By Dr Frank Shostak

On Wednesday March 16 2022, the US central bank the Fed raised the target for the federal funds rate by 0.25% to 0.5%. According to Fed officials, the increase in the federal funds rate target was in response to the strong increases in the yearly growth rate of the consumer price index (CPI). The growth rate stood at 7.9% in February against 7.5% in January and 1.7% in February the year before.

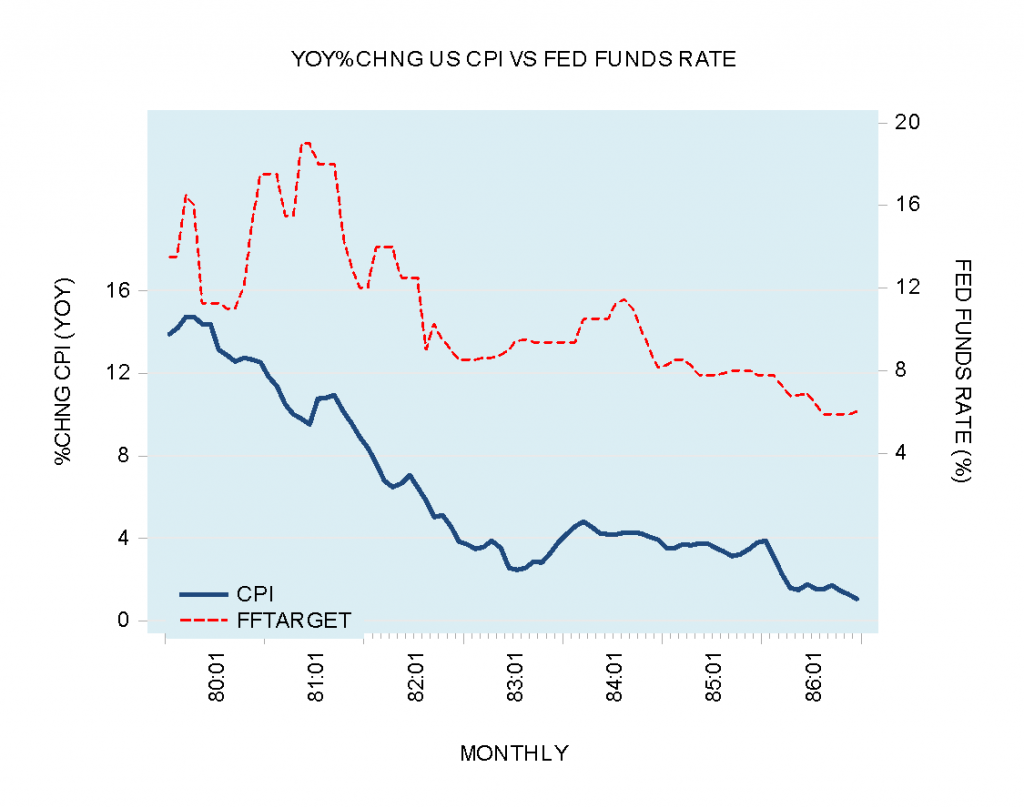

Most commentators are of the view that by means of raising the interest rate target the central bank could slow the increase in the momentum of prices of goods and services. As a proof that this is so commentators refer to May 1981 when then Fed Chairman Paul Volcker raised the fed funds rate target to 19% from 11.25% in May 1980. The yearly growth rate in the CPI, which stood at 14.8% in April 1980, fell to 1.1% by December 1986 (see chart).

Note that for most commentators the growth rate in the CPI is labeled as inflation. We hold that increases in money supply is what inflation is all about. Also, note that we do not say that inflation is caused by increases in money supply as some commentators are suggesting. Again, we hold that inflation is about increases in money supply.

Now, the price of a good is the amount of money paid for this good. Hence, whenever, there is an increase in the money that is injected to a particular good market this means that the price of the good in money terms has gone up. This increase in the price is not however inflation but rather the manifestation of inflation as a result of the increase in money supply, all other things being equal.

We hold that what matters as far as inflation is concerned is not its manifestation in terms of increases in the prices of goods but the damage it inflicts to the wealth generation process. This is inferred from the fact that increases in money supply set in motion an exchange of nothing for something, which generates a similar outcome to what the counterfeit money does. It weakens wealth generators thereby weakening their ability to generate wealth. This in turn undermines individuals living standards.

Also, note that when money is injected it initially enters a particular good market. Once the price of a good is rising to the level that is perceived as fully valued then the money leaves to another market, which is considered as undervalued. The shift from one market to another market gives rise to a time lag from increases in money and its effect on the wealth generation process.

Interest is not set by central bank but by individuals

Note that contrary to popular thinking, interest rates are determined not by the central bank monetary policy but by individuals time preferences. According to the founder of the Austrian School of economics, Carl Menger, the phenomenon of interest is the outcome of the fact that individuals assign a greater importance to goods and services in the present versus identical goods and services in the future.

The higher valuation is not the result of some capricious behaviour, but due to the fact that life in the future is not possible without sustaining it first in the present. According to Carl Menger,

Human life is a process in which the course of future development is always influenced by previous development. It is a process that cannot be continued once it has been interrupted, and that cannot be completely rehabilitated once it has become seriously disordered. A necessary prerequisite of our provision for the maintenance of our lives and for our development in future periods is a concern for the preceding periods of our lives. Setting aside the irregularities of economic activity, we can conclude that economizing men generally endeavor to ensure the satisfaction of needs of the immediate future first, and that only after this has been done, do they attempt to ensure the satisfaction of needs of more distant periods, in accordance with their remoteness in time.

Hence, various goods and services that are required to sustain an individual’s life at present must be of a greater importance to an individual than the same goods and services in the future. The individual is likely to assign higher value to the same good in the present versus the same good in the future.

With paltry means, an individual can only consider very short-term goals, such as making a basic tool. The meager size of his means does not permit him to undertake the making of more advanced tools. With the increase in the means at his disposal, the individual could consider undertaking the making of better tools. With the expansion in the pool of means, individuals are able to allocate more means towards the accomplishment of remote goals in order to improve their quality of life over time.

Again, whilst prior to the expansion of means the need to sustain life and wellbeing in the present made it impossible to undertake various long-term projects, with more means this has become possible.

Note that very few individuals are likely to embark on a business venture, which promises a zero rate of return. The maintenance of the process of life over and above hand to mouth existence requires an expansion in wealth. The wealth expansion implies positive returns.

Is the lowering of interest rate the key cause behind the increase in the capital goods investment?

Contrary to the popular thinking, a decline in the interest rate is not the driving cause behind the increases in the capital goods investment. What permits the expansion of capital goods is not the lowering of the interest rate but the increase in the pool of savings.

The pool of savings, which comprises of final consumer goods, sustains various individuals that are employed in the enhancement and the expansion of capital goods i.e. tools and machinery. With the increased and enhanced capital goods, it will be possible to increase the production of future consumer goods.

Individuals’ decision to allocate a greater amount of means towards the production of capital goods is signaled by the lowering in the individuals’ time preferences i.e. assigning a relatively greater importance to the future goods versus the present goods.

Hence, the interest rate is just an indicator as it were, which reflects individuals’ decisions regarding the present consumption versus the future consumption. (Again, the decline of the interest rate is not the cause of the increase in capital investment. The decline mirrors the individuals’ decision to invest a greater portion of their savings towards the capital goods investment).

In a free unhampered market, a decline in the interest rate informs businesses that individuals have increased their preference towards future consumer goods versus present consumer goods. Businesses that want to be successful in their ventures must abide by consumers’ instructions and organize a suitable infrastructure in order to be able to accommodate the demand for consumer goods in the future.

Note that through the lowering of their time preferences individuals have signaled that they have increased savings in order to support the expansion and the enhancement of the production structure.

Observe that in a free unhampered market, fluctuations in interest rates are going to be in line with changes in consumers’ time preferences. Thus, a decline in the interest rate is going to be in response to the lowering of individuals’ time preferences. Consequently, when businesses observe a decline in the market interest rate they are responding to this by lifting their investment in capital goods in order to be able to accommodate in the future the likely increase in consumer goods demand. (Note again that in a free-market economy a decline in the interest rate indicates that on a relative basis individuals have lifted their preference towards future consumer goods versus present consumer goods).

A major reason for the discrepancy between the market interest rate and the interest rate that reflects individual’s time preferences is the actions of the central bank. For instance, an aggressive loose monetary policy by the central bank leads to the lowering of the observed interest rate. Businesses respond to this lowering by increasing the production of capital goods i.e. tools and machinery in order to be able to accommodate the demand for consumer goods in the future. Note however, that consumers did not indicate their greater preference towards consumer goods in the future. The time preference interest rate did not go down. Because of this, a gap between the time preference rate and the market rate emerges.

Because of the gap between the time preference interest rate and the market interest rate, businesses responding to the declining market interest rate have now overproduced capital goods relatively to the production of present consumer goods. At some stage, by incurring losses, businesses are likely to discover that past decisions with regard to the capital goods expansion were erroneous.

Why a tight interest rate stance cannot undo the negatives of previous loose stance

According to Ludwig von Mises a tight monetary stance cannot undo the negatives of the previous loose stance. The misallocation of resources due to a loose monetary policy cannot be reversed by a tighter stance. According to Percy L. Greaves, Jr. in “The Causes of the Economic Crisis and other essays before the Great Depression” – Mises Institute- Books/ Digital text

Mises also refers to the fact that deflation can never repair the damage of a priori inflation. In his seminar, he often likened such a process to an auto driver who had run over a person and then tried to remedy the situation by backing over the victim in reverse. Inflation so scrambles the changes in wealth and income that it becomes impossible to undo the effects. Then too, deflationary manipulations of the quantity of money are just as destructive of market processes, guided by unhampered market prices, wage rates and interest rates, as are such inflationary manipulations of the quantity of money.

A tighter interest rate stance, whilst likely to undermine various bubble activities is also likely to generate various distortions thereby inflicting damage to wealth generators. Note that a tighter stance is still intervention by the central bank and in this sense; it falsifies the interest rate signal. A tighter interest rate stance does not result in the allocation of resources in line with consumers’ top priorities. Hence, it does not follow that a tighter interest rate stance can reverse the damage caused by inflationary policy. Now, if we were to accept that inflation is about increases in money supply then all that is required to erase inflation is to seal off all the loopholes for the generation of money out of “thin air”. A careful scrutiny of this is going to discover that the culprit behind the increases in money supply is the monetary policies of the central bank.

These policies that aim at stabilizing price increases are in fact producing economic upheavals. Observe that by February 2021 the yearly growth rate of our monetary measure for the US jumped to almost 80%. Against the background of this massive increase, one should not be surprised that the yearly growth rate of the CPI has accelerated. Policies that aim at slowing the growth rate of the CPI rather than arresting the growth rate of money supply are likely to undermine economic conditions.

Conclusions

As long as life sustenance remains the ultimate goal of individuals, they are likely to assign a higher valuation to present goods versus the future goods and no central bank interest rate manipulation is likely to change this. Any attempt by central bank policy makers to overrule this fact is going to undermine the process of wealth formation and lower individual’s living standards. It is not going to help economic growth if the central bank artificially lowers interest rates whilst individuals did not allocate an adequate amount of savings to support the expansion of capital goods investments. It is not possible to replace savings with more money and the artificial lowering of the interest rate. It is not possible to generate something out of nothing. Likewise, by raising interest rates the central bank cannot undo the damage from the previous easy interest rate stance. A tighter stance is likely to generate various other distortions. Hence, what is required is let the market be completely free from the central bank tampering.