As the world descends into a much-heralded recession, the surprise will be that interest rates will continue to rise as economic activity contracts. This is not what the economic establishment expects.

This article puts the outlook in the context of classical economic theory, when it was the principles behind the division of labour which went unchallenged. Adopting the theme of Say’s law, this article permits a forecast with a high degree of certainty that far from a recession leading to lower prices, lower interest rates, and therefore investor heaven, it will lead to higher prices, higher interest rates, budget deficits soaring out of control, and liquidation of the dollar by over-exposed foreign holders.

Far from being the investor’s salvation, it will be the recession that will be the fiat dollar’s greatest challenge, and for the fiat currency system upon which it is based.

Introduction

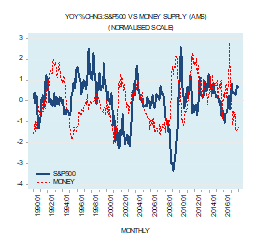

So far, the progression of events following covid has been entirely predictable. First, monetary stimulation was taken to excess. This was followed by the general level of prices rising beyond the mandated 2% rate. Central banks then raised interest rates in an attempt to curb price inflation. The growth in money supply slowed, and then began to contract. And now, the major economies face a global recession for which the evidence is mounting. Even though it has been a copybook progression, there has been a systemic blindness accompanied by dashed hopes at every turn.

The latest evidence is of an apparent collapse in international trade. China’s imports and exports have contracted sharply. Germany has already recorded falling export demand, and Britain has now also reported a slump in exports. According to last Saturday’s Daily Telegraph, “Orders from the US, China, Europe, and South America are all in freefall according to the Purchasing Managers Index, an influential survey of businesses from S&P Global”. Falling PMIs are also observed in France and Spain, as well, of course, as Germany.

In July, Chinese exports to America declined 23.1% year-on-year, and to the EU by 20.6%. As the world’s number one exporter, these figures from China are a global economic bell weather. A possible explanation is that after ramping up production following covid, global destocking is taking place due to a number of common factors. Slowing sales in the face of higher prices is an obvious one. Less obvious is the most important general factor, which is that bankers around the world are less greedy for profits and more frightened of lending risk. Quite simply, in highly indebted economies, the general rise in interest rates is scaring bankers who have highly leveraged balance sheets. This is leading to an unusual contraction of bank credit.

It is now beginning to frighten producers, who, turning to banks to shore up their liquidity as their profit margins come under pressure from higher input costs, find that their bankers on balance refuse to provide it. They have no option but to scale back their operations and reduce their inventories. Ergo, production of import and export goods is grinding to a halt.

Mainstream economists are about to discover a nasty reality. They assume that recessions are caused by consumers reducing their consumption, a situation which leads to falling prices and requires monetary stimulation. What they fail to grasp is that credit being denied to producers is at the root of the problem. And inevitably, producers will start laying off staff and cutting production. Apart from viewing developments through the wrong end of the telescope, the reason this is not properly understood by macroeconomists is because they rejected Say’s law, which informed classical economics. Let it be restated loud and clear in simple language:

We produce in order to consume. If we don’t produce, we don’t consume.

It is never the case that consumers suddenly get turned off from consuming. But it is always the case that individuals reduce consumption because they lose their employment. It therefore follows that when production declines unemployment rises. The supply of goods and services in general diminishes along with demand for them.

In practice, the relationship between supply, demand, and prices is more complex. The inventory destocking indicated by the sharp slowdown in imports and exports around the world might be expected to suppress the general level of prices temporarily. But that would only last for the period of destocking. But a far more important factor is variations in a currency’s purchasing power, and in this respect, we can already see energy prices beginning to rise with WTI oil having risen 21% in the last quarter, heating oil by 36%, and gasoline 17%. Some foodstuffs are also rising strongly: soybean oil up 41%, oats 34%, lean hogs 18%, canola 19%, and cocoa 20%. We should call these commodity inputs essentials, demand for which will continue even in a deep recession.

Obviously, there will be a shift in consumption patterns with discretionary items seeing a drop in demand relative to the essentials. But to assume that manufacturers and service providers will continue to churn out product into an unwilling consumer market is mistaken. They are bound to restrict their production accordingly. So, we can see that Say’s law cannot be denied: the relationship between production and consumption preserves a balance between the two and that the idea of a productivity glut assumed by neo-Keynesian economists is manifestly wrong.

In dismissing Say’s law, the Keynesians were able to fool themselves that productivity gluts in a recession existed, and that they would drive consumer prices lower, being the consequence of insufficient demand. Therefore, the Keynesian solution is to encourage consumption by discouraging saving and suppressing interest rates. To err on the side of caution, central banks began to target consumer price inflation to run at two per cent to ensure that recessionary conditions would not occur.

The misconceptions about a general slump in prices originated in the 1930s depression, which appeared to challenge the Say’s law precept. But to put it into context, the depression was the unwinding of the 1920s credit bubble. There were then two principal causes of what appeared to be proof against Say’s law. Firstly, the mechanisation of agriculture in the 1920s led to an oversupply of grains and other foodstuffs which continued to be produced into declining demand. And secondly, the failure of thousands of banks led to a substantial contraction of bank credit, increasing the purchasing power of the dollar, and giving the appearance of falling prices. And to compound the problems for America and the rest of the world was the signing into law of the Smoot Hawley Tariff Act by President Hoover in 1930.

Errors compounded at that time, and they will compound again today. Currency debasement has become official policy, with central bankers denying that rising consumer prices are in fact currency depreciation. And given that the debate is now devolving into whether the price inflation target should be increased to three or even four per cent, surely, this indicates a complete absence of reasoning. Instead, it can only be the desire to suppress interest rates coming to the fore.

But if we are to rehabilitate Say’s law, we must look at it in the modern context, of production of goods in particular being not by the consumers, but by foreign factories.

Say’s law and international trade

Jean-Baptiste Say pointed out the benefits of the division of labour over two centuries ago, now summarised as his law. At that time, other than imported raw materials and grain, nearly all production was by domestic industries. The argument that we all produce to spend the fruits of our production under the division of labour was obvious. But today, we need to allow for production being in different centres from its consumption. We need to establish if Say’s law applies in a modern economy, whose origin is based on credit expansion internationally, and not just domestically.

Since the mid-eighties, US money centre banks diversified into fee-based investment banking and securities dealing when London opened up stockbroking to banks. We called this the Big Bang, and it revolutionised the entire financial services industry, not just in London, but around the world, with the exception of domestic America. It permitted banks to operate in both investment and commercial banking. Under the Glass Steagall Act the US prohibited US banks from acting in both activities, and the Act was not repealed until 1999. Consequently, for fifteen years US banks pursued lucrative corporate financing outside the US, where Glass Steagall did not apply. The legacy of the US’s slowness in adapting to the new global banking regime was that US banks encouraged US corporations to build factories abroad, hollowing out US domestic manufacturing but allowing China and Southeast Asia to industrialise. Above anything else, this led to supply chains becoming international.

The impact of global manufacturing on the US is actually a minor part of its total economy. With US GDP running at about $27 trillion, imports account for 15% of GDP, and exports 11%. That leaves 74% of GDP unarguably subject to Say’s law in the original sense. But consumer items are actually a minor part of imports, being $784bn, less than 20% of US imports, and exported consumer items are $256bn, representing 8.3% of US exports.[i] As a proportion of total GDP of $27,000bn, the consumer goods affected at $1,040bn are only 4% of total GDP. The balance of import and export totals are comprised of commodities, raw materials, and intermediate goods.

This remarkably low figure reflects consumer items not so much being direct imports, but imports being assembled, distributed, and retailed in the US. Any argument that the international aspects of trade undermine the validity of Say’s law can therefore be dismissed.

We are seeking to establish the relationship between production and consumption at all times, particularly in a recession. Those who dismiss Say’s law incorrectly argue that in a recession production exceeds demand, leading to falling prices. But there are two further issues to clarify: the mismatch implied between modern automated productivity and individual consumption, and the consequences of welfare distribution, being unearned in the hands of the recipients.

In manufacturing, with modern mechanisation the value of an employee’s output is considerably in excess of his income. And we must bear in mind the sequence of events: consumers don’t just decide to stop consuming, they will only do so when they lack the means. In a recession it is always production that declines first, leading to an increase in unemployment. So, if unemployment in modern manufacturing increases as a result of production cuts, then the value of the outputs will decline far faster than the loss of income suffered by those laid off. Far from a recession leading to a general glut of unsold goods, beyond initial inventory destocking it is bound to result in increased shortages of product.

The same is true of high value-added services, such as financial, legal, and consultancy. Low productivity services such as the hospitality industry are vulnerable to other factors, such as being categorised by constrained consumers as non-essential spending. Obviously, Say’s law does not define supply and demand relationships in specific sectors, it only rules out a general slump in demand.

The economic distortions from welfare subsidies are a further issue which did not exist when Say was alive. Assuming that a government and charitable organisations are fully funded, then the ultimate source of welfare subsidies is production, because it is sales taxes, import duties, income tax, and all other revenue sources that ultimately are supplied by production. It is when welfare subsidies are not funded by revenues that currency debasement occurs. The consequences of currency debasement are reflected in higher prices.

Those struggling to accept that a recession does not lead to a general decline in prices should pause to reflect on the conditions during a hyperinflation. In a hyperinflation, an economy collapses, yet prices soar, measured of course in a rapidly depreciating currency. There is no offset from lower prices due to a collapse in demand. A collapse in demand is preceded by a collapse in supply, and it is the currency debasement which the Keynesians recommend as a response to a recession which does the real damage.

This matters in the context of current expectations, which are that the US and other major economies are on the edge of a recession, expected to lead to an easing of interest rate policy. This is an error, because as we can see from an understanding of Say’s law, even updated for modern economic conditions, that the general level of prices will not decline. And with a starting point of government budget deficits which are sure to rise further in a recession, currency debasement will be a far greater influence on prices than any marginal shifts of consumption patterns due to recession.

The relationship between trade and budget deficits

More than any other factor, the propensity to save is a major influence on national finances, being the swing factor between a government’s budget and the national trade position.

There is another important factor that most analysts ignore. It is the twin deficit hypothesis, whereby if the savings rate doesn’t change, a budget deficit leads to a trade deficit. The reason the two deficits are linked in this way is because of the following national accounting identity:

(Imports – Exports) ≡ (Investment – Savings) + (Government spending – Taxes)

In other words, a trade deficit approximates to a budget deficit not funded by savings but by additional credit. This can be confirmed by following the money. For a budget deficit, there are only two sources of funding. Consumers put aside some of their spending to increase their savings in order to subscribe for government bonds. Otherwise, the banking system comes up with funding in the form of credit issued by the central bank or by commercial banks, putting additional credit into circulation which didn’t exist before.

The financing of a budget deficit by credit expansion leads to excess credit in an economy without matching production. This is an important point behind Say’s law, which defines the division of labour. We produce to consume, and the function of money and credit is one of intermediation between the two. Injecting extra credit into an economy does nothing to raise production, but it does increase overall demand, at least until it is absorbed into the economy in accordance with the Cantillon effect.

Directly or indirectly, this excess demand can only be satisfied by imported goods, because an increase in domestic production is unavailable. Hence, we see a budget deficit being reflected in tandem with a trade deficit.

The role of savings in the context of national finances is very important. An increase in savings is at the expense of consumption, which is why economists often refer to savings as consumption deferred. For consumption to remain deferred requires it to be invested, either into production or government debt usually through the banks, pension funds, insurance companies or other financial channels acting on the savers’ behalf.

If, for example, the destination of additional savings is investment in government debt, they are turned into consumption by the government. By not being spent on additional consumer goods, the trade deficit falls relative to the budget deficit.

As noted above, despite the destructive Keynesian policies of its government, Japanese savers habitually respond to an increase in credit by retaining it in their savings accounts and other investment media. Consequently, consumer price inflation is subdued relative to that in other countries with lower savings rates. The Eurozone has employed similar interest rate policies and has suffered higher CPI-recorded debasement than Japan. But the EU has a lower overall savings rate. As we note below, in China whose savings ratio is over 40%, CPI measured inflation is currently zero.

The deployment of capital by China’s and Japan’s corporations, which is the counterpart of increased savings is invested in improvements in technology and production methods, keeping consumer prices lower than they would otherwise be. Because Chinese and Japanese savers are so consistent in their savings culture, their corporations have benefitted from a relatively low and stable cost of capital, making business calculation more reliable. For both nations, savings are the positive swing factor in the twin deficit hypothesis.

The same is true for any economy where there is a government deficit while at the same time there is a propensity in the population to save rather than spend. It is the driving force behind China’s huge export surpluses, because with the sole exception of Singapore, the Chinese are the biggest savers on the planet. The position of nations whose economic policies have been to tax savings and to encourage immediate consumption is diametrically different. It is consumption indirectly funded by the expansion of money and credit without increases in savings which has led to persistent US trade deficits being twinned with budget deficits.

In contradiction of neo-Keynesian economic policies, the evidence confirms that a savings driven economy is more successful and less inflation prone than a consumption driven economy. Not only do savings protect the currency’s purchasing power by reducing the need for reliance on foreign capital inflows to finance internal deficits, but empirical evidence clearly shows savings-driven economies are more successful at creating wealth for their citizens. Importantly, a currency backed by a savings culture can weather a greater level of credit expansion by its central bank without adverse consequences for prices.

The effects of recession on the twin deficit hypothesis

The explanation above of the relationship between trade and government budget deficits holds because it is a national accounting identity. And in the current economic climate, we are now faced with a downturn in global economic activity, which will lead to lower revenues for governments. And when they already have budget deficits, those deficits will inevitably increase even more.

A recession in business activity will create enormous difficulties for the US Government. On the eve of a recession, its budget deficit for the current fiscal year to the end of this month is estimated at $2 trillion, which is 7.4% of GDP. Almost certainly, it will go far higher as the recession progresses, which is now clearly signalled. At the same time, it appears that the savings rate is declining and credit card debt increasing, the natural consequence of consumers having faced prices rising faster than their income.

The national accounting identity linking a government’s budget deficit with its trade deficit informs us that far from a recession leading to lower demand for imports, and therefore a reduction in the trade deficit, the opposite will occur. Not only will the US budget deficit soar, but with savings already declining it will lead to a considerably higher deficit on the balance of trade. The question which now arises, is how can this possible be the case?

It is in this context that we should look at credit in the round — not just in the context of funding the budget deficit, but for private sector activity as well. Contracting bank credit does nothing to threaten the validity of the national identity linking the two deficits. Say’s law will still be true, even if the contraction in bank credit is severe enough to increase a currency’s purchasing power, as described above in the 1930s depression. In real terms, Say’s law will still hold. It is just the currency’s value in terms of goods that changes. With respect to a nation’s international trade, the volumes of imported raw materials will decline in a global recession, and so will their exports. The same is true of semi-manufactured products and consumer items. But volumes are not the same thing as accounting values recorded in currency.

This explains why the twin deficit hypothesis holds even at a time of declining international trade, a rising budget deficit, and a falling savings ratio — such as faced by the US economy. All else being equal, the decline in economic activity would be expected to lead to a decline in the balance of trade, but this is in real terms, not dollars. The solution to this conundrum can only be resolved through a decline in the purchasing power of the currency at the same time as there is a decline in economic activity. The explanation lies with the acceleration of the currency’s debasement, which is the direct consequence of the increasing budget deficit.

Contracting commercial bank credit intensifies the recession

We now know that in a recession or slump, it is the increased pace of currency debasement which drives the values of imports and exports, whose volumes decline. The role of contracting bank credit suggests otherwise, which is our next topic.

The chart below shows that headline bank deposits in the US have contracted from its peak in April 2022 by 4.8%.

The contraction of the circulating media has actually been greater recently, because to bank credit we must add declines in the Fed’s reverse repo facility, whereby authorised money market funds seek a higher interest rate than offered by commercial bank deposits through the money markets. Since last September, the facility has declined by $798bn. If we regard money funds to be properly classified as additional bank deposits, taking them into account indicates that the contraction in bank credit has actually been much more severe, particularly in recent months, declining by 9.2% from its peak in April 2022.

Monetarists would argue that a fall in money supply leads to an increase in the dollar’s purchasing power, or more conventionally noticed by a decrease in prices. It is this deflation they seek to avoid in recommending that the monetary authorities must reduce interest rates. But that assumes they are in a position to do so, which is not the situation. Interest rates are being driven by the cycle of bank credit, whereby bankers as a cohort are now in fear of escalating lending risk and attempting avoid it.

This is because on historical comparisons, US commercial bank balance sheets are highly leveraged, so the contraction of bank credit seems likely to continue as lending risks increase. But a problem for the banking system taken as a whole is that while it can contract the asset side of its collective balance sheet, it is less easy to reduce liabilities to depositors. The solution for them will be to increase their lending to the federal government, albeit in short-term Treasury bills to avoid duration risk, and to reduce their exposure to other assets. Therefore, within the bank lending total, the decline in lending to the private sector will be more rapid that the headline numbers indicate. The credit crunch is already being targeted at businesses and that is set to increase.

Consequently, the cost of credit for businesses will continue to rise and its availability will fall. Output will also fall, and unemployment rise. With supply of products falling at least as rapidly as consumer demand, this is the basis of the condition popularly termed stagflation, a condition which the neo-Keynesians in charge of macroeconomic analysis view as an anomaly. But actually, as argued in this article, it is easily explained, so long as one respects Say’s law. And while the neo-Keynesians expect falling interest rates to reflect falling demand, we can see why this will not happen.

Where do we go from here?

We must regard the US dollar as proxy for the other major fiat currencies: the euro, yen, pound, and Swiss franc. By accepting the dollar as the reserve currency and the settlement currency for international trade, they are all loosely on a dollar standard. Consequently, the effect of a global recession should be considered in the context of the dollar’s future and for the consequences facing the US economy.

According to the US debt clock, total government and state spending accounts for 37.9% of GDP, and its debt to GDP ratio is 135%. Arguably, the US government is now in a debt trap, being sprung by escalating interest rate costs approaching a trillion dollars. Ahead of a recession, when tax revenues are certain to decline and mandated welfare expenses are equally certain to rise, the budget deficit for the fiscal year just ending is $2 trillion. This is our starting point.

The budget deficit is currently expected to decline in fiscal 2024. The Congressional Budget Office forecasts it at $1.655 trillion, CPI inflation at 3%, and 3-month T-bills at 3.2%. Instead, in a recession the deficit will rise significantly. To the decline in revenues and increase in expenditure must be added higher inflation estimates and the consequences of higher interest rates on a rapidly increasing debt pile. We can be sure that the debasement of the currency is set to accelerate.

Adding to these woes is a virtually certain new round of bank failures from higher interest rates, brought about by a further tightening of bank credit and its consequences for over-leveraged businesses and financial asset values. The Fed and the US Treasury will be expected to protect bank depositors and the integrity of the entire banking system. Inevitably, this will involve additional monetary inflation.

The Fed itself has its own crisis, with bond assets acquired through quantitative easing putting its balance sheet deeply into negative equity on a mark-to-market basis. And, unless there is a change of neo-Keynesian policies towards economic management, we can expect to see quantitative tightening being abandoned, and quantitative easing being reinstated, further encouraged because it secures a degree of funding for the government’s soaring deficit. But it is one thing to do QE at a time when the Fed can suppress interest rates, but a different proposition when it cannot. Commercial banks are likely to be still driving rates higher by perpetuating a credit shortage in efforts to reduce their balance sheet leverage.

And this is where foreign ownership of dollars kicks in. Currently, foreigners own some $32 trillion in dollar denominated financial assets, about $14 trillion of which is in equity portfolio investment, $6.5 trillion in bank deposits, and the balance in long and short-term bonds the bulk of which is in US Treasuries.

We can already see a new round of price inflation emerging in energy and food prices, which combined with contracting bank credit is bound to lead to bond yields rising, and all dollar denominated financial asset values falling. In other words, foreign investors are facing a significant fall in financial asset values on their $32 trillion dollars and will begin to liquidate their positions. Obviously, American investors are likely to begin liquidating their foreign holdings at the same time. But there are three factors working against the dollar: Americans own far less foreign assets than foreigners’ possession of dollar assets, most US-owned bond interests in foreign entities are denominated in dollars and not foreign currencies, and equity interests are in American depository receipts which do not lead to buying of dollars on liquidation. Consequently, there are remarkably few foreign currency balances owned by Americans to absorb a potential tsunami of dollar selling.

With or without any alternatives, the fifty-two years of the pure fiat dollar’s existence is set to face its biggest challenge as the international reserve currency. But there is a gold-backed challenge being cooked up by Russia, with or without China’s support. Undoubtedly, the challenge has support from Iran and Saudi Arabia, nations which with Russia dominate global energy sales. And it is no longer just a case of a new gold-backed currency replacing the dollar on geopolitical grounds, but increasingly a necessity for America’s enemies to protect themselves from the fallout of a collapsing dollar-based fiat currency system.

[i] Consumer imports and exports supplied by Trading Economics.