The annual rate for US non-military capital goods orders excluding aircraft fell to 1.9% in September from 7.8% in August to stand at $69.6 billion.

Observe that after closing at $60.2 billion in December 2015 capital goods orders have been trending up.

|

|

Most commentators regard a strengthening in capital goods orders as evidence that companies are investing both in the replacement of existing capital goods and in new capital goods in order to expand their growth.

There is no doubt that an increase in the quality and the quantity of tools and machinery i.e. capital goods, is the key for the expansion of goods and services. However, is it always good for the wealth generation process?

Consider the case when the central bank is engaged in loose monetary policy i.e. monetary pumping and an artificial lowering of the interest rate structure. Such policy sets the platform for various non-productive or bubble activities. In order to survive these activities require real funding, which is diverted to them by means of loose monetary policy. (Once loose monetary policy is set in motion this allows the emergence of various bubble activities).

Note that various individuals that are employed in these activities are the early recipients of money; they can now divert to themselves various goods and services from the pool of real wealth.

These individuals are now engaging in the exchange of nothing for something. (Individuals that are engage in bubble activities do not produce any meaningful real wealth; they however by means of the pumped money take a slice from the pool of real wealth.)

Now bubble activities like any non-bubble activity also require tools and machinery i.e. capital goods.

Therefore, capital goods that are generated for these activities are in fact a waste of real wealth.

The tools and machinery that are generated here are going to be employed in the production of goods and services that are on the low priority list of consumers. (Wrong infrastructure has emerged).

These activities do not add to the pool of real wealth, they are in fact draining it. (This amounts to economic impoverishment).

The more aggressive the central bank’s loose monetary stance is the more drainage of real wealth takes place and the less real wealth left at the disposal of true wealth generators.

If such policy persists for too long this could slow or even shrink the pool of real wealth and set in motion a severe economic crisis.

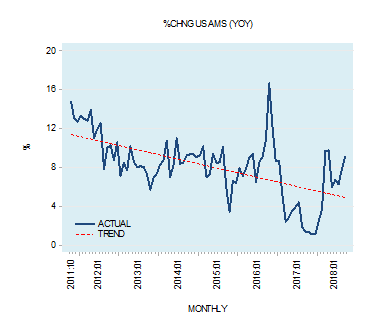

We suggest that because of a downtrend in the yearly growth rate of US AMS since October 2011 US economic activity is likely to follow this downtrend. Note that a downtrend in the AMS growth undermines various bubble activities.

|

|

We can conclude that an increase in capital goods in a free economic environment is likely to be supportive of a genuine economic growth. This is however, not going to be the case in an environment where the central bank manipulates interest rates and engages in monetary pumping.