By Thorsten Polleit

1.

We live in a fiat money regime. The US dollar, the euro, the Chinese renminbi, the Japanese yen, the British pound, the Canadian dollar, and the Swiss franc – all fall under the category of fiat money.

What exactly defines fiat money? Well, there are three characteristics.

First and foremost, fiat monies are literally created out of thin air. Whenever central banks and commercial banks extend loans, they effectively issue fiat monies.

The second defining characteristic of fiat monies lies in their de-materialised nature. They exist as colourful paper tickets or bits and bytes on computer hard drives – representing media that can be increased at any time, in any politically desirable amount.

The third characteristic: Fiat monies result from states’ monopolisation of money production. State-sponsored central banks hold the exclusive privilege of producing fiat central bank money, while commercial banks, leveraging fiat central bank money, create their own type of money, namely fiat commercial bank money.

Now you may ask: So what? Well, fiat monies are not harmless; in fact, they harbour serious economic and ethical flaws.

Chief among them is their inherent inflationary nature. Over time, they lose their purchasing power – which means you get less and less goods and services in exchange for them.

The issuance of fiat money favours some at the expense of many. Rather than fostering mutually beneficial outcomes, it creates a scenario where some win at the expense of others – a lose-win situation if you will. Indeed, a fiat money system is the epitome of social injustice.

Moreover, the issuance of fiat monies triggers cycles of boom and bust. Fiat monies are predominantly created through bank credit expansion, not backed by real savings. The synthetic influx of credit artificially suppresses market interest rates, driving them below levels that would prevail in the absence of such bank credit expansion.

The consequence? An artificial economic upswing, a boom, characterised by overconsumption and malinvestment. Yet, this artificial prosperity will inevitably prove unsustainable and sooner or later lead to a bust, typically associated with recession, unemployment, bank and business failures, debt defaults, asset price deflation, etc.

In a fiat money system, the burden of debt accumulates relentlessly. Consumers, producers, and particularly governments run into ever higher levels of debt relative to their incomes, gradually spiralling into a state of over-indebtedness.

Fiat money paves the path for government expansion – encroaching on the liberties of citizens and businesses, potentially leading to the emergence of a big, oppressive, and intrusive state.

Furthermore, fiat money affords governments a dangerously easy means to finance wars, far simpler than in a monetary regime where commodities such as gold or silver serve as money.

2.

Let me pause for a moment and allow me to say that it took me quite a while to fully comprehend the massive, and vicious, distortions wrought by today’s fiat money system.

As I said, within a fiat money system, market interest rates are artificially suppressed, held below the levels that would prevail absent artificial bank credit expansion.

This manipulation effectively distorts peoples’ time preference, inducing people to value current consumption even more highly than future consumption, at the expense of savings. While present enjoyment increases, it does so at the expense of diminished material well-being in the future, it hampers, or even destroys, economic and cultural progress.

Market prices and valuations of all kinds of assets (stocks, bonds, real estate, commodities) become inflated.

The artificial rise in peoples’ time preference leads to a shift in management practices within firms – with short-sighted decisions, when the lure of short-term profits is bigger than that of sustained long-term success.

The emphasis on short-term gains amplifies the temptation to adopt dubious accounting practices in an effort to present the company in a more favourable light.

The truth is that in a fiat money system, peoples’ valuation standards become corrupted, misguided, and unhinged. The consequences going well beyond the economic and financial sphere, permeating into the moral and civilisational fabric of our societies.

Now you might wonder: So why do we have fiat money? Where does it come from?

3.

The foundation of the today’s fiat money system rests squarely on the US fiat dollar. In the System of Bretton Woods, established in 1945, the US dollar was initially backed by gold: 35 US dollars could be redeemed for 1 ounce of gold at the US central bank.

However, on August 15, 1971, the US unilaterally severed the link between the dollar and gold – a pivotal decision through which the US administration effectively ushered in an era of unfettered fiat money dominance.

Be that as it may, the US dollar remains the preeminent fiat money globally, extensively used in trade, finance, savings and investment transactions, underpinned by the formidable economic prowess and military might of the United States. I give you some numbers:

According to the Bank for International Settlement (BIS), the OTC FX market saw an average daily turnover of 7.5 trillion US dollars in 2022, marking the most recent available figure. Notably, the US dollar was on one side of a staggering 88% of all trades. (As two currencies are involved in each transaction, the sum of shares in individual currencies will total 200%.)

Following not so closely behind, the euro was the world’s second most traded currency, involved in 30.5% of all trades. The Japanese yen and the British pound followed suit at 17% and 13%, respectively, with the Chinese renminbi involved in 7% of all trades.

However, the US dollar’s supreme status has come under increased scrutiny in recent years. The explosive surge of US government debt is one significant factor. Additionally, the escalating utilisation of the US dollar as a geopolitical tool has also raised concerns among investors, with some characterising the development as “financial warfare” being waged with the Greenback.

In particular, America’s decision to freeze Russian official and private/business foreign reserves has set off alarm bells in many non-western nations.

They realize that holding US dollar reserves is far from risk-free: Don’t align with Washington’s interests? Better watch out; you may lose access to the international payment system, or your US dollar holdings might be confiscated.

By no means less important is the fact that the US dollar’s status as de facto global reserve currency necessitates other countries to maintain export surpluses with the US, while the US consistently runs a negative trade balance, meaning its imports chronically exceed exports.

This arrangement affords the US a rather comfortable position, yet this status quo will increasingly be challenged by those countries in the world that do not see their future under the dominance of the United States of America or the Western hegemony, that is.

But are there alternatives?

The prospect of the so-called BRICS nations (Brazil, Russia, India, China, and South Africa, along with potential new members) introducing a brand-new money in the near future, perhaps even a gold-backed currency for international trade, remains conceivable, but it is not very likely.

The BRICS can be expected to gradually reduce their reliance on the US dollar, perhaps by holding foreign reserves in gold rather than Western fiat monies. At the same time, however, they are unlikely to remove the Greenback from its pedestal overnight, as the shock waves of such a drastic move could all too easily destabilise their own economies and political systems.

Countries such as China, India, Russia, and Brazil, despite harbouring interest in challenging the dominance of the US dollar, are far from being bastions of freedom and liberty. Their governments are unlikely to prioritise providing their citizens with better money, such as gold or silver or fostering a free market in money.

For governments worldwide, maintaining tight control over money is crucial to consolidating their power. Large states, in particular, are unlikely to voluntarily relinquish their authority over money in their jurisdiction.

Considering the problems and challenges I just outlined, the question arises: What lies in store for the US dollar, for the world’s fiat money regime? To answer this question, we may want to explore three potential scenarios.

Scenario #1: Investors lose faith in the US dollar and shift to national currencies for trade and financial transactions. In the absence of a universally accepted medium of exchange, the intricate global production and employment framework established over decades under the fiat US dollar regime disintegrates.

Defaults occur in the banking, corporate and public sectors, necessitating a surge in national money supply to stave off the collapse of the fiat money debt pyramid. A shrinking output and an inflation shock lead to a drastic decline in people’s material standard of living.

Scenario #2: An initial drop in confidence in the US dollar sooner or later translates into an even more severe crisis of confidence in many smaller fiat monies – like the euro, Japanese yen, British pound, and Canadian dollar. A flight into the US dollar sets in, and the US dollar emerges as the last man standing, so to speak, solidifying its dominance in the global monetary architecture.

Scenario #3: As challenges within the global fiat money system escalate, the concept of a single world fiat money becomes increasingly attractive for the major states. In this scenario, the exchange rates of key currencies like the US dollar, euro, Japanese yen and Chinese renminbi are pegged to a global unit of account, perhaps named the “global”, initially overseen by the International Monetary Fund, which could eventually evolve into a global central bank.

Let me note that none of the three scenarios offers a path to breaking away from US dollar dominance without paying a significant price. Moreover, all these scenarios fail to present a compelling solution to the world’s monetary dilemma.

4.

The world is in need for a sound global currency. However, identifying and implementing such a currency remains a complex task.

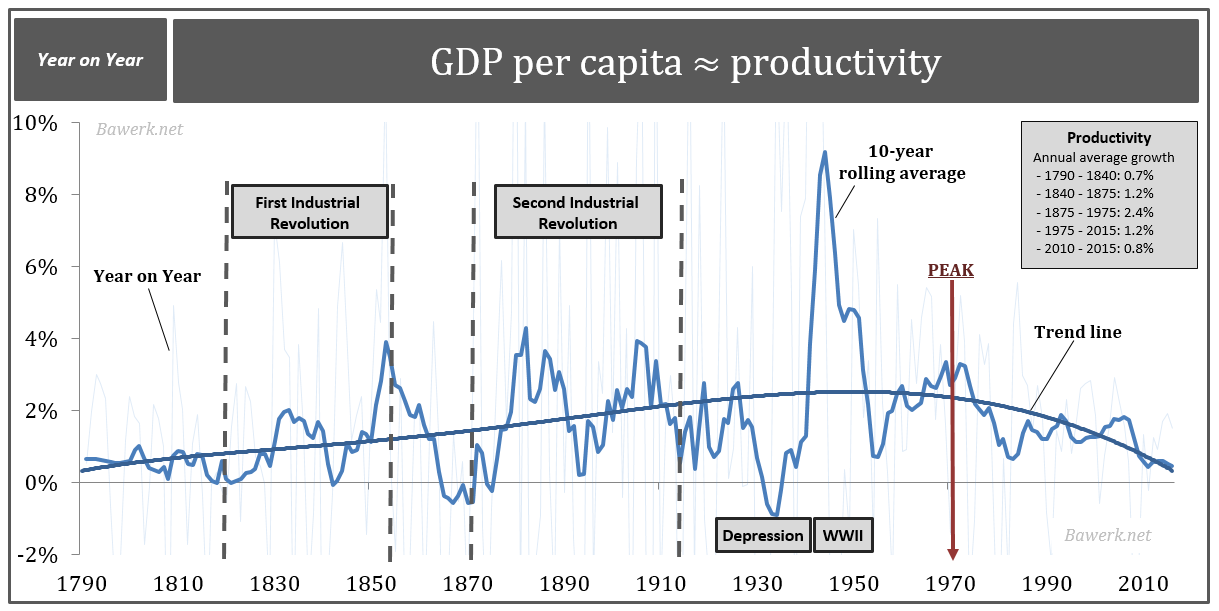

It is crucial to remember that money plays a vital role in driving productivity and is indispensable for maintaining and increasing peoples’ material well-being.

Money achieves its maximum utility when universally adopted, that is when all people use the same money. Because then the benefits of using money are maximised: economic calculation becomes most efficient, and transaction costs are minimised. Consequently, the ideal scenario is a world where a single money is used by all.

This isn’t just abstract theory; history all too clearly demonstrates its validity. In the 19th century, the global economy operated effectively under one world money: gold.

While gold money had different names in different regions of the world – such as the dollar in the US, the British pound in the UK, the mark in Germany, and the franc in Switzerland, gold served as the world’s money.

The era of gold money effectively ended with the outbreak of World War I, which made many countries to abandon the gold redeemability of their currencies. Remarkably, the US remained an exception, maintaining the link between the Greenback and gold. Eventually, the US followed the pack, dissolving the connection, as I noted earlier, on August 15, 1971.

Let me emphasise that the period of gold money was not abandoned due to inefficacy (incapability); rather, the decision was driven by political motives. To suggest otherwise would be a severe misinterpretation of the political intentions to eliminate gold as the world’s monetary standard.

In reality, governments sought to replace gold with their own fiat monies because the yellow metal stood in the way of their policy objectives – imposing the inflation tax, that is plundering the people by expanding the quantity of fiat money, and manipulating interest rates and economic cycles. Gold also impeded the convenient financing of wars – a priority for those in positions of state power and their cronies.

As the Ludwig von Mises (1881–1973) succinctly articulated, I quote: “The gold standard makes the determination of money’s purchasing power independent of the changing ambitions and doctrines of political parties and pressure groups. This is not a defect of the gold standard; it is its main excellence.”

Technically speaking, a return to gold money is feasible, albeit with potentially enormous transition costs. However, the main obstacle remains the lack of political will and public awareness necessary to dismantle fiat monies in favour of gold money – or even embrace a free market in money.

5.

What about the chance of the fiat money system collapsing, leading to a return to gold money?

The reality is that fiat money systems are remarkably resilient and don’t easily succumb to collapse. Even in cases of hyperinflation, as seen in the Brazilian real, the Turkish Lira and many others, these fiat monies are still used. Even the notorious German hyperinflation of 1923 merely resulted in replacing one fiat money, the paper mark, with another, the Rentenmark.

In the modern era, there are numerous tricks available to prolong the lifespan of a fiat money regime.

One of the perhaps most effective methods is gradually transforming the prevailing free economy and society into an unfree socialist or even fascist system.

It puts the state and special interest groups into a position to use their power to weaken or shut down the remaining corrective market forces. This is how it can be done:

Whenever banks and large corporations are in trouble, they will be bailed out by the central bank. Credit markets are propped up by monetary policy makers to prevent defaults of systemically relevant players. Central banks put a “safety net” under financial markets to keep investors buying bonds. They also suppress market interest rates, so that governments can run massive deficits to stimulate production and employment.

Unfortunately, it appears that this is precisely the trajectory I see unfolding in the Western world at the moment, under the guise of initiatives like the Great Reset, Green policies, private-public partnerships, central bank digital currency, and the digitisation of peoples’ lives.

It’s becoming evident that we’re witnessing a shift towards a less free economic and societal model – a trend that could be characterised as a “Chinarisation” of the Western world, a form of Communism-Light. Proponents and supporters of this ideology are likely to staunchly defend the fiat money system as part of their agenda.

Against this backdrop, I believe investors should exercise caution in assigning too high a probability to the scenario of an imminent demise of the US dollar or a breakdown of the world’s fiat money regime, even as pressure on the US dollar mounts. Instead, it may be prudent to prepare for the consequences that the continuation of the fiat money regime will likely entail.

This brings us to the topic of investing.

6.

Engaging in discussions and speculation about the future of the global fiat money system is one thing; making sound investment decisions is another.

At its core, investing revolves around safeguarding one’s or others’ hard-earned savings – with simply no room for hubris, complacency or experimentation.

If you were to ask me for investment advice for the next, say, 12 to 24 months, I would cautiously highlight four general considerations.

#1: Expect the debasement of the purchasing power of virtually all fiat monies worldwide to go on, to remain a significant challenge for investors.

#2: Anticipate a downward trend in interest rates in the US and the euro area from current levels. The US Fed and the ECB are likely to bring interest rates down, potentially driving key rates to 3 ½ and 2 ¾ per cent, respectively, towards the end of 2024.

Consequently, the likelihood of achieving a positive inflation-adjusted return with a buy-and-hold strategy in the bond market is relatively low. To secure a positive real yield, you must explore active trading strategies or assume more credit risk.

#3: Remain invested in the stock market. However, in a scenario where the fiat money system persists and inflationary pressure mounts, not all companies (and their stock prices) will thrive equally.

Typically, companies that can weather inflationary environments should do better than others.

Such firms are often characterised as “asset light”, meaning they don’t rely heavily on tangible assets that might incur higher replacement costs during periods of inflation.

Additionally, these firms have pricing power, allowing them to pass on higher input costs to consumers without significantly dampening demand for their products. Such companies are often described as having a strong “moat”, indicating a competitive advantage that keeps them profitable.

By no means less important is the extent to which a company’s success is in the state’s interest. In the era of increasing government interventions, it is wise to exercise caution when investing in businesses that the state may not favour. And to make things even more challenging, it’s worth noting that businesses that are endorsed by the state aren’t guaranteed success.

#4: Hold gold as part of your portfolio’s liquid components. Please allow me to elaborate on the reasoning behind this recommendation.

7.

Some investors view gold simply as a commodity akin to oil, gas, coal, or the like. Others consider it an asset alongside stocks, bonds, and real estate, while others categorise gold as money.

From my viewpoint, gold is money; it is mankind’s ultimate means of exchange, after all. Former Fed chairman Alan Greenspan perhaps summed it best when he said in 2014: “Gold is a currency. It is still, by all evidence, a premier currency. No fiat currency, including the dollar, can match it.”

Indeed, gold is arguably the most reliable form of money ever known to mankind – and for good reasons.

To serve as the universally accepted medium of exchange, a “thing” must have certain properties. For instance, it must be scarce, homogeneous, durable, mintable, portable, and universally valued. Pardon the pun, but gold fits the bill.

In comparison, let’s consider cryptocurrency, in particular Bitcoin. Is it on the verge of surpassing gold, or has it already done so? I have my reservations.

First and foremost, Bitcoin is not “digital gold”. Rather, gold and bitcoin possess distinct characteristics. Gold is a “real thing”, bitcoin is an open-source number code.

Bitcoin is solely intended to serve one purpose: as a means of exchange. Gold, in contrast, enjoys demand for multiple reasons: it serves both monetary and non-monetary purposes – including industrial applications and jewellery.

The price of Bitcoin could drop to zero if its monetary demand were to vanish, for example if a new crypto candidate were to appear in the marketplace that is considered a superior choice.

The market price of gold, in contrast, is highly unlikely to ever drop to zero, even if it were demoted from its monetary role, as it would still be in demand for non-monetary purposes, ensuring a positive market price.

In times of great euphoria for crypto units, especially for Bitcoin, such fundamental considerations might not appeal to many investors. Still, I believe they are essential to remember because their relevance, albeit currently obscured, will eventually resurface.

What is more, when it comes to the store of value function, let me remind you that gold offers a distinct advantage over fiat money in the form of bank deposits: Gold carries no counterparty or default risk. It can be stored outside the financial system at relatively low costs, unaffected by banks’ opening hours or electronic trading sessions.

In this sense, gold serves as insurance against the vagaries and pitfalls of fiat money. As Alan Greenspan pointedly stated: “Gold still represents the ultimate form of payment in the world. Fiat money in extremis is accepted by nobody. Gold is always accepted.“

8.

Now, what about the market price of gold?

From January 1978 to March 2024, its annualised compounded return in US dollar averaged 8 per cent, yielding significantly higher returns than short-term, interest-bearing US dollar bank deposits and also exceeding consumer price inflation.

Similarly, from the beginning of 1999 to March 2024, the annualised gold price increase was also 8 per cent on average – again outshining US dollar bills and exceeding official US inflation numbers.

It is evident that gold has not only served to safeguard your portfolio against the ongoing erosion of the US dollar’s purchasing power but has also added genuine, that is real, value.

As illustrated in this chart, there was a positive, albeit imperfect, relation between the price of gold in US dollar per ounce and the US money stock M2 in the period under review.

While the quantity of fiat money is just one of many factors determining the price of gold, it appears to play a significant role in determining the underlying trend of the price of gold.

If you side with the view that the fiat money system will persist, you have to expect a continued, even accelerating, expansion of the fiat money supply – accompanied by an upward drifting price of gold.

9.

In my personal assessment, the current price of gold is not in bubble territory. In fact, I could see the price of gold going up another 10 to 15 per cent from its current level over the next 1 ½ years under normal market circumstances – bringing it close to 2.600 US dollar per ounce.

If you factor in market stress, confidence losses, war etc., the previously mentioned estimate may indeed represent the lower end of the potential gold price range.

Please note that the important takeaway here is not my estimation of the gold price going forward. Instead, it is recognising the rationale for holding gold in today’s fiat money system, and that given its current market valuation, gold is likely to remain both return-enhancing and risk-reducing for your portfolio.

Ladies and gentlemen,

There is the saying: “Better a horrible end than endless horror.” Yet, in the case of the global fiat money system, it seems that “endless horror” is more likely for the foreseeable future than “a horrible end”.

My value proposition for gold must be seen in the light of this assessment.

From my viewpoint, gold serves as a sensible means to shield the investor against the inevitable inflation accompanying the continuation of the world’s fiat money regime. Additionally, it acts as an effective hedge against the potential fallout should the fiat money regime collapse earlier than anticipated.

As it stands, retaining your assets in gold and carefully selected stocks of companies capable of surviving inflationary pressure and government interference is, in my view, the prudent course of action.

Thank you very much for your attention and patience. God bless you all.