- The Federal Reserve continue to raise rates as S&P earnings beat estimates

- The ECB and BoJ maintain QE

- Globally, corporations rely on US$ financing, nonetheless

- Signs of a slowdown in growth are clearer outside the US

After last week’s ECB meeting, Mario Draghi gave the usual press conference. He confirmed the continuance of stimulus and mentioned the moderation in the rate of growth and below-target inflation. He also referred to the steady expansion in money supply. When it came to the Q&A he revealed rather more:-

It’s quite clear that since our last meeting, broadly all countries experienced, to different extents of course, some moderation in growth or some loss of momentum. When we look at the indicators that showed significant, sharp declines, we see that, first of all, the fact that all countries reported means that this loss of momentum is pretty broad across countries.

It’s also broad across sectors because when we look at the indicators, it’s both hard and soft survey-based indicators. Sharp declines were experienced by PMI, almost all sectors, in retail, sales, manufacturing, services, in construction. Then we had declines in industrial production, in capital goods production. The PMI in exports orders also declined. Also we had declines in national business and confidence indicators.

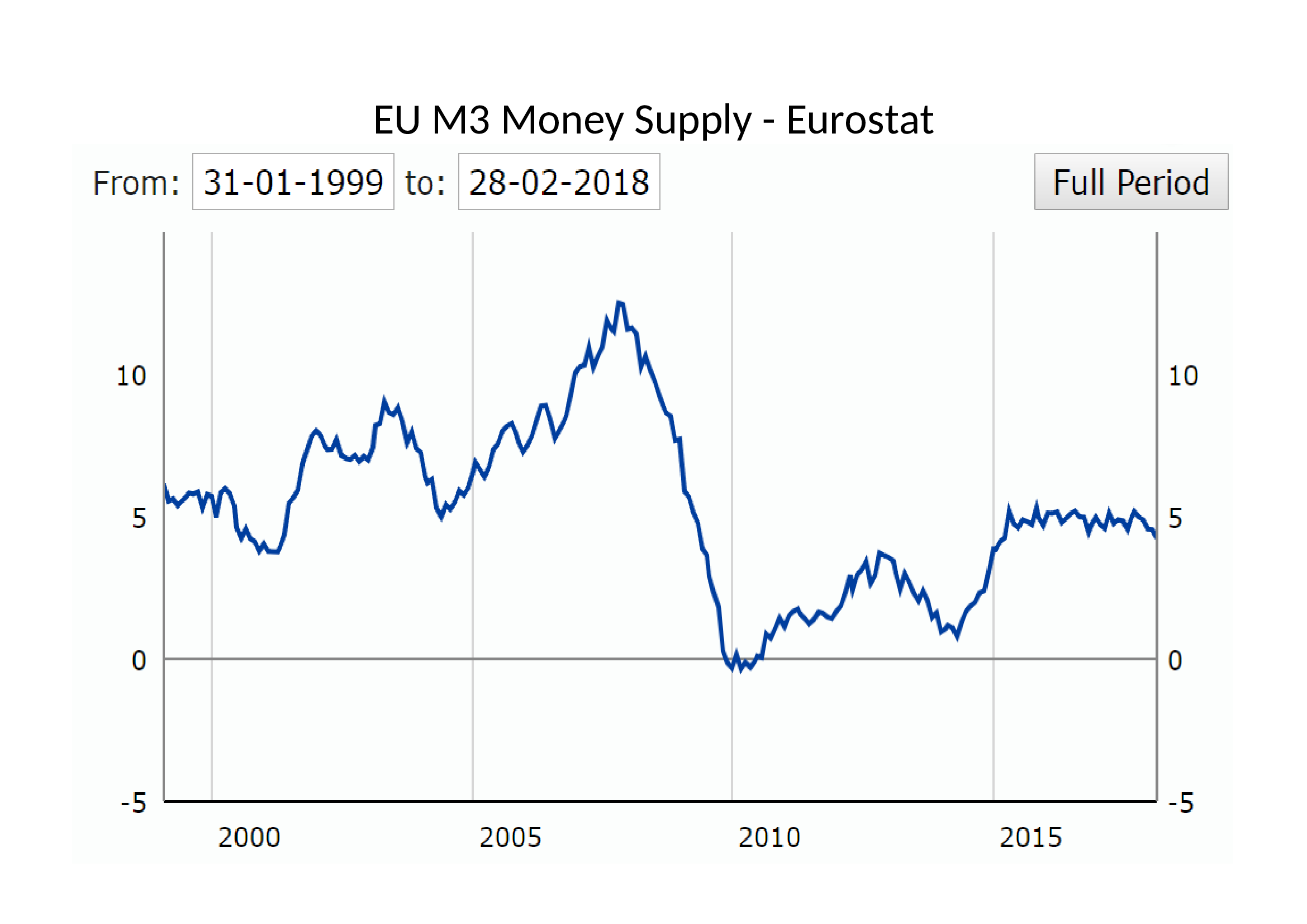

I quote this passage out of context because the entire answer was more nuanced. My reason? To highlight the difference between the situation in the EU and the US. In Europe, money supply (M3) is growing at 4.3% yet inflation (HICP) is a mere 1.3%. Meanwhile in the US, inflation (CPI) is running at 2.4% and money supply (M2) is hovering a fraction above 2%. Here is a chart of Eurozone M3 since 1999:-

Source: Eurostat

The recent weakening of momentum is a concern, but the absolute level is consistent with a continued expansion.

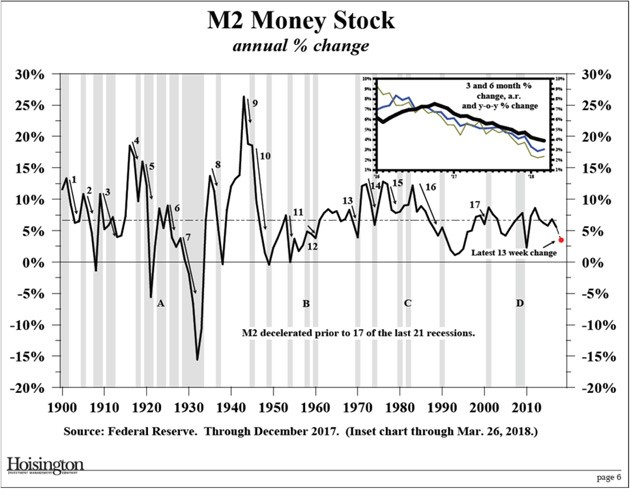

Looked at over a rather longer time horizon, here is a chart of US M2 since 1900:-

Source: Hoisington Asset Management, Federal Reserve

The letters A, B, C, D denote the only occasions, during the last 118 years, when a decline in the expansion (or, during the 1930’s, contraction) of M2 did not lead to a recession. 17 out of 21 is a quite compelling record.

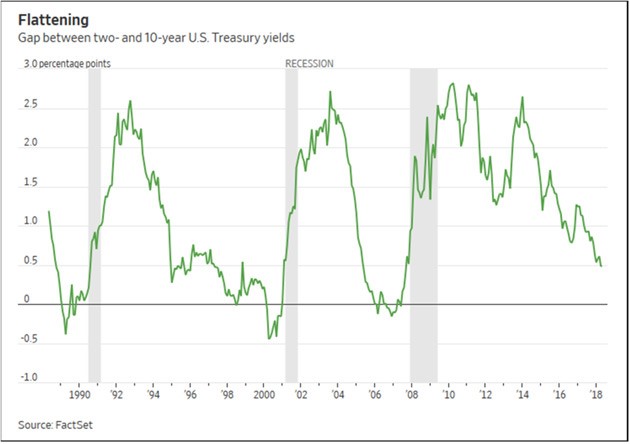

Another concern for markets is the flatness of the US yield curve. Here is the 2yr – 10yr yield differential since 1990:-

Source: Factset, Mauldin Economics

More importantly, for international borrowers, the 6-month LIBOR rate has risen by more than 60 basis points since the start of the year (from 1.8% to 2.5%) whilst 30yr Swap rates have increased by only 40 basis points (2.6% to 3%). The 10yr – 30yr Swap curve is now practically flat.

Also worthy of comment, as US Treasury yields have risen, the relationship between Bonds and Swaps has begun to normalise – 30yr T-Bond yields are only 40 basis points above their level of January and roughly at the same level as in the spring of last year. In April 2017 I wrote in Macro Letter – No 74 – US 30yr Swaps have yielded less than Treasuries since 2008 – does it matter?:-

Today the IRS market increasingly determines the cost of finance, during the next crisis IRS yields may rise or fall by substantially more than the same maturity of US T-bond, but that is because they are the most liquid instruments and are only indirectly supported by the Central Bank.

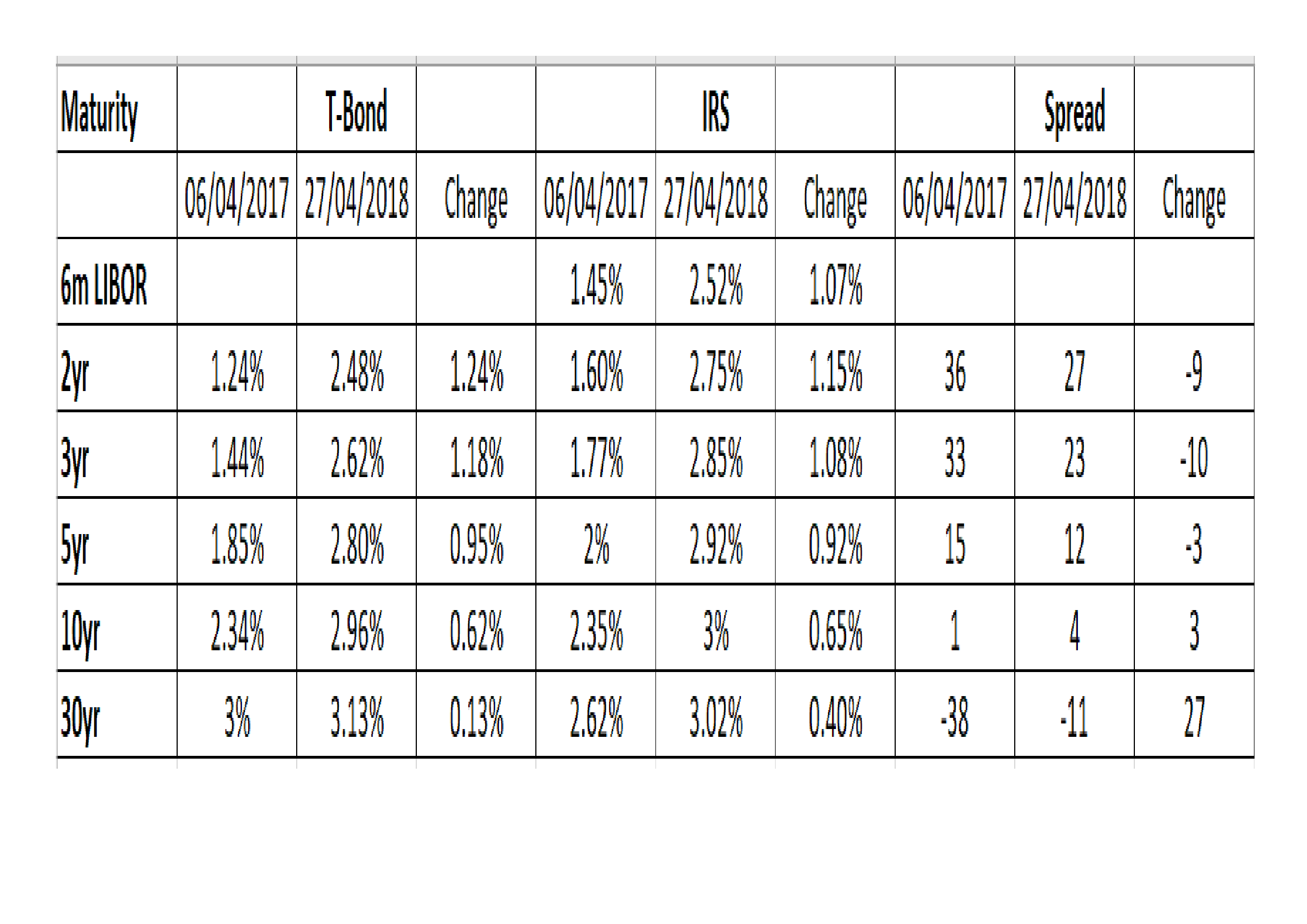

It looks like I may have to eat my words, here is the Bond vs Swap table revisited:-

Source: Investing.com, Interestrateswaps.com, BBA

What is evident is that the Bond/Swap inversion in the longer maturities has closed substantially even as shorter maturity spreads have narrowed. Federal Reserve policy has been the dominate factor.

Why is it, however, that the effect of higher US rates is, seemingly, felt more poignantly in Europe than the US? Does this bring us back to protectionism? Perhaps, but in less contentious terms, the US has run a capital account surplus for many years. Outside the US investment is closely tied to LIBOR financing costs, these have remained higher, except in the longest maturities, and these rates have risen most precipitously this year. Looked at another way, the higher interest rate policies of the Federal Reserve, despite the continued largesse of other central banks, is exporting the next recession to the rest of the world.

I ended Macro Letter – No 74 back in April 2017 – saying:-

Meanwhile, although interest rates have risen from historic lows they remain far below their long run average. Pension funds and other long-term investors still require 7% or more in annualised returns in order to meet their liabilities. They are being forced to continuously increase their investment risk and many have chosen to use the swap market. The next crisis is likely to see an even more pronounced unravelling than in 2008/2009. The unravelling may not happen for some while but the stresses are likely to be focused on the IRS market.

One year on, cracks in the capital markets edifice are beginning to become more evident. GDP growth has started to rollover in the US, Eurozone and Japan. Yields are still relatively low but the absolute increase in rates for shorter maturities (e.g. the near doubling of US 2yr yields from 1.25% to 2.5% in a single year) is guaranteed to take its toll on corporate interest servicing costs. US capital markets are the envy of the world. They are deep and allow borrowers to finance far into the future. The rest of the world is forced to borrow at shorter tenors. A three basis point narrowing of 5yr spreads between Swaps and Bonds is hardly compensation for the near 1% increase in interest rates, or, put in starker terms, a 46% increase in absolute borrowing costs.

Conclusion and investment opportunities

How is the rise in borrowing costs impacting the US stock market? Volatility is back, but earnings are robust. Factset – S&P 500 Earnings Season Update: April 27, 2018 – described it thus:-

To date, 53% of the companies in the S&P 500 have reported actual results for Q1 2018. In terms of earnings, more companies are reporting actual EPS above estimates (79%) compared to the five-year average. If 79% is the final percentage for the quarter, it will mark the highest percentage of S&P 500 companies reporting actual EPS above estimates since FactSet began tracking this metric in Q3 2008. In aggregate, companies are reporting earnings that are 9.1% above the estimates, which is also above the five-year average. In terms of sales, more companies (74%) are reporting actual sales above estimates compared to the five-year average. In aggregate, companies are reporting sales that are 1.7% above estimates, which is also above the five-year average. If 1.7% is the final percentage for the quarter, it will mark the largest revenue surprise percentage since FactSet began tracking this metric in Q3 2008.

… The blended (combines actual results for companies that have reported and estimated results for companies that have yet to report), year-over-year earnings growth rate for the first quarter is 23.2% today, which is higher than the earnings growth rate of 18.5% last week. Positive earnings surprises reported by companies in multiple sectors (led by the Information Technology sector) were responsible for the increase in the earnings growth rate for the index during the past week. All 11 sectors are reporting year-over-year earnings growth. Nine sectors are reporting double-digit earnings growth, led by the Energy, Materials, Information Technology, and Financials sectors.

We are more than halfway through Q1 earnings (I’m writing this letter on Wednesday 2nd May). Results have generally been above forecast and now the Fed seems conscious that they must not be too hasty to reverse the effects of both zero rates and QE. Added to which, while US stocks have been languishing mid-range, European stocks have recently broken out of their recent ranges to the upside, despite discouraging economic data.

The US stock market looks less expensive than it did in January 2017, when I wrote Macro Letter – 68 – Equity valuation in a de-globalising world. Then I was looking for stock markets with a low correlation to the US: they were (and remain) hard to find.

Other indicators to watch which exert a strong influence on stocks include the US PMI Index – last at 54.8 up from 54.2 in March. Above 50 there is little cause for concern. For the Eurozone it is even higher at 55.2, whilst throughout G20 no economy is recording a PMI below 50.

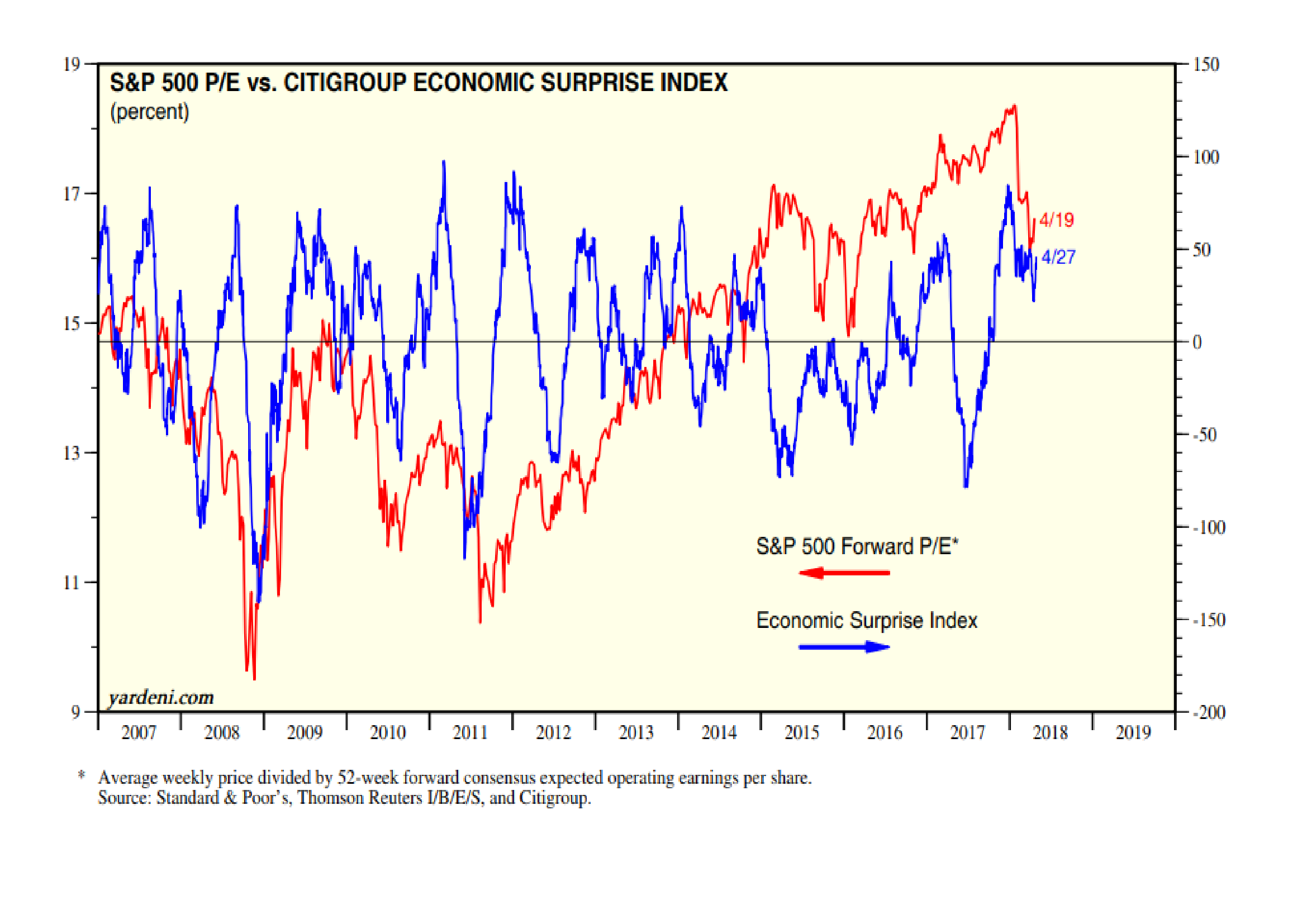

The chart below shows the Citigroup Economic Surprises Index (blue) vs the S&P500 Forward P/E estimates (red):-

Source: Yardeni Research, S&P, Thompson Reuters, Citigroup

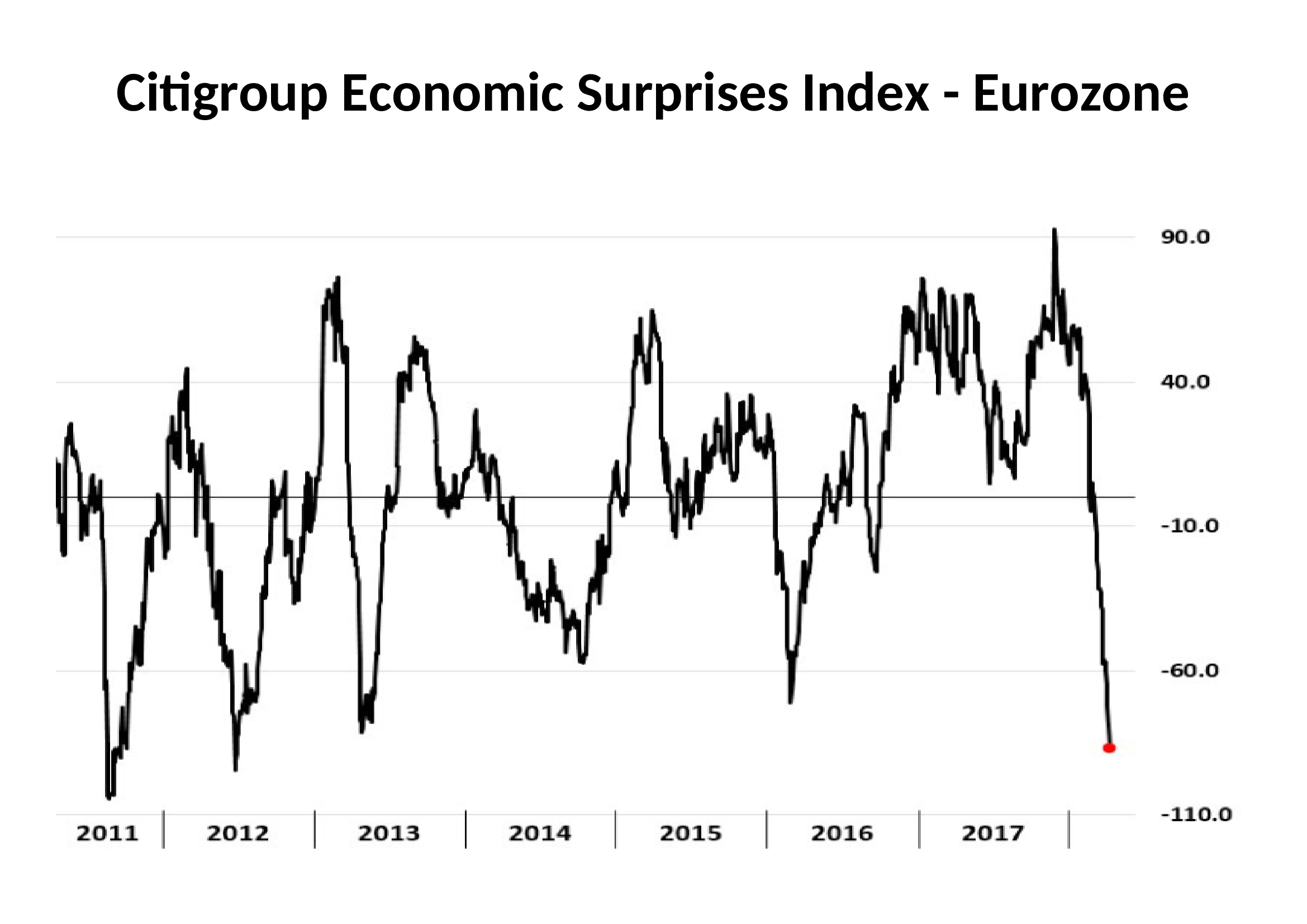

Economic surprises remain positive rather than negative for the US. In the Eurozone it is quite another matter:-

Source: Bloomberg, Citigroup

A number of economic indicators are pointing to a slowdown, yet US stocks are beating estimates. To judge from price action, the market appears to be unimpressed by earnings. I am reminded of the old adage, ‘When all the buyers are in the market it’s time to sell.’ From a technical perspective it makes sense to be patient, but the market has failed to rise substantially on a positive slew of earnings news. This may be because there is a more important factor driving sentiment: the direction of US rates. It certainly appears to have engendered a revival of the US$. It rallied last month having been in a downtrend since January 2017 despite a steadily tightening Federal Reserve. For EURUSD the move from 1.10 to 1.25 appears to have taken its toll. On the basis of the CESI chart, above, if Wall Street sneezes, the Eurozone might catch pneumonia.