- Emerging market currencies, bonds and stocks have weakened

- Fears about the impact of US tariffs have been felt here most clearly

- The risk to Europe and Japan is significant

- Turkey may be the key market to watch

As US interest rates continue to normalise and US tariffs begin to bite, a number of emerging markets (EM’s) have come under pressure. Of course, the largest market to exhibit signs of stress is China, the MSCI China Index is down 7% since mid-June, whilst the RMB has also weakened against the US$ by more than 6% since its April low. Will contagion spread to developed markets and, if so, which country might be the ‘carrier’?

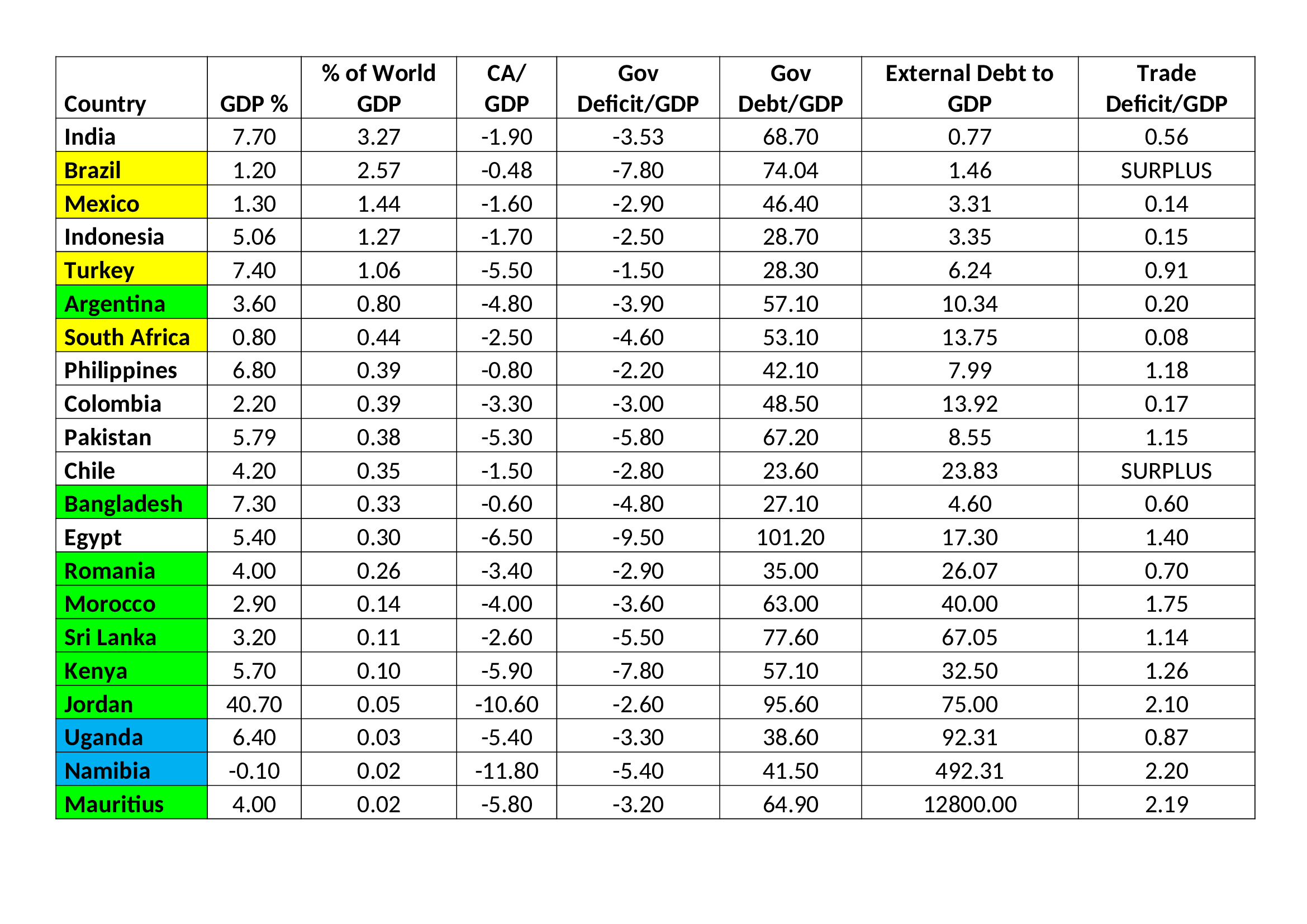

To begin to answer these questions we need to investigate this year’s casualties. Argentina is an obvious candidate. Other troubled countries include Brazil, Egypt and Turkey. In each case, government debt has exacerbated instability, as each country’s currency came under pressure. Other measures of instability include budget and trade deficits.

In an effort to narrow the breadth of this Macro Letter, I will confine my analysis to those countries with twin government and current account deficits. In the table which follow, the countries are sorted by percentage of world GDP. The colour coding reflects the latest MSCI categorisation; yellow, denotes a fully-fledged EM, white, equals a standard EM, green, is on the secondary list and blue is reserved for those countries which are so ‘frontier’ in nature as not to be currently assessed by MSCI: –

Source: Trading Economics, Investing.com, IMF, World Bank

For the purposes of this analysis, the larger the EM as a percentage of world GDP and the higher its investment rating, the more likely it is to act as a catalyst for contagion. Whilst this is a simplistic approach, it represents a useful the starting point.

Back in 2005, in a futile attempt to control the profligacy of European governments, the European Commission introduced the Stability and Growth Pact. It established at maximum debt to GDP ratio of 60% and budget deficit ceiling of 3%, to be applied to all members of the Eurozone. If applied to the EM’s listed above, the budget deficit constraint could probably be relaxed: these are, generally, faster growing economies. The ratio of debt to GDP should, however, be capped at a lower percentage. The government debt overhang weighs more heavily on smaller economies, especially ones where the percentage of international investors tends to be higher. Capital flight is a greater risk for EM’s than for developed economies, which are insulated by a larger pool of domestic investors.

Looking at the table again, from a financial stability perspective, the percentage of non-domestic debt to GDP, is critical. A sudden growth stop, followed by capital flight, usually precipitates a collapse in the currency. External debt can prove toxic, even if it represents only a small percentage of GDP, since the default risk associated with a collapsing currency leads to a rapid rise in yields, prompting further capital flight – this is a viscous circle, not easily broken. The Latin American debt crisis of the 1980’s was one of the more poignant examples of this pattern. Unsurprisingly, in the table above, the percentage of external debt to GDP grows as the economies become smaller, although there is a slight bias for South American countries to continue to borrow abroad. Perhaps a function of their proximity to the US capital markets. Interestingly, by comparison with developed nations, the debt to GDP ratios in most of these EM countries is relatively modest: a sad indictment of the effectiveness of QE as a policy to strengthen the world financial system – but I digress.

Our next concern ought to be the trade balance. Given the impact that US tariffs are likely to have on export nations, both emerging and developed, it is overly simplistic to look, merely, at EM country exports to the US. EM exports to Europe, Japan and China are also likely to be vulnerable, as US tariffs are enforced. Chile and Mexico currently run trade surpluses, but, since their largest trading partner is the US, they still remain exposed.

This brings us to the second table which looks at inflation, interest rates, 10yr bond yields, currencies and stock market performance: –

Source: Trading Economics, Investing.com, IMF, World Bank

In addition to its absolute level, the trend of inflation is also an important factor to consider. India has seen a moderate increase since 2017, but price increases appear steady not scary. Brazil has seen a recent rebound after the significant moderation which followed the 2016 spike. Mexican inflation has moderated since late 2017, posing little cause for concern. Indonesian price rises are at the lower end of their post Asian crisis range. Turkey, however, is an entirely different matter. It inflation is at its highest since 2004 and has broken to multiyear highs in the last two months. Inflation trends exert a strong influence on interest rate expectations and Turkish 10yr yields have risen by more than 5% this year, whilst it currency has fallen further than any in this group, barring the Argentinian Peso. For comparison, the Brazilian Real is the third weakest, followed, at some distance, by the Indian Rupee.

India, Brazil, Mexico and Indonesia may be among the largest economies in this ‘contagion risk’ group, but Turkey, given its geographic proximity to the EU may be the linchpin.

Is Turkey the canary?

The recent Turkish elections gave President Erdogan an increased majority. His strengthened mandate does not entirely remove geopolitical risk, but it simplifies our analysis of the country from an economic perspective. Short-term interest rates are 17.75%, the second highest in the group, behind Argentina. The yield curve is inverted: and both the currency and stock market have fared poorly YTD. Over the last 20 years, Turkish GDP has averaged slightly less than 5%, but this figure is skewed by three sharp recessions (‘98, ‘01 and ‘08). The recent trend has been volatile but solid. 10yr bond yields, by contrast, have been influenced by a more than doubling of short-term interest rates, in defence of the Turkish Lira. This aggressive action, by their central bank, makes the economy vulnerable to an implosion of growth, as credit conditions deteriorate rapidly.

Conclusion and investment opportunities

In Macro Letter – No 96 – 04-05-2018 – Is the US exporting a recession? I concluded in respect of Europe that: –

…the [stock] market has failed to rise substantially on a positive slew of earnings news. This may be because there is a more important factor driving sentiment: the direction of US rates. It certainly appears to have engendered a revival of the US$. It rallied last month having been in a downtrend since January 2017 despite a steadily tightening Federal Reserve. For EURUSD the move from 1.10 to 1.25 appears to have taken its toll. On the basis of the CESI chart, above, if Wall Street sneezes, the Eurozone might catch pneumonia.

Over the past few months EM currencies have declined, their bond yields have increased and their stock markets have generally fallen. In respect of tariffs, President Trump has done what he promised. Markets, like Mexico and Chile, reacted early and seem to have stabilised. Argentina had its own internal issues with which to contend. The Indian economy continues its rapid expansion, despite higher oil prices and US tariffs. It is Turkey that appears to be the weakest link, but this may be as much a function of the actions of its central bank.

If, over the next few months, the Turkish Lira stabilises and official rates moderate, the wider economy may avoid recession. Whilst much commentary concerning EM risks will focus on the fortunes of China, it is still a relatively closed, command economy: and, therefore, difficult to predict. It will be at least as useful to focus on the fortunes of Turkey. It may give advanced warning, like the canary in the coal-mine, which makes it my leading indicator of choice.