Central Bank reform is the least sexy area of policymaking in the UK at the moment. There is very little appetite from the current crop of politicians to address it, despite central bank failings playing a large part in the steady, insidious impoverishment of vast swathes of people that live on this island and a pernicious eroding of the price signals that coordinate production over time in our economy.

The last political leader to even threaten to review the Bank of England’s remit and look again at its mandate, how it is organised, and its targets, was Liz Truss back in 2022. The failure of the Bank could not have been more obvious at the time, with inflation running in double digits after yet another bout of money printing during the pandemic, and yet Truss was derided as “deeply irresponsible” for even questioning its performance by then Shadow Chancellor Rachel Reeves.

Reeves claimed that Truss’s criticism of the Bank was creating “huge uncertainty that will hold back vital investment in our economy” and much of the media commentariat agreed. The Bank is often held up as a stabilising force in the British economy and many of Britain’s ‘opinion formers’ saw this as an attack on an independent institution whose contribution was an unalloyed good. Criticism of it was verboten.

This highlights the twin challenge that is faced by those of us who are convinced by the arguments of the Austrian School economists that our current system of central banking is fuelling destructive inflation, debt bubbles and malinvestment. The majority of commentators in the media and the policymakers who design our monetary policy still believe that central banking is not just necessary to avoid economic harm, but critical to ensuring a successful economy.

A new book, “The Age of Debt Bubbles” – edited by the Cobden Centre’s Max Rangeley, aims to tackle the policymakers head on and encourage them to question the system they’re operating. The more of them who can be encouraged to come out publicly to cast doubt on our present unstable system, the more the battle of ideas will shift in our favour and the prospect of reform won’t seem so outlandish.

To do this, Max has assembled a series of heavy hitters – both economists and policymakers, several of whom have served as central bankers themselves – who have the authority and the experience to write persuasively in the kind of language and jargon that the world’s leading professionals and academics in the field use.

They tackle the problems of central banking from first principles, addressing fundamental failings in the knowledge base of senior policymakers. As William White, former head of the Economic and Monetary Department at the Bank of International Settlements (the central bank of central banks) sets out in his chapter on the need for fundamental reform of the monetary policy framework worldwide, “Central Bankers have made a profound epistemological error. They have misunderstood the nature of the system they are trying to control.”

The book aims to correct what are often completely wrong, and in many ways back-to-front, misconceptions amongst today’s policymakers and the academic establishment that purports to inform them. Frankly shocking elementary errors about the nature of money itself – what it is and where it comes from, and how it is created in a modern economy, found in economic textbooks from the undergraduate right through to the PhD level, are all systematically exposed.

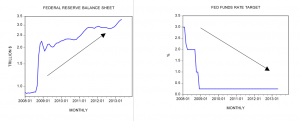

It then goes on to deal with the consequences of this faulty thinking and how central bank policies have led to the creation of immense debt bubbles of the last 40 years, how they formed, why they’re so destructive to our economy, the colossal levels of malinvestment that have been created by the artificial manipulation of interest rates and the painful process which will have to be endured to unravel this mess.

“The Age of Debt Bubbles” is written with policymakers in mind, so the reader must contend with some esoteric terms, but many of the authors in it manage to display that rare skill displayed by the likes of the great Henry Hazlitt in explaining complex ideas in simple, inventive and often entertaining ways.

“Of all the ways of organising banking, the worst is the one we have today”. Little has changed since former Bank of England Governor Mervyn King’s bleak assessment of the monetary system back in 2010. Hopefully “The Age of Debt Bubbles” will help those who have designed such a malfunctioning system to see the errors of their ways and speak out, so that radical reform is no longer seen as an “irresponsible” belief but an inevitable and sensible cure.