It is only now becoming clear to the investing public that the purchasing power of their currencies is declining at an accelerating rate. There is no doubt that yesterday’s announcement that the US CPI rose by 6.2%, compared with the longstanding 2% target, came as a wake-up call to markets.

Along with the other major central banks, the Fed’s reaction is likely to be to double down on interest rate suppression to keep bond yields low and stock valuations intact. The alternative will lead to a major financial, economic and currency shock sooner rather than later.

This article introduces the reader to some of the basic fallacies behind state currencies. It explains the misconceptions policy planners have over interest rates, and how central banks have become contracyclical lenders, replacing commercial banking’s credit creation for non-financial activities.

In effect, narrow money is being used by the major central banks in a vain attempt to shore up government finances and economic activity. The consequences for currency debasement are likely to be more immediate and profound than cyclical bank credit expansion.

Introduction

It is becoming clear that there has been an unofficial agreement between the US Fed, Bank of England, the ECB and probably the Bank of Japan not to raise interest rates. It is confirmed by remarkably similar statements from the former three in recent days. When, as the cliché has it, they are all singing off the same hymn sheet, those of us not party to agreements between our monetary policy planners are right to suspect they are doubling down on a market rigging exercise encompassing all financial markets.

That these policy planners are clueless about money and economics escapes nearly everyone affected. It is assumed the so-called experts know what they are doing. But for nearly a century, universities have promoted statist beliefs on their economics courses to the exclusion of reasoned theory leading to the current situation. In modern times it started with Georg Knapp’s Chartalist movement in Germany before the First World War. And it really took off with Keynes’s General Theory published in 1936. The essence of it has been state attempts to dehumanise economics; to turn economic actors, that is you and me, into predictable components in a mathematical economy.

The infamous failure of communism’s command economies in the Soviet Union and Maoist China bear testimony to the futility of these policies. But while Western capitalists felt vindicated by communism’s failure, they failed to understand its similarities with their own economic policies. For the truth was that western economies were and remain highly socialistic, with the unfettered relationships between transacting individuals being increasingly interfered with by their relevant governments. The triumph of capitalism over communism was hubris, little more than a power play, an opportunity for the Western Alliance to move its missile bases into newly liberated eastern Europe.

The propaganda that the state’s primary function is to control human activity has been so pervasive and effective that it is no longer questioned. Capitalism, in the sense that corporations exist for profit, is unanimously declared to be a necessary evil and reluctantly tolerated. This is even believed by those who are cast by the media as the agents of capitalism themselves: leaders in big business, the bankers, and in fossil-burning oil megaliths. With their social consciouses they subscribe to a new form of Marxist philosophy. They attend gatherings to plan for a better world — their world. The COP26 conference in Glasgow is the latest manifestation of it with private participants seemingly unconscious that travelling in 118 private jets to do so is inconsistent with their professed green credentials.

The wellspring of this self-importance is ignorance of economics. Universities have turned out highly intelligent students who know nothing other than mathematics and statistics and think it makes them economists. They ignore their own life experiences in fields such as the division of labour, promoting instead macroeconomics — mainly a Keynesian invention. Its origin arose from Keynes’s denial of Say’s law, a cast-iron definition of the division of labour and the role of the medium of exchange:

“That Say’s law, that the aggregate demand price of output as a whole is equal to its aggregate supply price for all volumes of output, is equivalent to the proposition that there is no obstacle to full employment. If, however, this is not the true law relating the aggregate demand and supply functions, there is a vitally important chapter of economic theory which remains to be written and without which all discussions concerning the volume of aggregate employment are futile.”[i]

By dismissing in the first sentence a proposition without proper explanation (the few paragraphs preceding it are irrelevant), in the second sentence Keynes proposes his new science of macroeconomics, which then becomes the subject of his General Theory. It marks the formal separation between classical free market economics as a social science and the new statist mathematical macroeconomics masquerading as a natural science.

But Keynes’s proposition is preceded by a conditional conjunction, a supposition for which there is no evidence. To the contrary, the evidence is clear: we specialise in our work to maximise our output which we exchange for all the other things that satisfy our needs and wants, and the role of money is to make the transactions involved as efficient as possible. And anyone not so employed and lacks savings to draw upon must be carried by someone else — fully employed is a red herring.

The few words that follow Keynes’s conditional “if” are the mainspring driving modern socialism and the belief held by statists and the super-rich alike that their contribution in the fields of economics and money is for the general good. It has seen the establishment ignore the similarities between the new economics and Karl Marx’s megalomania.

Given the motives and statist beliefs prevalent in the corridors of power it is hardly surprising that monetary policy is badly flawed. And when, as it now appears, there is collusion between the major central banks to keep interest rates heavily supressed, we should at least suspect that all is not well, and that everything might be about to unravel.

Central bank interest rate errors

Statists have long held the belief that interest rates are usuary imposed on borrowers by wealthy savers. By casting savers as the greedy party and borrowers as the victims they constructed a moral case for suppressing interest rates.

In pursuing their moral case, statists have ignored the reality behind what they and borrowers perceive to be the cost of money. A lender parting with money’s utility is justified in expecting compensation for the loss of that possession. When a lender is promised instant access to his money, then compensation becomes a fitting reimbursement for risk, comprised of the sum of currency and counterparty risks. Nowadays, money has been replaced with a reserve currency, so a lender will often think of currency risk as being the difference between the dollar and that of his national currency.

When a lender parts possession with money for a defined period, an additional time-preference element is introduced, compensating him for loss of possession for the time agreed with the borrower. Therefore, the normal condition for yield curves plotted against a basis of time is positive, with longer maturities yielding greater interest that shorter ones.

A borrower is bound to view interest differently. For an entrepreneur it is the cost of obtaining financial capital for investment in a project. He must perform an economic calculation which involves all his anticipated costs from initial capital investment until final production output, which with his estimate of the value of final production allows him to calculate a margin for profits. He might refine his calculations as the project progresses, which could lead to it being abandoned, and he might have difficulty in repaying the lender. A lender must also allow for these implied risks in his calculations of what interest compensation he requires. And when an agent, or a financial arranger, acts for the lender that agent will make these calculations on his behalf.

These are the basic factors which determine interest rates in free markets with sound money. There is the further consideration behind setting them, and that is whether it is the lenders or the borrowers who take the lead in setting interest rates. Do lenders, as Keynes assumed, seek to obtain the maximum return on their capital, forcing borrowers to pay up needlessly, or do borrowers bid up interest rates in order to attract the capital necessary to proceed with a business project? Which party drives the rate?

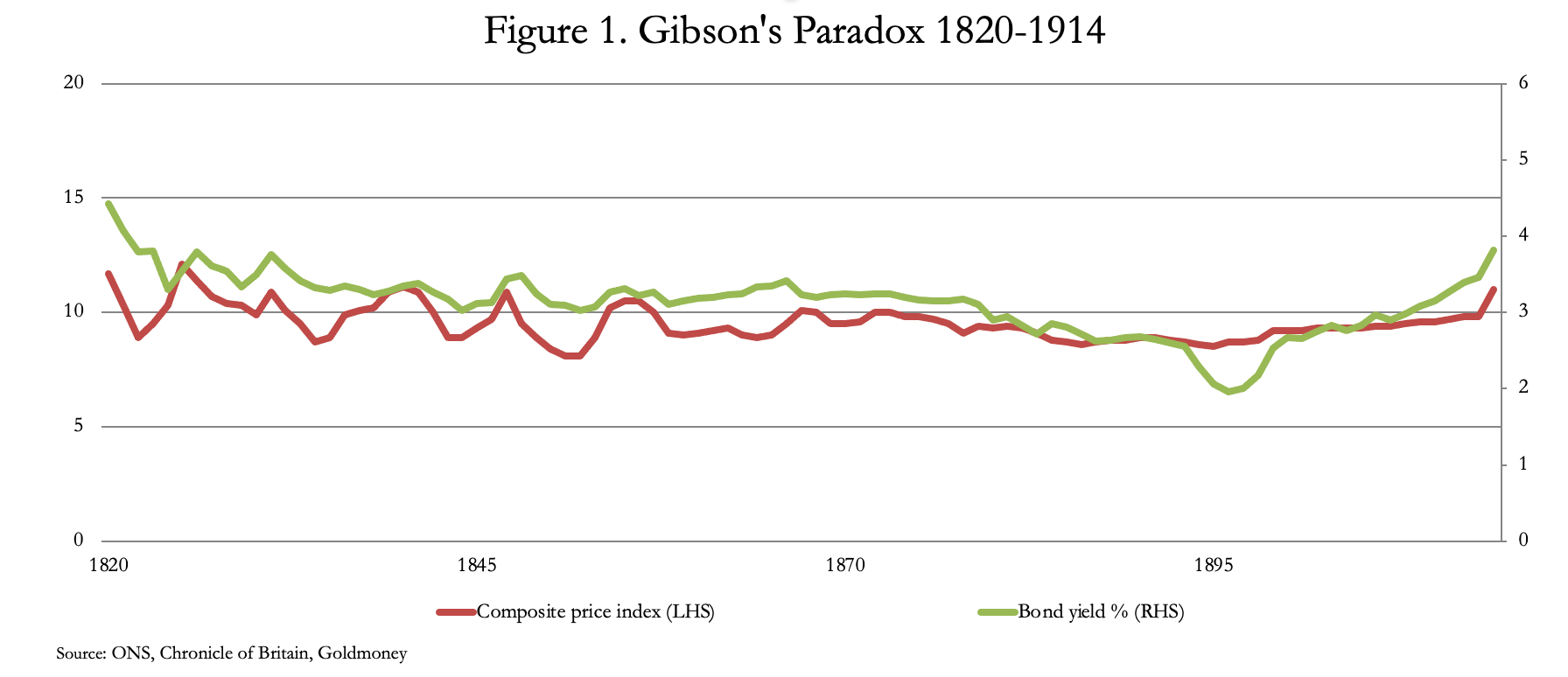

The evidence from free markets before central banks managed or imposed interest rate policies upon them is provided to us by Gibson’s paradox. Figure 1 covers the time from Lord Liverpool’s introduction of the gold sovereign as circulating coinage up to the outbreak of the First World War, when the gold coin standard was abandoned. It compares the wholesale price index with the yield on Consols stock, undated government bonds that provide a pure yield indication without the distortion of maturity factors.

An estimate of final values of production is necessary for a borrower to estimate in his calculations how much interest he can afford for an investment to be profitable. By ensuring a high degree of price stability, sound money backing the circulating currency allows the calculation to be made. This explains why free market interest rates for borrowers tracked wholesale prices under the gold standard and the two correlated well.

There were times of moderate price volatility, but these were mainly due to the cycle of bank credit expansion which led to extra currency being in circulation, followed by periodic banking crises and credit contractions roughly every ten years. But the overall price stability provided by the gold standard still allowed businesses to continue to make the relevant calculations.

In the early days of the gold standard, domestic considerations had a greater impact on wholesale prices than later. This can be seen in a relative price instability between 1820—1850 compared with later. In the second half of the nineteenth century the combined benefits of free trade (the Cobden—Chevalier Anglo-French free trade agreement was signed in 1860), the adoption of gold coin standards by Britain’s trading counterparties and the increasing ownership of gold coins by the general public all led to greater price stability.[ii]

The importance of the spread of gold coin standards is underlined by statistical evidence in Tables 5 and 6 in Timothy Green’s report (referenced in endnote 2) which showed that gold coins in public circulation increased substantially between 1873—1895. Total minted worldwide between these dates was 5,809 tonnes, of which the combined production of Australian and UK sovereigns was 1,395 tonnes, 24% of the world total. The British and Australian minted amounts were in addition to coin production from 1817 representing an additional 1,500 tonnes for a total of nearly 2,900 tonnes, the equivalent of 396 million sovereigns. Some of these coins would have been taken in for reminting and to that extent there is double counting.

By way of contrast, leading central banks and government treasury departments for UK, France, Germany Italy, Russia, and the US between them held only 2,013 tonnes in 1895, one quarter of the quantity minted into circulating coins during the previous twenty-two years. These statistics show that gold coins in circulation made up a significant amount of the combined quantities of money and narrow measures of currency supply, which with free trade provided international price stability at a time of rapid global industrialisation and technological progress.

By way of contrast with the correlation between prices and wholesale borrowing costs, Figure 2 shows the relationship between the inflation rate of prices and wholesale borrowing costs. There is no correlation between the two. It tells us that the assumption held by central bank policy makers, that inflation, by which they mean changes in the general level of prices, can be managed by varying interest rates, is incorrect.

This was the essence of Gibson’s paradox, which plainly showed the opposite to be true of what was expected by statist economists, none of which were able to resolve the paradox. It was never, to my knowledge, addressed by the Austrian School, which was probably generally unaware of it, only being named after Gibson by Keynes who then proceeded to ignore it. A search of all Ludwig von Mises’ writings tuns up nothing on Gibson, and the only two references to Thomas Tooke, who was credited with first seeing the unexplained relationships in the nineteenth century, refer only to his involvement with the banking school.

Monetary policy objectives

Having examined the role of interest rates in unfettered free markets we can now turn our attention to the consequences of central bank interest rate policies. By resolving Gibson’s paradox, we have a starting point; the knowledge that attempts to manage the rate of price inflation by interest rate policies are flawed at the outset. But the interest rate policies of central banks have another motivation for price management, which is to reduce the cost of borrowing at the expense of savers.

By suppressing interest rates, central banks have brought about several destructive changes to trade and the economy in respect of money and credit. By expanding their balance sheets from a customary minimum reflecting mostly circulating currency and required reserves for commercial banks as central bank liabilities before the Lehman crisis, the sum of the Fed’s, the ECB’s, the BoE’s, and the BoJ’s balance sheets has expanded over six times from $4 trillion equivalent to $25.4 trillion currently. The Fed’s expanded about ten times, the ECB’s nearly five times, the BoJ’s over six times, and the BoE’s by nearly seven times.[iii]

In effect, central banks have subsumed the role of commercial banks with respect to credit expansion, directed at their respective economies with an important difference. Central bank credit expansion is countercyclical to commercial bank credit and directed mainly at financing government spending instead of industrial production. The stated objective is to support growth in the wider economy. But being countercyclical a more accurate policy description is to prevent credit-cleansing recessions and to cover government deficits. Commercial banks have refocused their credit expansion towards a combination of acquiring government bonds, which are deemed the lowest lending risk, and financing purely financial activities. For example, the Fed’s H8 form recording assets and liabilities of commercial banks in the US shows Commercial and Industrial Loans (line 10) to have declined every quarter since 2020 Q3.

To a degree, the decline in commercial lending reflects the offshoring of production. An optimist would point to the improvement in cash flows replacing debt finance, and bank credit expansion doesn’t include changes in the level of bond finance. These structural factors must be admitted, but they cannot adequately explain why credit to manufacturers is contracting at a time when consumer demand outpaces product supply. The logical answer is that far from an improving economic outlook, the outlook has been deteriorating in terms of lending risk. Headline GDP figures are therefore an unreliable guide to economic conditions, GDP being indirectly inflated by the expansion of central bank balance sheets.

Clearly, the countercyclical financing of the whole economy in all major jurisdictions is a valid description for the current actions of central banks. It takes no leap of the imagination to deduce that without central bank credit expansion all these major economies would be sinking into deep slumps. This is particularly true of the US, UK and EU, while the BoJ’s balance sheet total unlike the others has admittedly declined over the last year. Therefore, while current economic conditions persist, we can expect a continuing expansion of central bank balance sheets for no real economic benefit.

But monetary policy can never be commercial in nature. It is not the function of a bureaucratic body answerable only to the government to make commercial lending judgements. Central banks acting as countercyclical lenders, a role that requires the judgement of profit-seeking company doctors, cannot deliver a positive economic outcome. While the cycle of commercial bank credit expansion had its own evils, at least it involved institutions capable of commercial judgement. That has now been marginalised.

Monetary policy is now trapped with an ultimate failure looming. Without a change in policy the only outcome will be a further acceleration of inflation of the currency quantity led by its narrower measures. And as we saw in Figure 1, the consequences for prices of the cycle of bank credit expansion and contraction were broadly confined to consecutive periods of expansion and contraction. But there is no such limitation on the expansion of unbacked base currency, and the effect over recent times is shown in Figure 3.

This cannot be undone, and the debasement of currencies can only accelerate unless policymakers sum up the courage to face the consequences: a deliberate act to unwind all the distortions by stopping the printing presses, which will simply crash their respective economies.

This is as likely as the moon colliding with Mars, at least, that is, before the situation deteriorates to the point where central bankers are driven to consider backing their failing currencies with a gold coin standard. Meanwhile, by venturing into the business of contracyclical currency expansion central banks have entered dangerous territory. The commitment to continue suppressing interest rates is now greater than ever. But the consequences for the purchasing power of their fiat currencies are likely to be manifest far sooner than might be generally expected.

The economic outlook will also rapidly deteriorate

Besides the inability of intervening central bank policymakers to make commercial judgements, their actions also take their respective economies even further away from commercial progress. The relationship between currencies, credit and private sector enterprises can be expected to deteriorate more rapidly from here as time preference factors re-emerge. The model relationship between prices and borrowing costs in a successful sound-money economy illustrated by Gibson’s paradox has been destroyed by depreciating fiat. For too long, malinvestments driven by a widespread expectation of profits arising from interest rate suppression more than from genuinely profitable production have dominated economic activity. That is now set to be displaced by malinvestments arising from expectations of rising prices. It can only be stopped by letting free markets set interest rates. But no businessmen in the major economies believe in free enterprise anymore with good reason, only in profits from speculation, the root of which is currency debasement. They are all addicted to interest rate suppression and rising prices as mechanisms to get rich.

While monetary policymakers persist in believing in monetary stimulation the consequences are in fact horribly destructive. The following bullet points are not exhaustive:

- Suppression of interest rates has encouraged businesses to borrow for projects which otherwise would have not been deemed profitable. When central banks have subsequently been forced to raise interest rates in response to rising prices these projects collapse or are rescued by the state. Every credit cycle, this burden on central bank policymaking accumulates.

- Interest rate suppression transfers wealth from savers for the benefit of borrowers. Consequently, savers reduce their savings in favour of immediate consumption, while borrowers take advantage of interest rate suppression to benefit from the wealth transfer effect. A low propensity to save is associated with a tendency towards consumer price inflation and greater interest rate instability.

- The increase of circulating currency is of most benefit to those who receive it first before it has driven prices higher due to the increase in its quantity. Those who benefit most are the issuer, the government, and licenced banks. As the extra currency is spent into circulation it drives prices higher, to the detriment of later receivers. The people who lose most are those who are distant from financial centres and those on fixed incomes, such as state pensioners and the low paid.

- Since tax thresholds are not adjusted for the effects of inflation, inflation increases the tax burden on the productive economy, reducing its ability to prosper.

- The Keynesian justification for inflationary financing was to stimulate the economy. It relies on economic actors being unaware of the increased quantity of currency and the effect on its purchasing power. Instead, the rise in prices for everyday goods and services is widely attributed to increased demand, giving the illusion of improved trading conditions. Inevitably, once the increased quantity of currency has been fully absorbed in general circulation, the effect passes and even reverses, and further stimulation is required to perpetuate the effect. But the more this trick is deployed, the more widely the consequences become understood and the less effective it becomes.

- The more a government uses monetary inflation to finance its spending, the more difficult it is to control. Political practicalities force politicians to continue with inflationary financing, increasing the burden on private sector production. The interests of a government and its electors diverge, with governments increasingly desperate for the benefit of wealth transfer through currency debasement at the expense of economic progress.

- Unless it is somehow stopped, the accelerating collapse of a currency whose decline yields progressively less value to its issuer destroys economic activity, leading to widespread destitution and political rebellion. These are the conditions that open the door to political instability, dictatorships, and extremism.

The first test as to whether any of the major central banks will see the light and tackle the inflation problem will take place in the coming few weeks as evidence of falling purchasing power for fiat currencies mount. The US Fed faced a shock yesterday with the consumer price index up 6.2% against expectations of 5.8%, and a mandated target of 2%. Its claims that inflation is “transient” is looking more preposterous by the day.

Investment managers have yet to challenge the Fed’s view, but with mounting evidence that it is incorrect, it is likely to be a matter of only weeks, possibly days, before yields on government bonds begin to reflect currency debasement. In assessing the situation, driven by macroeconomic theories investment managers in bond markets tend to think of inflation in terms of real yield, being the nominal redemption yield on a bond adjusted by the official rate of price inflation. The shock of a CPI rising at 6.2% adjusts the current yield on the 10-year US Treasury bond from the current 1.6% to a negative yield of 4.6%. The more fund managers making this calculation, the greater the threat to bond prices.

Usually with a lag, a rise in bond yields and the prospect of higher ones to come begin to undermine equity market valuations. This is important for the satisfaction of policy management objectives, which for some time, and certainly since the Lehman crisis thirteen years ago, has placed an emphasis on a healthy stockmarket to maintain economic confidence. For the Fed, the BoE and the BoJ this has been particularly important, and is the rationale for quantitative easing.

This brings us to the Rubicon: in the face of a currency’s loss of purchasing power, evidenced in a higher and rising general level of prices, will one or more of the major central banks abandon what has become an untenable monetary policy, calling a halt to further currency expansion?

Alternatively, will they all continue to combine efforts to suppress interest rates and accelerate currency expansion through increased QE to support financial markets and contain the financing costs on further government borrowing?

The former choice by just one of them would end all central bankers’ efforts of contracyclical expansion to support markets and the illusion that all is well in their underlying economies. It would end central bank control over markets and allow markets to reassert themselves with respect to currencies and the conditions for domestic and international trade. It would expose to the vote of the marketplace government finances for what they are. The abandonment to the marketplace of interest rate policies would bring about the crisis central banks have strived to prevent for decades.

The latter choice will involve central banks to overtly coordinate their attack on markets, an attempt to force them to accept continuing dominance of state currencies and the monetary policies that go with them. Further measures can be expected, such as a currency accord to ensure continuing stability against each other with increased swap arrangements. We can expect political policies in other spheres, such as capping energy prices and prices of other goods deemed politically sensitive.

These are all symptoms of an ultimate failure of the state. We have seen them repeated throughout history. The decision to choose to face the reality of the situation or to struggle on in accordance with the state’s self-sought mandate is a choice as to whether the looming crisis visits us sooner, or later.

[i] Keynes, General Theory, Book 1, Chapter 3.1.

[ii]See Central Bank Gold Reserves — an historical perspective by Timothy Green.

[iii] Yardeni Research, Nov 8 Monthly balance sheets. BoE figures additional from BoE.

It would be of great and useful interest to know an absolute count or ratio of these choices historically as referenced:

[These are all symptoms of an ultimate failure of the state. We have seen them repeated throughout history. The decision to choose to face the reality of the situation or to struggle on in accordance with the state’s self-sought mandate…]

My gut intuition tells me such a ratio would be dismally out of balance with the scale tilting severely in favor of “struggle on in accordance”.