“Black cab drivers to revel in victory over Uber for centuries to come”

- Headline from The Daily Mash.

Baroness Ros Altmann could fairly be described as a City insider. The UK Minister of State for Pensions between 2015 and 2016, she has worked at investment institutions including Chase Manhattan, Rothschild and NatWest, and is now an independent consultant. Last week she wrote a letter to the Financial Times which, somewhat remarkably, it elected to publish. Responding to an earlier piece by FT columnist Martin Wolf on the apparent conflicts between capitalism and democracy, she wrote:

Perhaps another factor has been overlooked which could at least partly explain the loss of trust in politicians and capitalism.

It is possible that the side-effects of unconventional monetary policies may have distorted capitalism, fed populism, and undermined democracy.

Global central banks have artificially distorted capital markets for several years, by creating vast amounts of new money to buy sovereign debt. The supposedly “risk-free” interest rate, on which much of the system depends, has been undermined.

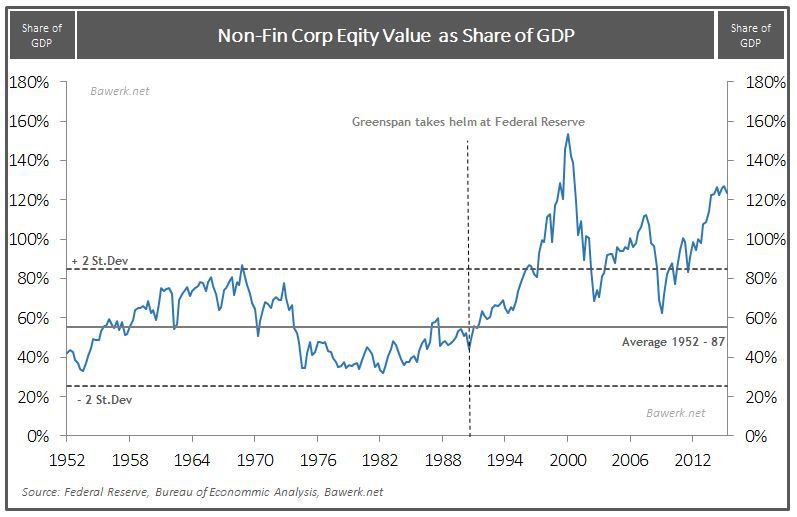

Quantitative easing artificially boosts asset prices but with assets so unevenly distributed, the wealthiest and older households become even wealthier, while QE-induced house price inflation and rent increases have further disadvantaged non-homeowners and the young. Such social, distributional – and political – side-effects of unconventional monetary policy are routinely overlooked.

If politicians announced tax changes to enrich the wealthiest groups and redistribute away from young to old there would be a voter backlash. But disguising such fiscal measures as monetary policy has achieved similar impacts without democratic accountability.

Is the populist wave engulfing the west reflecting this ? The powerful groups that benefit most from QE – governments, financial market participants and the wealthiest – have so far held sway, but it is important to consider the democratic dangers to capitalism which prolonged QE may pose.

[Emphasis ours.]When the Global Financial Crisis erupted in 2007/8, the governments and central banks of the world faced a choice: to bail out insolvent banks using taxpayers’ money, or let the tender mercies of the free market work their magic and determine the ultimate winners and losers. Among the losers would have been debt and equity investors in those same banks. Universally governments took the former option. Rentiers would not be euthanised but incentivised instead.

That decision had consequences. The two big ones were QE (quantitative easing) and ZIRP (a policy of maintaining zero interest rates).

As Baroness Altmann points out, QE has inflated asset prices and made the rich richer. By definition asset price inflation does not act uniformly across the economy. Those who own assets benefit; those without assets are effectively made poorer. As she also hints, if these manoeuvrings and wealth transfers had been effected via the tax code, there would likely have been a revolution.

In the wake of the financial crisis we have had, of course, at least one revolution, and other than signalling profound political change, its implications still remain unclear. As John Gray put it in the immediate aftermath of Britain’s EU referendum last year,

The vote for Brexit demonstrates that the rules of politics have changed irreversibly. The stabilisation that seemed to have been achieved following the financial crisis was a sham. The lopsided type of capitalism that exists today is inherently unstable and cannot be democratically legitimated. The error of progressive thinkers in all the main parties was to imagine that the discontent of large sections of the population could be appeased by offering them what was at bottom a continuation of the status quo.

As it is being used today, “populism” is a term of abuse applied by establishment thinkers to people whose lives they have not troubled to understand. A revolt of the masses is under way, but it is one in which those who have shaped policies over the past twenty years are more remote from reality than the ordinary men and women at whom they like to sneer. The interaction of a dysfunctional single currency and destructive austerity policies with the financial crisis has left most of Europe economically stagnant and parts of it blighted with unemployment on a scale unknown since the Thirties. At the same time European institutions have been paralysed by the migrant crisis. Floundering under the weight of problems it cannot solve or that it has even created, the EU has demonstrated beyond reasonable doubt that it lacks the capacity for effective action and is incapable of reform.. Europe’s image as a safe option has given way to the realisation that it is a failed experiment. A majority of British voters grasped this fact, which none of our establishments has yet understood.

If the Establishment failed to understand Brexit in June last year, it has doubled down on its confusion since. Part of the problem is a framing error: people are aggravated by the perceived demerits of capitalism when it is actually crony capitalism that is at fault. In a legitimate free market, government would not be able to manipulate interest rates – the most important price signals of all – through their agent central banks. But then in a legitimate free market, bad banks would have been allowed to fail, and the last decade’s increasingly surreal monetary science projects might never have been started in the first place.

A small but telling example of crony capitalism at work: Transport for London’s shameful refusal last week to renew Uber’s operating licence in the UK capital, what Stephen Daisley of The Spectator calls

a win.. for fans of over-regulation, who have been out to get Uber for some time now. They are aficionados of rigidity and Uber was frustratingly fluid, its business model less susceptible to the impositions dreamed up by restive bureaucrats..

An entire industry is being shut down and tens of thousands of people put out of work. A lobby that predominantly represents white British men has succeeded in putting a service populated by immigrants and ethnic minorities in their place. (For more on the ugly racial undertones of anti-Uber campaigns, see here.) It is a curious progressive who would celebrate such a thing, and yet TfL’s announcement will gladden many a heart on the authoritarian left. There will be no plaintive cries of ‘Solidarity Forever’ with a workforce facing the dole queue. No lectures will be delivered on the importance of diversity in the private transport sector. You see, they’re the wrong kind of workers.

London cannot pride itself on openness and vibrancy while pandering to advocates of the status quo and the 21st century closed shop. TfL has done nothing to improve transport provision or passenger safety today. It has made London a costlier, less safe city to travel in.

Does this cheap spat really come down to public safety ? Mayor Sadiq Khan can’t even protect passengers on the London Underground. Perhaps there is more here than meets the eye, including some spectacularly grubby settling of old scores between a left-leaning administration and some former Tory incumbents, including David Cameron and George Osborne, with the latter’s close new ties to Blackrock (which reportedly invested £124 million in Uber in 2014).. The Adam Smith Institute pulled no punches in their analysis of this nasty little stitch-up:

TfL’s decision to revoke Uber’s license is a disaster for Londoners. They are choosing to punish the 3.5 million Londoners who regularly use Uber just because it’s cheaper, it’s safer, and it’s quicker. This decision jeopardises the livelihoods of 40,000 drivers who choose to use the app because it gives them valuable flexibility.’

If you agree that this shabby decision should be reversed, you can petition the London Mayor Sadiq Khan here.

So how does one invest in a false market ? The greatest trick government ever pulled was persuading investors that government liabilities (that now surpass $20 trillion in the United States) could somehow ever be regarded as assets. With the Federal Reserve confirming its intention to start slowly unwinding its portfolio of Treasury holdings, bond “investors” don’t need to be warned twice. With global interest rates at 5,000 year lows, bonds are in most cases uninvestible and should be rightly ignored.

That leaves pockets of opportunity from within the world’s stock markets, where investors can endorse honest entrepreneurial endeavour rather than continue to subsidise feckless government bureaucracy – especially if the shares of those businesses can be bought at no great premium to those businesses’ inherent value. In light of the growing shadow of debt tapering and its unforeseeable consequences in financial markets, exposure to portfolio protection by way of price momentum strategies makes eminent sense. And given the rising geopolitical temperature, owning crisis and inflation insurance by way of the monetary metals, gold and silver, still has real merit.

Given what’s at stake both socially and financially, how is it that major news publications, Baroness Altmann’s missive aside, have barely addressed the moral and democratic deficits at the heart of QE and reflationist monetary policy ? There’s a reason why most newspaper audiences are declining. Most of what’s in them isn’t fit to print.

“The greatest trick government ever pulled was persuading investors that government liabilities” Precsiely

The electorate is at last beginning to realise that their leaders and elites are completely and utterly incompetent, and do nopt deserve their support!