By Jai Khemani

Jai recently got 2 A*s and an A in his A levels and is now looking forward to university. Jai is particularly passionate about political economy and a believer in laissez-faire capitalism. The less government the better! His main interests in Economics are Healthcare, monetary, public finances and business cycle theory. He adheres to the Austrian School of Economics, with Ludwig Von Mises and Murray Rothbard as personal favourites. Jai is currently interning at The Cobden Centre and is working on some interesting economics projects.

Nick Hanauer is a billionaire investor-entrepreneur who advocates taxing the wealthy and implementing a higher minimum wage so that the middle-class can gain more income. If households have more money to consume, this will increase the demand for goods and services, leading to an increase in demand for employees.

Based on the idea that its consumer demand that drives growth, government must tax and redistribute, raise minimum wage and increase union power.

The Importance of Production

Nick has it the wrong way around. Consumers have to first receive income in order to buy any good or service. Given that output per worker (productivity) determines real wages in the long term, productivity can be improved by increasing the capital stock, which requires capital investment. Hence, it is the level of saving that determines how much is available for firms to invest, thus productivity growth would depend on higher saving – not consumption. The fastest rate of economic growth was between 1870 and 1913 and 1950-1973. These 2 periods both had significantly higher savings rates as a percentage of GDP. Today, the personal savings rate is half of what it was in 1960, hence explaining why investment as a percentage of GDP lower today is than in 1960, and also explains slower growth today. When the amount of savings increases, it leads to more loanable funds. As a result, interest rates fall and hence entrepreneurs can borrow to invest in capital.

Nick Hanauer says his business is struggling because there is no one to actually buy the goods that he sells (pillows). However, there is a simple way he could increase his consumer base – lowering prices. The best way to lower prices is by expanding production, so that unit costs fall, which can be achieved by increasing the level of capital in the economy. The fall in unit costs leads to firms passing on lower prices, thus increasing purchasing power. In addition, the expansion in a firm’s ability to produce goods and services leads to higher derived demand for labour. This, in turn, leads to higher wages and more jobs, which in turn leads to an expanded consumer base. This implies that consumption comes last; consumers have to first earn money in order to demand goods and services like haircuts, pillows, and radios, TVs and so on.

Many left-leaning critics point to Henry Ford’s $5 per day wage for his employees. They claim that Henry Ford increased the wage to $5/day so that his workers could buy Model Ts, hence a justification for a higher minimum wage. However, that is not the real reason why Ford raised wages. He was concerned about the turnover rate. Ford Motors had a turnover rate of 370% per year; meaning 3.7 workers were employed to fill 1 job every year. In 1913, Ford was employing 52,000 people just to maintain a workforce of 14,000. This was a huge problem for Ford because he had spent money training factory workers, only to see them quit after 3 months. As a result, he increased the wage to $5/day to reduce turnover and improve worker productivity. The government or labour unions did not force him to increase the wage; competition between the rivals did. In addition, when the costs and revenues for Ford are analysed, it can be seen that he would have made a loss if he raised wages for the purpose of increasing demand for his cars.

Say’s Law:

Say’s law can also hep refute the claim that consumer demand does not create wealth, jobs and output. Before describing the theory, there is an even simpler example; the Deserted Island dilemma. Imagine there are 5 people stranded on an island. Each person makes different goods. Each person must make their respective good so that they can consume the others’ goods. The person who produces the least because they are the least productive will be unable to buy many goods. As a result, one can conclude that a person’s ability to consume depends on his ability to produce. Therefore, production must precede consumption. Take a baker for example. The Baker produces bread not solely for his own consumption, but mainly for others so that he can acquire other services as he could not survive solely on bread! The bread he produces is in turn exchanged for other goods. It implies that the production of bread hen allows the baker to exercise his demand for other goods. This once again proves that production must exceed consumption. Of course, the baker does not pay for goods with bread, but with money. However, the effect is the same. Should the baker want to desire more lamb chops, computers and TVs, he must increase his total profits. In order to do that, he must increase his productivity. Through savings, he can acquire machinery and tools, which improves his production. Once he has done so, his average costs fall, passing on lower prices to consumers. In turn, consumers can buy more bread. Consumers have not realised that they demand more bread, until the production increased, further proving that production must precede consumption. Now that the baker has produced more bread for his consumers and is duly rewarded, he can exercise more demand for lamb chops.

Now that we have discussed these examples, how does this relate to Say’s Law?

Say’s law states that supply is always met with corresponding demand. To have the means to buy, you first have to have something to sell, Say reasoned. So, the source of demand is production, not money. Supply creates in other words, creates its own demand. As a result, there is no such thing as overproduction, all production produced is met with consumers. In other words, every producer who brings goods to the market does so only to exchange them for other goods.

Say’s Law holds true and Austrians generally support it, provided the government is not distorting the economy.

Build Up of Capital Goods Can Even Help the Service Sector

In a documentary on inequality, the billionaire goes further by saying that the wealthy can only get ‘so many haircuts per year’. However, he fails to recognize that hairdressers can also reduce the prices if the cost of razors, scissors, shampoo, gel et cetera falls. These goods can fall in price if there is more capital in the economy that can produce more scissors, razors and so on. The best way to build that required capital is through savings, so growth needs to be led by saving and investment, not consumption. So once hairdressers have lower costs of equipment, they can provide a service for a cheaper price. This would allow more consumers to be priced into the market and hence more people would be able to afford haircuts. Hence, Hanauer’s claim about the wealthy not spending all of their income is irrelevant. Consumption is the end goal, but production is the means to that end. Evidence of this is seen by the fact that the fastest wage growth for unskilled workers and GDP growth in the US was actually during the 1880s. This was a time when income taxes were 0% and when the national savings rate was much higher. The real wages of unskilled workers grew by 44% between 1880 and 1914 (Gilded Age).

Rapid Economic Growth Cannot be Explained by Consumer Demand

For most of human history, the rate of wealth creation was relatively slow. Even in the richest countries during the 1700s, such as Britain and France, the vast majority of the population lived in extreme poverty. This all started to change only in the early to mid-1800s in Europe and the USA. The principal source of the rapid economic growth and subsequent improvement in the standard of living can be attributed to industrialization. However, it is absurd to suggest that industrialization happened because, in the 1850s, poor rural British families suddenly demanded more goods. The real reason for rapid increases in real wages in Britain, US and Europe was because of the new build-up of capital goods and more sophisticated technology (steam engines, for example) which facilitated mass production in large factories. This attracted millions of farmers in rural Britain into the big industrial towns of Manchester and London. These new jobs offered higher wages as output per worker increased. Since the 1800s, the world has seen dramatic reductions in extreme poverty, child labour, hunger and vast increases in literacy rates. This implies that there is simply no evidence to show that increased consumer demand determines periods of high economic growth. The increase in production allowed British workers to be able to consume more healthcare and more consumer goods.

Many individuals like Nick Hanauer have claimed that society once lived in an economic system whereby taxes on the wealthy were so high, that it allowed a large transfer of income from rich to poor. The 1950s and 1960s had normal tax rates whilst also being an era of prosperity.

Tax Rates in the Past

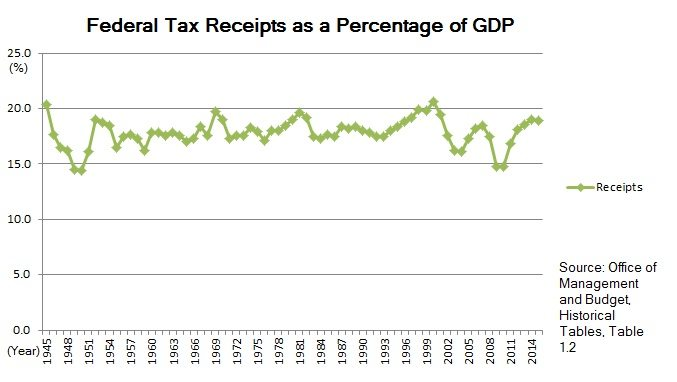

While it’s true that the top marginal tax rate in the US and Europe topped 90%, many countries adopted tax codes with significant deductions and exemptions. As a result, the wealthy could systematically reduce their taxable income, thus narrowing the tax base. According to the Manhattan Institute, when all deductions are accounted for, the average tax burden of the top 0.01% of earners was only around 31% in the 1950s. In 2004, the average tax burden stood at 25%, and so increasing the effective tax burden on the wealthiest 0.01% from 25% to 31% would have a negligible effect on total tax revenue (source: Manhattan Inst). Overall, taxes were not higher during this time, because tax revenue as a percentage of GDP stayed flat even when top tax rates were reduced in the 1960s and then in the 1980s. (source: CBO).

Source: Office of Management and Budget

In order to redistribute a further $5,000 to the bottom 100m Americans ($5,000 plus the welfare benefits they already get), the federal government would have to tax the wealthy a further $500bn. To collect $500bn, there would need to be a 100% income tax on incomes above $1.1m. This would have a terrible effect on investment. As a result, even if the government did implement a 100%, tax it would likely lose revenue. In fact, by some measures, the tax burden for the overall economy was actually less in the 1950s. As a result, a conclusion that can be drawn is that higher taxes today have reduced the reward for investment, and hence capital accumulation is much less today than it had been in the 1950s. Fundamentally, in order to empower consumers who are key to prosperity, the money must be taken from another segment of society.

The Welfare State of the Past

If the rationale behind taxing the wealthy at higher rates (such as in the 1950s) is to redistribute more income to the poor, then one should also expect a much larger welfare state in the 1950s. However, the evidence doesn’t suggest that entitlements were bigger. In fact, the welfare state was far smaller. For example, transfer spending as a percentage of the federal budget was only 9% in 1965, compared with 36% today. Overall, entitlements as a percentage of GDP has increased from 5% in 1955 to 17% in 2015 and the proportion of households eligible for welfare programs has increased, not decreased.

In fact, if one were to add up all anti-poverty spending in the U.S (both state and federal) and divide equally among the poorest 25% of households, each household would receive $45,000 per year. Despite this large redistribution, the poorest 25% of households in many rich countries are struggling to pay bills. $45,000 per households is plenty to consume- so why isn’t there more prosperity? Based on these figures, there is more redistribution to the poor today, yet the 1950s was a decade of a sizable and relatively wealthy middle class.

Conclusion

Although consumption is not the driver of economic growth and higher wages, this does not mean that the wealthy are necessarily the centre of the economy. But they do play a significant role in contributing investment by saving a high percentage of their income and also providing a major source of funds in private equity and IPOs. However, middle-income workers can also provide investment through their savings. For example, pension funds and mutual funds can pool thousands of middle-income workers’ savings and then, in turn, create a portfolio, which invests in companies listed on the stock exchange.

Consequently, publicly listed companies can synthesize these savings, as the stock market is another vehicle with which firms can receive the necessary capital to fund their projects. Repealing laws such as the Sarbanes-Oxley Act would certainly help because, 1 year after this law was passed, the number of firms de-registering from the NYSE tripled. In addition, given that all members of the economy have a role to play, taxes should be cut across the board and all taxpayers should be treated equally. To this end, countries should consider adopting a flat income tax and financial deregulation, so that savings can be converted into investment far more easily.