Is it true that changes in money supply are an important driving force behind changes in the stock price indexes?

Intuitively it makes sense to argue that an increase in the growth rate of money supply should strengthen the growth rate in stock prices.

Conversely, a fall in the growth rate of money supply should slow down the growth momentum of stock prices.

Some economists who follow the footsteps of the post-Keynesian (PK) school of economics have questioned the importance of money in driving stock prices[1]. It is held that rises in stock prices provide an incentive to liquidate long-term saving deposits, thereby boosting the money supply.

The received money then employed in buying stocks and other financial assets. According to the PK the trend is reversed when stock prices are falling. Hence, changes in stock prices cause changes in money supply and not the other way around.

Does a shift of money from savings to demand deposits affect money supply?

Is it possible to have an increase or a decline in money supply because of a shift of money from long-term saving deposits to demand deposits and vice versa?[2]

Can there be such thing as saving deposits? The existence of such deposits implies that money somehow can be saved. We hold that individuals do not save money. They only exercise demand for money in order to be able to employ it as a medium of exchange whenever they deemed it necessary.

For instance, out of his production of twelve loaves of bread a baker may consume two loaves of bread and save ten loaves. He then exchanges these ten loaves for ten dollars with a shoemaker. What we have here is a situation in which the baker has increased his demand for money to the tune of ten dollars whilst the shoemaker has lowered his demand for money to the tune of ten dollars.

The ten dollars that the baker has acquired are claims on real savings (i.e. unconsumed final consumer goods) to the tune of ten dollars. The acquired ten dollars provide the baker with an access to a variety of final consumer goods and services.

By holding these ten dollars however, he does not generate savings he is only exercising demand for money. Note that the savings was already achieved when the baker saved the ten loaves of bread out of his production of the twelve loaves of bread.

What is then labelled as saving deposits is in fact a credit transaction – an individual who places his money into a so-called saving deposit is actually lending his money by means of bank mediation to a willing borrower. By acquiring a saving deposit, an individual transfers his claims over goods and services to the borrower of his money for the duration of the credit. (The lender has temporarily relinquished his ownership over the specified amount of money – his money now transferred to the borrower).

Once the money is transferred, what we have here is a situation where the lender has lowered his demand for money whilst the borrower has increased his demand for money. The overall amount of money obviously did not change.

If for whatever reasons the lender decides to liquidate his saving deposit then again this will not cause an increase in money supply. The liquidation of the saving deposit means that the borrower or the bank has agreed to sell some of their assets for money and then transfer the money to the original lender.

Money has simply shifted from one individual to another individual –overall money supply however cannot change because of such transactions. If changes in savings deposits does not alter money supply obviously these changes have nothing to do with changes in the stock of money.

Contrary to the PK, is it possible that prices of assets in general will increase without a preceding increase in money supply? After all a price of a good is the amount of money per unit of the good. In order then to have a general increase in prices, all other things being equal, there must be an increase first in the money supply.

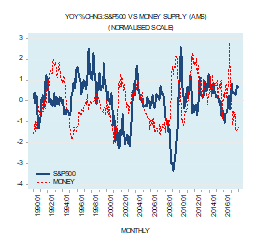

Observe that even in terms of a statistical display the annual rate of our monetary measure AMS tends to precede changes in the S&P500 stock price index (see chart). Also, note that statistical correlations without a theoretical framework proves nothing, it is only for illustrative purposes only.

Given, that the key source of monetary expansion is the central bank monetary policies and the fractional reserve banking we can conclude that it is these that drive the stock prices.

[1] See the exposition of post Keynesian thinking by L.Randall Wray Modern Money, Working Paper No.252 September 1998, The Jerome Levy Economics Institute.

[2] Marc Labonte and Gail E. Makinen – Monetary Policy: Current Policy and Conditions CRS Report for Congress July 28, 2006.