The “law of one price” holds that identical goods should trade for the same price in an efficient market. But how well does it actually hold internationally? The Economist magazine’s famous Big Mac Indexuses the price of McDonald’s Big Macs around the world, expressed in a common currency (U.S. dollars), to measure the extent to which various currencies are over- or under-valued. The Big Mac is a global product, identical across borders, which makes it an interesting one for this purpose.

Big Macs travel badly, however. Flows of burgers across borders won’t align their prices. So in 2013 we created our own Mini Mac Index that compares the price of iPad minis across countries. Minis are a global product that, unlike Big Macs, can move quickly and cheaply around the world. As explained in this video, this helps equalize prices.

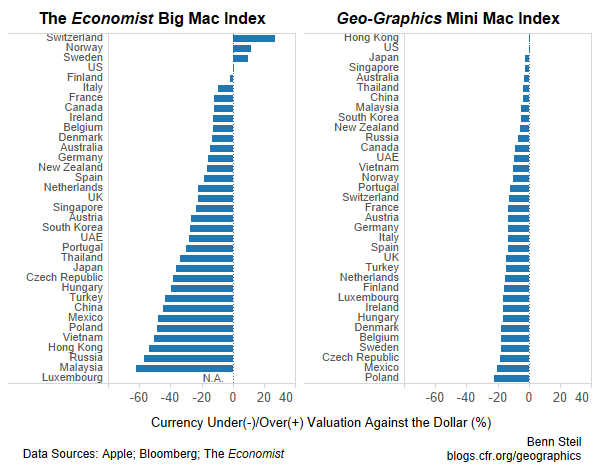

As shown in the graphic at the top, the Mini Mac Index suggests that the law of one price holds far better than does the Big Mac Index. Both indexes currently show the dollar overvalued against most currencies. But the Big Mac Index puts the average overvaluation at 25 percent—a Whopper. Our Mini Mac Index puts it at only 11 percent—Small Fries.

Those who believe the #FakeNews that China is manipulating its currency downward will no doubt take heart from the Big Mac Index, which puts the RMB’s undervaluation at a super-sized 45 percent. But that won’t cut the mustard with us. The Mini Mac Index puts the undervaluation at a mere 3.7 percent—not tarrific news for currency warriors.

Source: https://www.cfr.org/blog-post/how-fairly-valued-chinas-currency-big-mac-and-mini-mac-square-again