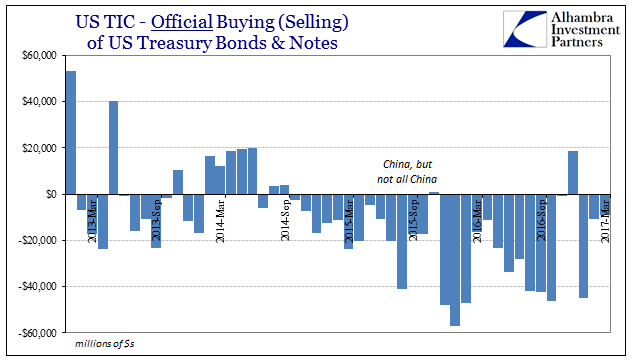

TIC data confirms that “reflation” captured more than just pricing sentiment. It appears to have occurred in bank balance sheet activity, and related official sector UST transactions. As to the latter, official holdings of US$ assets did decline on net in March 2017, the latest figures, including more selling of UST’s. The scale of the decline was less than we had seen in previous months. In January 2017, for instance, total net “selling” was huge at almost $49 billion, but in the past two just $5.2 billion for February and $10.7 billion in March.

On a cumulative, rolling six-month basis, this method of ad hoc central bank measures intended (largely China but not just the Chinese) to try to offset private sector “dollar” retreat was at its lowest level since the six-month period ended June 2015. If there was an orthodox organization with the clout to declare officially an end to the “rising dollar”, they would likely have done so given these figures.

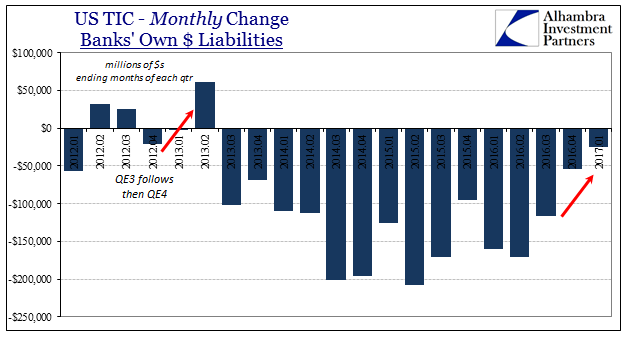

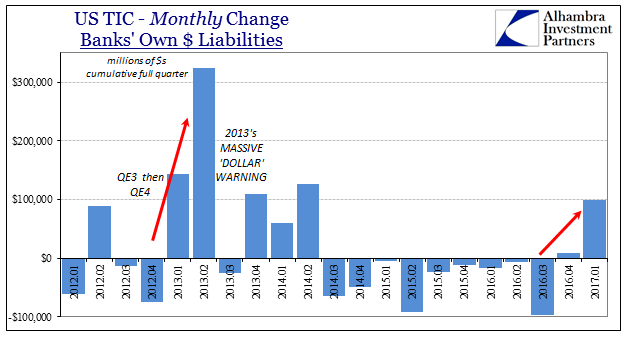

The reason for the lowered central bank pressure is undoubtedly a similar reduction in scale of bank balance sheet contraction. Going back to 2013, it had become common for banks to reduce their reported dollar liabilities (to foreign entities) in the final month of each quarter, some of those months with truly drastic reductions that almost in every case matched the outward monetary conditions globally.

In June 2015, for example, just as the official sector was about to be forced into more determined “selling UST’s”, TIC records an enormous $207 billion decline in these bank liabilities. Given that banks had in the two months prior during the same quarter only expanded by a total $116 billion combined, the net decline for Q2 2015 was a likewise enormous -$91 billion, leaving little mystery about the events that followed over the next few months.

In the latest quarter-end, March 2017, banks only withdrew $25 billion. Having added $12 billion in February and a hefty $113 billion in January, for Q1 2017 combined they contributed the largest representative increase in balance sheet capacity since the middle of 2014 – just prior to the start of the “rising dollar.”

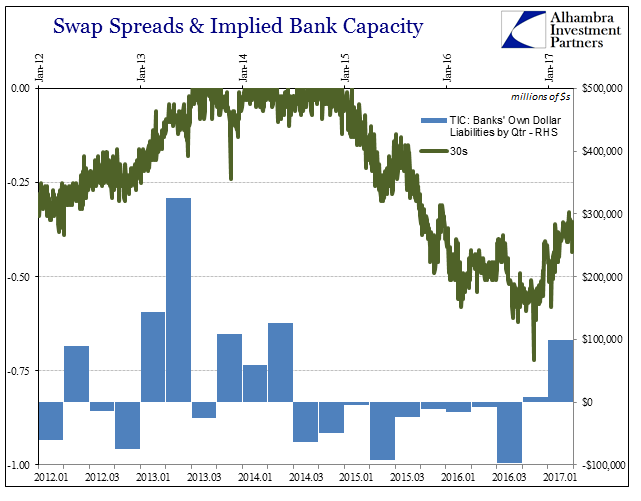

These changes in indicated balance sheet behavior largely matches (almost perfectly) other proxies for the same. Swap spreads at the 30-year maturity follow the rise after QE3 and QE4, and then the downfall of the “rising dollar” by early 2015; only to decompress (swap spreads) again over Q1 this year. Similarly, though not as good a fit, the 10-year swap spreads echo largely the same general interpretations.

The difference in the 10s is largely the timing of that compression, where the spread turned negative much later into 2015 than the turn in the 30s. Given that 30-year interest rate swaps are far more balance sheet intensive (the math of longer-term modeling) it isn’t surprising to find that the 30s were first to pick up on serious balance sheet reduction. Thus, the compression in swap spreads down in maturity over time (even getting to the 2s by the time of “global turmoil”) tells us a lot about the severity and more so the sustaining pressure on and because of withdrawing bank balance sheet capacity.

Some perspective is warranted at this juncture in the same way it is for other prices and indications like oil. Though there is a clear “reflation” trend in balance sheet capacity, it is by wider perspective a relatively small one; the history of swap spreads like reported bank balance sheet liabilities is instructive.

One quarter of reprieve may be just that, a temporary reduction in pressure like what occurred in the 2013-14 version of “reflation.” With swap spreads along with other pertinent prices turned against “reflation” since mid-March, it seems likely at this point what we see here is, again, like commodities; they aren’t actually up, merely less down than they were last year. Thus, “dollar” pressure hasn’t disappeared, it is just less intense than it was over the preceding two years.

That much we can see from the related though indirect official sector response. Though they are “selling” fewer UST’s on net, they are still selling. Improvement like that in the economic sense is therefore relative rather than a more hopeful potential paradigm shift. If nominal UST yields or eurodollar futures (or swap spreads) had done more than trade sideways to very slightly higher during this time that might have suggested a true reflation and potential rebound back toward normal.

Given especially more recent prices, that is likely too much to hope for. Though the Fed still clings to the idea that interest rates have nowhere to go but up, it is ironically that the FOMC is likely to have pushed markets back in the opposite direction after this few months of eased monetary destruction. As I wrote earlier today with respect to inflation expectations and swap spreads (subscription required):

The markets “wanted” the Fed exit to be the one that was described three years earlier, where “overheating” was a more common term slipped consciously into policymaker speeches and media presentations. But the Fed only disappointed, with Janet Yellen at her press conference forced by less fawning questioning to admit, complete with the deer-in-headlights stare only she can give, that none of the models foresaw any uptick in growth whatsoever. Worse, the FOMC statement confirmed that though the CPI was nearly 3% at that moment, it was indeed going to be just a temporary artifact of oil price base effects, and that officially inflation was not expected to return to “normal” until after 2019. Major, major buzzkill.

I suspect, given market prices and conditions so far during this quarter that over the next few months of TIC updates we will see cumulative bank liabilities track back lower again across Q2. How much will depend on a number of factors, but overall it is largely tied to this reality; nothing has changed, as this latest “reflation” is nothing more than the last one (and is on many accounts a great deal less). They are temporary reprieves from the same haunting global monetary decay.

Conditions didn’t improve so much in Q1 as they just weren’t as bad as they were the year before. That may not seem like much of a difference for interpretation let alone setting a balance sheet together, but it is everything. In other words, the end of the “rising dollar” isn’t the end of the whole eurodollar disaster, merely the finale of its latest phase of direct intrusiveness. We are left only to wait for the next one.