“The Earth speaks to us through the elements of nature. In every natural thing, we can find a hidden, powerful message.” Ralph Waldo Emerson

Every natural element to which the earth has been endowed has a usefulness – a purpose. If we listen to gold, one of the earth’s natural elements, its message is loud and clear – gold is money. To serve as natural money is gold’s highest purpose.

The advance of civilisation demonstrates that nature throughout the ages to our good fortune has provided everything humanity needs to progress, including money. Few today, however, understand money as it has existed from pre-history and was perceived up to the dawn of the twentieth century. Since the commencement of the First World War in 1914, time-honoured principles have been abandoned. Humanity has become enthralled with money-substitutes like national currencies and more recently, cryptocurrencies, circulating in place of money and has subsequently lost sight of natural money itself.

Although gold these days rarely circulates as currency because of government imposed restrictions and impediments, gold still retains all the features that explain why humanity in pre-history chose it to be money. Gold is natural money, or stated another way, nature’s money is gold, which is well illustrated by the following chart that presents the price of crude oil measured in four different currencies from a base of 100.

A gram or an ounce of gold buys essentially the same amount of crude oil today as it has anytime over the past seven decades. I have purposefully chosen oil because the energy it provides is essential to our standard of living, but other commodities have a similar result.

The price of manufactured products tends to fall over time because advances in technology lead to increasing efficiencies. An obvious example is computer chips, the price of which has fallen dramatically in recent decades, yet are still profitable to the companies that make and sell them.

Natural Money

Gold preserves purchasing power, which is one of the key requisites of money and an outcome that no national currency can match. As illustrated by the above chart, that desired result is achieved by gold alone.

Another requisite of money is the enablement of sound economic calculation, which is only possible when using a consistent, unchanging unit of account to measure prices over time. Gold serves this role perfectly because it is the only element in the known universe that is eternal and not subject to decay or degradation. A gram of gold today is identical to a gram of gold mined by the Romans.

Gold is Natural Money

Gold does not need management by a central bank or government. Gold is money that manages itself because of its inherent, natural features that fulfil the two requisites of money stated above, which explain why gold is accumulated. Commodities are consumed and disappear, but because it is money, all the gold mined throughout history still exists in its aboveground stock, except for the inconsequential weight lost in shipwrecks and from coin abrasion.

A gold stock of 297 tonnes is estimated(1) to have existed in 1492, when generally reliable record keeping of production and stocks began. That weight of gold when visualised comprises a cube of 4.3 feet (131cm) per side for a total of 79.5 cubic feet, which equals the volume of space encompassed by a small kitchen table.

Over the last 529 years the gold stock has grown at an average annual rate of 1.2% and now approximates a cube when visualised that would just about slide under the arches of the Eiffel Tower. Since 1950 the gold stock has grown 3.5-times in size, but a gram of gold still purchases the same amount of crude oil.

Growth of the Gold Stock

Over the centuries gold becomes harder to find and mine, yet its aboveground stock grows for long periods of time at approximately the same annual rate. But this growth rate has increased as civilisation and the standard of living advance from new technologies.

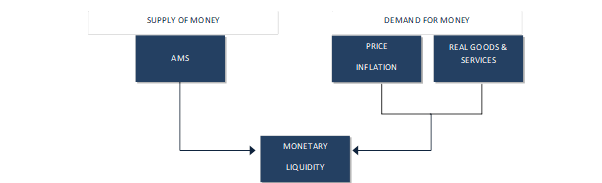

Prior to the Industrial Revolution and the benefits it introduced that improved production, the gold stock grew at the rate of approximately 0.6% per annum. Over the past century the gold stock has grown consistently year after year by about 1.8% per annum. During both periods the growth of the gold stock approximately equalled the growth rate of world population and new wealth creation. Consequently, the purchasing power arising from the interaction of gold’s supply – its aboveground stock – and the inelastic demand for gold that exists because it is money, make gold uniquely useful to accurately calculate the price of goods and services throughout time. It is a feature that the dollar and other national currencies fail to match because their annual growth rates are not consistent, causing fluctuations in their ‘aboveground’ stock.

For example, the annual growth rates of the stock – the total quantity – of dollars since 1960 varies from a low of 1% in 1993 to a high of 19.1% in 2020.(2) This inconsistency results in swings in the dollar stock that in turn causes volatility in prices expressed in dollars because there are not enough or too many dollars circulating relative to the prevailing level of economic activity. What is more, the growth rate of the dollar stock since 1960 has averaged 7.1%, which is 4-times greater than the average growth rate of the gold stock over this period. This more rapid increase in the dollar stock is debasing the dollar relative to gold, a reality clearly illustrated in the above chart of crude oil prices, which raises an important point.

The stock of dollars is controlled by the managers of the banking system. Recurring bank and currency crises throughout history result from human error and other human frailties that inevitably destroy fiat currency, like the unwillingness to ‘take away the punch bowl’ after a period of prolonged credit expansion. Growth in the gold stock occurs at a consistent rate because the cost of production is controlled by constraints imposed by nature.

Gold is not valuable because it is rare. Plenty of gold exists that has yet to be mined on land, under the oceans, and even extracted from ocean water when the technologies become available to make that mining possible. Gold is valuable because it is mined – produced – only when it is profitable to do so, which depends on how gold has been dispersed in the earth’s crust when combined with humanity’s ability, financial capacity, and available technology needed to discover, mine, and refine it. In contrast to the stock of national currencies, the gold stock is controlled by nature, which prevents the over-issuance of purchasing power. Nature imposes the discipline that prevents the punch bowl from overflowing, which is a key element explaining the fortuitous outcome of gold preserving purchasing power over long periods of time. The interconnection of the factors of supply and demand sets gold apart from national currencies as does their essential nature.

Gold is tangible; national currencies are an intangible financial promise with counterparty risk. This risk arises because promises do get broken as was demonstrated in the 2008 financial crisis and countless other banking and fiat currency crises that are a recurring event.

Gold is natural money that has served humanity well throughout history by enabling people to achieve an ever-higher standard of living. We can ponder whether this outcome results from gold being formed in the universe by fortuitous chance or by the intelligent design of a creator endowing the earth’s resources providentially to equip humanity with natural money. Regardless of its source, which is unknowable, it cannot be denied that gold is money and is as useful today as anytime in history.

(1) See https://www.goldmoney.com/images/media/Files/Old_GM_WP/theabovegroundgoldstock.pdf The research in that report is updated in Money and Liberty.

(2) See https://fred.stlouisfed.org/series/M2SL#0

Source: https://www.fgmr.com/natural-money/

Gold is natural money, yes, and has been the best money we could have for thousands of years.

But unfortunately, authorities found the “bug” in gold money and they exploited it. So successful was the exploit, that we now have pure fiat money for more than 50 years in a row worldwide.

People like me, way older than the average millennial, would have a hard time recognizing proper gold from some piece of lead with a nice golden coating. Most generations now have never used gold at all monetarily.

Fiat is going down the drain, but gold will not replace it. Or if it does, it will not be for long. The cat is out of the bag: Authorities have learn the hack and will apply it again, only faster this time:

Gold -> paper gold -> all is credit -> Fiat 2.0

The power of controlling the money supply is too big to ignore or resist. Even when that power means poverty, wars and disaster for the majority of the population, the non-rulers. Authorities thrive and grow their power enormously with money they can print for themselves almost at will.

To avoid being enslaved by fiat, the next money we need might not be natural, but must have the fundamental properties that gold had and a few more:

– Trust-less & easily verifiable. No central authorities or intermediaries required.

– Easy & cheap to custody. Expropriation resistant.

– Censorship resistant.

– Fast. Value can be transacted quickly and cheap directly, not as a an IOU.

– Deterministic Supply. Not bound to discoveries of new worlds, meteorites or ocean mining tech advances.