By Dr Frank Shostak

By a popular view, a strengthening in the stock market i.e. a general increase in the stock prices is considered an important factor in providing support to the economy. We suggest that this is a questionable observation. We hold that an increase in the supply of money relative to the demand for money also labelled as the monetary liquidity is a major driver of the stock prices. We are of the view that the heart of economic growth is the expanding pool of savings and not the state of the stock market. Here is why.

Monetary liquidity the price of assets and the pool of savings

Note that the increase in liquidity does not enter all asset markets instantaneously. It enters various markets sequentially. Now, the price of an asset is the amount of money paid for the asset. When money enters a particular asset market, there is now more money per unit of the asset. This means that the price of the asset in this market has gone up. After a time lapse, once investors adopting the view that the asset price is overvalued, they move the monetary liquidity into other asset markets. Hence, we can establish that there is a time lag from changes in liquidity and changes in the average price of assets.

Note that the increase in the momentum of asset prices including the momentum of the prices of stocks is driven by the increase in liquidity. Conversely, we can suggest that a decline in liquidity after a time lag results in the decline in the momentum of the prices of stocks.

Can an increase in investors’ optimism, because of the increase in the prices of stocks, cause a further strengthening in the stock prices? In the absence of increases in the monetary liquidity, an increase in the prices of stocks is going to divert liquidity from other assets thus pushing the other asset prices momentum lower.

Could a strengthening in the stock prices become a facilitator for the strengthening of the economy? For this to occur increases in the stock prices should be able to cause an expansion in the economy’s production structure, which would enable the increase in the production of goods and services.

According to Mises,

Stock speculation cannot undo past action and cannot change anything with regard to the limited convertibility of capital goods in existence.

Hence, when experts suggest that a particular factor is an important driving force in lifting the economic growth, one needs to examine the factor’s relation to the pool of savings. Does the factor provide support or undermine this pool? Following this reasoning, we can suggest that a rising stock market does not expand the pool of savings and therefore cannot generate an economic growth.

What about the view that, a stronger stock market makes individuals more optimistic about the future. This in turn, it is assumed, strengthens the demand for goods and strengthens the economic growth.

It is however not individuals’ psychological disposition that determines whether their demand can be fulfilled but whether they possess an adequate amount of means. I can be very optimistic about the future however; if I do not have enough means, I will not be able to obtain the goods I desire. Improved psychology can do very little in lifting economic growth without the support from the pool of savings.

Furthermore, we suggest that monetary policies both loose and tight undermine the pool of savings and this in turn undermines the process of wealth generation and economic growth.

Notwithstanding the popular view that increases in the money supply can help growing the economy, money cannot do such things. More money cannot replace savings that sustains individuals in the various stages of production. On this Rothbard held that

Money, per se, cannot be consumed and cannot be used directly as a producers’ good in the productive process. Money per se is therefore unproductive; it is dead stock and produces nothing.

Note that the increase in the pool of savings permits the improvement of the infrastructure and this in turn enables the strengthening in the economic growth. Again, the improvement in the infrastructure can take place because of the increase in the pool of savings. Hence, anything that weakens this pool undermines the prospects for the economic growth. The heart of the economic growth then is the pool of savings also known as the subsistence fund.

According to Richard von Strigl

Let us assume that in some country production must be completely rebuilt. The only factors of production available to the population besides labourers are those factors of production provided by nature. Now, if production is to be carried out by a roundabout method, let us assume of one year’s duration, then it is self-evident that production can only begin if, in addition to these originary factors of production, a subsistence fund is available to the population which will secure their nourishment and any other needs for a period of one year……..The greater this fund, the longer is the roundabout factor of production that can be undertaken, and the greater the output will be. It is clear that under these conditions the “correct” length of the roundabout method of production is determined by the size of the subsistence fund or the period of time for which this fund suffices.

Increase in the money driven stock prices and wealth

Some commentators are of the view that the strengthening in the stock market because of the easy monetary policy of the central bank increases individuals’ wealth. The increase in wealth in turn provides support to the overall spending in the economy and this in turn strengthens the overall production of goods and services i.e. the economic growth.

We suggest that a strengthening in the stock market because of easy monetary policy cannot strengthen the overall wealth in the economy. On the contrary, the loose monetary policy weakens the process of wealth generation by weakening the pool of savings. The increase in the money supply because of easy monetary policy of the central bank sets in motion an exchange of nothing for something. This amount to the diversion of savings from wealth generators to non-wealth generating activities i.e. bubble activities.

Central bank policies cause investors to commit erroneous decisions

We suggest that in the framework of the market selected money such as gold and in the absence of the central bank the increase in the stock market is going to reflect the increase in the pool of savings and thus economic growth. Note however that a strengthening in economic growth is not because of the increase in the stock market but because of the increase in the pool of savings. The increase in the stock market is in response to the increase in the pool of savings that also drives the economic growth higher.

Note again, that in the framework of the market chosen money and without the central bank the increase in the pool of savings is going to be mirrored by the strengthening in the stock prices. We suggest that the emergence of the bull-bear markets in the framework of the present monetary system is in response to the central bank monetary policy that sets in motion the menace of the boom-bust cycles.

Again, any monetary policy whether easy or tight by the central bank is bad news for the process of savings generation. The central bank policies curtail investors ability to distinguish wealth generating activities from non-wealth generators i.e. bubble activities. This in turn results in erroneous investments decisions.

By not being able to identify genuine wealth generators investors are in fact becoming gamblers with the stock market seen as a casino. Again, the chaotic state of the stock market is because of the tampering of the central bank with financial markets. This makes it harder for investors to identify wealth generators versus bubble activities.

Various theories such as the Efficient Market Hypothesis (EMH) suggest that it is futile for investors to attempt to identify wealth generators versus non-wealth generators. In fact, one of the pioneers of the EMH Burton Malkiel has even suggested that

A blindfolded monkey throwing darts at a newspaper’s financial pages could select a portfolio that would do just as well as one carefully selected by the expert.

Conclusions

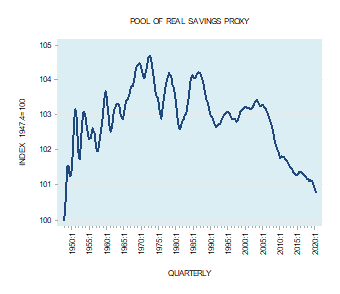

By a popular thinking, a strengthening in the stock market is an important factor in providing support to the economy. We suggest that this is questionable. In the framework of the gold standard without the central bank and without the boom-bust cycles there is going to be an ongoing strengthening in the savings generation process. The increase in the pool of savings in turn is going to drive the economy and the stock market. Note that without the improvement in the infrastructure irrespective of the state of the stock market it is not possible to strengthen the economy. We are of the view that in the absence of the boom-bust cycles the stock market is likely to follow an uptrend. We hold that the disruptive fluctuations of the stock market labelled as the bull-bear market is a result of the monetary policies of the central bank. These policies undermine the savings generation process and in turn the stock market.

Indeed. All the stock market is a proxy for is the increase in the value of the underlying businesses. The value of a stock being the discounted cashflow of it expected future returns. In other words business firms are there to trade and if they are successful at that their owners get richer as their firm is more valuable having greater potential future cashflows,

The real distorter of those returns is ‘inflation’ – and we all know what that is don’t we?