Those of you based in London hopefully know that I have a regular column in City AM each Tuesday. Last week I discussed government vs. private investment:

When private sector investment declines, then the reasons need to be identified and a solution found. The key policy question needs to be “why aren’t businesses investing?” Attempting to offset it with government spending is just an accounting deception. And too much government intervention can be the underlying cause, not the cure – through high tax rates, burdensome regulations and policy uncertainty.

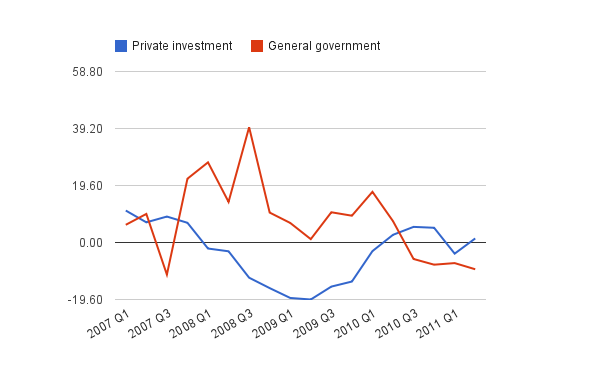

The print edition contained a chart in which I used the Gross Fixed Capital Formation data to compile and contrast government and private investment. That data has now been published by Kaleidic Economics: here is the announcement, and you can view the data here.

What are the units of the y-axis?

Hi Rob, it should be YoY % change. Maybe actual amounts would be better, but I need to correct that. Thanks for pointing it out.