By Brendan Brown

A serious omission is notable in the circulating list of suspects responsible for the early August quake in global risk-on markets. This is the role of “monopoly capital” in stimulating wild technological change which by-passes potential benign control by the invisible hands of free markets.

In assessing the charge against monopoly capital, the concept of revolution and its differentiation from coup is important. Revolution starts from below amidst a groundswell of new ideas and individual actions. Its continuing progress means at some point an overturning of the status quo regime. A coup by contrast describes a change in regime brought about by deliberate plotting on the part of a group within the present elites,

The distinction is perhaps most obvious in the case of politics. Ryan McMaken reviewed recently how the “October revolution in Russia 1917” in which the Bolsheviks assumed power was a coup not a revolution. We can extend the concept to waves of technological change.

The great technological revolutions of modern times, maybe as far back as the printing press and all the way forward to digitalization say from the early 1990s to 2000s, all started from below. They included at an early-stage great participation from small-sized innovators competing at all stages from basic design to ultimately applications. Competition also remained fierce with the pre-revolution technology. An array of competitors using prior capital equipment technologies exerted a brake on headlong and wasteful adoption of new technologies still untried and underdeveloped to a considerably degree by making bold pre-emptive price-cuts so as to salvage some returns despite obsolescence.

Consider the alternative to such revolution from below – technological change as driven from “above”, albeit featuring still spontaneous innovations in some areas of application. Monopolists or oligopolists or Big Government are then in charge of the process of new technology introduction meaning this has the characteristics of a coup rather than a revolution. The process has special danger as we shall see for the present case of Artificial Intelligence (AI).

Big powerful existing technology firms who control already the gateway platforms to the internet are playing a key role both in the technical innovations (developing the language models) and then in deploying massive capital to implement them. Spending by just 5 Big Tech companies – Alphabet, Apple, Amazon, Meta and Microsoft – on AI amounted to $60bn in 2024Q2, up 65% from a year earlier.

Commentators stress the importance of FOMO (fear of missing out); present monopolists have been fearful of profits erosion by new entrants to the tech industry if they do not act first, safeguarding the “kill zones” around their existing products and services. Yes, there are many unicorns amongst the start-ups which are seeking to apply AI. But, that is much further downstream in the process of technological change and is not a threat to the tech monopolists’ profit. Indeed, the opposite is true given the likely structure of monopoly fees for access to key inputs.

Commentators and indeed even great economists have exposed themselves to the charge of obsequious acquiescence in technological change whatever its form. Some have lauded the role of monopoly power in accelerating the process. We can go all the way back to Schumpeter’s conversion to a belief (opposite to in his early writings) that temporary monopoly power is beneficial in intensifying the process of creative destruction and thereby technological change.

The obsequiousness apparent in widespread societal attitudes to those leading the technological change, even if ugly in key respects, can be explained by the perception that technological revolution is intrinsic to how capitalism builds prosperity over time. We all know those charts showing an explosion of economic growth in the past two hundred years which accompany the new phenomenon of persistent waves of technological change.

Yet all of this is not to say that bigger and more rapid revolutions are always a Good Thing. The invisible hands of the market ideally influence the pace and extent of technological change so as to maximize possible living standards over time. But this means neither driving too fast into the forest of the unknown rather than benefiting from the passage of time to learn about the downsides nor jettisoning ruthlessly earlier technologies meaning immediate obsolescence of pre-existing capital stock. There is no guarantee that on every occasion the invisible hands will succeed in that mission – but as for democracy we can say they are a better proposition than the alternatives for that purpose.

The empirical evidence in favour of non-competitive conditions spurring technological change is at best ambiguous. And we should be wary of economists asserting as a tautology that faster technological progress is always better than slower. The invisible hands should restrain as well as incentivize. The invisible hands of market forces ideally determine the pace of technological change including application in a highly decentralized way (not amongst a cabal of oligopolists) across a vast array of economic activities at an enterprise level.

Even under sound money and highly competitive markets in product and services it is possible for the invisible hands to preside over serious error in the path of technological change. Most obviously there might be a failure at the start for all to envisage snags in the technology and large ensuing costs. And the guardrails of free market capitalism might fail in the context of the new technology, allowing powerful monopolies to form and much malfeasance to occur especially as regards the trampling over pre-existing property rights (including ownership of private information).

Let’s illustrate these concerns with the IT revolution, starting broadly in the 1990s, and under at first highly competitive conditions, but almost continuously under conditions if monetary inflation. It is implausible that the full extent of virus vulnerability in much of the new software was at all apparent in the early years – or the extent of resources which would have to be deployed in defence and the possible inadequacies of this. Yet once the true extent of the costs become apparent, there is no going back.

Monetary inflation has crippled or distorted seriously the invisible hands beyond the amount due to just stark flaws of original vision. A characteristic of asset inflation is search for yield amidst speculative narratives which spread without the normal push-back from sober rationality. Especially in a very low-interest rate environment investors become entranced by the possibility of a long-run stream of monopoly rents emerging; firms which promise this as part of their speculative narrative enjoy a premium. The scope for monopoly in the IT revolution has been notorious – network effects and establishing gateway platforms. And persistent asset inflation has abetted the growth of monopoly capital. Yield-hungry investors have collectively put large premiums on the equity of enterprises with a plausible path to achieving a long-run stream of monopoly rents.

The monopoly capitalists attained new scope to plot a technology coup in recent years with the advent of AI. An eye-opener to the extent of malevolence is now evident in legal dispute between Elon Musk as co-founder and original key financier of Open AI and its chief executive Sam Altman. Musk accusing Altman of deceptively maintaining at the start that Open AI was a non-profit research institute rather than an enterprise in which a controlling partnership via a subsidiary – would subsequently be consummated with Microsoft (also in at the start with Open AI).

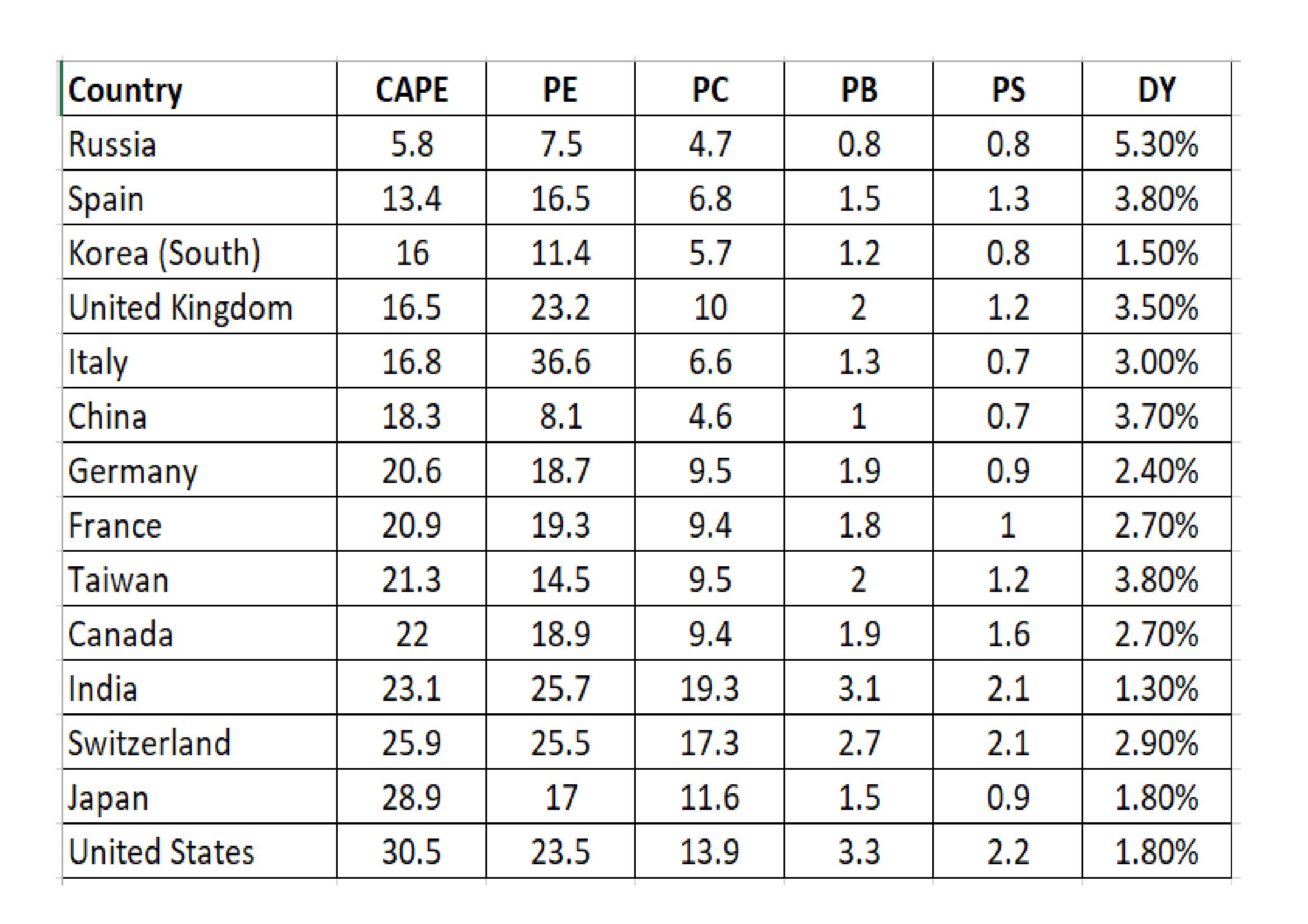

It is implausible that the processes of monopoly-led coups will lead to anything like the optimal rate of technological progress which could likely emerge under sound money and competitive capitalism. Extreme optimism has reigned in the marketplace about the potential monopoly profits (in this example via Chat GBT) from such “plots amongst the oligopolists” – hence all the buzz about the magnificent seven amidst a chorus including Nobel economists and Big Business titans about the productivity surge which lies ahead.

Pessimism though can suddenly break out as we saw in early August. The uninformed child can call out that the emperor is naked. Those tens of billions of capital expenditure by the monopolists on AI, where will be the return? Such doubts would multiply if monetary inflation were indeed now losing strength, perhaps because the rhythm of goods prices is no longer downwards given that supply conditions have generally normalized two to three years on from the pandemic. Monetary authorities will have to work harder (in terms of exerting monetary restraint) to achieve their two per cent inflation target than was the case during 2023-4.

Bottom line: technological change related to AI is occurring largely under the control of the monopolists who rule over the great gateway platforms and has the characteristics of coup rather than revolution. The coup has been featuring a wave of tremendous spending by Big Tech. Jitters have been evident recently in the marketplace that this has gone far beyond what can produce good returns in the future. Hence considerable financial instability and economic disappointment would lie ahead.

Source: https://mises.org/power-market/markets-quake-monopolist-capital-pursues-technological-coup

Data is power, and these handful of monopolies own everybody’s data right now. This is a very bad situation. It is not only bad for free market workings, but also means authorities can arbitrarily tap into such data honeypots, when it is not regular hackers doing it, some of them maybe on a foreign government payroll.

People should wake up and take control of their own data. But before that, we need to make peer to peer technologies that already exist accessible for non-nerds. We have all the bits and pieces to replicate the ease of use and convenient user experience of retail cloud services without the need to hand over you data and devices control to a handful of companies. That will need to come first, then wait for people’s awakening that if they are not data sovereign, they will have no freedoms at all in an increasingly digital driven world.