I first met Professor Salin in late 1997, in his office at the University of Paris-Dauphine. When I mentioned that I had been drawn to the Austrian School not least of all because of Mises’s epistemology, he raised his eyebrows and put on a skeptical face. I stopped talking and he threw in with amusement, “And all of economics is for you nothing but applied epistemology.”

I protested that this was not my opinion, but the point was well taken. Economics is not a branch of epistemology; and one cannot say anything meaningful about its epistemology before one is perfectly familiar with its contents. My interest in the logical and epistemological problems of economics has remained unshaken, but I took Pascal Salin’s reproach to heart and over the following years focused on economic theory proper. Now is the time to make an exception. The present paper is an epistemological bouquet for my dear mentor, thankfully remembering that he admonished me not to confuse the florist’s job with that of the gardener.

I

Many writers who have set out to describe the logical and epistemological character of economic science consider the precept of methodological individualism to be among the distinctive features of economic analysis.1 This point of view is especially widespread among Austrian economists.2 According to this precept, the analysis of individual behavior is not only necessary to understand microphenomena such as consumer expenditure; it is also indispensable to grasp macrophenomena such as inflation, unemployment, and economic crises. The reason is that these aggregate or macrophenomena do not exist independent of human action, but result from the interaction of various individuals.

There cannot be the slightest doubt that this basic rationale for methodological individualism is simple, solid, and clear. Whoever wants to trace back the emergence, transformation, and decline of aggregate social phenomena to their root causes cannot sidestep the analysis of individual actions.3 He must deal with the choices of individuals. He must deal with the meaning that individuals attach to the context in which they are acting, and to the alternative options that they believe are at stake.

It is a very different question, however, whether methodological individualism is a method of economics or, more precisely, of economic theory. In what follows, we will argue that it is not. Based on the Misesian distinction between theory and history, we will show that, while methodological individualism is properly applied in history, it is not a method that we use in theory.

II

In the causal analysis of individual human behavior we must distinguish between invariant and contingent factors.

Any human action has certain invariant causes and consequences. Invariant consequences result from like action at any place and any time and are said to follow from it by necessity or law. For example, an increase of the quantity of money tends to entail an increase of the price level above the level it would otherwise have reached, irrespective of when and where the money supply is increased. According to Ludwig von Mises, the study of such consequences is the task of praxeology and economic theory.

But human action also has contingent causes and consequences. The very same action — increasing the quantity of money — can be inspired by different ideas and value judgments. And the objective consequences resulting from any action can provoke very different individual reactions at different times and places. In other words, the causal chains through which ideas and value judgments are connected with human action are contingent. According to Mises, the elucidation of these contingent causal chains is the specific task of historical research.4

Mises did not exclude that individual value judgments and ideas had invariant causes, but neither he himself nor anybody else knew what they were. At present, only some of the contingent causes of human action can be identified by historical understanding on a case-by-case basis. And even this analysis is not likely to give the full picture. There is an unfathomable remnant that defied any explanation whatever: historical individuality. Mises explained:

The characteristics of individual men, their ideas and judgments of value as well as the actions guided by those ideas and judgments, cannot be traced back to something of which they would be the derivatives. There is no answer to the question why Frederick II invaded Silesia except: because he was Frederick II.5

Historical analysis, if it just sticks to the known facts, must explain all social phenomena as resulting from individual action, and the causal chain of events must start and end with the ideas and value judgments of individuals. History describes in retrospect how the acting person perceived the situation in which he had to act, what he aimed at, what he believed to be the means at his disposition. And it uses the laws provided by economics and the natural sciences to describe the objective impact that the acting person had through his behavior. Thus the mission of history is to describe the drama of social and economic evolution from the point of view of its protagonists. Its own specific tool in this task is “psychology” or — Mises’s favorite expression — “thymology.”

III

With these distinctions in mind, let us turn now to the precept of methodological individualism and see where it applies. As a matter of fact, it has shown its usefulness in a number of important cases. The best-known example is the explanation of the origin of money.

Thinkers from Aristotle to John Locke have explained the origin of money with the help of an intellectual shortcut. They have suggested that money, being a social institution, has come about by some sort of collective deliberation. Money is indeed so useful that it would have to be invented if it did not already exist. So what is more natural than to assume that a group of wise men decided to sit together and institute the use of money? The problem is that no such convention is known ever to have existed.

But as Carl Menger has famously argued, there is no need to postulate that money came into being through the deliberation of such a mysterious council.6 Money would have come into being even in the complete absence of a coordinated collective decision-making process. Consider that in the absence of money, only barter exchanges (one-step) are possible and that the opportunities for barter are severely restricted by great problems, in particular, by the requirement that there must be a double coincidence of wants. Two-step “indirect exchanges” (with the help of a medium of exchange) help to overcome this limitation. Most importantly, indirect exchange can be beneficial even with an ad hoc medium of exchange, that is, even if there is yet no such thing as a generally accepted medium of exchange.

Media of exchange become ever more generally accepted to the extent that they are objectively more suitable than their competitors in arranging indirect exchanges. Silver is more suitable as a medium of exchange than cherry cakes because it is durable, divisible, malleable, homogeneous, and carries a great purchasing power per weight unit. Market participants are likely to recognize this relative superiority in a process of learning and imitation, and eventually most of them will use silver to carry out their transactions. Hence, one can explain why the technique of indirect exchange is adopted on an individual level; and one can explain why specific media of exchange become generally accepted and thus gradually turn into money. It is not necessary to postulate the creation of money through collective deliberation.

Methodological individualism has also been successfully applied to a number of other cases, such as the origin of the division of labor, the origin of nations, and to rather technical issues such as the explanation of redistribution effects resulting from money production.7 It has proved its utility especially in those cases in which we set out to explain aggregate social phenomena as resulting from individual perceptions, ends, and values. In short, it has proved its case in historical analysis.

IV

To understand our point that methodological individualism is not a method of economic theory, it is best to start with a few examples of what economic theory is all about. Consider the following economic laws:

More-roundabout production is more productive (in physical terms) than less-roundabout production.

When X persons divide labor amongs themselves, their work is more productive (in physical terms) than when it would have been if these same X persons had produced the same type of products in isolation from one another.

Under indirect exchange the market (and thus the division of labor) is greater than under direct exchange.

Any quantity of money can serve as an intermediary for any volume of trade, except for technological constraints (e.g., coin size).

These propositions are genuinely theoretical propositions in the Misesian sense. They make assertions about time-invariant relations between cause and effect. Indirect exchange for instance is not said to have produced greater exchange opportunities than direct exchange last year in Brazil — or that it will have this effect next month on the French Riviera. It is said to have this effect at all times and all places.

The question is whether methodological individualism is needed to demonstrate such propositions. The answer is in the negative. Methodological individualism helps us to understand why and how aggregate phenomena can result from individual actions. But it does not help us to demonstrate propositions about invariant — or even necessary — relationships between cause and effect. It is, for example, not strictly speaking impossible to introduce money through collective deliberation at a council; and neither is it impossible that increases of the money supply do not bring about redistribution effects. By contrast, the propositions of economic theory, according to Mises, purport to make statements about necessary causation.

Let us examine our first example in more detail to make our point. We come to know about the effects of roundabout production in two steps: first we analyze the conditions of production in general, and then we study how a more- or less-roundabout production process affects these conditions. In the first step, we realize that the physical productivity of labor is subject to the law of returns. In the second step we learn that more-roundabout production means to take time off from the production of consumers’ goods in order to increase the supplies of the other factors, so that human labor becomes more productive. Notice that here we do not take our departure from any concrete choice. Rather we compare the consequences of two different hypothetical actions: more-roundabout as compared to less-roundabout production. These two hypothetical courses of action are a priori causally related to one another by the fact that they are choice alternatives. Their causal nexus is scarcity — the fact that the choice of one course of action prevents the realization of all other actions that could also have been chosen. The choice of the one alternative necessarily causes the renunciation of the others.

Our comparative analysis provides insights about the relative consequences of choosing one rather than the other — irrespective of which one would actually be chosen. If these relative consequences are invariant, as they are in the present case, then we have identified an economic law, that is, a necessary relationship between the choice alternatives on the one hand and their relative consequences on the other hand. In the present case, as we have seen, the law can be formulated as follows: “More-roundabout production is more productive (in physical terms) than less-roundabout production.”

Now suppose we apply this law to explain observed behavior. Then the law still keeps its comparative nature, but the comparison is no longer a purely hypothetical one. It turns into a counterfactual comparison as we compare the observed behavior to alternative courses of action that could also have been chosen.8 For example, if we watch Smith hunting rabbits with bow and arrow, we might explain, “Smith kills more rabbits than he could have killed with his bare hands because he took some time off to first make bow and arrows.” And with just as much exactness, those who see the glass half empty might explain, “Smith kills much less rabbits than he could have killed because he did not take enough time off to first make a shotgun.”

Methodological individualism plays no role in this demonstration. Neither would it have played any role if we had examined the other three initial examples in more detail. The reason is that it serves a very different type of explanation than the one offered by economic theory. It serves to explain observed behavior as resulting directly from (contingent) individual motivations that prompted this very behavior. By contrast, economic laws serve to explain the (invariant) causes and consequences of human behavior in comparison to completely different, alternative courses of action which are related to the observed behavior through the a priori nexus of scarcity.

Methodological individualism is therefore not some sort of a basic foundation on which we erect the edifice of economic theory. It is actually the other way round. Only if we first have a correct economic theory can we then successfully apply methodological individualism to reconstruct the emergence of aggregate phenomena. For example, in the Mengerian explanation of the origin of money, the starting point is the fact that indirect exchange at all times and places creates more exchange opportunities than barter. If it were not for this economic law, Menger’s account of the origin of money would not make any sense at all. If indirect exchange were more beneficial than barter only at some times and places, but not at others; or if silver were more suitable as a medium of exchange than butter only at some times and places, but not at others; then one could not argue that the technique of indirect exchange becomes ever more widespread through a process of learning and imitation. People can learn about something only if this something remains constant through time. It is only because there is an economic law at play that one can successfully apply methodological individualism to explain the origin of money.

V

Methodological individualism is a precious tool for historical analysis. But it is not a foundation of economic theory. One could, of course, define economic theory in such a large sense that it would include even those elements that are indeed obtained with the help of methodological individualism, such as Menger’s explanation of the origin or money. But this would be a purely verbal finesse. There is a fundamental difference between the logical character of explanations based on economic laws on the one hand, and the logical character of explanations based on methodological individualism on the other hand. The purpose of the foregoing essay was to emphasize and explore this difference.

This paper was first published under the title “Methodological Individualism is Not the Method of Economics” in M. Laine and J.G. Hülsmann (eds), L’homme libre — Festschrift in Honour of Pascal Salin (Paris: Les Belles Lettres, 2006), pp. 122–128.

Also published on Mises Daily July 27, 2009

- 1.The expression “methodological individualism” has been coined by Schumpeter. See J.A. Schumpeter, “Der methodologische Individualismus,” Wesen und Hauptinhalt der theoretischen Nationalökonomie (Leipzig : Duncker & Humblot, 1908), part I, chap. VI, pp. 88–98.

- 2.See in particular L. von Mises, “The Principle of Methodological Individualism,” Human Action (Scholar’s edition, Auburn, Ala.: Mises Institute, 1998 [1949]), chap. 2, sect. 4 ; F.A. Hayek, “The Individualist and ‘Compositive’ Method of the Social Sciences,” The Counterrevolution of Science (Indianapolis: Liberty Press, 1979 [1952]), pp. 61–76 ; L. Lachmann, The Legacy of Max Weber (Berkeley: Glendessary Press, 1971), pp. 37–43 and passim; idem, “Methodological Individualism and the Market Economy,” Capital, Expectations, and the Market Process (Kansas City: Sheed Andrews & McMeel, 1977), pp. 149–165; M.N. Rothbard, “Praxeology as the Method of the Social Sciences,” The Logic of Action (vol. 1, Aldershot: Elgar, 1997), in part. pp. 52–57; F. Machlup, “Ludwig von Mises: The Academic Scholar Who Would Not Compromise,” Wirtschaftspolitische Blätter, vol. 28, no. 4 (1981); E. Butler, Ludwig von Mises — Fountainhead of the Modern Microeconomics Revolution (Aldershot: Gower, 1988), preface.

- 3.This has been famously argued by Carl Menger, Untersuchungen zur Methode der Socialwissenschaften und der politischen Oekonomie insbesondere (Leipzig: Duncker & Humblot, 1883), Bk. III, chap. 2, pp. 153–171.

- 4.Individual value judgments and actions “are ultimately given as they cannot be traced back to something of which they would appear to be the necessary consequence. If this were not the case, it would not be permissible to call them an ultimate given. But they are not, like the ultimate given in the natural sciences, a stopping point for human reflection. They are the starting point of a specific mode of reflection, of the specific understanding of the historical sciences of human action.” Mises, Theory and History (New Haven: Yale University Press, 1957) p. 310, emphasis added.

- 5. Mises, Theory and History, p. 183.

- 6.See Menger, Grundsätze der Volkswirtschaftslehre (Vienna: Braumüller, 1871), pp. 250–260; idem, Untersuchungen, pp. 171–183.

- 7.On the theory of the emergence and decline of language communities see Mises, Nation, State, and Economy (New York: New York University Press, 1983), chap. 1. On redistribution effects of money production see idem, Theory of Money and Credit (Indianapolis: Liberty Fund, 1980), chap. 12. For a discussion of the theory of the division of labor see Hülsmann, “Discursive Rationality and the Division of Labor: How Cooperation Emerges,” American Journal of Economics and Sociology, vol. 58, no. 4, pp. 713–727.

- 8.See Hülsmann, “Fact and Counterfactuals in Economic Law?” Journal of Libertarian Studies, vol. 17, no. 1, pp. 57–102.

- Source: https://mises.org/wire/how-use-methodological-individualism

Maybe this reply can be moved to it belongs? There was no right of reply.

You also wrote about Pal Krugman’s definition of inflation.

You incorrectly wrote:

“it seems that our Nobel Laureate instead of discussing inflation is actually referring to its possible symptoms, which are price increases.”

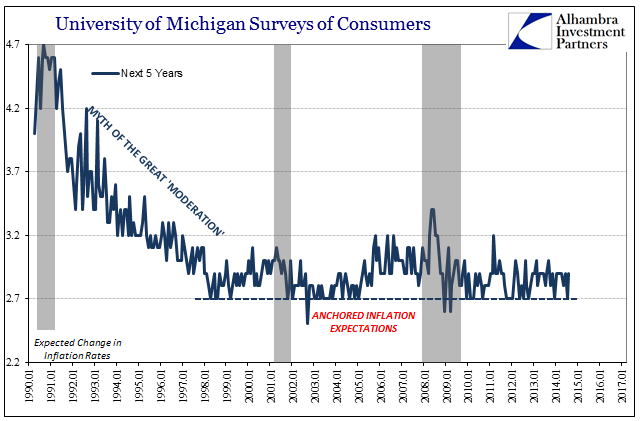

There are many factors to take into account such things as population growth, other demographics like working population, money not circulating but placed on standby, changes in the level of net exports / imports which alters the amount in circulation.

When it comes to backing money with gold or any other thing you are wasting resources to buy an irrelevant asset and you are distorting the value of the asset.

What money does is to allow transactions to take place, allows accounting to be done, and wealth to be assessed in the most economical way.

So please let there be enough of it but as you say, not too much.

DEFINITION OF INFLATION

This comes back to how fast money is falling in value. We all agree about that I think.

The value of money is what it can be exchanged for. Prices determine that, and the rate of any general increase determines rate of inflation because you can buy less. Less of what? Less of everything that money can pay for.

This includes the cost of hiring people, (incomes), the cost of loan repayments, the cost of assets and so forth.

The trick is to design the financial contracts and the market structures so that all such prices can make the adjustment as at the same rate, before market prices determine the additional or lesser cost of an item which results from balancing supply with demand. Two-part pricing.

If average costs, including the value of government debt (savings etc) increase at the same pace as average earnings, then each cancels the other as if money had NOT changed in value relative to earnings. No one gets badly hurt.

Get that right first and then allow market forces to determine the final figure. Two-part pricing.

I show a new contract for government debt, a new one for the cost of loan repayments, a new way to price interest rates, and a new way to price currencies. They all sort this problem out in their own part of their own economy.

Check out MACRO-ECONOMIC DESIGN.

Will I get the promised Nobel Prize?