A few recent articles bring to the public’s awareness that wealthy investors are preferring not to sell their assets, and thereby pay capital gains taxes. Instead, they borrow against them, on margin. This reminds me of an experience I had some years back. I was on a panel, and the moderator asked this question.

“Should companies pay dividends, or should investors get their profits in the form of capital gains?”

One of my co-panelists was an innovator in methods for public companies to engineer higher share prices. But he was stuck on promoting higher share price—capital gains—as the only means for investors to profit from their investments. He said no, companies should not pay dividends as a matter of principle.

Central Banks Have Turned Investment into Speculation

I have written much about the central banks’ war on interest. They have rid the world of yield. And in this environment, people have no alternatives to speculating. Capital gains are the surrogate to earning interest or dividends.

But that was not my co-panelist’s point. He was not merely saying that we have no choice, and therefore this is the next-best strategy. He promoted this as the way capital markets should work.

My answer was that stocks without dividends is like a currency without redeemability. Suppose you buy shares which will never pay dividends, no matter how profitable the company becomes. The only profit you will ever make, will be paid to you by the next buyer. He forks over his capital, which to you is income to be spent. He does this, for the same reason you did—in hopes that the next-next guy will pay him even more.

Dividends and Irredeemable Currency

Like buying an irredeemable currency, it is giving a blank check to the issuer. The issuer may invest it wisely, or squander it. You have no say, and no recourse. You can only foist it off on the next buyer.

With corporate shares, there is usually an end when the company goes bankrupt. And my co-panelist was proposing that a company—from its inception to its bankruptcy—never pay investors a penny. In his view, investors can just trade the shares, and hopefully make gains off the next wave of investors. Of course, near the end, there are no gains, only losses. One imagines that this guy would just smirk, wink, and advise you to sell before it gets to that point. In his view of economics, just make sure that it’s not you left holding the bag and suffering total loss of principal.

It matters how you make your profit

However, where the profit comes from, matters. If it comes from a third party, who pays you more of his wealth than you originally paid, then that’s just him handing over his savings for you to consume.

The profit should come from production. If you own a farm (to go back to an old analogy I’ve used several times), your food should be grown on the farm itself. If you are selling off the acreage to pay for groceries, then you are consuming your capital.

The same is true for shares in a productive business. If the business pays dividends and/or interest which you spend, this is analogous to eating food grown on your farm. If it pays nothing, and you sell shares to pay for groceries, that is analogous to selling acreage.

Economically, it makes all the difference in the world whether the issuer pays you what he owes, or whether a third party buys it from you at a higher price (due to the central bank administered falling interest rate).

The difference between Investment and Speculation

This is a critical distinction that the science of economics should emphasize more. Investing is providing capital to a producer, to finance an increase in production. In investment, the profit to the investor is paid out of this increase. By contrast, speculation is giving capital to the seller of an asset, in the expectation that the next buyer will give you even more capital. In speculation, the gain comes from a third party. It is his wealth, converted to your income.

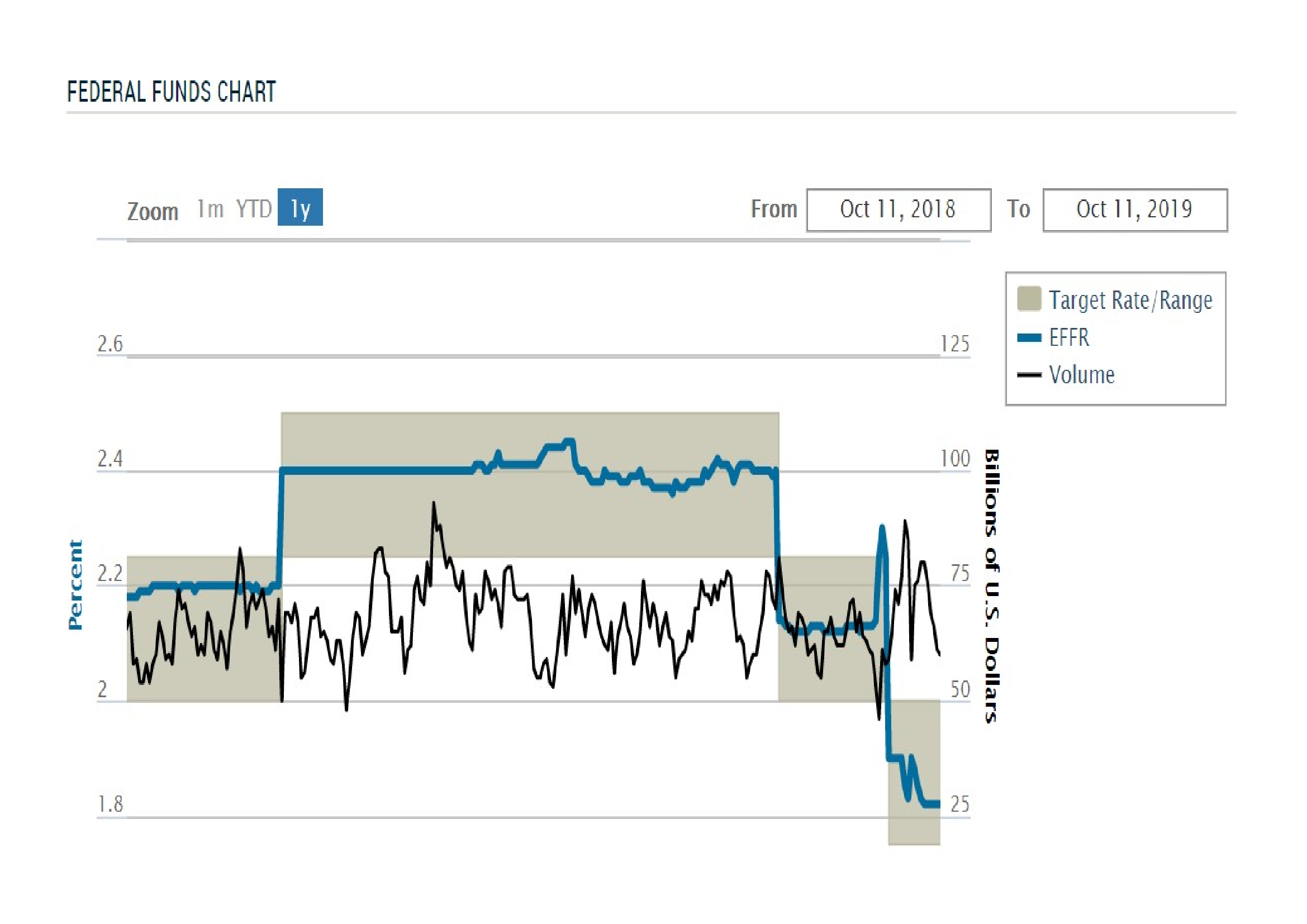

This is why I founded my company. This is why we are on a mission. The central banks have waged a war on interest, which is now all but over in the US (and beyond over in Switzerland, Germany, Japan, and other countries). Deprived of interest, people turn away from investing. They end up with the only alternative to investing, speculating. Whether they use stocks, bonds (low-, zero-, and even negative-yield bonds can generate capital gains), real estate, bitcoin, or even gold, the result is the same. The buyer hands over his precious capital to the seller, who may consume it.

Yes, I said gold. In this world, people buy whatever asset they think will go up (in dollar terms). They use these assets as chips in the Fed’s casino.

The System is Broken, we need a new system

This process of consuming capital is what’s killing us. Forget inflation. Forget taxes and regulations. The real killer is that the Fed has made it profitable for us to consume our inherited capital, that was accumulated over many generations. No one wants to be the Prodigal Son, but people are happy to spend their speculative gains.

And they are not just spending their gains, once they have made them. They are borrowing capital, and spending that. Lenders are happy to provide this capital, as they are getting good assets as collateral. You can see why people are getting angry! Something is wrong with the system, though the people who own assets are not to blame, nor the lenders who lend against them to try to earn a little bit of yield.

The root of the problem is our broken monetary system. We urgently need a better system, one which has a stable interest rate and hence stable asset prices. And hence people can invest for interest and dividends, rather than speculating for gains.

The name of that system is a four-letter word beginning with “g”.