The US budget had a deficit of $32.6 billion in January compared with a deficit of $13.3 billion in December and a surplus of $8.7 billion in January 2019. The yearly growth rate of government outlays rose by 22.2% in January from 7% in the month before and 6.7% in January last year.

|

|

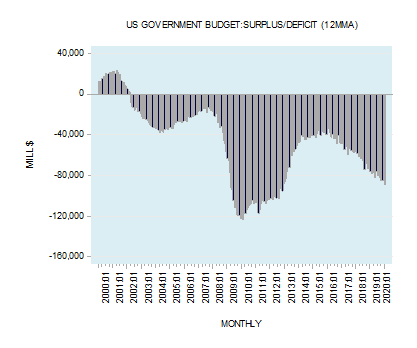

The yearly growth rate of government revenues climbed to 9.5% last month from 7.4% in December and minus 5.8% in January the year before. Note that the 12-month moving average (12mma) of the budget displays a visible widening in the deficit (see chart).

What matters to economic health is the size of government outlays not the budget deficit

A budget deficit emerges when government spends more than it collects. Conversely, when the government collects more than it spends, a budget surplus occurs.

Some commentators hold that during an economic slump it is the duty of the government to run large budget deficits in order to keep the economy going. On this way of thinking if overall demand in the economy weakens on account of a weakening in consumer outlays then the government must step in and boost its spending in order to prevent overall demand from declining.

According to commentators, a widening of the budget deficit in response to larger government outlays can be great news for the economy. In contrast, the opponents of this view hold that a widening in the budget deficit tends to be monetized and subsequently leads to a higher inflation.

So from this perspective a government must avoid as much as possible a widening in the budget deficit. In fact, the focus should always be on achieving a balanced budget.

We suggest that the goal of fixing the deficit as such, whether to keep it large or trying to eliminate it altogether, could be an erroneous policy. Ultimately, what matters for the economy is not the size of the budget deficit but the size of government outlays – the amount of resources that government diverts to its own activities.

The more government spends the more resources it takes from wealth generators

Observe that a government is not a wealth generating entity – the more it spends the more resources it has to take from wealth generators. This in turn undermines the wealth generating process of the economy. This means that the effective level of tax is the size of the government and nothing else. For instance, if the government plans to spend $3 trillion and funds these outlays by means of $2 trillion in taxes there is going to be a shortfall, labeled as a deficit, of $1 trillion. Since government outlays have to be funded it means that in addition to taxes the government has to secure some other means of funding such as borrowing or printing money, or new forms of taxes.

The government is going to employ all sorts of means to obtain resources from wealth generators to support its activities. Hence, what matters here is that government outlays are $3 trillion, and not the deficit of $1 trillion.

For instance, if the government lifted taxes to $3 trillion and as a result would have a balanced budget, would this alter the fact that it still takes $3 trillion of resources from wealth generators?

We hold that an increase in government outlays sets in motion an increase in the diversion of wealth from wealth generating activities to non-wealth generating activities. It leads to economic impoverishment. So in this sense an increase in government outlays to boost the overall economy’s demand should be regarded as bad news for the wealth generating process and hence to the economy.

Does budget surplus contributes to national savings?

A budget surplus is seen as contributing to national savings. By generating surpluses, so it would appear, the government creates real wealth, thereby strengthening the economy’s fundamentals. This argument would be correct if government activities were of a wealth-generating nature.

This is, however, not the case. Government activities are confined to the redistribution of real wealth from wealth generators to wealth consumers. Government activities result in taking wealth from one person and channeling it to another.

Various impressive projects that the government undertakes also fall into the category of wealth redistribution. The fact that the private sector did not undertake these projects indicates that they are low on the priority list of consumers.

Given the state of the pool of real wealth, the implementation of these projects will undermine the well-being of individuals since they will be introduced at the expense of projects that are higher on the priority list of consumers.

Let us assume that the government decides to build a pyramid that most people regard as low priority. The people who will be employed on this project must be given access to various goods and services to sustain their life and well-beings.

Since the government is not a wealth producer it would have to impose taxes on wealth producers (those individuals who produce goods and services in accordance with consumers’ most important priorities) in order to support the building of a pyramid.

Government taxes stifle the market process

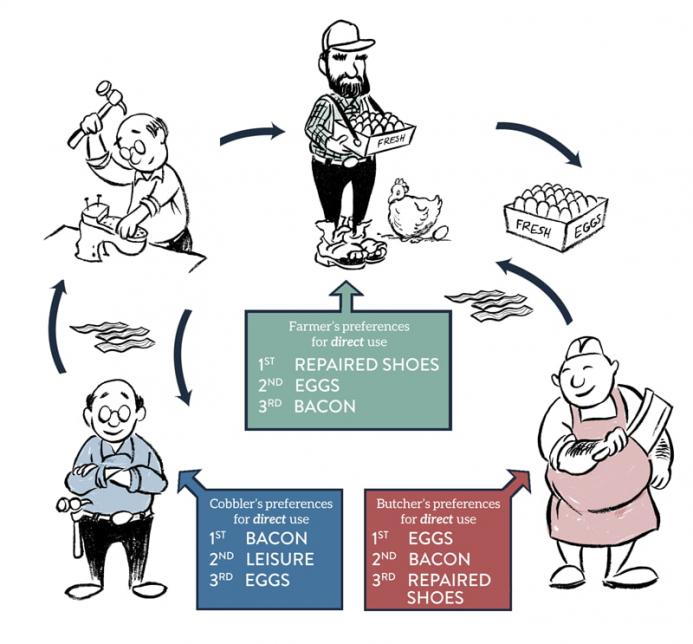

Whenever wealth producers exchange their products with each other, the exchange is voluntary. Every producer exchanges goods in his possession for goods that he believes will raise his living standard.

The crux therefore is that the exchange or trade must be free and thus reflective of individual’s priorities. Government taxes are, however, of a coercive nature: they force producers to part with their wealth in exchange for an unwanted pyramid. This implies that producers are forced to exchange more for less, and obviously this impairs their well-being.

The greater the amount of non-market related projects government undertakes – the more real wealth is taken away from wealth producers. We can thus infer that the level of tax, i.e. real wealth, taken from the private sector is directly determined by the size of government activities.

Observe that by being a wealth consumer the government cannot contribute to savings and to the pool of real savings. Moreover, if government activities could have generated wealth then they would have been self-funded and would not have required any support from other wealth generators. If this were the case, the issue of taxes would never arise.

The essence of what was said is not altered by the introduction of money. In the money economy the government will tax (take money from wealth generators) and pay out the received money to various individuals that are employed directly or indirectly by the government.

This money will give these individuals access to the pool of real savings. Government-employed individuals are now able to exchange the taxed money for various goods and services that are required to maintain and to improve their lives.

The meaning of a budget surplus in a money economy

What then is the meaning of a budget surplus in a money economy? It basically means that government’s inflow of money exceeds its expenditure of money. The budget surplus here is just a monetary surplus. The emergence of a surplus produces the same effect as any tight monetary policy. On this Ludwig von Mises wrote,

Now, restriction of government expenditure may be certainly a good thing. But it does not provide the funds a government needs for a later expansion of its expenditure. An individual may conduct his affairs in this way. He may accumulate savings when his income is high and spend them later when his income drops. But it is different with a nation or all nations together. The treasury may hoard a part of the lavish revenue from taxes, which flows into the public exchequer as a result of the boom. As far and as long as it withholds these funds from circulation, its policy is really deflationary and contra-cyclical and may to this extent weaken the boom created by credit expansion. But when these funds are spent again, they alter the money relation and create a cash-induced tendency toward a drop in the monetary unit’s purchasing power. By no means can these funds provide the capital goods required for the execution of the shelved public works.[1]

A budget surplus – i.e. a monetary surplus – does not automatically make room for lower taxes. Only if real government outlays curtailed, i.e. only when the government cuts the number of pyramids it plans to build will an effective lowering of taxes emerge. Lower government outlays imply that wealth generators will now have a larger portion of the pool of real wealth at their disposal.

If, however, government outlays continue to increase, no effective tax reduction is possible; on the contrary, the share of the pool of real wealth at the disposal of wealth producers will diminish.

Critics of smaller governments will argue that the private sector cannot be trusted to build up and enhance the nation’s infrastructure. However, can Americans afford the improvement of the infrastructure? The referee here should be the free market where individuals, by buying or abstaining from buying, decide on the type of infrastructure that is going to emerge.

If the size of the pool of real savings is not adequate to afford better infrastructure then time is needed to accumulate real savings to be able to secure better infrastructure. The build-up of the pool of real savings cannot be made faster by raising government outlays. An increase in government spending will only weaken the pool of real savings.

Government can force non-market chosen projects it cannot make these projects viable

The government can force various non-market chosen projects. The government, however, cannot make these projects viable. As time goes by the burden that these projects will impose on the economy through higher ongoing levels of taxes is going to undermine the well-being of individuals and will make these projects even more of a burden.

What about the lowering of taxes on businesses – surely this will give a boost to capital investment and strengthen the process of real wealth formation?

As long as the lowering of taxes is not matched by a reduction in government spending this will encourage a misallocation of real savings. The emerging budget deficit is going to be funded either by borrowings or by monetary pumping. Obviously, this amounts to the diversion of real wealth from wealth generating activities to non-wealth generating activities. Various capital projects that emerge on the back of such government policy are likely to be the equivalent of useless pyramids.

Why Government cannot be genuine borrower

One of the ways the government employs in securing the necessary funds is by means of borrowing. But how can this be?

A borrower must be a wealth generator in order to be able to repay the principal loan plus interest.

This is, however, not the case as far as the government is concerned, for government is not a wealth generator – it only consumes wealth. So how then can the government as a borrower, producing no real wealth, ever repay its debt? The only way it can do this is by borrowing again from the same lender – the wealth-generating private sector. It amounts to a process whereby government borrows from you in order to repay you.

[1] Ludwig von Mises Human Action Scholars edition chapter 31 p793

“The more government spends the more resources it takes from wealth generators.” So it’s undesirable to take money from those wonderful private enterprise “wealth generators”, like purveyors of pornography, drug dealers, producers of totally useless “ostentatious consumption” items like Rolls Royces and spend the money on health and education?

Along with about 95% of the population, I am more than happy to see money taken from the above n’er do wells and spent on health and state education. That’s because I regard the output of the UK National Health Service as being an extremely valueable form of “wealth”: a much more valuable form of wealth than what purveyors of porn and drugs make and sell.

Hi Ralph.

Upon reading your comment, I was immediately reminded of this quote from William Graham Sumner: “This, then, is the point at which he desires to arrive, and he has followed a familiar device in setting up a definition to start with which would produce the desired deduction at the end.”