Advocates of sound money place much of the blame for inflation on bank credit. Do away with the creation of bank credit, they say, and the destructive cycle of boom and bust will be cured. But is this solution practical, and is it the real inflation problem?

It may be an inconvenient fact, but commodity prices prove to be far more volatile under a fiat currency regime than they ever where under sound money and fluctuations in bank credit.

Understanding bank credit possesses a new urgency, given that this cycle of its expansion appears to be ending and the fiat world is heading for a periodic credit contraction. This article details how bank credit is created, how it has evolved and its role in fostering economic progress. We look at the alternative of banks of deposit, their history, and their practicality as a replacement for banking as we know it today.

We must be clear that there is a difference between cycles of bank credit, which so long as they are moderate can be tolerated, and state-induced inflation of the currency, which can be expected to lead to a permanent loss of a fiat currency’s purchasing power. In this context, are proposals to do away with bank credit taking a sledgehammer to crack the wrong nut?

On this subject, the Keynesian and Austrian economists disagree fundamentally. The conclusion of this article is that bank credit is economically beneficial, but it is state intervention in one form or another which has made it not just a driving force for economic progress, but unnecessarily destructive as well.

Bank credit is central to our monetary system[i]

Understand that money is gold and nothing else. Everything else is credit. These words were spoken by John Pierpont Morgan in his testimony before Congress in 1912. This was not just his opinion; he was stating a legal fact. That some governments have banned private ownership of legal money and that all central banks now refuse to exchange their notes for gold does not change the legal position.

It is credit that interests us here. Officially, it comes in two forms. There are bank notes, today issued by central banks but formally issued by commercial banks. These notes are a liability of the issuer and appear on a central bank’s balance sheet as such. And there is bank credit, the liability of commercial banks in the form of customer deposits, checking, or current accounts. Unofficially, it also exists in shadow banking and further credit goes unrecorded between individuals.

Limited by their creditworthiness, credit among individuals is an important economic factor. A father might tell his son or daughter that he will fund him or her through university. That is credit. A local shop might offer an account for valued customers, allowing them to pay monthly or even quarterly, rather than as they spend. Wholesalers offer retailers the facility to pay for goods a month after delivery, or even more — that is credit. The examples in our daily life are numerous. These informal or non-banking arrangements are a large part of working society, greasing the wheels of personal and business relationships. All this goes unrecorded in the monetary statistics. Given the ubiquity of credit, would it be right to entirely ban banks, who formalise credit arrangements, from creating credit benefiting trade?

The whole economy revolves on credit. In accordance with Gresham’s law, people hoard gold coin and spend currency and deposits. Gold coin does not circulate, even under a gold standard, because people realise it is superior money to notes and deposit money. It is there as a backstop to credit — bank notes and deposit accounts.

So far, we can probably agree there is little contentious in these statements. When we take the subject further the disagreements arise. Gold should no longer be part of a modern monetary system, argue neo-Keynesians and most monetarists. Credit expansion is the source of our troubles, argue others, particularly the Austrians.

The Austrian tradition is exemplified by the writings of Ludwig von Mises and Friedrich von Hayek. Mises observed the effects of inflation in Europe after the First World War, and in particular his native Austria. He understood why the crown collapsed and knew the remedy. Since then, he wrote extensively about the business, or trade cycle, undoubtedly caused by a cycle of bank credit expansion and subsequent contraction. But in all his writings, collectively running to over 7,000 pages, he mentions “bank credit” surprisingly little. I have counted only nineteen references, some of which are in content summaries and footnotes.

His lecture to the Vienna Congress of the International Chamber of Commerce on May 1933 is typical, when he stated that “The cause of the exchange rate’s depreciation is always to be found in inflation, and the only remedy for fighting it is a restriction of fiduciary media and bank credit”. Mises is, of course, correct. But nowhere in his comments, so far as I can see, does he recommend a complete ban on bank credit — only its containment.

Hayek devised a triangle to illustrate to his students at the LSE the consequences of an artificial lowering of interest rates — the consequence of credit expansion. Again, it is logical for the followers of these great men to conclude that credit must be banned if the purchasing power of currency is to be preserved. But we must acknowledge that a wholesale currency collapse through continual and accelerating debasement, such as that which afflicted Austria in 1922, is an entirely different matter from a cycle of bank credit.

The purpose of this article is to see whether banning bank credit is practicable. The timing is propitious, since we appear to be on the verge of another bank induced slump, this time of such potential severity that it could threaten the future of banking itself. If bank credit expansion has an economic role that can be justified, then its replacement could end up being less beneficial, particularly if the state takes the initiative in establishing a different banking system. If it does, we can be sure it would be designed to serve the state more than the productive economy.

Is there a practical alternative to bank credit creation?

Neo-Austrians put forward a simple proposition. That is, they recommend the ending of bank credit with banking being split into banks of deposit, where banks act either as custodians, the deposits remaining the property of the depositors, or as arrangers of finance to distribute savings to businesses in need of investment capital — never both. The world of circulating media becomes free of bank credit and from all the problems that it has created.

Before we tackle the subject proper, we should ask whether this is the nut we need to crack. Cycles of expansion and contraction of bank credit have existed for as long as we have statistical evidence, and yet we are still here and have a better standard of living than our forebears. But Figure 1 shows the consequences for the purchasing power of the pound under a sound money standard — the gold sovereign in the United Kingdom, where the circulating media has been dominated by bank credit.

With a time-lag, the price effect of changes in bank credit under a gold coin standard led to significant fluctuations in the general price level, the consequence of the expansion and subsequent contraction of bank credit — credit-driven booms and busts. The length of time whereby bankers seem to forget the consequences of excessive credit expansion for their own operations is roughly ten years, a periodicity which still holds today.

In the nineteenth century, government economic policy was broadly to mind its own business and to let events take their course. Interestingly, these fluctuations diminished over the century, during which time the underlying trend of bank credit outstanding expanded significantly on the back of collective wealth, trade, and technological progress. Clearly, growing financial sophistication of credit markets was having a beneficial effect, particularly following the Bank Charter Act of 1844 which in its framing omitted to recognise the potential of bank credit to destabilise the gold-backed currency.

Therefore, a question is raised as to whether fluctuations in bank credit are the evil neo-Austrians believe? Could it be that the greater evil is central banking endeavours to intervene: attempts that turned into efforts to manage demand for bank credit though interest rate policies from the late 1920s onwards? If so, then the neo-Austrians’ preferred solution whereby no bank credit is created is not so urgent a remedy. But this has still led many of them to recommend banks of deposit as a replacement for banks dealing in credit.

The problem with banks of deposit

The practicality of banning bank credit is rarely considered. In the form of both notes and deposit liabilities it is 100% of our circulating medium, and notes issued by the Bank of England represent less than 3% of the total, the rest being funded by bank credit. In the US, Federal Reserve notes represent 10% of the total, with significant quantities of them circulating outside the US. Therefore, a move to deposit banking with banks acting as custodians would eliminate nearly all our circulating media. That would mean a collapse in GDP, which is not “the economy” as erroneously supposed, but the total of qualifying transactions recorded in credit. No credit, no transactions.

In the past, banks have been constructed on the deposit principal in Venice, Amsterdam, and Nuremberg, among others. Small in themselves, these places were the centres of foreign commerce and large quantities of foreign coin of all sorts and denominations circulated, mostly worn and clipped. In order to remedy the inconvenience presented, the authorities in these cities instituted banks of deposit into which merchants paid coin from everywhere. Merchants’ accounts were credited with the proceeds of the bullion valued by weight deposited, and depositors were entitled to withdraw new coin on demand.

These banks professed to keep all the coin and bullion deposited with them in their vaults but converted into standard coin. The merchants with accounts at these banks had to pay the costs involved. One convenience was replaced by another inconvenience. And despite the sanctity of their non-profit mission, the banks of deposit in Venice and Amsterdam eventually advanced large sums to their respective governments which led to their ruin.

The lessons from the past are clear. Banks of deposit performed a specific function which is not required today. Nowadays, maintaining metallic coinage is a function of the mint which can be stored in safe deposit boxes. We do not have clipped coinage. And even if a gold coin standard was to be reintroduced, coins would rarely circulate anyway. The loss of credit interest and the administrative costs borne by the depositors would make banks of deposit an unattractive proposition.

Banks of deposit are not banks in the true meaning of the word. They are trustees or custodians. And in the absence of bank credit, presumably they would be vaulting bank notes and to a lesser extent coin. Bank notes are central bank credit, whether or not they are exchangeable for coin. If deposit institutions are to be licenced as banks, perhaps they could digitise the process, backed one for one with an account at the central bank instead of storing notes.

Banks of deposit would not therefore remedy the inflation of bank notes, which would be likely to expand mightily to satisfy the absence of bank credit. And if the solution is to deposit bank notes against which to draw cheques, then this is the equivalent of having a bank account with the central bank.

Is this not what the Bank of International Settlements is working towards, with central bank digital currencies? A world without commercial banks? The principal of deposit banking without specie convertibility is the equivalent of the central bank operating as a bank of deposit in a fiat currency environment. In essence, it is the road to central bank digital currencies.

Let us stay with the deposit concept for the moment. With respect to the distribution of savings whose origin is not bank credit, we must consider the effect on interest rates, or the cost of borrowing for businesses seeking to produce goods and services. There can be no doubt that the severe contraction of circulating medium due to the absence of bank credit would drive up interest rates mightily. To demonstrate why, we can track this another way by looking at how interest rates changed as the circulation of credit increased under metallic money standards.

Before the importation of gold and silver from the New World, where usuary laws allowed the common rate of interest throughout Europe was 10% or more. Over the sixteenth and seventeenth centuries, the increased quantity of specie permitted an increase in trade. To provide associated services, banking facilities evolved on the back of it, notably by the London goldsmiths in the mid-seventeenth century. And with modern bookkeeping, particularly the double-entry system, came the ability of the goldsmiths and the banks that followed them to expand the quantity of credit offered to their customers. This expansion of credit meant that as trade expanded, so did the credit to facilitate it. Increasing quantities of credit led to a decline in the base level of interest rates, which in the mid-nineteenth century settled at about 3%.

While the whole credit system was anchored in specie (silver predominantly followed by gold), the long-term expansion of bank credit failed to undermine purchasing power. Nor did the decline in the base level of interest affect purchasing power either. It was fluctuations in the rate of expansion that was the problem, not credit itself. Bank credit is in fact indispensable. If it is to be done away with, there is no doubt that the contraction of circulating media would drive up interest rates at least to the levels that existed before the days of the London goldsmiths. To prevent this, central banks would either increase the note issue or bring forward their own digital currencies to offset the loss of bank credit. Currency debasement would merely accelerate.

The importance of credit to trade

Put simply, the evolution of goods or commodities typically progresses to consumption through the following hands:

- The grower, miner, or importer

- The manufacturer or processor

- The wholesaler

- The retailer

- The customer or consumer

The chain of four classifications of business which produce goods for the consumer does not get settlement until the consumer pays for them. Consequently, in the absence of credit these businesses must possess the means to pay their costs. Furthermore, at each step in the process the amount of ready capital required to cover costs increases with the value of the product. In practice, very few parties in this chain have the capital available to do so. It disadvantages new businesses which are even less likely to have the capital required up front. It would be catastrophic for any economy for trade to be so restricted.

There are two solutions. The first is for the grower, miner, or importer to give credit for goods to the manufacturer or processor and for him to give credit for to the wholesaler and so on by deferring payment. But these parties would still have to possess sufficient money to cover their own costs, because their suppliers are unlikely to see it as their function to advance extra credit over transaction values. Employees, in particular, will want regular payment of their salaries before their employer is in funds. Other than contractual terms setting out when payment is due, this solution is impractical on its own.

The second solution is to have formal credit facilities. Historically, they existed in the form of trade finance, bills of exchange, and access to bank credit. Money, as such, is never used. All commerce is settled through credit.

The customer’s payment for the end-product is satisfied by bank notes or by drawing down on his bank’s liability to him as a depositor. Bank notes are diminishing in importance, so it is increasingly bank credit. The customer obtains this credit through his earnings as an employee or from the profits on his business, paid to him by transfer of bank credit from his employer or his customers accordingly. Dividends and interest on his savings are also paid to him in bank credit.

The theory of banking

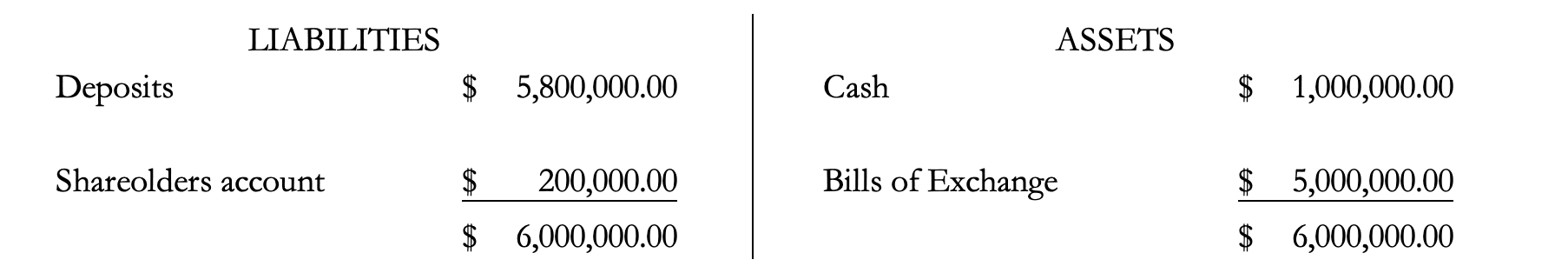

To understand how bank credit arises requires an understanding of the mechanics of banking. Banks are simply dealers in credit, taking in credit and creating credit. Suppose a banker’s customers pay in $1,000,000 into their accounts. This money or currency becomes the property of the bank. The banker credits the customers’ accounts in his books. In legal terms, he creates Rights of Action against himself which gives his customers the right to demand back equivalent sums at any time they please. His balance sheet then looks like this:

Some depositors might wish to withdraw funds at any time, for which the banker will keep a cash reserve. But others may wish to add to their accounts, and yet more depositors may open accounts. But in ordinary and quiet times, long-standing experience has shown that customer deposit balances in aggregate vary little day by day in the normal course of business. The old rule of thumb from the time of the London goldsmiths was that day-to-day deposit balances varied by not more than one thirty-sixth of the total.

For simplicity’s sake we will say the banker retains a cash cushion of $100,000. That leaves him $900,000 to trade and make a profit. It is commonly supposed that a banker employs this sum to lend to borrowers. That is incorrect. He will argue that $900,000 will bear liabilities several times that amount in credit. The easiest way to illustrate the mechanics is to assume the banker buys commercial bills. Let us assume he buys these bills in the market at a discount rate of four per cent. Let us further assume he buys $5,000,000 of them at a cost of $4,800,000. His books will then look like this:

A banker buys commercial bills, makes loans, even invests in financial securities with his own credit, by creating credit in his own books. The balance of $200,000 is his own property, or profit. By this process, he has not gained 4% on the $900,000 with which he is free to trade, but 4% on the $5,000,000 bills he has bought.

In practice the market for commercial paper is very liquid, and it does not have to be held to maturity. Considerably less cash liquidity against deposit withdrawals need be held in our example. And if the bank creates loans to customers instead of buying financial assets, the margins can be expected to be greater.

Thus, by its nature a bank is a dealer in credit, creating and issuing it payable on demand. And the bank’s credit circulates as if it was the currency. Therefore, a bank is not, as people think, a business for borrowing and lending. It is a credit factory. It is literally a licence to print the equivalent of money, in the form of credit.

Credit, not gold gave us the industrial revolution

The golden age of industrial development was achieved at a time of widespread adoption of metallic coin standards. Britain went on a formal gold standard in 1817 and remained so until 1914. Even while silver set the standard, the first gold coins in England were issued in the reign of Edward VI, in 1553. The standard of sterling silver was fixed by William the Conqueror in the eleventh century.

For many centuries after the conquest, England was a feudal and military power with an agricultural population. Its laws were almost entirely feudal, relating to the tenure of the land. Merchants and commerce were held in low esteem and commercial law didn’t exist. Eventually, in the reign of Charles II men began to devote themselves more to industry and commerce, and this was made possible by the development of banking.

The invention of bank credit emerged with the London goldsmiths in the mid-seventeenth century. From the storage of bullion, specie, and valuables a profitable business arose whereby the goldsmith would buy a depositor’s assets from him in return for a credit note (a Right of Action against himself) repayable on demand and the promise that the goldsmith would pay 6% interest. The goldsmith had bought bullion and specie on credit, which he then used to buy commercial credit, which at that time had a benchmark yield of 10%. Trading off his own credit, he soon discovered that if his own credit was acceptable in the market, he was able to buy multiples of discounted bills — bills of exchange, real bills, and accommodation paper maturing at short intervals thereby allowing the goldsmiths to meet claims from their depositors and make a healthy profit. This enabled merchants who received bills in exchange for goods to find a market where they could immediately convert their bills payable at a future date into ready money.

The availability of this finance improved the business of merchants, which in turn increased trade generally. Admittedly, when this expansion of credit funded speculation instead of trade it led to crisis, England’s South Sea bubble in 1720 being the obvious example. But bank credit also financed the industrial revolution through its phases from canals to railways and led to Britain dominating the world’s shipping — over 80% of ships afloat before the First World War were built in British shipyards. It led to this small nation developing the most powerful and advanced economy ever seen. And gold was not involved, other than remaining in the background underwriting the whole credit system.

The origins of overdraft lending

There is a little-known source of the creation of bank credit which was of great commercial benefit, and that was a mechanism deployed by the Scottish banks. By expanding bank credit from the financing of trade by purchasing discounted bills — which in our history of banking has been our topic so far, access to credit for entrepreneurial activity became the basis of much of today’s banking activities.

Under Scottish law, the Bank of Scotland was founded in 1695 with unlimited powers of issue. It only issued bank notes in the following denominations: £100, £50, £10, and £5. It should be borne in mind that in today’s currency, £100 was the equivalent of £36,000.[i] Clearly, the Bank of Scotland’s plan was to service and foster significant trading customers in line with banking in London, which was directed principally at dealing in discounted commercial bills. The bank did not issue £1 notes until 1704.

Its monopoly expired in 1727 and a rival, the Royal Bank of Scotland was then formed. The problem then was that with the economy being commercially undeveloped, there were not enough commercial bills available in Scotland to satisfy both banks. It was the Royal Bank which came up with a solution.

On receiving sufficient guarantees, it agreed to advance credit in limited amounts in favour of trustworthy and respectable persons. These cash credits are drawing accounts created in favour of a person who pays in no money, which he operates as an ordinary account; except that instead of receiving interest on the balance he is charged interest. On the bank’s balance sheet, a cash credit loan was logged as an asset, balanced by a deposit representing the amount available to be drawn down.

It was the forerunner of modern bank lending, as opposed to banking which in London at that time revolved round discounting commercial bills.

Cash credits were applied in two different ways: to aid private persons in business, and to promote agriculture and the formation of commercial business of all types. Agricultural land was under-developed for lack of capital. But what particularly interests us here is loans to individuals in business.

The banks limited their advances to anything between £100 and £1,000 (the equivalent in today’s sterling of about £36,000 and £360,000. No collateral was required, other than sureties from persons familiar with the borrower. These “cautioners” as they were known in Scottish law, would keep a close eye on how the funds were invested, always had the right to inspect the borrower’s account at the bank, and had the authority to intervene at any time. In evidence given to a House of Commons Committee in 1826 almost a century after the Royal Bank of Scotland created them, one witness cited the case of a modest country bank offering cash credit facilities which over twenty-one years turned over £90,000,000 and only suffered losses of £1,200.

Prior to the existence of banks offering cash credits, Scotland was a backward country whose people were more employed in cattle rustling and warring with neighbours than peaceful agriculture. Above all, there was a lack of money and only a subsistence existence. The creation of the cash credit system together with the circulation of Bank of Scotland and Royal Bank notes, which were accepted as if they were money, led to enormous progress. As the cash credit system became established, it was expanded for financing larger projects. The Forth and Clyde Canal was built on a cash credit of £40,000 granted by the Royal Bank. Railways, docks and harbours, roads, even public buildings were financed by cash credits.

As one example of many, Henry Menteith served twice as Lord Provost of Glasgow and subsequently the Member of Parliament for Linlithgow. He started in business as a merchant-weaver with a modest cash credit. And by 1826, Menteith employed 4,000 men and women.

The Scottish enlightenment of the eighteenth century, giving us David Hume, Adam Smith, Robert Burns and all many other luminaries owes its existence to the transformation of Scotland from a backward nation by cash credits. In only fifty years, Scotland advanced commercially as a nation more than it had done in its entire history.

The success of cash credits and the wider adoption of their equivalent by credit unions and other organisations on a local basis in England and Wales subsequently became not only the basis of some notable fortunes but also the foundation on which many more modest businesses thrived. There is no doubt that the evolution of bank credit from Scotland’s cash credit system has been beneficial, not only to Scotland but to the wider United Kingdom. And the global adoption of English banking law has transmitted the benefits to other civilised nations as well.

It is the destabilising cycles of bank credit expansion and contraction which is the problem, not the existence of bank credit, which is unquestionably a public benefit.

Bank credit in today’s financial environment

Clearly, bank credit played a pivotal role in the economic progress which transformed the British Isles from feudalism to an industrial society. The same is surely true of every other European economy and those of North America as well.

Despite the obvious cycle of credit expansion and contraction, which led to successive booms and busts and consequential inflation of prices and their deflation, the world is a far better place on the back of bank credit. This is certainly the case where bank credit expansion provides the means for economic progress, as opposed to speculation. There can be no doubt, though contemporary accounts make little or no reference to it, that the expansion of bank credit fuelled the South Sea bubble three hundred years ago, and it was used by John Law to inflate his Mississippi bubble.

The South Sea bubble differed from Mississippi in an important respect. It was a child of commercial banks, principally the Sword Blade Company which operated as the promoting institution in the private sector. John Law colluded with the Duke of Orleans, Prince Regent for the young Louis XV. The Mississippi bubble was essentially a state project, with Law turning his bank into a prototype central bank, managing the market for his stock. Being non-government in origin and with the Bank of England not involved, the South Sea bubble did not take the currency down with it. The Mississippi bubble did.

This is why it is important to draw a line between the cyclical creation of bank credit and the creation of credit as a consequence of government policy. The former is always self-correcting, while the latter might not be.

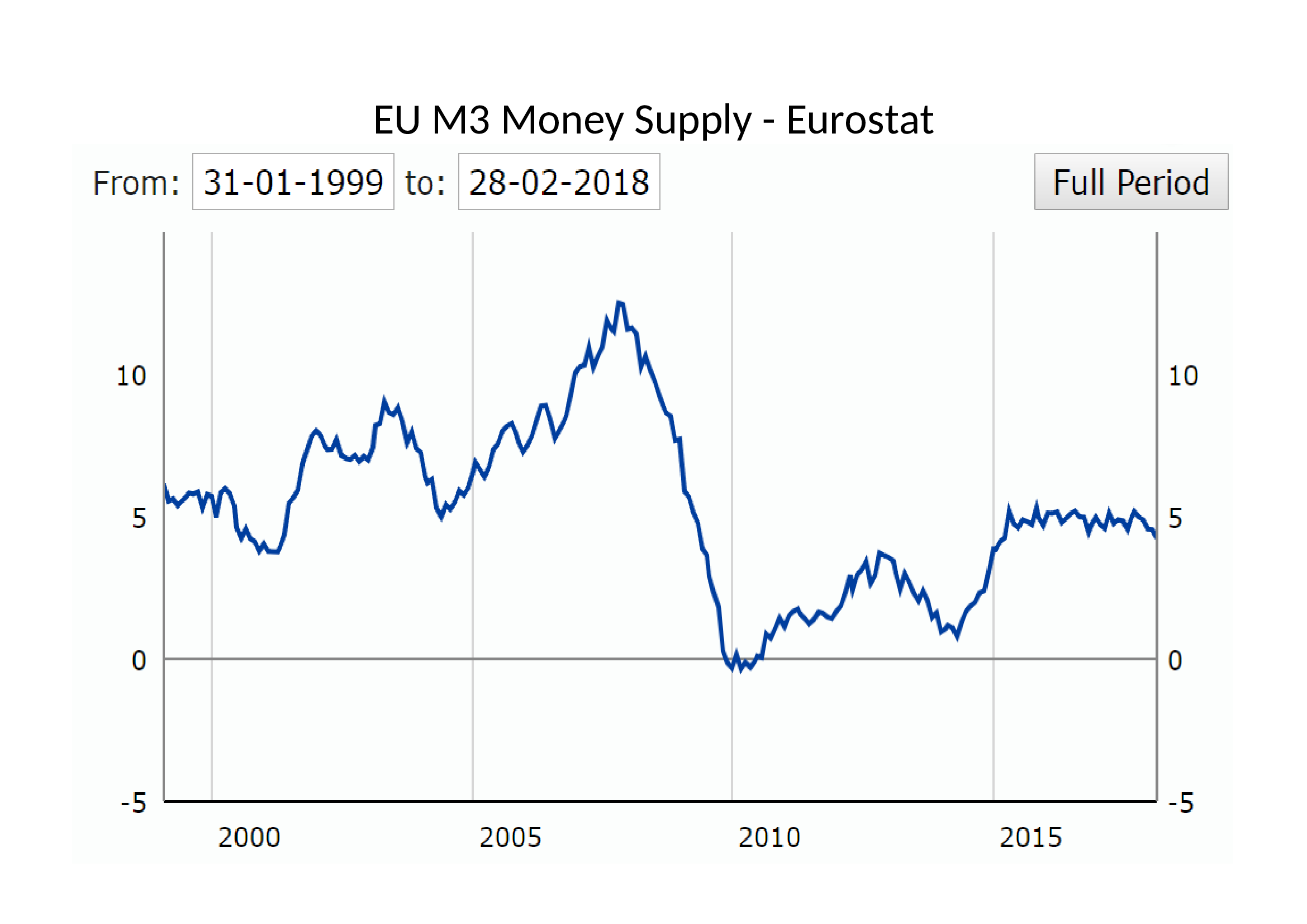

In recent decades, the expansion of bank credit has had more in common with John Law’s Mississippi venture than Britain’s South Sea bubble. As a deliberate act of government and central bank policies, the expansion of bank credit has been increasingly focused on financing financial speculation instead of genuine production. Directed by legislation, monetary policies, and banking regulation, commercial banks have fuelled a world-wide asset bubble. Led by central bank monetary policies, they have been complicit in the John Law experience but on a global scale, rather than a repeat of the South Sea bubble.

Just as the Mississippi bubble took down John Law’s fiat livre, this bubble threatens to take down entire currencies backed by nothing more than public faith in them.

The responsibility is more with central bank management of markets than commercial banks themselves. Historically, at the top of the bank credit cycle the ratio of a bank’s balance sheet assets to shareholders’ funds approached ten, or perhaps twelve times. In the Eurozone and Japan, their global systemically important banks (G-SIBs) now have leverage ratios of twenty or more times. Looking at all the G-SIBs in different jurisdictions, we see that the more suppressed interest rates have been by the central bank, the higher the leverage.

The reason is not difficult to deduce. Negative rates in the Eurozone and Japan have forced banks to increase their leverage to maintain profitability because their lending margins have been badly squeezed. The phenomenon has been worsened through banking regulation, which accords risk-free status to government debt, discouraging banks from lending to commercial enterprises on the basis of supposed risk. Furthermore, nowhere in the Basel regulations do we see an attempt to limit the ratio of assets to equity, focussing instead on balance sheet liquidity.

The errors in bank regulation are substantial. Instead of letting bankers run their own businesses as they see fit and by suppressing interest rates in the interest of financing government spending, the looming bank credit crisis and its unprecedented likely scale has been brought upon us substantially by state intervention.

The role of gold

We saw that Britain’s gold coin standard in the nineteenth century did not stop bouts of price inflation, but they always corrected fully. And as shown in Figure 1 above, over a century of bank credit expansion the net result was no inflation at the general price level at all. Despite the expansion of bank credit through its cycles over time, why an effective gold standard imparts stability to a currency’s purchasing power deserves further comment.

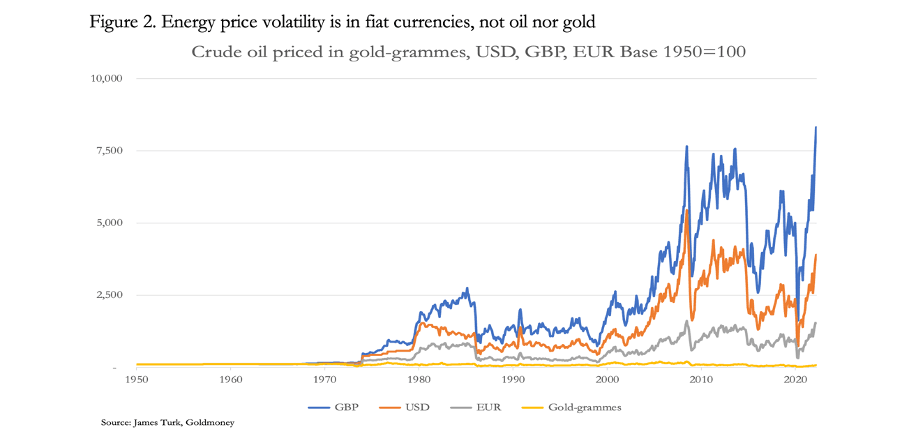

We have seen that cycles of bank credit predictably affect prices. So long as there is public confidence in the currency, its purchasing power will vary inversely with changes in the quantity of currency and credit extant. What is excluded is a situation where the public begins to look at the currency not only as the objective value in transactions, but subjectively in relation to sound money. So long as a currency is on a gold coin exchange standard, this is not a problem. But in the absence of a credible sheet anchor a currency’s true subjectivity becomes exposed. Figure 2, of the oil price in dollars, pounds, euros, and gold illustrates the point.

Since 1950, the oil price in gold has actually fallen 30% over seventy-two years. Volatility has been insignificant compared with that of the oil price measured in the three major fiat currencies. There can be no doubt that if they were anchored to a gold standard, the volatility of the oil price in these currencies would be minimal. Charts illustrating a wide range of commodities comparing their prices in gold and fiat currencies tell the same story.

From the chart, we can see that before the end of Bretton Woods in 1971, there was very little volatility in oil prices, confirming the point. Even though the link between dollars and gold was somewhat tenuous, it was enough to stabilise the oil price in dollars, sterling, and the German mark (which is proxy for the euro in this chart before the euro replaced it). That ended with the introduction of the petrodollar in 1973.

The only valid interpretation of this chart is that following the ending of Bretton Woods the volatility is not in the oil price but in the currencies themselves. Furthermore, what volatility there has been in oil priced in gold is probably partly attributable to disturbances emanating from the currencies, and from deliberate attempts from time to time to suppress the gold price. The interference in the gold price notwithstanding, these currencies are not acting as they should in pricing relationships.

It also explains an argument made by von Mises about why monetarism fails to capture the relationship between changes in the quantity of a currency and their effect on prices. Mises argued that the monetarists ignored a potentially more powerful force in the relationship: shifts in the general level of currency and credit liquidity held by the population compared with ownership of goods and services. To illustrate the point, if the general public decides en masse to reduce their ownership of currency and credit to a bare minimum by exchanging them for goods, it will drive the purchasing power of the currency to virtually nothing because it has been effectively rejected by its users.

So long as a currency is backed credibly by gold, this will not happen. The worst case is the public simply sells gold substitutes and buys gold, testing the standard. But it is a fatal danger for any fiat currency if the public decides to reject it. This is a far more potent force in the relationship between a fiat currency and its purchasing power than that expressed by the quantity theory of money. Following 1973, variations in the public’s acceptance of its national currency explains the volatility seen in Figure 2, the implication being that fiat currencies are much more unstable than generally recognised.

This being the case, the inflationary consequences of fluctuations in bank credit are a relatively minor issue. And comparing the charts in Figure 1 with Figure 2, the fluctuations of prices in nineteenth century England were minor compared with those seen since the ending of Bretton Woods.

Resolving the bank credit problem

We can see that it is very difficult to do without bank credit. And in current circumstances, this is tacitly admitted by those who hanker after a deposit banking system, where banks act as custodians. Instead, they talk of a resetting of the system, probably after a crisis which awakens us all to the evils of bank credit. But I would hope that patient readers who have travelled this far will understand why the absence of credit, bank or otherwise, is virtually impossible and undesirable. Indeed, if only gold and its bank note substitutes circulated to the exclusion of bank credit, the descent of interest rates from the ten per cent level at the time of London’s goldsmiths would be reversed due to the shortage of circulating media. And that’s even assuming the purchasing power of money is maintained.

It is these considerations that have led me to believe that even after the much-vaunted financial crisis that is now widely expected, bank credit should continue to be permitted. After all, it is a more organised form of credit than the alternative ad hoc arrangements between individuals. But banks should be on a similar footing to those giving personal guarantees.

Accordingly, in a post-crisis reset limited liability for banks and their shareholders should be rescinded, which would almost certainly restrict the leverage ratio of assets to owners’ equity. It can also be expected to reverse the trend of joint stock banks getting larger and larger. It should lead to a more fragmented banking system less focused on creating credit for purely financial activities. Sound banking, more in the line of Scotland’s cash credit system modernised for today’s environment, directing bank credit for productive use is a far better and more practical alternative to the neo-Austrian solution, which is to do away with bank credit entirely.

[i] In this article for the historical and legal background, I have drawn on the writings of Henry Dunning Macleod (no relation) who in the late nineteenth century was the leading expert on English banking law.

[ii] This estimate is based on the current value of the gold sovereign, which is £360.

The problem is not that credit exists, but that under the fiat standard is compulsory.

Gold made credit convenient even for use cases that credit is not fit for, like holding your savings.

Gold is expensive to move and custody, it tends to centralization because keeping 1 ton of gold safe is not 1000 times as expensive as keeping 1kg of gold safe. So people end up letting gold be guarded by banks and, over time, became used to exchange paper claims of gold for their daily transactions.

The problem is, once you put your money on the bank you have lent it to the bank. It is no longer yours, and this is NOT a legal matters, is a practical one:

Not your vault, not your gold.

Once all gold is in banks, it is subject to the fractional reserve and credit expansions, booms and busts.

The key problem of fractional reserve is not whether it should be legal, or how much percentage of backing is allowed. The problem is that under the gold standard regular people have a very hard time escaping from their savings been diluted by fractional reserve banking.

Gold makes credit TOO convenient.

Once all gold is in banks, it can be confiscated. And if something can happen that will be advantageous for the authorities, it will happen. And so it did.

Note that gold cannot come back as an standard again because authorities would have to “promise to be good and never confiscate gold again”. That’s not going to happen, gold would be confiscated again and again.

Once gold got confiscated by authorities, it was just a matter of time their power seeking incentives would leve them to detach from it completely. Once people was no longer used to exchange paper claims for actual gold, that was an easy step to take (in 1971).

In the fiat standard the situation with credit is even worse that under gold: Regular people have No escape from savings dilution. If they keep the paper claims those will be inflated away by the central bank. If they deposit it in banks, both inflation and fractional reserve will dilute and put them at risk.

Fiat makes credit compulsory.

What is the solution?

The solution is to find a new form of sound money, that fixes the “bug” in gold and prevents it to be “hacked” by authorities the way gold was.

It needs to be money with a very deterministic supply, easier to keep scattered than centralized, so banking services are OPTIONAL and almost impossible or impractical to confiscate.

By deterministic money supply I mean, none decides or changes the money supply:

Humans cannot be trusted with the money supply.

Regarding credit, such a new form of money will not make credit extinct, but it would it make it OPTIONAL again.

On top of that, if such money could provide “Proof of Reserve” it would allow Banking services that can prove are NOT using Fractional Reserve. People that are not holding the money themselves or on an entity that provides Proof of Reserve should KNOWN they have effectively lent their money to a 3rd party.

On such money foundation, credit will still exist. Prosperity like in the good days of the gold standard, before it got hacked, would return.

The key thing here is that technological limitations on what is or is not actually possible (such as proof of reserve and personal custody) ar far more important that legal limitations which are subject to authorities decisions.