brought us this mess in the first place. “In the panicky haste of blind expediency, central bankers drop interest rates to zero and unleash unlimited liquidity to save the bubbles they inflated. Instead of flushing the system of bad debt and speculative leverage and allowing the market to reprice impaired assets, central bankers push the perverse incentives that inflated the bubble to new highs”.

Unfortunately central banks and their QE experimentation will not address the fundamental underlying problems of the economy, whether nationally in the UK or internationally. The UK itself is experiencing anaemic business growth, poor wage growth and a massive productivity puzzle. A significant proportion of current UK job growth and creation is within the low-pay sector, increasing issues of underemployment and badly structured compositional factors. I believe there are two major reasons for this. One, the UK has an overregulated labour market. “Measures such as the National Living Wage, pension auto-enrolment and the apprenticeship levy, amongst others” are contributing to non-fluid and badly-responsive labour markets. Secondly, entrepreneurial activity is significantly dampened due to pathetic business investment from established banks and the increasing stringency of venture capital in an economic environment of large uncertainty.

The best reforms that can be taken are for government and central bank intervention in financial markets and banking structures to end. The strict regulations of the FCA and FSA have contributed to banking monopolisation, and limited the capacity for new lenders and forms of capital to develop and expand. Secondly, by freeing up capital, new entrepreneurial activity can be funded, creating new avenues within the real economy for productive investment and limiting the need for speculative finance. Thirdly, freeing up labour markets from unnecessary top-down regulations can mean a move away from underemployment and towards productive employment ventures coming from increased entrepreneurial activity. Such basic reforms allow for new economies of scale to develop around different economic and financial structures, such as those in hi-tech manufacturing and local infrastructure projects. Finally, and most fundamentally, the end to state and central bank’s money monopoly. As Vishal Wilde has pointed out, there are a lot of benefits that can come with competitive currency regimes. Optimising trading preferences for particular regions by allowing exporting or importing networks or economic units to use weak or strong currencies respectively, creating variable interest rates between different currencies and monetary networks (thus allowing for multiple forms of expectations-management and subjective preferences) and potentially minimising the impact of speculative finance through increasing the avenues of productive investment and financial market construction and regulation.

However, in writing this, there is neither the economic will from central bankers or the political will from governments to do any of this. They would rather fuel credit crises through quantitative easing and politically-influenced interest rates as they simply react to events they’ve helped create. Thus, it is simply a matter of time before the next big economic crash.

This piece was by Chris Shaw for The Cobden Centre

About Chris:

I am currently a masters student at the University of Warwick studying International Political Economy. Ideologically I see myself as a libertarian anarchist. I’ve been published at a number of libertarian sites, including the Mises Institute, the Libertarian Alliance and C4SS. I also run my own blog here: thelibertarianideal.wordpress.

Before I read th remainder of this essay please discuss the following extract from the above:

““Integrating the two theories, the geo-Austrian theory of the business cycle is as follows. At the beginning of the expansion, the banking system expands credit by an amount greater than in is warranted by available savings. This artificially reduces interest rates; ”

The banking system expands credit…available savings.

Am I right in thinking that you are assuming that the savings available from the money created in some OTHER way than fiat money (how?) from loans ought to be enough to meet the demand for loans?

Kind Regards,

Edward