The Adam Smith Institute have recently published my report “Killing the Cash Cow: Why Andy Haldane is Wrong on Demonetisation” on Andy Haldane’s proposal (“How low can you go?”) to abolish cash. [Disclosure: Andy and I are old friends and I criticize him reluctantly.] I think Andy has made some marvellous contributions to the economic policy debate since the onset of the Global Financial Crisis, but this isn’t one of them. Going further, I believe that those who advocate or who are even willing to entertain the abolition of cash are onto a seriously bad idea.

In this posting, I would like to outline my critique of Haldane’s proposal and put it into the context of the broader War on Cash (WoC).

Andy made his proposal at a speech in Portadown in Northern Ireland on September 18th 2015. I confess that I was horrified when I read it and wrote up a first draft shortly afterwards. For various reasons, I was unable to work on it again until this year and hence the delay in publication. In the interim period, there were further major developments of which two in particular stand out. The first was the publication of Ken Rogoff’s book “The Curse of Cash” in August 2016, and the second was the Indian WoC, the policy unexpectedly announced by Prime Minister Narendra Modi in November last year by which the highest denomination notes – the 500 and 1,000 rupee notes, making up 86% of the note supply – were to be almost immediately withdrawn from circulation. I touched on these in the revised version of my report, but chose not to dwell on them at any length because my report was already overly long and the Indian experiment is ongoing.

The first point to note is that the WoC is not just about technocratic issues related to payments technologies: cashless payments systems are already both commonplace and spreading. On the cash vs. digital issue, sometimes cash is better (e.g., for small anonymous transactions) and sometimes digital (e.g., where the parties concerned have the technology and anonymity is not an issue). Instead, the core issue in the WoC is whether people should be compelled not to use cash, and this issue is of profound importance. In a nutshell, my argument is that the abolition of cash threatens to cause widespread economic damage – as an example, just look at what has been happening in India – and to have a devastating impact on many of the most vulnerable in our society. It also threatens to destroy what is left of our privacy and of our financial freedom: we wouldn’t be able to buy a stick of gum without the government knowing about it and giving its approval.

Haldane’s support for the abolition of cash did not receive the generally positive response that normally welcomes his policy statements. My straw poll of the blog comments about it in the Financial Times immediately afterwards suggests that some 75-80 percent of readers were opposed to it, some strongly. “It’s almost fascist in its undertones. A totalitarian move to track and control all spending,” wrote one blogger. “Lives in intellectual bubble. Would endanger our democratic freedom for financial experimentation,” wrote another. His critics included Andrew Sentance, a former member of the Bank of England Monetary Policy Committee: “Sorry to say but Andy Haldane’s spouting rubbish here,” Sentance said on Twitter.

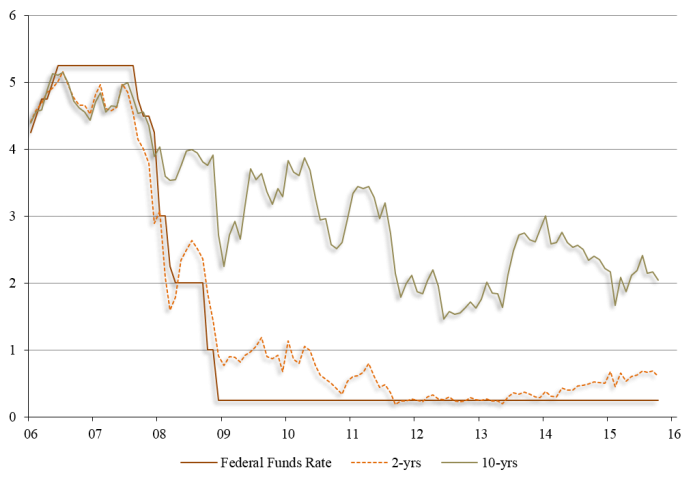

The core of his argument goes as follows. His primary concern is the central bank’s room for manoeuvre: its scope to reduce interest rates if it felt it needed to. This room for manoeuvre depends on three factors. The first two are the real interest rate and the inflation target, and the inflation rate and the real rate together determine the nominal rate. The third is the Zero Lower Bound (ZLB), the lowest interest rate that the central bank can achieve without triggering a widespread move from deposits into cash, and in practice this ‘ZLB’ will be a wedge below 0.

The problem he addresses is that long-term declines in real rates – due to factors that are beyond the control of the Bank of England – have reduced this room for manoeuvre, and he is looking for means to widen it again. Among the options he considers is to abolish cash in the event that the central bank should want to implement a Negative Interest Rate Policy (NIRP). With no cash, there is no longer a ZLB to prevent the central bank going into negative rate territory.

To be fair, he does not actually say that he wants negative rates or that he wants to abolish cash. Instead, he gives a technocratic perspective in which he regards these as options that should be considered along with more conventional options such as, e.g., raising the inflation target. But to me, what is alarming is that he is willing even to put these options on the table as if NIRP and banning cash were merely technical exercises that did not entail a raft of major economic, social and other problems. It is those problems on which I focus in my report.

Why NIRP is mistaken

Let me first offer some comments on NIRP. One problem is that it seeks to double down on unconventional monetary policy – low interest-rate policies (LIRP) and zero interest-rate policies (ZIRP) in particular. Yet we have had nearly a decade of such policies and the results have been dismal. Faced with such a record, I would suggest that the natural conclusion is that policies that attempt to achieve stimulus through ever lower interest rates have been tested to destruction and should be written off as failures.

However, the more extreme Keynesians – Haldane included – have managed to convince themselves that the problem is not that their interest rate policies are unsound, but that they haven’t been tried on a sufficiently ambitious scale: first they confidently assured us that we needed LIRP. When that failed, they assured us that we needed ZIRP, and now that ZIRP has failed, they confidently assure us that we should seriously consider NIRP.

By that same logic, those who argue that central planning has failed are mistaken; central planning only appears to have failed because it has not been tried with sufficient enthusiasm.

Personally, I am not convinced. Res ipse locquitur, as the lawyers say: the thing speaks for itself.

Another problem with NIRP is that negative interest rates are unnatural. As any decent economics textbook will explain, economic theory suggests that interest rates should be positive and for two different reasons. The first relates to time preference – our preference to consume now rather than later, which leads to a positive interest rate as compensation for deferring consumption. My friend Alasdair Macleod is nicely to the point here: “NIRP is a preposterous concept. It contravenes the laws of time preference, commanding by diktat that cash is worth less than credit.”[1] The second relates to the productivity of capital and as compensation for the risk of default: I will lend to you to enable you to go ahead with your investment project, but only if you offer me some inducement to do so, e.g., interest, which might also include an extra premium to compensate me for the risk that you might default. NIRP is, thus, better described as Totally Weird Interest Rate Policy or TWIRP.

Bagehot once wrote that “John Bull can stand many things but he cannot stand two per cent.” By this he meant that John Bull could not stand an interest rate as low as 2 percent, let alone a negative interest rate. In fact, for 315 years prior to 2009, Bank Rate had never been below 2 percent.

Indeed, recent interest rates have been lower than at any time over the last 5,000 years.[2]I suggest would that these facts are telling us something: they are confirming that negative interest rates are unnatural and they suggest that policymakers are playing with fire if they attempt to make rates negative. In any case, for those who advocate negative interest rates, then please tell me: why is it that we never had negative interest rates in the nearly 5 millennia since Hammurabi, but we need them now? I fail to see how the world has suddenly changed or why something that what was considered irresponsible before the crisis should be considered necessary now. Indeed, I wonder how Haldane would answer his own question: how low do you go? As interest rates potentially plunge into negative territory, how would you know where to stop?

I shudder to think of the unintended consequences of such a voyage into the monetary unknown, but at some point in this process – as interest rates fall ever further – saving would stop, investment would stop, capital accumulation would stop and then go into reverse and the financial system, predicated on positive interest rates, would unravel. The contradiction between positive time preference and the return on capital, on the one hand, and ever more negative interest rates, on the other, would tear the economy apart and in ways that we can barely begin to understand. Again, how low can you go? No idea, but let’s give it a go.

You might think that that is bad enough, but there are other problems as well. Let’s suppose that NIRP could be implemented and the central bank had selected the ‘right’ negative interest rate – lets say minus 5 percent for the sake of argument. We would then have a steady state in which bank deposits were being taxed at the rate of 5 percent a year, so roughly speaking, money supply would be falling at about the same rate. Thus, NIRP would involve a tax on deposits and a falling money supply. So where is the stimulus coming from? When is a tax stimulative? The NIRPers have not thought it through.

Implementation is a big problem too. If the central bank were to impose interest rates on deposits of well below zero, then there would be a run on the banking system as people flee to cash which bears an interest rate of zero in preference to deposits which would bear negative rates. Leaving aside that this flight to cash would cause major financial stability problems, it would also stop NIRP firmly in its tracks.

Abolishing cash

So we come to Haldane’s solution to this latter problem: to abolish cash. I would not presume to be able to describe all the negative effects of abolishing cash, but some are obvious. There are many transactions for which cash is the ideal medium of payment, and it is not for nothing that cash is used in 85 percent of global transactions.[3] Cash is a very efficient way of handling small transactions; it is costless and easy to use; cash transactions are immediate and flexible; cash is highly anonymous and traditionally, the anonymity of cash was considered to be one of its greatest benefits; cash does not need a password and, unlike a bank account, can’t be hacked; the state of the art in anti-counterfeiting technology (think Canadian dollar, not U.S. dollar!) makes it more difficult to corrupt than many digital currencies; and the usefulness of cash is not dependent on technology that might break down. Most of us have experienced situations where we had difficulty paying for a bill at a restaurant or gas station because of some system failure on the part of our debit or credit card provider, and have then had to resort to cash to sort the problem out. Good luck trying to sort out such problems when the government won’t allow you to use any cash at all. These are major benefits that would be obliterated if cash were abolished.

We should also consider the impact that banning cash would have on vulnerable groups. To work as intended, everybody would have to have the digital technology and be able to work it. Well, many people don’t have that technology, and there are many more who would struggle to work with it and/or would be made very vulnerable if they were forced to depend on it. Consider the destitute, dependent for their survival on begging for spare cash on the street corner. Their very existence depends on cash, and it cannot reasonably be expected that such people could easily switch over to a cashless economy: many don’t have mobile phones and wouldn’t don’t know how to use them if they had them. And, needless to say, banning cash would cause great problems for the old. Those of us of a certain age in the UK and Ireland remember all too well the difficulties that decimalisation imposed on our grandparents. I didn’t like the decimal currency myself – the old coins were splendid – but I could easily adjust to it. My grandmother however had dreadful difficulties and never got used to it. Banning cash would cause similar problems for the old, and maybe worse.

My point is that it is unreasonable to expect significant sections of our society – the most vulnerable sections, especially – to be able to adjust to the abolition of cash. Indeed, I think I can say with certainty that a large number of these people – the destitute, the infirm and the elderly – would not so much be disempowered but devastated by the abolition of cash.[4] From this perspective, the proposal to abolish cash is simply cruel: it is hard to imagine any other single economic measure that could cause as much human suffering.

Naturally, I am not suggesting for a moment that any of those who advocate the abolition of cash intend any such consequences; I am suggesting that they haven’t got a clue what the consequences of their proposals would be.

It is not just these groups that would be adversely affected, but anyone without a bank account and potentially anyone with an unconventional digital profile that does not tick all the boxes. As Brett Scott writes:

So, good luck to you if you find yourself with only sporadic appearances in the official books of state, if you are a rural migrant without a recorded birthdate, identifable parents, or an ID number. Sorry if you lack markers of stability, if you are a rogue traveller without permanent address, phone number or email. Apologies if you have no symbols of status, if you’re an informal economy hustler with no assets and low, inconsistent income. Condolences if you have no official stamps of approval from gatekeeper bodies, like university certificates or records of employment at a formal company. Goodbye if you have a poor record of engagements with recognised institutions, like a criminal record or a record of missed payments.

This is no small problem. The World Bank estimates that there are two billion adults without bank accounts, and even those who do have them still often rely upon the informal flexibility of cash for everyday transactions. These are people bearing indelible markers of being incompatible with formal institutional space. They are often too unprofitable for banks to justify the expense of setting them up with accounts. This is the shadow economy, invisible to our systems.

The shadow economy is not just ‘poor’ people. It’s potentially anybody who hasn’t internalised the correct state-corporate narrative of normality, and anyone seeking a lifestyle outside of the mainstream. The future presented by self-styled innovation gurus has no scope for flexible, unpredictable or invisible people.[5]

— –

My report then discusses the implications of the WoC for financial privacy and civil liberty, and ends with some ruminations about the transformation of the central bank from being the prudent guardian of the financial system that it used to be into the most reckless risk-taker of them all: its unique pivotal position exposes the whole system to the consequences of any mistakes it makes in a way that no other institution can match.

One aspect of the WoC that is mentioned but not developed in Haldane’s paper is the argument that cash should be abolished because bad guys use it. This argument is in fact the central pillar of Rogoff’s case for abolishing cash. Rogoff’s book has been nicely demolished in a series of reviews by people I respect – Martin Armstrong,Peter Diekmeyer, Doug French, David Gordon, Jim Grant, Dan Joppich, Norbert Michel and Tim Worstall – but let me add a couple of comments of my own:

The first is the obvious absurdity of any argument to the effect that some amenity should be prohibited merely because bad guys use it. Well, bad guys use paper clips and sidewalks, so why don’t we get rid of those as well? Thinking about it, bad guys make a lot of use of defense lawyers, so we should definitely get rid of them. You can see where I am going. By this logic, we should ban all amenities and services and destroy our entire civilization in the process just because bad guys benefit from them. Yes, the bad guys do use them but the rest of us benefit from them too. And if we really have to buy into this abolish something mindset, then I have a much simpler solution that would solve the problem at its root: let’s just abolish the bad guys and leave the rest of us in peace.

The second is that the ‘bad guys’ argument fails to consider that bad guys don’t just use cash to carry out or finance their nefarious activities. Indeed, cash is not even their number one vehicle of choice. The word on the street is (so I believe) that the smart bad guys do not even need to use cash: Amazon gift vouchers are much better. More seriously, a UK government risk assessment of money laundering and terrorist financing in October 2015 ranked cash as the third biggest risk factor a little ahead of legal service providers.[6]Second ranked was accounting service providers and the number one risk factor was banks. So abolishing cash would take care of the third ranking risk factor but the top two risk factors would still remain in place. But if we are determined to solve the bad guy problem, then why on earth would we want to knock out the third-ranked risk factor but leave the first and second ranked risk factors alone? Going further, both banks and accounting service providers are already heavily regulated – and especially so in the illicit transactions area. The fact that we have had such regulations for a long time now and yet banks and accounting firms are still the main risk factors suggests that this regulation has failed pretty dismally. In short, let’s not blame cash. The main problem is regulatory failure – and there’s a surprise.

It seems to me that the next significant stage in the development of this literature will be strong empirical case studies, which would set out how the WoC actually works in practice: how it is implemented in any particular case and why, the problems it creates, and especially the unintended consequences. The two polar cases are of obvious interest: Scandinavia, where the digital monetary economy is highly developed and the use of cash is limited; and of course India, which is still a predominantly cash-based economy. As far as I can tell, the experiences of these countries amply bear out the worst concerns of those of us who oppose the WoC.

If this conclusion is correct and we can get this message across, then there is an excellent chance that we can put this particular genie back where he belongs in his bottle.

Source: http://en.irefeurope.org/The-War-on-Cash-Haldane-Edition,a1201