Marc Levinson writing recently in The Wall Street Journal provides a very pessimistic view for the American Dream, “Why the Economy Doesn’t Roar Anymore: The long boom after World War II left Americans with unrealistic expectations, but there’s no going back to that unusual Golden Age“:

People who had thought themselves condemned to be sharecroppers in the Alabama Cotton Belt or day laborers in the boot heel of Italy found opportunities they could never have imagined. The French called this period les trente glorieuses, the 30 glorious years. Germans spoke of the Wirtschaftswunder, the economic miracle, while the Japanese, more modestly, referred to “the era of high economic growth.” In the English-speaking countries, it has more commonly been called the Golden Age.

[…]The Golden Age was the first sustained period of economic growth in most countries since the 1920s. But it was built on far more than just pent-up demand and the stimulus of the postwar baby boom. Unprecedented productivity growth around the world made the Golden Age possible. In the 25 years that ended in 1973, the amount produced in an hour of work roughly doubled in the U.S. and Canada, tripled in Europe and quintupled in Japan.

[…]Ever since the Golden Age vanished amid the gasoline lines of 1973, political leaders in every wealthy country have insisted that the right policies will bring back those heady days. Voters who have been trained to expect that their leaders can deliver something more than ordinary are likely to find reality disappointing.

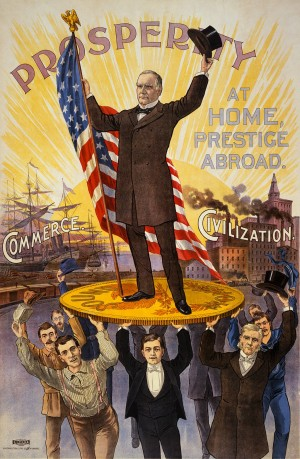

Levinson, whose column uses “Golden Age” as its leitmotif, strangely fails to make the connection, or even explore, the fact that the era he calls the Golden Age correlated precisely with America (and the world) being on a form of gold standard, particularly the modified gold standard known as the Bretton Woods System. (Bretton Woods had the inherent flaw of using the dollar as an international reserve asset but, until that flaw undermined it, it served equitable prosperity.)

Bretton Woods was finally, formally, ended in 1973, the very year that Levinson points to as the end of the Golden Age. This appears to have far more significance than he assigns to it.

Levinson’s focus on the importance of productivity growth is correct. GDP growth is a function of growth of jobs plus productivity growth. Per capita GDP lets everyone get richer (if the productivity growth is equitably shared). It is contingent on productivity growth. It’s a big deal.

While correct as far as it goes, this analysis is incomplete. Levinson seems to consider productivity growth a stochastic, meaning random, factor. That’s not obviously true.

There’s an underlying factor to consider. The gold standard maintained the integrity of the most important unit of account in the economy: the dollar. It is easy to understand how fluctuations in our units of account — inches and ounces — would throw enormous sand in the gears of industry, degrading productivity. Their definition does not fluctuate. There is no such thing as a “floating” ounce or inch. The idea of a floating — meaning wobbly — dollar is, simply, gobbledygook.

A wobbly dollar undermined the economy. It was a significant factor in ending, after one term, the presidencies of Gerald Ford and Jimmy Carter. It seriously retarded job creation under George W. Bush and Barack Obama. A wobbly dollar throws at least a much sand in the gears of the economy as a wobbly inch or ounce would.

It’s worth looking harder at the correlation between “floating exchange rates” — a euphemism for a wobbly dollar (and other wobbly currencies) and productivity. Reagan and Clinton, under the Fed’s Great Moderation — an imperfect proxy for the gold standard — saw enormous job growth and upward mobility. Call it a Silver Age. While not as good as gold, it was far superior to the Age of Dross in which we have been mired for 16 years.

Whether Trump or Clinton wins, America’s economic success over the next four years — and their chance of re-election — will depend in large measure on “It’s the economy, Smarty,” getting job growth and upward income mobility going for workers. To achieve equitable prosperity, the next president will need to be really smart about, rather than neglecting, monetary policy.

Treating the dollar with “benign neglect” is a recipe for massive poverty and political failure … as too many presidents have discovered too late. Donald Trump promises to make America great again. Hillary Clinton aspires to make America good. The next president would be well served to take a really hard look at the correlation between the gold standard and a Golden Age making America both great and good.

The Cobden Centre keeps on bringing this up year in year out. So they need to ask themselves what it is that their argument has overlooked.

The facts are that money cannot be fixed in value.

The fact is that the value of anything is what good or service or asset it can be exchanged for.

There is a vast range of such possible exchanges, so vast and so negotiable that it cannot be quantified as a value of money.

The Cobden Centre needs to find other reasons for the golden age and there are other explanations.

The link between the end of Bretton Woods and the end of that age is statistically clear. There are good explanations for that too. It ushered in an age in which the value of money was more or less disregarded as something to keep stable.

That is also not a good idea.

So what is the best way forward?

Firstly to accept the ever changing value of money but to limit its rate of change. That is easily done. It can be a part of the mandate of central banks.

Then to address the real problem so as to prevent most people and businesses and governments from the consequences. Doing this is more practical and it is 90% or so achievable. It means changing savings and debt contracts to reflect the changing value of money and to offset that as far as is practical. The benefits are like those of fixing the value of money – in theory anyway. It has the merit of being possible.

It means other things too like restructuring the currency markets and the way that interest rates are determined. Interest rates are a price like any other.

That is not the end of the story. To quote something outlining my own researches:

“Anyone who has read the basic content [of Ingram’s forthcoming webinar series] and discussed it with Mr. Ingram is already aware that policy-makers need a simplified financial framework that removes most of the problems which they are trying to address. Currently the instruments which they have at their disposal are not adequate to cope with all of the issues. The problem is not their lack of expertise. It is the overwhelming number of policy targets and financial instabilities which they are trying to address.

There is a well known ‘law’ in control systems theory (and application) which says that you cannot manage two variables with one instrument. You need one instrument for each variable. The actual problem is worse than that because for every action (intervention) taken new issues arise which conflict with the overall management targets already set.

In the proposed Ingram re-design of the financial framework the number of financial instabilities needing management attention will be drastically cut, leaving policy makers with one instrument for each variable, and no significant unwanted side effects to be dealt with.

Here is the key to solving the problem:

There is a well known fact when dealing with complex systems which Ingram calls the Complex Systems Theorem:

In any dynamically complex system, if any one part of it is not working in the way it should, then there are knock-on effects which affect other parts of the system. These then become problems (new policy targets) as well; and they in turn have further knock-on effects on other parts of the system. If you remove the original source problem then all of the other problems vanish as if they had never existed.

The majority of these source problems relate to wrong pricing and improper of zero adjustment to offset the changing value of money. Every wrong price re-distributes wealth and causes increased cost and instability, just like having and unstable ounce.

CONCLUSION

The Cobden centre is right about the virtues of a fixed value of money in theory, but there is nothing like having all prices able to adjust to offset that changing value of money. Too high a price wastes resources and too low a price does the same in a different way. Only the markets know what price is right and does not waste resources more than necessary during the adjustment processes. No one else knows what price is right. Not even the Cobden centre. Certainly not gold.

That’s it ?

Slogans and Platitudes about something as undefined as the Yellow Brick Road ?

So, Professor, how would it do it, and what would adopting a gold “standard” do, for making America great again ?

Take for example that right now we had a gold standard, and the dollar was ‘standardized’ at 1 / 35th oz. gold.

Let’s say we totally trust your ideas.

What do we do tomorrow to get American moving again, and close the GDP – gap?

Cause, you know, credibility, and all that.

Thanks.