“Look at it this way. In 100 years, who’s gonna care ?”

- Nancy, waitress, in ‘The Terminator’ (screenplay by James Cameron and Gale Ann Hurd).

Imagine that a cyborg from 10 years into the future paid you a visit back in 2007. Here is what is going to happen, he says, in a thick Austrian accent, his body looking like a condom stuffed with walnuts. After deregulation and a gaudy credit boom, Wall Street will face an extinction level event. So will the City of London. As a result, interest rates will be driven down to zero and kept there for a decade as a “temporary” emergency measure. The UK will vote to leave the European Union. Donald Trump will be elected US President. On the basis of these facts alone, what do you think would happen to global stock markets ? Would they be higher, or lower – and perhaps much lower ?

Since we know the answer, it’s hardly a fair question, and there can in any case be no counter-factual. But this thought experiment does reveal the vulnerability of ‘global macro’ investing in a world in which central banks are almost exclusively calling the shots. Which might explain why an increasing number of ‘global macro’ managers are quietly folding up their tents.

The first requirement to harvest superior long-term returns from the markets is to have some kind of edge. If you do not know what your edge is, you do not have one. It is difficult to see how many (or any) ‘global macro’ managers can possess any form of edge when the financial markets are largely at the mercy of the arbitrary behaviour of monetary central planners, either adding or withdrawing liquidity as they see fit. Which is just one of the reasons why we don’t invest in ‘global macro’ funds.

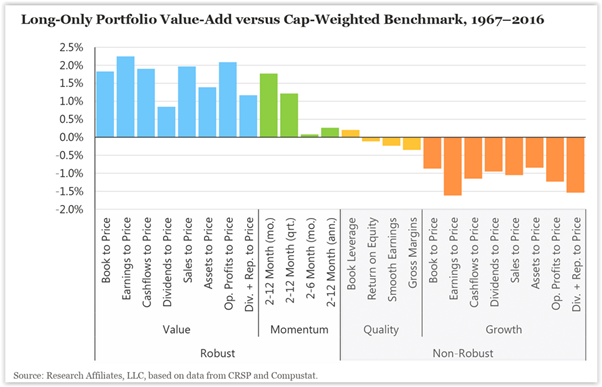

Research Affiliates earlier this year published a fascinating paper, ‘How not to get fired with smart beta investing’, which highlights some of the good and not so good strategies for adding value relative to the stock market on the basis of 50 years’ worth of data.

‘Quality’ and ‘growth’ investing have been wildly popular of late, which makes Research Affiliates’ conclusions all the more intriguing, in that their analysis of the data strongly suggests that ‘quality’ and ‘growth’ factor investing typically subtract value versus the rest of the market, as shown in the table below. (Perhaps the last few years for the likes of the FANGs have been a colossal anomaly ? Perhaps a world of zero interest rates is one that inspires wholesale investor irrationality. Discuss.)

Conversely, ‘value’ and ‘momentum’ strategies have a tendency to add value versus the rest of the market, albeit over the longer term. We define ‘value’, cheaply and cheerfully, as dollar bills bought for forty cents, i.e. decent businesses that for whatever reason are available for purchase in the stock market at a discount to their inherent worth. ‘Momentum’ can be defined simply as stuff that’s going up – unless it’s going down, but in either case, that momentum can feasibly be exploited by nimble traders with a facility for managing stop losses. ‘Value’ and ‘momentum’ are not remotely similar – in fact they are close to being polar opposites – but nevertheless would seem to outperform over the longer term, if Research Affiliates’ number-crunching is anything to go by.

It doesn’t end there. Research Affiliates also acknowledge the human limitations of any single strategy – namely, that clients will tend to fire their adviser during a prolonged period of underperformance regardless of the longer term viability of that strategy:

For all horizons.. the agent who allocates only to value funds will have the highest chance of being fired because all the value strategies are highly positively correlated; thus, when one underperforms, they all tend to..

So you end up with a huge perversity that seems like a paradox: ‘value’ is the best performing equity strategy there is, and it’s simultaneously the strategy most likely to get you fired, especially if you concentrate exclusively on it above all else.

We attempt to square this apparent circle by means of honest diversification. Warren Buffett derided diversification as “protection against ignorance. It makes little sense if you know what you are doing.” That may be correct, but we’d rather not take the chance. The one commodity rarest in the practise of asset management, in our experience, is humility – and we are humble enough to recognise when the market environment is sufficiently challenging to warrant an extra diversification of risk attributes. So in addition to focusing on value characteristics in equity investments (difficult to find in western markets, but not so difficult to locate in Asia), we also choose to diversify amongst ‘momentum’ styles, by way of systematic trend-following funds, and also amongst real assets, notably the monetary metals, gold and silver, which we continue to believe will provide real value in the event that the world’s monetary technocrats come to realise that they may have bitten off more than they can chew when it comes to messing with the mechanisms of market interest rates.

To put it another way, why invest in one sensible and defensive asset class if you can invest in three of them ? Longstanding readers will recognise that we no longer mention debt as an investible asset class. There’s a reason for that. Meanwhile, given the vulnerability of markets to any number of threats, whether geopolitical, valuation-based or triggered by central planning hubris, a combination of value, momentum and hard asset protection seems like a reasonable triumvirate on which to base a diversified investment portfolio. Doing something radically different would require a degree of confidence in predicting the future that we simply do not possess.