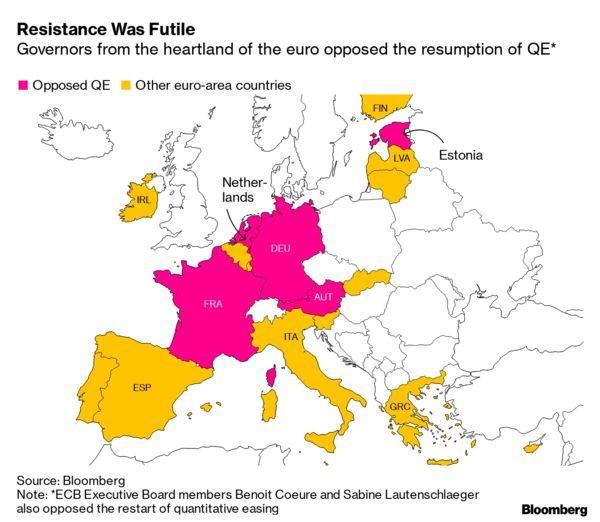

Any hopes that the replacement of Mario Draghi, who on Halloween left the ECB more polarized than ever, as the core European nations revolted against the Italian’s profligately loose monetary policy in an unprecedented public demonstration of discord within the European Central Bank…

… with the ECB’s new head, former IMF Director and convicted criminal, Christine Lagarde would result in some easing of tensions, were promptly crushed when Lagarde picked up where Draghi left off, calling on Germany and the Netherlands to use their budget surpluses to fund investments that would help stimulate the economy, in a sharp rebuke that will not win the former French finance minister any friends in fiscally conservative Germany.

In an appeal to Germany’s sense of solidarity, and in hopes that Germany’s memory of hyperinflation has faded enough, Lagarde said that there “isn’t enough solidarity” in the single currency area, adding: “We share a currency, but we don’t share much budgetary policy for now.”

“Those that have the room for manoeuvre, those that have a budget surplus, that’s to say Germany, the Netherlands, why not use that budget surplus and invest in infrastructure? Why not invest in education? Why not invest in innovation, to allow for a better rebalancing?” asked Lagarde, blaming Germany and the Netherlands for living within their means, and demanding they should no longer do so, just because most other Europeans decided to pull a page out of the American playbook, and live exorbitantly outside of their means.

Lagarde’s direct attempt at shaming Europe’s fiscal conservatives was nothing short of shocking: normally ECB officials avoid naming individual countries in public statements, because their mandate is to act in the interests of the eurozone as a whole. But when Lagarde made her speech she had not yet officially taken over at the Frankfurt-based institution — she succeeds Mario Draghi on Friday.

We somehow doubt this “explanation” will fly with the German population, which sees itself as funding peripheral Europe’s profligate ways for the past decade, even as it benefited from the weak euro to supercharge the German export machine.

And just to guarantee she is as resented by Germany as was Mario Draghi, she said that the German and Dutch governments, which last year had budget surpluses of 2% and 1.5% respectively, “have not really made the necessary efforts,” she added, referring to establishment’s increasing desperation to force anyone with an even remotely normal balance sheet to sink to the same level as their insolvent peers.

As for the punchline, Lagarde defended the negative interest rates introduced by her predecessor Draghi, arguing that people should be happier to have a job than a higher savings rate. This, as a reminder, comes at a time when virtually everyone who is not named “Draghi” or “Lagarde” thinks that negative rates are catastrophic, and assure doom for the Eurozone.

When asked about the impact of negative rates on savers, Ms Lagarde said on Thursday that they should think about how much worse the situation would be if the ECB had not cut rates as much as it had.

“Would we not be in a situation today with much higher unemployment and a far lower growth rate, and isn’t it true that ultimately we have done the right thing to act in favor of jobs and of growth rather than the protection of savers?” she asked.

The unemployment rate in the 19-country eurozone has fallen from 12 per cent in 2013 to 8.2 per cent last year. GDP growth in the single currency zone was 1.8 per cent last year and the ECB expects it to slow to 1.1 per cent this year.

Finally, for those curious if the authorities will stop at anything to destroy the currency and send rates to even more negative levels if it means kicking the can on a global, populist uprising, by just a few months, weeks or days, here is the answer: “We should be happier to have a job than to have our savings protected,” said Lagarde.

“I think that it is in this spirit that monetary policy has been decided by my predecessors and I think they made quite a beneficial choice.”

Let’s check back on that statement in a year, shall we?

Of course, there is no magic solution here: all the ECB has done is kick the can, and ensure that the next crisis will be even worse than if some semblance of a price-clearing reality had been allowed under Draghi’s 8 years. Instead, the ECB’s balance sheet exploded to €4.7 trillion euros, as the world’s largest central bank-cum-hedge fund bought every bond in sight in hopes of keeping asset prices artificially elevated.

In October, the ECB, less than a year after it ended QE in a failed attempt to “renormalize” monetary policy, announced it would cut rates to a record -0.5% and unveiled open-ended plans to start buying €20bn of bonds starting in November.

Needless to say, the comments by the former French finance minister confirm market expectations that she is likely to pursue similar monetary policy strategy to Draghi who flooded the financial system with cheap money to fight slowing growth and inflation while calling on governments to do more through fiscal policy to take the burden off the central bank.

In the end, the consequences of Draghi’s monetary policy, as we explained before, will be catastrophic, but the former Goldman partner was wise enough to get off the European Titanic before it hit the iceberg. It will now be Lagarde’s task to save as many people as possible once the ship starts sinking, and judging by her remarks, she is perfectly fine of not only going down with the ship, but also being blamed for the collision.

Source: https://www.zerohedge.com/economics/lagarde-we-should-be-happier-have-job-have-savings