This article points to the factors driving sterling gilt yields higher. They are likely to lead to a sterling crisis as foreign selling gathers pace of gilts acquired since 2018. Before interest rates began to rise, foreign buyers had enjoyed higher gilt prices which more than offset losses on sterling. That is no longer the case.

Instead, there is growing disaffection with the Bank of England’s performance and perhaps a realisation that a general election in only 18 months’ time introduces political risk.

This article explains the consequences of denying Say’s law, otherwise known as the law of the markets, and by pursuing interest rate policies which have been disproved as a means of controlling inflation. Furthermore, it will be increasing shortages of bank credit which drive interest rates and bond yields higher, not central bank policies.

These are factors which affect all currencies allied to the dollar. The difference between the dollar and sterling is not so much to be found in broad policy dissimilarities, but the lower levels of foreign confidence in sterling as a currency in uncertain times.

Introduction

Of the four major western alliance currencies, only one shares its underlying economic characteristics with one of the others. In this respect, sterling is the poor man’s dollar. While financial headlines have focused on the dollar, sterling has been side-lined. But this is now changing.

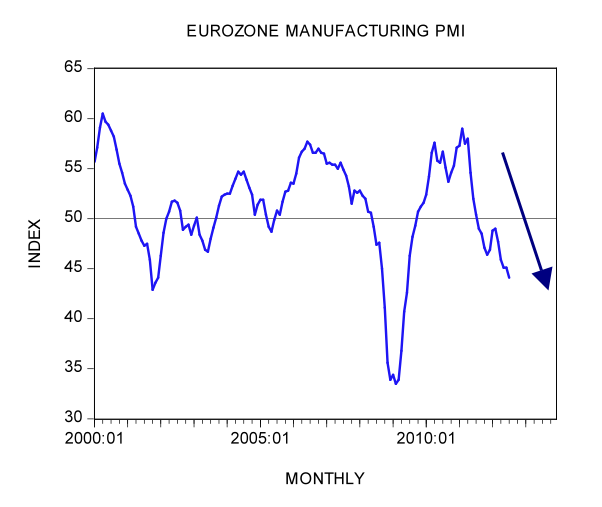

After a period when the 10-year UK gilt yield was significantly less than that of the equivalent US Treasury bond, the former’s yield is now racing ahead as the chart below shows.

It is worth observing that the sudden increase in the gilt yield takes it back to similar levels when the market reacted badly at the time of the Truss administration’s budget, the reaction to which created a crisis for pension funds forcing them to liquidate gilts at any cost to meet margin calls. The return of gilt yields to those levels is therefore a warning not to be ignored. But instead of UK pension funds in crisis, we must turn our attention to international investors, thought to have invested about £200bn in gilts since 2018, but already turning net sellers if the rise in yields is anything to go by.

This loss of foreign appetite for gilts in currently echoed in US Treasuries. Conventionally, global investors regard US Treasury bonds as the risk-free investment against which all others are measured relatively by yield premiums. But that only really applies at times of crisis when a combination of yield and currency relative to the dollar together reflect a flight to safety. At other times, individual central bank interest rate policies can dominate bond pricing.

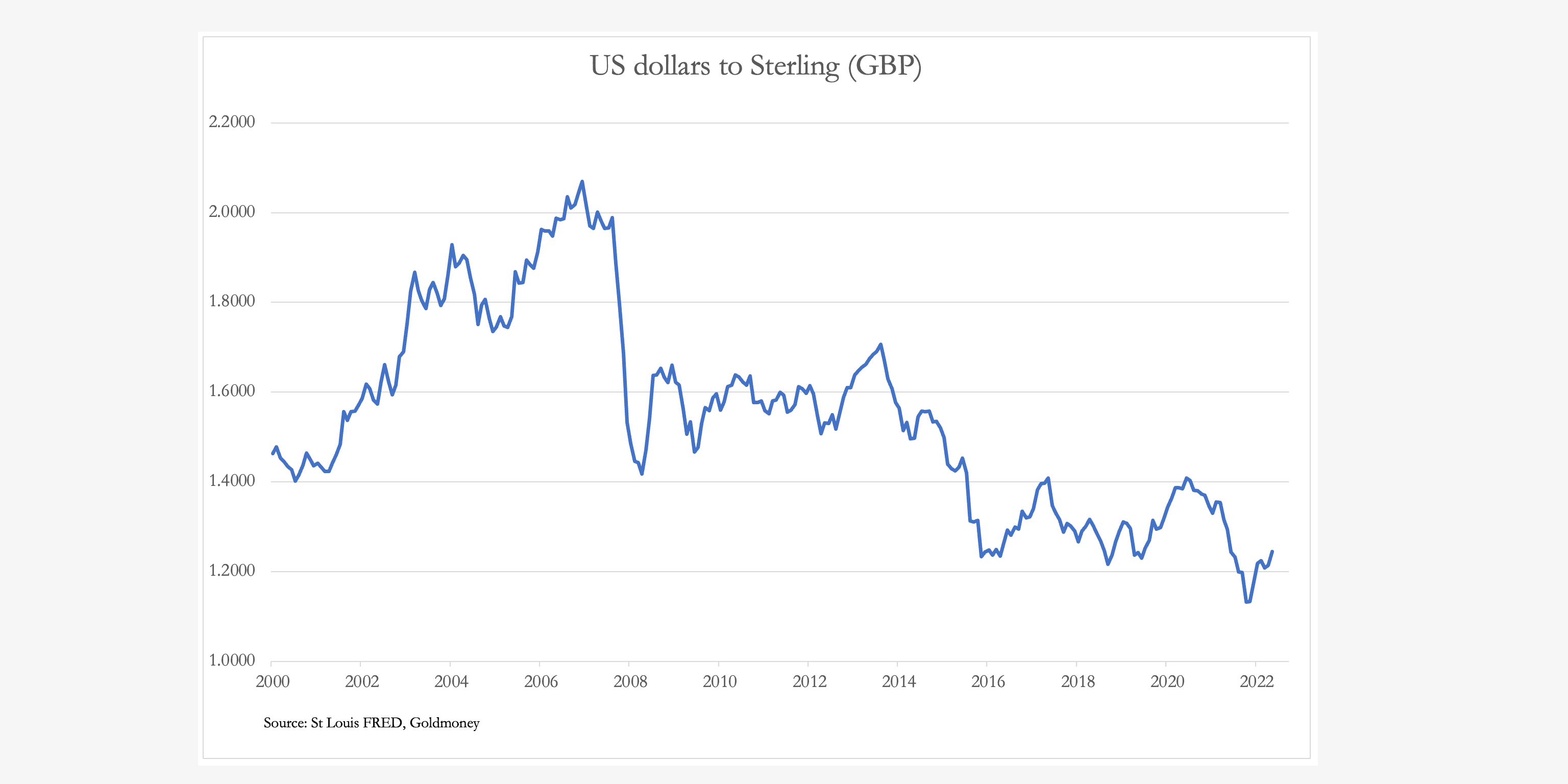

To complete the comparison between bond yields in the UK and the US we must therefore look at changes in the sterling/dollar exchange rate as well. This is our next chart.

Before the last combined banking and financial crisis in 2008, sterling had rallied strongly against the dollar. When the crisis struck, sterling lost all gains made since the year 2000 when it peaked at over $2.000, taking it back to $1.4000. Now that we appear to be in the early stages of another US banking and financial crisis, a question over the future course of sterling arises in potentially similar conditions.

Until covid struck in 2020, international holders of sterling and sterling securities had patiently absorbed a combination of lower bond yields and gently declining currency values relative to the US “risk-free” alternative. Since then, while sterling has continued to decline, the yield discount on gilts relative to US Treasuries began to narrow, and since January this year has turned into a sharply rising premium. The least one can say about this turn of events is that whatever reasons foreign holders of gilts had for accepting the British authorities’ cool aid in recent years, they have now evaporated.

To complete the graphic evidence, we must now observe the dire state of the US Government’s own finances by looking at how its borrowing costs are now soaring out of control.

Clearly the US Government is mired in a debt trap, whereby even if the pace of government spending slows as current debt ceiling negotiations are attempting to achieve, interest expense will drive the US Government deeper into insolvency. It is not a question of if this will happen but simply of when — unless a cohesive argument for significantly lower interest rates can be made.

There are further elements to this debt trap which must be observed. Commercial bank credit is in the early stages of contracting. Without massive monetary expansion by the Fed, mathematically that can only lead to a contracting GDP. The US Government’s mandated welfare costs will increase accordingly and tax revenues will decline. Furthermore, by creating a shortage of available liquidity, contracting bank credit will increase borrowing costs for American businesses and consumers, because banks will demand higher lending margins. And this is something beyond the Fed’s control. Therefore, with the outlook being for even higher interest rates, the cost of US Government borrowing will increase accordingly.

The UK’s debt trap differs in its make-up to that of the US but is no less deadly. Being longer in average maturity the UK government’s debt interest problem may not be so urgently a problem, and relative to GDP total government debt is lower than that of the US. But against these positives, the higher level of the overall yield curve is to be reckoned with.

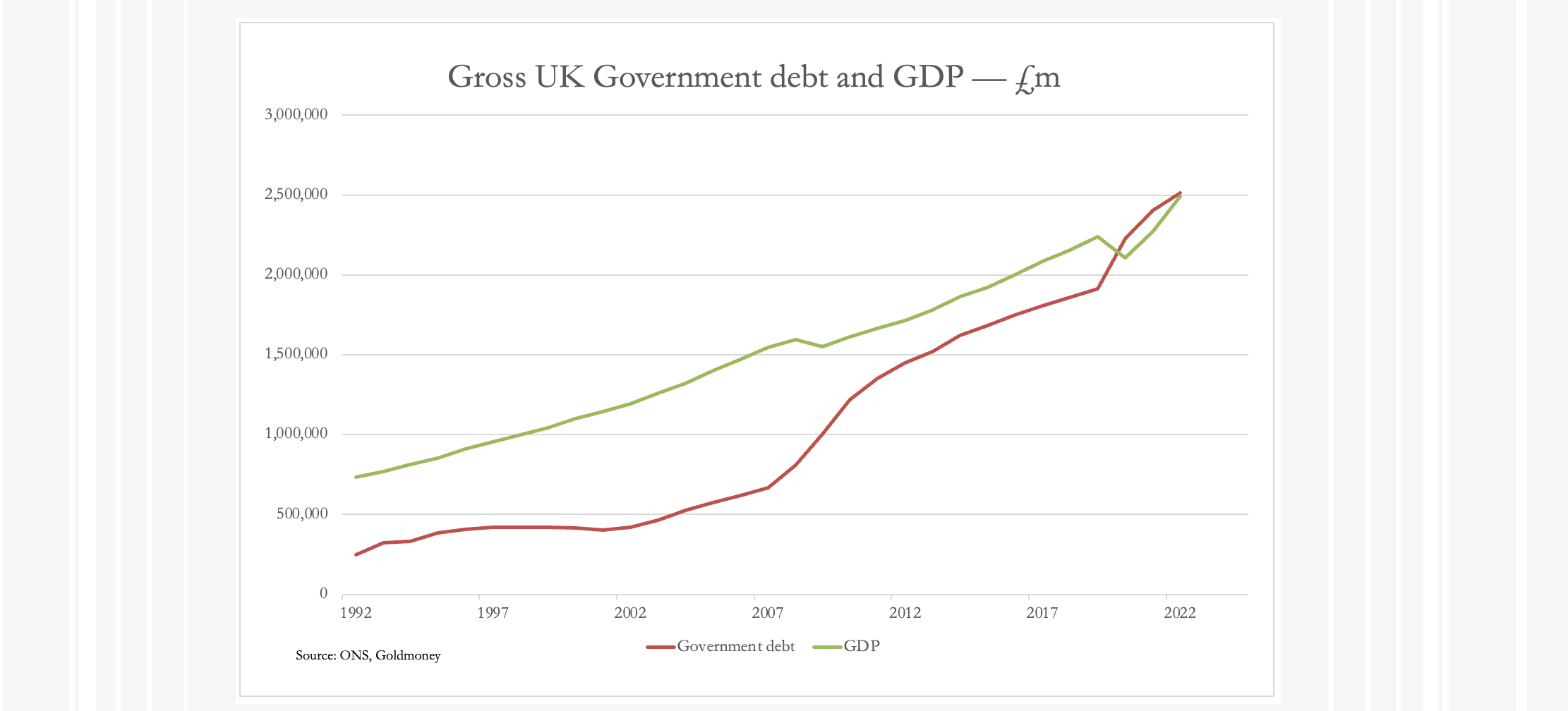

The next chart shows how total UK government borrowing has increased in recent decades, along with nominal GDP.

The figure for calendar 2022 is now similar to GDP. But GDP also includes government spending, which at 44.6% of the total leaves a private sector base of only 55.4% of GDP to fund government spending. Furthermore, the increase in government debt through its spending has undoubtedly been a major contributor to increasing GDP, masking a stagnating private sector economy.

In terms of market sentiment, being the dollar’s poor relation means that both sterling and gilt yields appear to be highly vulnerable to persistently high interest rates. This is the message that the sudden rise in gilt yields is now giving us: not only that it’s taking a little more time to conquer inflation, but that Britain’s public finances are in serious decline.

Why CPI inflation continues to rise in a recession, or slump

It is commonly believed by economists today that a recession is a slump in demand, and a developing glut of unsold production leads to falling prices. And falling prices discourage consumers even further from spending by deferring their purchases. They also fear that a recession could easily develop into a catastrophic loss of consumer confidence. This led the neo-Keynesians to believe in a savings paradox, that saving as opposed to consuming which bolsters GDP is deemed undesirable. It has therefore become a function for the state to stimulate and maintain consumption under these circumstances by deficit spending.

These wrong-headed and ultimately destructive economic beliefs stem from Keynes’s dismissal of Say’s law, which simply explains the hard facts behind the division of labour. Jean-Baptiste Say understood that we produce in order to consume, and money or credit is the means by which we turn our specialised production into our wider consumption. Keynes’s dismissal of Say’s law, on the basis that if it were true there would be no barrier to full employment, was just a red herring, a linguistic deception. Like his dismissal of Gibson’s paradox (more on which below), it has led to fundamental errors in public interest rate policies. It became necessary to replace facts with fantasy for the entire house of cards of Keynesian macroeconomics to be constructed. And the UK Treasury and the Bank of England base all their policies on little more than this fairy tale.

The relevance of Say’s description of the division of labour — an incontestable fact — is that conditions which lead to higher unemployment, which are always at the back of policymakers’ minds with respect to an economic slump, lead to both declining production and consumption. This is because the unemployed are no longer producing. In a broad sense, this is obviously true, even though some goods and services will be less affected than others. The point is that a general glut, which is the danger feared by policy makers simply cannot happen.

The belief in official circles expressed by the Chancellor last week, that a recession “will reduce inflation and therefore should be welcomed” will turn out to be an error with significant consequences. Production and consumption will tend to decline in tandem as demonstrated by Say’s law, and therefore CPI inflation will not reduce due to declining consumption as the Chancellor stated. For empirical evidence we need only ask ourselves what are the true economic conditions in every hyperinflation, and why was it that in the difficult 1970s it was necessary for the Bank of England to raise interest rates to 15%? Why was it that consumer price inflation rose to 25%, and why was it necessary for Paul Volcker at the Fed to raise the Fed Funds Rate to nearly 20% in 1980?

Consequently, recessions have between little and nothing to do with the general level of prices. They are driven by other factors that have more to do with changes in the purchasing power of credit when it is unanchored from sound money, which internationally is simply gold. The seeming wilful ignorance by the British authorities of the factors that drive a fiat currency’s purchasing power eventually sends signals to foreign holders of sterling that it should be sold, driving its purchasing power lower still both in terms of commodities and on the foreign exchanges. So-called inflation has less to do with the expansion of the Bank of England’s credit obligations, though that is undoubtedly a consideration, but more to do with loss of confidence in the currency by its users.

We can say therefore with increasing confidence that these factors will begin to undermine sterling, and that its purchasing power will continue to decline, likely to be at an accelerating rate. A trend of higher interest rates will remain the outlook, the economic consequences of which are all negative for sterling’s purchasing power.

Driven by similar neo-Keynesian macroeconomic policies, the US, Europe, and Japan all share the same trend, though initially perhaps not so viciously. Believing that Say’s law has been roundly dismissed, mainstream investors have yet to fully understand the danger that the entire fiat currency system might be on the brink of failure. All they admit to so far is that in the UK’s case, CPI inflation is proving to be stickier than expected and that it is being driven by labour shortages, public sector strikes, and unexplained failures of fiscal and monetary policies. But that may be changing.

The fault lines in fiscal policies

The UK government’s economic policies are fully aligned with global group thinking among its peers. Politicians seek solace that their policies are the right ones through global forums such as G7, G20, and from supra-nationals such as the IMF and OECD. And the bean-counting establishment in the Treasury sees the private sector simply as a source of tax revenue, rather than as a driver of economic progress. And where there is economic progress, that is claimed to be the product of government spending, often through public-private partnerships promoting favoured activities and technologies.

There is little or no understanding of the true value of laissez-faire economics, with the Treasury’s mandarins stubbornly Keynesian in their beliefs. There is nothing unusual in this, as the global debate over economic management by the state illustrates. Supported publicly by the IMF, the approach is always to raise taxes, never to reduce public spending, and to even increase it to stimulate production and demand in the private sector.

When Liz Truss and her Chancellor tried to emphasise free market policies last autumn, they were promptly smacked down, not just by the Westminster and Whitehall establishments, but by the state educated and regulated investment community. But even then, the policy was not to contain or reduce public spending, only to stimulate the private sector into growing tax revenues. But it was the preliminary budget deficit which scared the bean counters, unconvinced by the promise of future revenue benefits to the exchequer.

The Prime Minister is now encouraging supermarkets to put caps on prices of essential food items. When a government says “encourage” it tends to conceal a threat of “or else we will regulate”. And now according to a Daily Telegraph headline this morning, “Ministers are planning a food price plan”.

It is the same mistake made by every government facing currency debasement from the Roman Emperor Diocletian two thousand years ago to the present day. But if there’s no profit to be had in selling something, it won’t be sold. Essential food items will become scarce.

The earliest stages of a government resorting to price controls will not reassure foreign investors and depositors holding sterling balances. Increasing voter disaffection and only a maximum of eighteen months before the next general election, which could lead to a Labour government doubling down on failing economic policies, is a further cause of concern for sterling’s future value.

Monetary policies — the empirical evidence behind its failure

The Bank of England has come under considerable criticism for its failure to control inflation and to manage interest rates. However, while the Bank’s critics have an easy target, they are mostly misguided in their analysis.

The greatest misconception, shared by all official monetary policy committee members and nearly all investors alike, is over the role of interest rates. They assume it is the “price” of money, that it can be used to regulate demand for credit, and that it is entirely under the control of a central bank. For this to be only half true, there has to be a clear correlation between changes in interest rates and changes in the general level of prices. This has never been the case, as Keynes himself observed when he dubbed the apparent phenomenon Gibson’s paradox. It was a paradox because Keynes couldn’t explain it, and having not explained it, he chose to ignore it. Both branches of macroeconomics, Keynesian and monetarist, have ignored the evidence ever since, that there is no correlation between interest rates and the rate of inflation.

The explanation is simple. Interest rates are set by a balance between what businesses seeking capital for profitable projects are prepared to pay, and savers who need to be encouraged to defer their consumption. Keynes’s assumption was that it was the other way round, that it was usurious rentiers (savers) demanding high rates thereby ripping off the honest producer.

In the days of sound money, when a saver was confident that a currency would retain its purchasing power over the period of a loan, the saver simply required compensation for the temporary loss of use of earnings or profits arising from employment or trade. And there was a further consideration in the risk that the funds might not be returned, what we call credit risk. In other words, the future value of money and credit was always valued at a discount to that of today.

Under the UK’s nineteenth century gold standard, interest rates became remarkably stable, despite the massive expansion of commercial bank credit over time as Britain’s economy boomed. So long as the Bank of England’s notes could be exchanged for gold coin, the value of the notes was maintained irrespective of their quantity in circulation. Earlier in the century, fluctuations in the general price level were due to a combination of the consequences of the cycle of bank credit leading to bank failures, and the lack of a proper clearing system beyond the London banks, which only included the Bank of England from 1864. Following the perfection of clearing and the development of efficient credit markets generally, prices became remarkably stable despite the banking crises in the second half of the century.

But now we inhabit a world of fiat currencies. Where they have alternatives, savers are naturally wary of lending a depreciating currency beyond instant access to it, without extra compensation for the potential loss of its purchasing power over the period of a loan.

The situation is different for a capital-seeking business. In calculating his return on capital employed, an entrepreneur considers all costs including interest, the time taken from initial investment to production, and the final value of sales. He is bound to refer to current values for his eventual sales and costs, which would be the correct approach under a gold standard. Whether today he builds in a factor for a fiat currency’s declining value is a moot point. If so, then it is likely to be based on official forecasts for both his costs and final sales value. But that is what determines an interest rate which is economic to his investment, and he may be prepared to bid up the interest rate accordingly in order to proceed.

It should become clear from the foregoing that setting interest rates is not a function for a government agency. It can whistle into the wind as much as it likes, but if savers don’t get compensation for loss of purchasing power, the loss of possession, and counterparty risk, they will spend and not save. This is the sound theoretical background to understanding the true function of interest rates today: they represent the discounted future value of an unbacked currency.

In practice, the commercial banking system operates as intermediaries between savers and borrowers. Banks are dealers in credit, creating both credit and matching obligations. Initially, they take the place of savers deciding to save. But in order to retain deposit liabilities, they need to pay deposit interest on obligations with any time element. It is therefore a matter of fact that interest rates are influenced by commercial bank policies, which by varying over time have become cyclical in nature. At times banks compete with each other for loan business, suppressing interest rates lower than they would otherwise be, and at other times they are reluctant to lend, only doing so at higher rates.

Again, we can see that interest rates are not naturally under official control, being set by commercial considerations between the banks, their borrowers, and their depositors. It is this reality which is now driving the outlook for interest rates, not official expectations of the inflation outlook.

Having been adversely affected by official interest rate policies which squeezed their lending margins, commercial banks increased their balance sheet leverage to unaccustomed levels. Now that interest rates are rising, initially their profit margins increased. But so have lending risks, with borrowers’ business calculations being badly undermined. Consequently, banks are now trying to contain lending risks by reducing their balance sheet exposure, leading to a shortage of credit.

Particularly when they are unexpected by borrowers, credit shortages always produce an element of distress among them. If they are to survive, they are forced to scale down their demand for credit. Rarely can this be done immediately, and the cohort of borrowers will demand more bank credit as the effects of a credit crunch begin to bite. Unsold inventories which need financing begin to accumulate in the non-financial economy. In the financial sector, rising bond yields and falling security values not only contribute to on-balance sheet losses, but undermine collateral values as well. The reduction of bank credit in this direction leads to a reduction in speculative activities.

The consequence is predictable: if credit can be obtained, it will be at higher interest rates. And the risk, of which economic historians are acutely aware is that contracting bank credit could accelerate, taking everything with it in a downward value spiral as collateral is liquidated.

The early progression of events towards this danger is now being observed in multiple jurisdictions, with broad money supply statistics contracting — M2 and M3 is overwhelmingly comprised of bank deposits, reflecting the other side of bank lending. But the problems for over-extended banks are only just starting. Besides shareholders’ equity, bank deposits are only one source of bank balance sheet funding. Another is loans to the banks, which in the short term are expanding to fill some of the gap left by contracting deposits. In Britain, the difference is that loans cost a bank 5%+, while customer deposits currently cost 2% or less. In other words, the cost of a bank’s funding is now rising, squeezing their own credit margins accordingly. This is a further factor driving lending rates for credit higher still.

The last time we experienced these conditions was in late 1973, when the squeeze on bank margins led to a full-blown banking crisis in commercial property lending. A number of secondary banks which specialised in this sector failed, and share prices for property companies collapsed spectacularly.

This time, it is likely that residential mortgage funding will be a casualty, undermining building societies. But this is taking us away from our current focus. The crisis for government, which is our primary consideration with respect to the failure of monetary policies, was in its growing inability to borrow, culminating in a crisis three years later.

There are some similarities with events developing today which are striking. The government was running a large fiscal deficit with mounting government debt, apparently oblivious to the potential consequences. Even though the government at the time was a left-wing Labour administration, its persistent budget deficits resonated with that of today’s government. It led to a sterling crisis, reflecting a falling pound and an increasing lack of foreign confidence in government finances. Even domestic institutions lost confidence in the gilt market. The Bank of England was forced to raise rates to 15% in October 1976, but that was still insufficient to persuade pension funds and insurance companies to buy gilts.

These problems were only resolved with outside intervention in the form of an IMF bailout of $3.8bn, an enormous sum for those days, which came with spending strings attached. Subsequently, the discovery and development of North Sea oilfields at a time of rising oil prices came to sterling’s rescue. Today, sterling has not yet sunk to needing some sort of international rescue effort but with other major currencies in a similar position a rescue package similar to that of 1976 might not be available. And North Sea oil is not only depleted but off the agenda because of climate change policies.

The funding calamities of the 1970s pushed government borrowing costs up, leading to three gilts being issued with coupons of 15%, 15 ¼%, and 15 ½%. There is no knowing how high coupons will have to go, unless the government seriously addresses its spending, and even that might not be enough. In order to stabilise a deteriorating situation, the whole Keynesian belief system will need to be discarded, laws passed so that mandated spending can be substantially reduced, a return to free markets unfettered by unnecessary regulations embraced, and ultimately sterling credit credibly tied to a gold coin exchange standard.

These events are not about to occur without a severe crisis forcing them to happen. Until then, the UK is left with a rapidly deteriorating situation, both globally and domestically. Most sensitive to these developing conditions are foreign holders of sterling. The only potentially positive factor for them is that domestic institutions are large holders of foreign currencies, and that if they are so minded can absorb substantial quantities of foreign sterling liquidation — but a willingness to do so has yet to be established. Instead, the banks and shadow banks in London are unlikely to have an appetite for sterling and sterling bonds at a time of foreign liquidation.

The consequences for British individuals’ wealth

It is becoming increasingly obvious that the long-term monetary policy of separating the value of currency credit from legal money in the form of physical gold is now leading to a serious crisis for the western alliance’s currencies. Commercial banking systems are horribly overleveraged and face an increasing scramble to save what they can for their shareholders. And thanks to quantitative easing, the central banks which we rely on to backstop the commercial banks are all technically bust because on a mark-to-market basis their bond holdings wipe out their notional equity many times over.

The fiat dollar’s hegemony is now on a slippery slope, along with all the currencies of America’s monetary allies. Their central banks are bound into a common groupthink, a fear of doing anything different. In this article, I have pointed out only two misconceptions. The first is the abandonment of Say’s law which leads nearly everyone to think that there will be a general glut as a result of bank balance sheets contracting. But a general glut is impossible, which is why the general level of prices will not decline as a consequence of failing production, and why interest rates will not decline as officially forecast.

The second misconception is in the widespread belief that interest rates are the “price” of credit and can be deployed to manage price inflation. Instead, they reflect the time-value of loss of possession of instant access to credit, counterparty risk, and in the case of fiat currencies an expectation of loss of purchasing power. Together, these misconceptions will lead to interest rates rising far higher than currently discounted in markets with severe consequences for all asset values.

The problem is particularly acute for holders of sterling and sterling denominated assets. Foreign holders can be expected to be the first to sense that the currency and gilts are significantly overvalued in these developing conditions. Both are more exposed than the dollar and US Treasuries to loss of confidence, already reflected in soaring gilt yields relative to those of equivalent US Treasuries.

There can be little doubt that UK investors in financial assets will be badly hurt by rising interest rates. These evolving conditions are extremely bearish for UK financial asset values. And the values of residential property, that mainstay of the middle classes, are currently in a state of stasis, likely to decline as mortgage finance is progressively withdrawn from the market, the rates increased on existing mortgages, and overleveraged holders get behind on their payments.

For Britons, the system of sterling credit is on the brink of a crisis which is likely to be even worse than that of the stagflationary 1970s. Despite the rising level of interest rates and the opportunity cost of not receiving interest, gold increased from £15 per ounce in 1970 to £288 in January 1980. The precedent for today is clear: to escape from the consequences of collapsing credit, it should be sold for physical gold.

Physical gold is still legal money, and gold sovereigns legal tender, despite all the Keynesian propaganda to the contrary. If sterling declines relative to the dollar at a similar pace to that seen during the Lehman crisis, it will fall 12.3%. And if gold held its current level against the dollar, that would lift the sterling price from £1580 to £1800.

It is a tragedy that Britain sold most of her gold at the turn of the century, leaving only 310 tonnes in reserves. To fully cover the note issue amounting to £81bn requires 1,571 tonnes. At only 20% cover, the UK government’s gold reserves are not enough to reinstate a gold coin exchange standard for banknotes. As well as reforming economic policies as stated above, either sterling would have to fall so that it has at least 40% cover, or the value of gold expressed in sterling would have to rise to over twice the current level. And then, any further note issues would have to be backed one to one by gold.

But first, a credit crisis of such severity would have to occur to fully discredit macroeconomics and statist intervention. Only then will the political class obtain a public mandate to dismantle the precepts of modern government entirely. And finally, it would require a small group of statesmen to understand the errors of persistent currency debasement and implement the necessary reforms. Until that day, the ordinary Brit should build a war chest of sound money, which is only physical gold and gold coin, because the restoration of sound money is far, far away.