- Monetary and fiscal stimulus to ameliorate the effect of the pandemic has exceeded $9trln

- Stock markets have recovered, although most are below their February highs

- The combined supply and demand shock of Covid-19 is structural

- A value-based investment approach is critical to navigate the transition

In my last Macro Letter – A Brave New World for Value Investing – I anticipated the beginning of a new phase for equity investment. In this Letter I look at the existing business and economic trends which have been accelerated by the pandemic, together with the new trends ignited by this sea-change in human behaviour.

In economic terms, the Covid pandemic began with a supply-shock in China as they were forced to lockdown the Wuhan region. This exacerbated strains which had already become evident in trade negotiations between China and the US, but also revealed weaknesses in the global supply chains. A kind of ‘Mexican Wave’ has followed, with a variant on the initial supply-shock occurring in successive countries as the virus spreads from region to region and governments responded with lockdowns.

The supply-shock has gone hand in hand with a global demand-shock. The key difference between this recession and previous crises is the degree to which it has impacted the service sector. According to 2017 data, the service sector represents 65% of global GDP, whilst Industrial/Manufacturing accounts for 25%, Agriculture represents only 3.43%. Over time, Agriculture and Manufacturing has become more increasingly automated, the principle growth sector for employment is Services. The ILO Monitor: COVID-19 and the world of work. Fourth edition states: –

As at 17 May 2020, 20 per cent of the world’s workers lived in countries with required workplace closures for all but essential workers. An additional 69 per cent lived in countries with required workplace closures for some sectors or categories of workers, and a further 5 per cent lived in countries with recommended workplace closures.

The latest ILO estimate for Q2, 2020 indicates a 10.7% decline in working hours – equivalent to 305mln lost jobs worldwide. 60% of these job losses have been in four industries, leisure, retail, education and, perhaps counter-intuitively, healthcare. The knock-on effects have been felt almost everywhere.

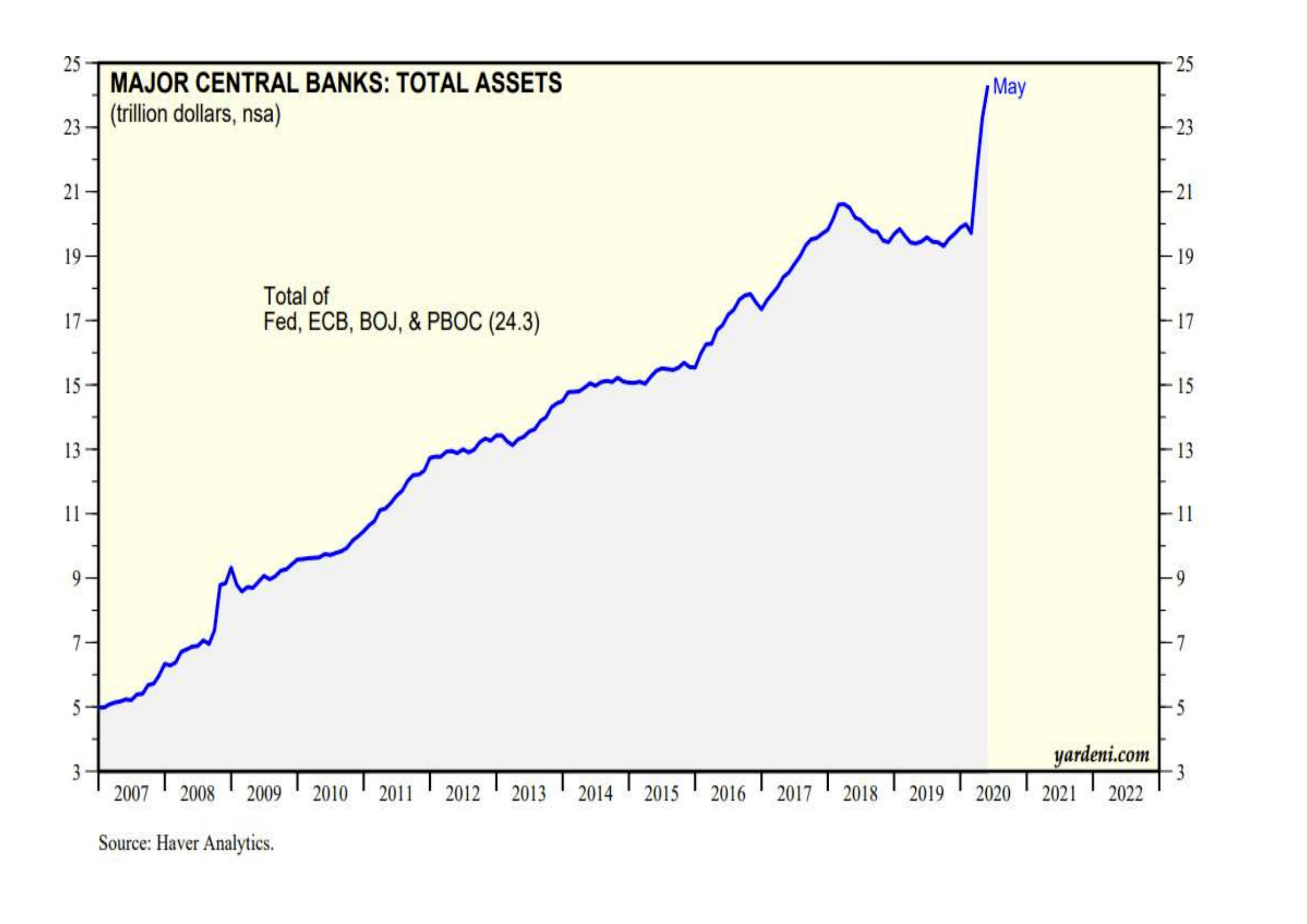

Governments and central banks have responded. The chart below shows the rapid expansion in central bank balance sheets: –

Source: Yardeni, Haver Analytics

The Federal Reserve began their latest round of quantitative easing in August 2019, well before the onset of the pandemic. They have added $3.3tlrn in nine months, seeing their balance sheet balloon to $7.1trln.

Around the world, governments have also reacted with vigour; on May 20th the IMF updated their estimate of the global fiscal response to $9trln, of which $8trln has emanated from G20 countries. The geographic breakdown as a percentage of GDP can be seen in the table below: –

Source: IMF

The majority of global stimulus has come from the richer developed nations. Assuming this pattern continues, emerging market equities are likely to lag. The table below ranks a selection of emerging economies by four measures of financial strength, public debt, foreign debt, cost of borrowing and reserve cover: –

Source: The Economist, IMF, JP Morgan, iShares

Overall, whilst the flood may subside, global expenditure should continue to rise as the pandemic sweeps on across the globe. Whilst loan forbearance and forgiveness, together with state guarantees, will help to maintain the solvency of many existing corporations, new spending will be aimed at stimulating employment. Infrastructure projects will be legion.

Impact on Industry Sectors

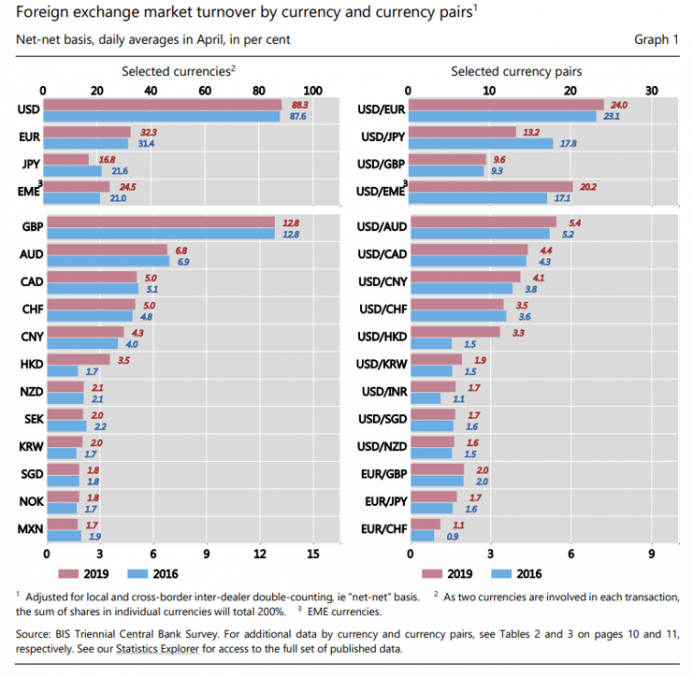

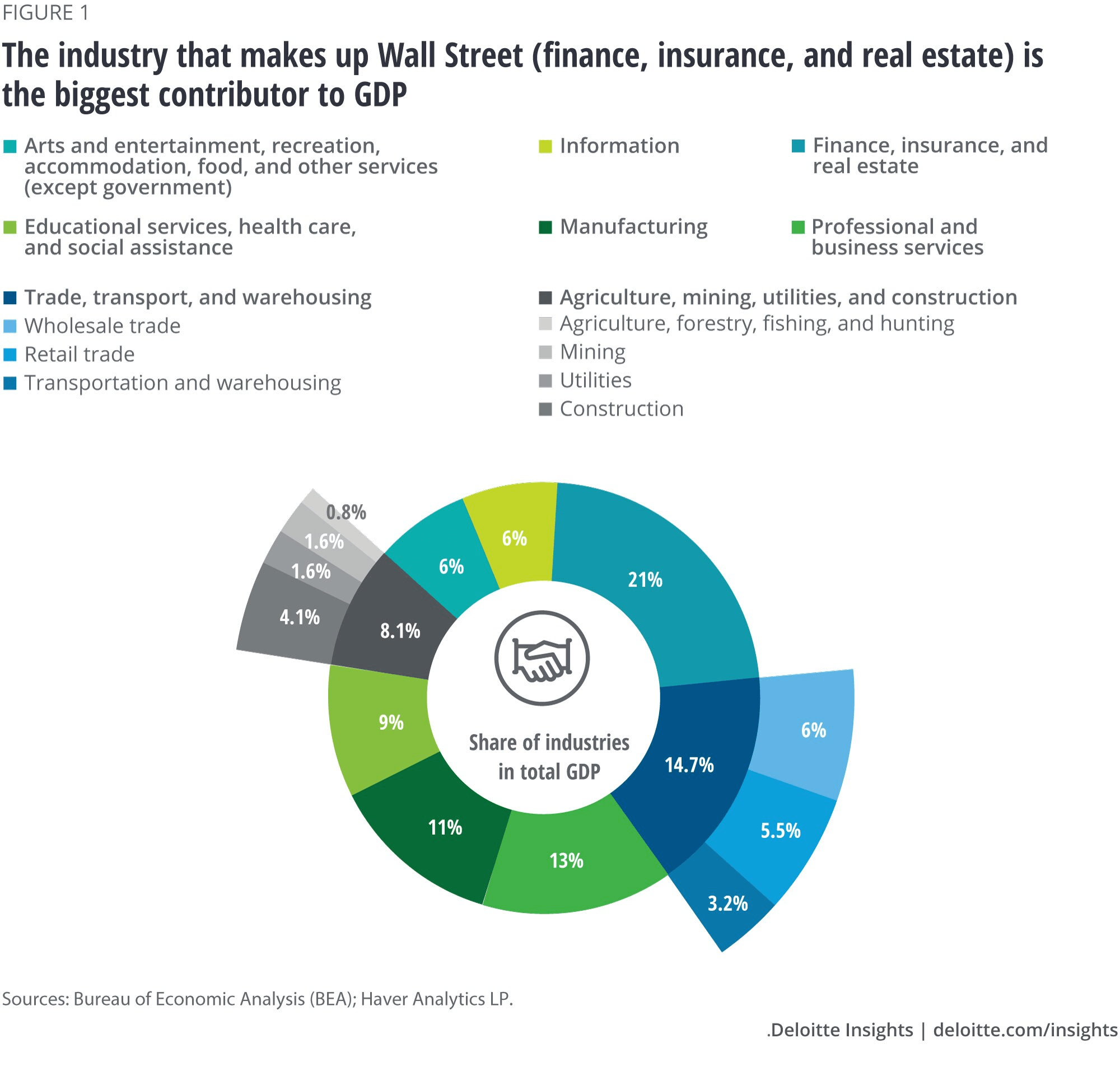

For investors, the abrupt changes in supply and demand, combined with the impact of the fiscal and monetary response, make navigating today’s stock markets especially challenging. To begin, here is a chart from 2019 showing a breakdown of industry sectors in the US by their contribution to GDP: –

Source: Deloitte, BEA, Haver Analytics

This tells us that finance, insurance and real estate are the largest sector but it fails to tell us which sectors are thriving and which are not: –

Source: Deloitte, BEA, Haver Analytics

Here we see the continued march of digital transformation, but also the ever increasing share of healthcare services in GDP; near to four decades of asset price appreciation has created an asset rich aging cohort in developed economies which, if not healthier then definitely wealthier. Looking ahead, developed nations are better equipped to weather the crisis better than their developing nation peers. Within developed nations, however, smaller businesses, especially those which cannot access capital markets, will fail, whilst larger firms will fare far better. Private Equity funds will also find rich pickings among the plethora of distressed private market opportunities.

Since the outbreak of Covid-19, several trends have accelerated, others have been truncated or reversed. Social behaviour has had a negative impact on travel, leisure and retail. Declining demand for travel has damaged a range of industries including airlines, autos, oil and gas. The leisure sector has been hit even harder with hotels, restaurants and bars closed, in many cases forever. The sports industry has been severely undermined. Meanwhile the decline in retail has accelerated into a downward spiral.

Nonetheless, several industries have benefitted. Within retail, online sales have hit new records, grocery sales have ballooned. Healthcare has gone digital, from consulting to dispensing productivity gains have been evident. The home improvements industry has benefitted even as commercial real estate has suffered. Working from home will be a permanent feature for many office workers. Every existing home owner will need to create a permanent office space, every new home buyer will need more space to incorporate an office. Longer, occasional, commutes will lead people to move further from the city. Some workers will move to more clement climes, requiring less energy. Structural changes in where we live and how we live present threats and opportunities in equal measure. For example, every house will require better communications infrastructure, high speed connectivity and broad, broadband will become the norm.

Changes in the delivery of goods (direct to homes rather than to retail outlets) means more inventory will held in out-of-town locations. Inner city retail and commercial property businesses will consolidate as out-of-town commercial thrives. New out-of-town property demand will also emerge from the manufacturing sector. The on-shoring of production was already in train, with robots replacing cheap labour from developing countries, now, concern about the robustness of supply chains, especially for critical manufactures such as pharmaceuticals, will encourage a wave of old industries in developing countries to be reborn. Whereas in retail, larger inventory may become more prevalent, in manufacturing, ‘just-in-time’ delivery and lower transportation costs will compensate for higher fixed production costs.

The energy sector has suffered a medium-term setback, for example, 28% of all US gasoline is consumed in the daily commute. After the lockdown, some commuters will choose to travel alone rather than by public transport, many more will now work permanently from home. Yet whilst gasoline demand falls, demand for diesel, to fuel the home delivery revolution, will rise. Home heating (and cooling) is also set to rise and, with it, demand for heating oil and natural gas. Overall demand may be lower but there will be many investment opportunities.

In healthcare, aside from tele-medicine, which is forecast to capture between one third and half of consultation demand, there is also increased appetite for bio-sensors to measure multiple aspects of health. Hospital consolidation will continue in an attempt to drive efficiency. On-shoring of drug manufacture may well be mandated, online delivery is likely to become the new normal, especially to the elderly and infirm who are advised to shelter-in-place. On-shoring creates domestic jobs, government favour will focus on these companies.

Airlines will be forced to diversify or merge; I envisage a mixture of both strategies. A diversification into car hire, travel insurance and hotels seems likely. Many airlines are national carriers, they possess an implicit government guarantee, their financing costs will remain lower, their low-budget competitors will diminish, fare discounts will become fewer and, thereby, their fortunes may conceivably rebound.

The automobile industry remains in a state of turmoil, but new technology will continue to determine its fortune. If de-urbanisation continues, whilst commuting will decline, there will be an increased demand for individual car ownership, especially electric vehicles. In the fullness of time, the industry will transform again with the adoption of driverless transportation.

Technology will, of course, be ubiquitous. The fortunes of the cybersecurity sector have been ascendant since the crisis began, but even relatively ‘non-tech’ businesses will benefit. Commercial real estate will gain as tech firms seek out ever larger data centres to support their cloud computing needs. The auto industry will benefit from improvements in battery storage and charging times. This will also change the economics of electricity for homes and factories. Green energy will come of age.

Tourism will recover, the human race has not lost the desire to travel. In Europe tourism is down between 30% and 40% – it accounts for 10% of GDP. The rebound will be gradual but the travellers will return. More consumers will buy on-line.

Banking and finance will evolve to meet the challenges and needs of the industrial and services sector. Certain trends will continue, bricks and mortar will give way to on-line solutions, branch networks will consolidate. With government support, or threat, existing loans will be extended, new loans made. As household savings rise, new credit will be granted to new and existing entities, few questions will be asked.

Insurance companies will consolidate, once claims are paid, premiums will rise and competition lessened. As with banking more consumers will move on-line.

Employment

Looking beyond the business potential of different industry sectors and the technological advances which will support them, we should remember that governments around the globe will direct fiscal policy to alleviate unemployment, the initial flood of fiscal aid may moderate but if the tide goes out the ebb will be gradual, this is one of the benefits of a fiat currency system. According to the ILO, in 2019, employment in services accounted for 50%, Industry 23% and Agriculture 27%. The chart below shows how employment by sector has evolved over the last 28 years: –

Source: World Bank, ILO

The services sector has embraced employees leaving agriculture, whilst industry has grown without significant employment growth. The leisure industry, including hotels, restaurants and bars, is one of the largest employers of low-skilled, part-time employment. Consolidation within the hotels sector is inevitable. Larger, better capitalised groups will benefit as smaller enterprises fail. Corporations from beyond the leisure sector will diversify and private equity will fill the gaps which public companies step aside.

Conclusions and Investment Opportunities

In my previous Macro Letter I concluded that value-based analysis would be the best approach to equity investment. On closer examination, one can find risk and opportunity in almost every industry sector. In the last three month, stock markets have risen, but stock return dispersion remains heightened. A prudent, value-oriented, framework should yield the best results in the next few years.