Demographics, productivity & the great central bank fallacy of interest rate determination

Summary

As we go to press, the Mighty Oz’s and Grand Panjandrums of central banking are descending upon the rural splendours of Wyoming in order to engage in a very public display of navel gazing and to enact a ritual, group reinforcement of confirmation bias.

Here, we will probably hear much nonsense talked about low – even negative -‘natural interest rates’ and of the seeming impossibility of triggering an alchemically meaningful dose of price inflation with which to restore the balance of the humours in the global economy.

It was most timely, then, for the ever-mischievous BIS to publish a paper first presented last year which challenges much of the received wisdom of our monetary overlords and which broadly affirms arguments I, too, have long been offering against their approach.

But to be young will be very Heaven!

Over the years, I have often had occasion to question the received wisdom that an ageing society is one in which sav- ing takes precedence over spending and that therefore the slow greying of a population necessarily means a ‘paradoxical’ penury both for its parsimonious pensioners and for its dwindling cohorts of opportunity-starved work- ers. Thus it was a very welcome surprise to find that grand old economist Charles Goodhart and ex-Morgan Stanley man, Manoj Pradhan, presented a just-released paper at last year’s annual BIS conference which shared a broadly simi- lar – and equally contrarian – approach to this matter.

My argument has always been based on the idea that, as labour becomes increasingly scarce, capital goods must come to substitute for it so that ‘saving’ becomes merely an act of ‘spending’ on things other than immediately exhaust- ible (‘Verbrauchbar’ to use the useful Germans appellation) sources of material satisfaction. Given that such a phenom- enon also goes by the name of ‘investment’ and that we are always being castigated for not undertaking ‘enough’ of it, there is a certain grim amusement to be had from the deter- mined display of cognitive dissonance put on by one’s op- ponents among the Reverse Malthusians of the Demo- graphic Decline school.

As labour begins to be less readily available, two key bal- ances start to shift. Firstly, the demand for capital means (or funding) starts to rise in relation to a pool of savings now either being actively run down or, at the very least, not being as rapidly augmented as previously by those with fewer opportunities to earn an income, thanks both to the toll taken of their energies by age and to the slow obsoles- cence of their ‘human capital’, i.e., of their stock of ac- quired skills and useful experience.

Demand up and supply down – for savings – implies noth- ing other than that interest rates must start to rise, not fall.

In the second case, the increasingly rare young workers find that the commodity they are most eager to sell – namely, their labour – is becoming more and more prized and hence that its reward is inexorably increasing. Though there

may well be periods when unpredictable bursts of innova- tion and technological advance lessen the effective scarcity of labour – and so briefly retard this progression – it is highly unlikely to do away with it entirely.

Thanks for your help, R2. But I’ll take it from here if you don’t mind.

Both by dint of their increased bargaining power, as well as of the fact that each worker is on average and by definition able to draw on an ever-multiplying capital endowment, it is almost inconceivable that he or she will not enjoy a secu- lar increase in their real wages – at least, their real pre-tax wages.

Taken to an illustrative extreme, imagine, say, Japan turned a century hence into an archipelago peopled by some tens of millions of bowed and decrepit Crusoes, each needing the services of the very last, prime-of-life Man and Woman Friday then alive. Even if this Omega couple’s only task is to check briefly each day that the master switch to the vast array of automated assembly lines, self-steering machinery, cyber-surgeons, robotic care-workers and digital compan- ions – on whose uninterrupted functioning their multitudi- nous elders utterly depend – remains firmly in the ‘On’ po- sition, can you imagine the riches at their disposal, as well as the enviable expanse of time they will have in which to enjoy them?

At this point, the general reaction of my interlocutors has been to acknowledge that the logic seems superficially plau- sible, but then to succumb to the implicit Underconsump- tionist pessimism which the mainstream position involves – a long-enduring fallacy whose rejection provides surely the single greatest litmus test of economic understanding, to- day. (Sorry, Larry, you fail!).

Rather than thinking for themselves, all too many are hap- py to parrot the ramblings of the MIT Archimandrites in uncritical acceptance of their rehashed, 1930s ideas of ‘Secular Stagnation’. It is but a short step from there to be- coming persuaded of such self-evident, Swiftian lunacy as the need for negative rates of interest as a dangerous, quack cure-all for a misdiagnosed ill.

Mixed in with all this is the misplaced belief that we must do all we can to keep exhaustive spending running as hot as possible for as long as possible since only the maintenance of high levels of ‘effective demand’ is held to be able first to call forth and then to validate investment outlays – how- ever inadvisable its constitution and no matter how danger- ously over-borrowed the officially-sanctioned, Prodigals who are to do the demanding have become.

Higher demand today, coupled with ‘expectations’ of high- er prices tomorrow is supposed to be the key to boosting ‘animal spirits’, raising the projected ‘productivity’ of in- vestment, and thus moving the fictional ‘natural rate’ well into positive territory and so safely removing it from the yawning abyss of the dreaded Zero Lower Bound. Note, in passing, that even if there were some small kernel of truth to the suggestion that this largely intangible constellation of factors was one tending initially to raise rates, it still does not tell us from where they are to be raised. That starting point – on a truly unhampered market – can only be set by people’s schedules of preference for jam today and jam tomorrow.

Moreover, the fact that those same entrepreneurial ‘animals’ might instead have their spirits depressed by a candid, Ricardian-equivalence assessment of their debt- bearing customers’ longer term prospects never seems to enter into the reckoning. The spurious and ahistorical idea that higher prices are a prerequisite of faster growth is an- other notable source of confusion. Finally, tangled in this mare’s nest of sloppy thinking is the hoary old confusion that interest rates are determined by productivity trends: a proposition first put convincingly to rest by Eugen von Boehm-Bawerk, sometime finance minister of the Haps- burg Empire and one of the founding fathers of the mod- ern Austrian School.

Let me count the ways

The problem with this concept is that it seductively at- tempts to apply a basic tenet of business – that one should apply ‘hurdle’ rates to the calculation of the worth of in- vestment proposals – to the question of what determines interest rates per se. At the same time, it casually elides a crucial distinction between ‘object’ productivity and ‘dollar’ productivity (i.e., it tends to confound the real with the nominal). Furthermore, it overlooks a key objection that what might well hold for one particular enterprise does not necessarily do so for the entirety of such undertakings in the round. Additionally, it ignores a potentially fatal circu- larity in the argument it proposes.

To take each of these briefly in turn, suppose an enterprise

has hit upon a way to make more goods per unit of input – either by increasing the rapidity of the productive process or by lessening the physical quantity of material factors contributing to each one.

All well and good. But this tells us little about whether the improvement will bring in greater revenues since a higher batch count could simply command a proportionately low- er unit selling price, even one sufficiently depressed to ne- gate the lower costs involved and hence to leave profits en- tirely unchanged.

It also neglects to consider that the success enjoyed by any first-mover firm is sure to spark rapid emulation such that its competitors will gradually arbitrage away its excess prof- its to the point their actions have largely restored the status quo ante.

In fact, the objection goes beyond even this, since those espousing an orthodox position which sees a tight link be- tween productivity and interest rates do so on an economy- wide scale. But this can only mean that not just the special, but even the average firm is now adding to supply when their favoured measure turns up.

However, as more and more product comes to market across a widening range of goods, it is not hard to see that only a countervailing inflation of the money supply could prevent this from leading to a generalised fall in prices.

True, this is a phenomenon which, historically speaking, has tended to deliver higher material living standards – and would do so again were our modern central banks not ge- netically programmed to resist it – but it is also something that would render all expectation of achieving greater pecu- niary returns (and thus of offsetting the higher borrowing costs being incurred) somewhat moot.

Turning to our charge that the theory also employs a circu- lar argument, consider next the matter of the price of the firm’s inputs – including that of the labour it employs. If it expects their use will give rise to greater future returns, why will it simply not pay up to secure them in accordance with the economic tenets of marginal utility as well as the norms of commercial habit?

To presume, as the standard argument implicitly does, that the price of these inputs will remain unaffected – and that their effective return or ‘yield’ will thereby remain elevated beyond the norm – involves the untenable idea that a whole subset of present goods (the inputs) will not respond to an increase in demand sufficient to raise the interest rates payable on the capital means by which that demand is realised while the future goods (the outputs) to which they will give rise will not respond in their turn to the circumstance of their greater supply!

If that suspension of microeconomic reason is still not enough to persuade you that something is horribly awry here, try this. By analogy, this assumption is equivalent to imagining that the greater revenue stream offered by a new- ly-offered, high-coupon bond will somehow trade at the same capital price as an existing, lower-coupon one and will not therefore be bid up to the point where the two yields are indistinguishable. Worse, it even seems to imply that the very fact of the new bond’s issue will allow it to super- sede all previous valuation and somehow act to force the price of all securities on the secondary market DOWN through par until their yields equalize at the upstart bond’s new, higher rate.

Taking this a step further, if we all become more produc- tive of goods and services, by construction we will face conditions of lessened scarcity (or, conversely, of greater material satisfaction). Hence, the diminished marginal utili- ty of each additional present good will encourage us to set it aside for a more deferred enjoyment – i.e., to save and invest it. Thus, the more productive we are, the richer we become: the richer we are, the more likely we are – assum- ing the existence of the just laws and stable institutions needed to safeguard our choice – to consume relatively (though not absolutely) less (and, importantly, in today’s framework, to undertake less exhaustive borrowing to main- tain that consumption) and to save both relatively and abso- lutely more.

Not even a Keynesian, with his irrational phobia of the lowered ‘propensity to consume’ which he frets is an incur- able vice of the wealthy could argue with that particular chain of consequence.

But consider what that change in balance would mean: a greater pool of savings – genuine, voluntary, ‘subsistence- funded’, ex ante savings, at that – to put at the disposal of entrepreneurs so that they might undertake longer- maturation, more slowly-amortizing, more capital-intensive projects with which to whet our now-jaded appetites in the days ahead.

Can anyone seriously suggest that greater productivity would not tend to a world in which interest rates were therefore lowered, not raised, over the long haul?

Till Seraphs swing their snowy Hats

Goodhart and Pradhan themselves are rightly dismissive of the current orthodoxy. In a key section, they write:-

‘It is commonly assumed that an intrinsic relationship exists between potential output growth and the equilibrium real interest rate [potential output being, broadly, the product of population growth and productivity changes]. Laubach and Williams’ popular model uses the Ramsey framework to impose a long-term factor that is common to both potential output growth and the equilib- rium real interest rate. That assumption, more than anything else, drives their estimates of the equilibrium real interest rate over their estimation period. However, this assumption does not find adequate support in the data.’

‘In an empirical study designed to investigate the determinants of the equilibrium real interest rate in the United States, Hamilton et al (2015) finds that the only significant relationship of US real interest rates is that they are co-integrated with real interest rates in the rest of the world. Growth plays a part, as do many other factors, but shows no dominant relationship in determining the equilibrium real interest rate using data from 1858–2014.’

Where then, do they look for the variations we do see? Where else but the business cycle and the interplay it has with the relation between loanable funds and entrepreneur- ial activity; effectively with the net time preference exhibit- ed by the exhaustive users for whom all present goods are definitionally intended (end-consumers, both public and private) and the productive users (the transformers, we might say) who give rise to these.

As they explain:-

‘Cyclically too, much of the perceived link between growth and interest rates, we suspect, comes from observing a decline in both growth and interest rates during economic slowdowns and connecting the two. The decline in real interest rates cyclically also has more to do with the behaviour of ex ante investment relative to ex ante savings and, in particular, to the greater amplitude of the swings in investment relative to those of savings. As desired investment falls sharply (while desired savings tend to remain more steady) towards the trough of the cycle, so do interest rates. Similarly, an increase in desired investment relative to savings during expansions leads to higher interest rates. These rela- tionships are then mistakenly assumed to hold over the structural hori- zon.’

Our main quibble with this is that they are far too sanguine about the role of central bank interference in this process, attributing much of the secular fall in rates these past 35 years to a ‘prima facie’ case that ‘ex ante savings have exceeded ex ante investment over this period’. Much more of what they de- scribe as ‘saving’ has been ex post (after the fact) or ‘forced’

to our mind, while the peculiar shift to that ever more high- er indebtedness incident among all sectors and across al- most all nations which gives rise to so many gloomy head- lines seems hardly demonstrative of an ongoing enthusiasm for thrift!

Moreover, one reason investment ‘swings’ are arguably of ‘greater amplitude’ than those in the ‘steadier’ pool of sav- ings is that our central bank-backstopped system of elastic credit tends to prevent any natural feedback from regulat- ing them in time to prevent wild overshoots in both direc- tions. Were firms only able to utilize genuinely pre-saved capital, rather than enjoying an over-ready access to monies summoned up from the vasty deep of our Unfree Banks – to ’fictional’ capital, as our far-sighted Victorian forebears would have put it – then those same swings would be greatly dampened out, to the greater benefit of all.

Note, too, that this is a disparity made even worse by the facility with which those who classically do the saving – individuals rather than companies – can also avail them- selves of finance. Nowadays, therefore, not only do inap- propriate official rate settings mislead entrepreneurs into thinking more and longer-term projects will be viable than the existing resource base will support, but it inveigles dissaving at the personal (and state) level, too, thus actually shrinking that reserve. As an added complication, today’s unanchored currencies remove most, if not all, external restraint, given the general indifference with which current account deficits are treated and the ease with which they may be financed – if only with the hottest of hot monies.

O Fortuna velut luna

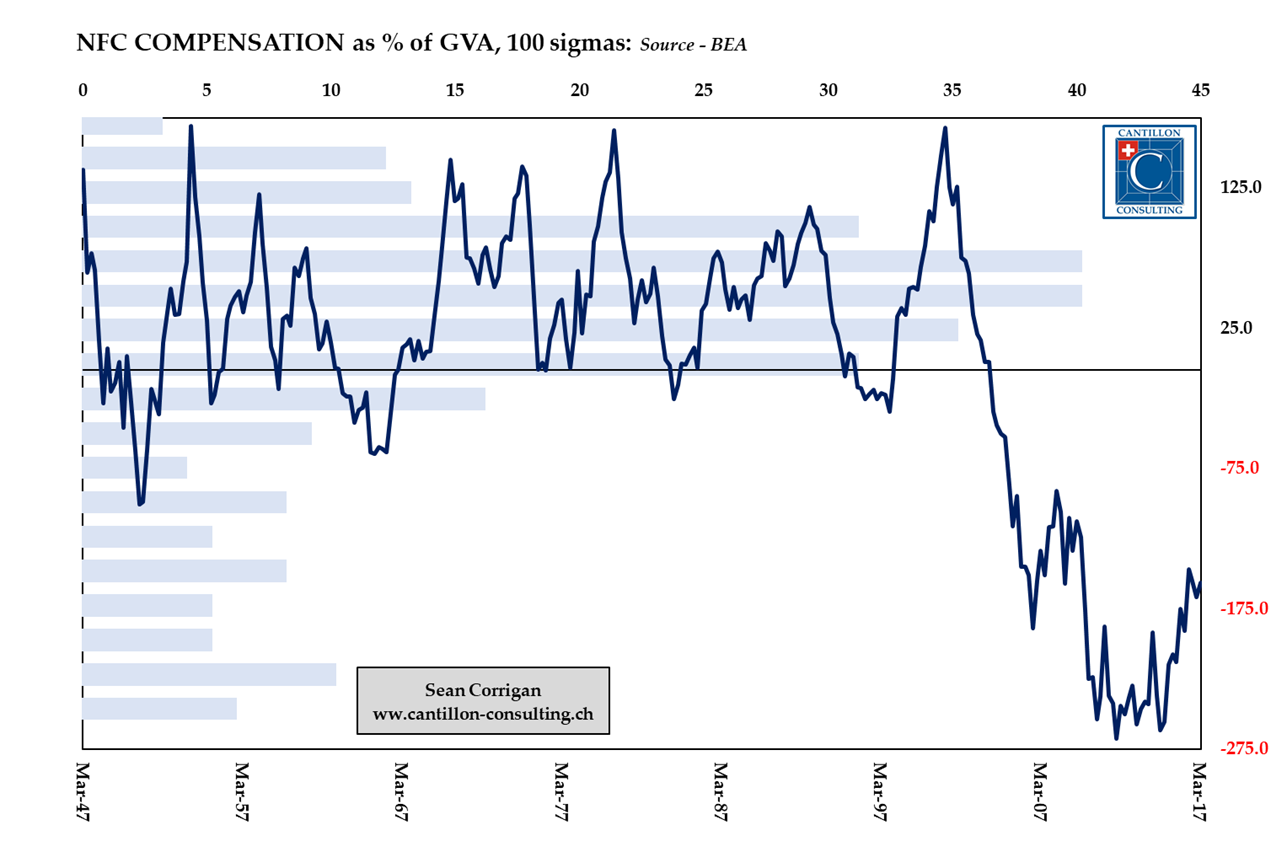

No doubt, many better econometricians than I have wres- tled with this (see the allusion to Hamilton et al, above) but

– no matter whether we take the official, GVA-based US productivity numbers or try our own comparisons with data for total output – any meaningful link to real interest rates remains elusive. Conversely, if we look at cyclical changes in the economy, we can tease out a reasonable de- gree of co-movement.

This admittedly does require a certain amount of statistical legerdemain since the three decades or so from the de jure (if not entirely the de facto) liberation of the Fed from its fiscal-capture by the Treasury in 1951 saw interest rates rise ever higher, just as the subsequent three-and-a-half have seen them trend inexorably back down. The great, two- generation, capital-lambda spike which this has traced out (one clearly nothing to do with either cycles or productivity) thus has to be massaged out of the nominal data before we can proceed. Conversely, real yields show no appreciable

trend an may be used as they are.

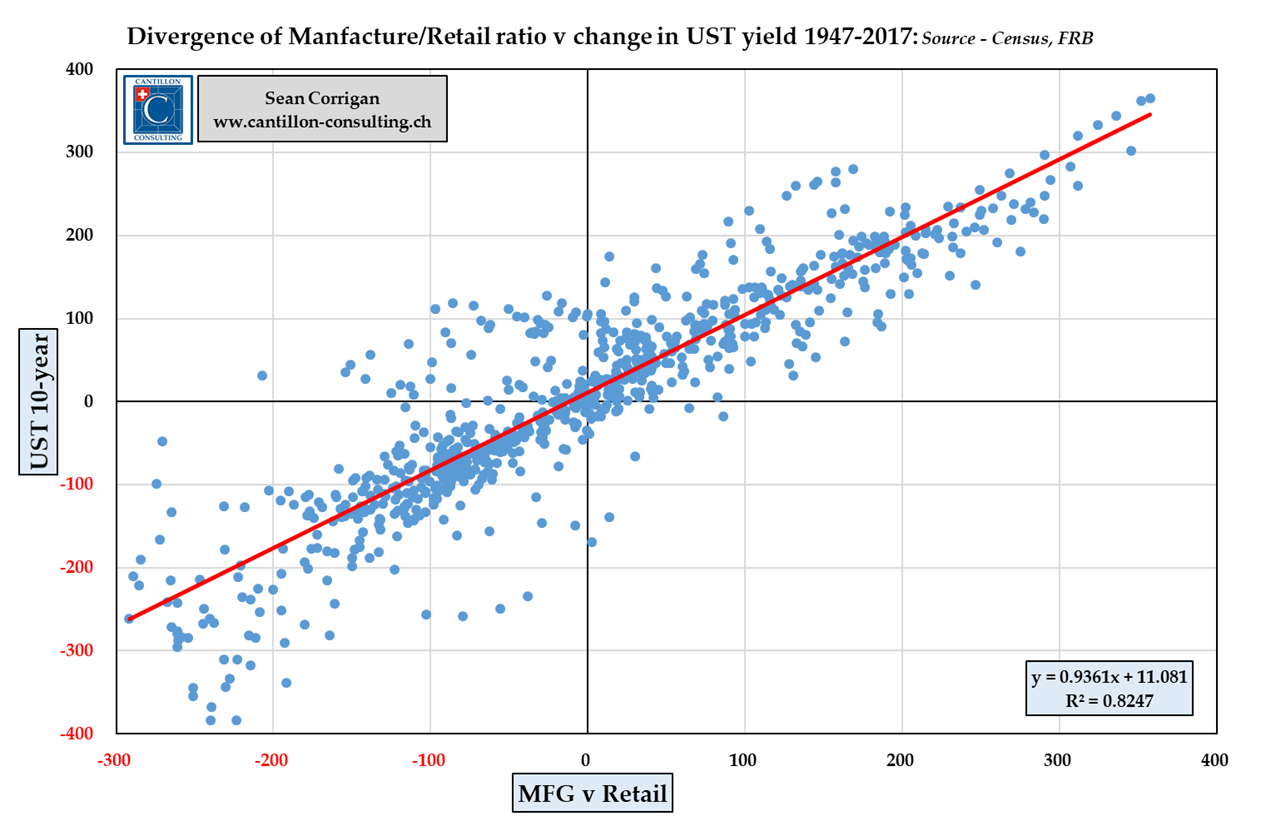

However, once we do this (either by breaking our regres- sions into two halves either side of the early-80s, Volcker peak, or by measuring changes in relation to a shorter-term moving mean and sigma), we can see that not just classical, NBER-designated recessions but archetypal, Austrian high- er-to-lower order goods proportional changes do indeed coincide with rates which fall well beneath the path of their existing trend.

Where Goodhart and Pradhan talk of ‘desired’ levels of investment rising and falling in relation to ‘desired’ levels of saving, we would rather expound our ideas of an overly enthusiastic ‘lengthening’ – and subsequently a crisis- induced ‘shortening’ – of the productive structure; of swings in its degree of ’roundaboutness’, if you will. However we describe these, we can easily and usefully illustrate them by the simple expedient of comparing the magnitude of manu- facturing sales to those of the retail variety exactly as do the accompanying graphs.

As already mentioned, we Austrians would attribute much, if not all, of the incidence of these wastefully recurring os- cillations – these ‘hystereses’, to invoke the Mainstream’s own phrase against it – to the false signals being given off by the artificially-lowered rates which help trigger and sub- sequently nurture the Boom.

The distinction, in this context, is not important. The key overlap between the Goodhart and Pradhan position and ours is the contention that the cyclical overlay is the domi- nant feature and that, as such, it in no way precludes a longer-term reversal of the present trend should the ratio of loanable funds to borrowing needs (should ‘societal time preference’) become durably altered.

In turning to the practical implications of something we might ironically term ‘Secular Stagflation‘, Goodhart & Pra- dhan see wage rates rising as a diminished labour force fights to recoup the vast transfer payments voted to itself for its sustenance by the superannuated masses – a conflict especially likely where the habits of thrift or the depreda- tions of the state have not allowed the latter to build a deep enough prudential fund of capital off which to live and whose only means of support therefore is a Ponzi-scheme, PAYGO state pension scheme.

Our twin sages therefore see rising bond yields ahead and also argue that the impact of this on a world awash in cheap-money indebtedness requires a rapid re-tilting of the playing field in favour of equity finance inside the next ‘three to five years’. We would broadly concur in both in- stances.

While the first should suffice to cause sleepless nights to those with fixed income portfolios stuffed with record du- ration instruments boasting often unprecedentedly low yields, this combination is hardly conducive to a continua- tion of elevated price/earnings multiples on equities either. Thus, with their principal determinant moving against them, stock market returns will be dampened, too, even if a resurgence of cost-saving investment spending helps boost aggregate earnings in the interim by moving more outlays below the line and hence shields them from immediate costing.

All in all, such a fundamental reversal of recent experience should have that boulevard Bolshevik, Thomas Piketty, dancing in the streets as his mythical ‘r’ finally threatens to tumble beneath a declining ’g’. Those of us grizzled heads who have spent a lifetime on a rollercoaster where, despite the interruption of a few bracing ascents, yields have ratcheted ever lower (and asset prices consequently ever higher) will not be quite so ecstatic. Our brash, young suc- cessors – whose only experience has come amid a decade of capital market insanity and who have never therefore been fully weaned from the bounteous teat of the great Central Bank mother – will have to progress to deriving sustenance from much grittier fare or else they will quickly starve.

What goes unsaid here is that efforts to prevent the pie from shrinking in per capita, as well as in absolute, terms are becoming increasingly jeopardised by a veritable witch- es’ brew of political and societal factors.

Among these, we can number the bitter-end continuation of inappropriate monetary policies; the widespread out- break of an ill-conceived ‘austerity fatigue’; and a general political swing to the left which has seen the financial pres- tidigitators who people corporate boards in place of genu- ine entrepreneurs increasingly supplemented with social justice virtue-signallers primarily interested in using their shareholders’ money to advance their own ideologies, ra- ther than attending to the fortunes of the business itself.

Sadly, the frustrations inherent to a continuation of today’s widely-perceived economic underperformance – woefully misidentified with a supposed ‘failure of capitalism’ in the common mind – can only serve to sharpen social division and to increase the incidence of both civil and international strife as a result.

Coda

Compounding the possibility of ruinous conflict is the on- going, indiscriminate mass migration which – far from be- ing a repeat of the integrationist fairy-tale which was the Wirtschaftswunder‘s generally successful enrolment of willing Gastarbeiter – looks like loading the already swelling welfare rolls with hordes of bored and alienated young men, toxi- cally gifted a sense of entitlement, if not outright immunity, by the European Left.

Even where such chronically idle hands do not fall prey to the Devil’s work of extremist violence, it is unlikely that they will be spared an overproportionate involvement in crime or disorder, something all too prone to the initiation of a rising cycle of hatred and counter-hatred.

In turn, such strains and flashpoints as these will only in- crease the likelihood that our overlords will fully succumb to the evident temptations which the global digital revolu- tion offers for the imposition of global digital tyranny.

Move over, Big Brother: Siri and Alexa are now watching you!

Exacerbating all the above, there are worrisome signs that the Frankfurt School’s subversive ‘long march through the institutions’ may be drawing near its destructive goal of shattering all faith in those same Enlightenment values which the likes of Deidre McCloskey convincingly argue lie at the root of the West’s rise to material predominance and, through mutual reinforcement, to the classically liberal val- ues which are its shining legacy to the rest of humanity.

Neither the seemingly complete conversion of our insti- tutes of higher learning into breeding grounds for baying packs of Twitter-swarming Red Guards – nor their cynical use as the shock-troops of what is this time a domestically– staged series of ‘Colour Revolutions’ whose aim is to deny the exercise of democratic choice to those not already fully indoctrinated in the losers’ Neo-Jacobinism – make, alas, for the ideal conditions under which to deal rationally with the daunting challenges or to negotiate in a suitably dispas- sionate manner the painful compromises which undeniably lie before us.

Given all the foregoing, is it really too dark to say that, run- ning between the twin signposts vaingloriously proclaiming ‘Whatever it Takes’ and ‘Wir schaffen das’, we can make out the arrow-straight lines of a four-lane highway, unmistakably paved with the sticky, asphalt goo of misplaced Good In- tentions?

Ah, well! ‘Tu ne cede malis’ and all that…