By Dr Frank Shostak

The US consumer sentiment index as compiled by the University of Michigan fell to 69.5 in August from 71.6 in July. In August last year the index stood at 58.2. A weakening in the consumer sentiment index is seen as posing a threat to consumer spending and in turn to the economy.

Most economic commentators are in agreement that individual’s consumption rather than savings is the key for economic prosperity. Savings are seen to be detrimental to economic growth as it weakens the demand for goods.

In this framework of thinking, economic activity is depicted as a circular flow of money. Spending by one individual becomes part of the earnings of another individual, and spending by another individual becomes part of the first individual’s earnings.

If, however, individuals become less confident about the future it is held they are likely to cut back on their outlays and hoard more money. Therefore, once an individual spends less, this worsens the situation of some other individual, who in turn also cuts his spending.

A vicious circle emerges– the decline in individuals confidence causes them to spend less and to hoard more money. This weakens economic activity further, thereby causing individuals to hoard more etc. To arrest this downward spiral it is held, the central bank must increase the supply of money.

It is believed that by placing more money in individuals’ hands, their confidence is going to increase. Consequently, individuals are going to spend more and the circular flow of money is going to reassert itself.

All this sounds very convincing and indeed various surveys of business activity show that during recession businesses emphasize the lack of individuals demand as the major factor behind their poor performances.

Notwithstanding can demand by itself generate economic growth? Furthermore, nothing is said here about the supply of goods – are we to take this supply for granted? Are goods always around and all that is required is to have demand for them?

By this framework of thinking tt would appear that what impedes economic prosperity is the scarcity of demand. However, is it possible for demand for goods to be scarce?

Scarcity of means thwarts demand

We suggest that in the real world, it is necessary to produce some useful goods that can be exchanged for other useful goods.

For instance, when a baker produces bread, he doesn’t produce everything for his own consumption. Most of the bread he produces is exchanged for the goods of other producers, implying that through the production of bread the baker exercises demand for other goods.

His demand is fully supported by the bread that he has produced. Again, the production of bread permits the baker to procure various goods. Bread is the baker’s means of payment. According to David Ricardo,

No man produces but with a view to consume or sell, and he never sells but with an intention to purchase some other commodity, which may be immediately useful to him, or which may contribute to future production. By producing, then, he necessarily becomes either the consumer of his own goods, or the purchaser and consumer of the goods of some other person.

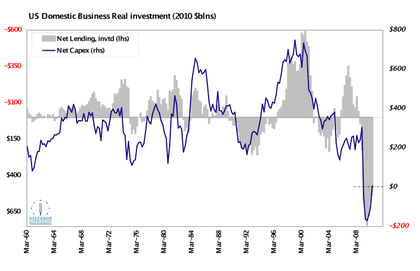

What limits the production growth of consumer goods is the availability of tools and machinery i.e., capital goods, which raise workers productivity. Tools and machinery however, are not readily available, they must be made.

In order to make capital goods, there is the need to allocate consumer goods to those individuals that are going to be engaged in the production of these capital goods. The consumer goods are going to sustain individuals’ life and wellbeing whilst they are busy making capital goods. This allocation of consumer goods is what savings is all about.

Note that savings become possible once some individuals have decided rather than to consume to transfer a portion of their consumer goods to individuals that are engaged in the production of capital goods. Obviously, they do not transfer consumer goods for free, but in return for a greater quantity of goods in the future. Since savings enable the production of capital goods, obviously savings is the heart of economic growth that raises individuals living standards.

Money and savings – what is the relationship?

The introduction of money does not alter the essence of what savings is all about. It enables the produce of one producer to be exchanged for the produce of another producer.

Observe that money does not produce goods, it only facilitates the exchange of goods. According to Rothbard,

Money, per se, cannot be consumed and cannot be used directly as a producers’ good in the productive process. Money per se is therefore unproductive; it is dead stock and produces nothing .

Also, in the money economy the payments are done with goods for other goods. Thus, a baker exchanges his saved bread for money and then employs the obtained money in the exchanges for other goods, implying that he pays with his saved bread for other goods. Money only facilitates this payment.

When a baker exchanges his saved bread for money with a shoemaker, he supplies the shoemaker with saved i.e., unconsumed, bread. The supplied bread is going to sustain the shoemaker and allow him to continue making shoes.

By means of money, individuals channel savings, which permit economic activity to take place. Note that we do not save money but employ money to channel savings i.e., unconsumed consumer goods to individuals engaged in the various stages of production.

When an individual hoards money, he does not save money but rather exercises his demand for money. Exercising demand for money can never be bad news as the popular thinking has it.

Contrary to popular thinking then, savings do not weaken but rather strengthen economic growth.

Money “out of thin air” and economic growth

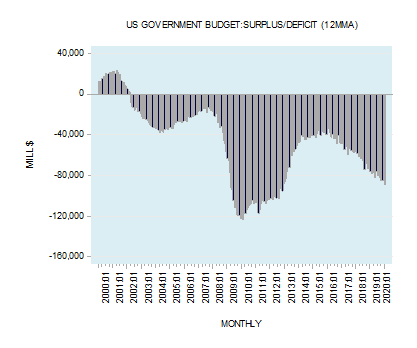

When money is generated “out of thin air” it sets in motion an exchange of nothing for money and then money for something i.e., an exchange of nothing for something. An exchange of nothing for something leads to consumption that is not supported by production. This amounts to the diversion of savings i.e., consumer goods from wealth generating activities towards the holders of money “out of thin air’. The diminished flow of savings towards wealth producers weakens the goods production flow and in turn weakens the demand for goods i.e., sets in motion an economic recession.

Observe that what weakens the demand for goods is not a sudden capricious behaviour of consumers, but an increase in the money supply “out of thin air”. Again, the increase in the money supply “out of thin air” weakens the flow of savings towards wealth generators thus weakening the production of wealth. As a result this undermines the demand for goods.

As long as the pool of consumer goods is expanding the central bank and government officials can give the impression that loose monetary and fiscal policies drive the economy, this illusion however, is shattered once the pool becomes stagnant or declining. Note that without the expanding pool all other things being equal, economic growth is not possible.

Conclusion

We suggest that most individuals aspire to have good and comfortable life. What thwarts these aspirations is the means that have to be produced. What permits the expansion of the means is savings. Observe that the increase in savings, which supports the increase in the production of goods, also generates increases in demand for goods. Any attempt to create an illusion that individuals demand could be somehow strengthened through the monetary presses is sooner or later shattered by the facts of reality i.e., that it is not possible to get something out of nothing.