“FRED GOODWIN. Have the last laugh by donating a couple of million to the Tory party and receiving a life peerage.”

– From the Twitter feed of TWOP TWIPS.

Never pick a fight with someone who buys ink by the barrel. (This sound advice may need tweaking in an age where digital commentary requires the purchase of no ink whatsoever.) Notwithstanding the acres of column inches already sacrificed to the banal debate over Fred Goodwin’s virtual defenestration, the British press is in no position to lay claim to any moral high ground when it comes either to conducting business in an ethical way, or to swivel-eyed criticism of those who have visibly fallen short of the mark. Macaulay had it right:

We know no spectacle so ridiculous as the British public in one of its periodical fits of morality.

Or, perhaps, “one of its periodical’s fits of morality.” The sorry, zombified mess that is RBS seems to have come about through a grotesque mixture of managerial overreach and regulatory failure (the sort of thing that every retreating bull market leaves in its wake), but at least the bank had a regulator. The print media in the UK doesn’t even have that – or rather, it chooses to regulate itself, which is much the same thing, given that the outcome has included, but by no means been limited to, the phone-hacking of dead teenagers, the phone-hacking of the families of British soldiers killed in action, and the suicide of the News of the World.

Simon Walker of the IoD was right to warn of politicians whipping up “anti-business hysteria” but his concern at the politicisation of the honours system was only ever going to sound ironic. The press witch-hunt against (so far) Messrs Goodwin and Hester is doubly frustrating in that it disingenuously obscures the role played by politicians in the financial crisis, whether Labour ministers blinded by the illusory wealth creation of City banks, then subsequently unable to follow their emergency support for insolvent banks through to its logical conclusion in the form of full nationalisation; or Conservative and Labour ministers now breathlessly pandering to the lowest common denominator in public opinion. It does not even touch upon the broader causes of the crisis: in the words of Detlev Schlichter,

The present mess is the result of decades of institutionalized monetary debasement and the accumulation of public debt. These policies have left us with bankrupt welfare states and overstretched banks, yet none of this has diminished the enthusiasm of politicians and bureaucrats to give us more of their medicine.

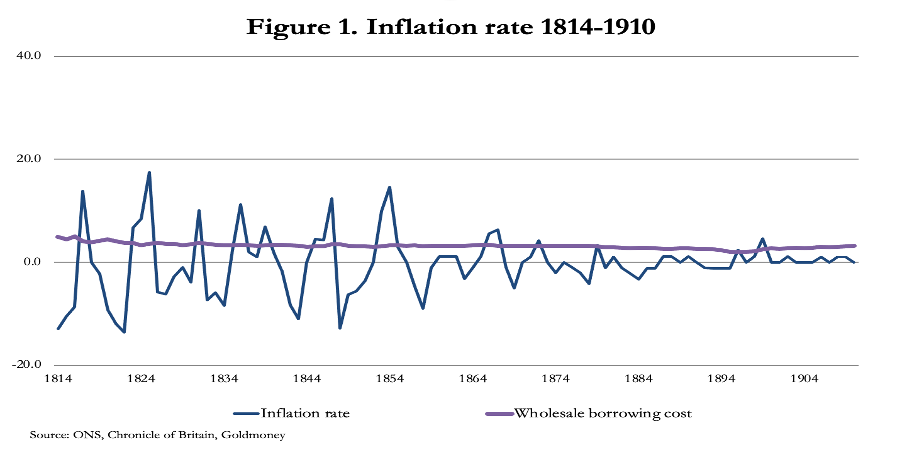

Endlessly flaying bankers on a pyre of public disgust achieves nothing more useful than picking at an open wound. It completely ignores the underlying disease. Media hype is just a painful and distracting sideshow. Since President Nixon took the US dollar off gold in 1971, we have had four decades of unbacked, state money, globally. Governments have reacted to this new-found monetary freedom precisely as you would expect. Like Warren Buffett’s teenage boy encouraged by his father to have a normal sex life, it is not exactly a push that they needed. We have had limitless money creation, limitless bank credit creation, limitless deficit spending.. Until now.

To many investors, the financial crisis began when American banks’ distributed subprime mortgage product started going bang throughout the world. But that is like blaming the mother of all hangovers on the very last cocktail. The reality is that the rot has been slowly seeping around the west for forty years, like a gradual hardening of the arteries around money. We have lived through a collective myth of wealth that was really mostly inflation. Money itself has gone from being a tangible store of value, via paper, to a mere electronic ghost – what Satyajit Das has nicely called “the abstraction of an abstraction”. Having rather belatedly woken up to the perilous lack of solvency throughout the financial system (governments and banks complicit both), central banks have now exhausted all conventional means of keeping the plates spinning, and are seemingly committed to a policy of permanent money creation and currency destruction that threatens to impoverish everyone. Since we are all obliged to use government money, in this sense we are all truly in this mess together.

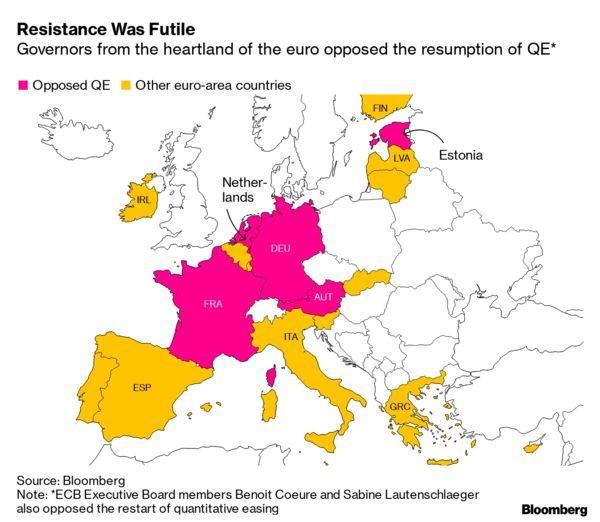

Bill Gross, the world’s largest bond fund manager, has begun to warn of the dangerous things that happen when interest rates start to approach “the zero bound” beyond which they cannot sink further. He is right to observe that the credit-based financial system “became egregiously overlevered and assumed far too much risk” long before the current Fed chairman, Ben Bernanke, was installed. Nevertheless, Mr Bernanke is now tasked with managing the US economy, or at least Wall Street interests, through the resultant carnage. While the media have been variously hounding senior bankers or reporting grimly on the ongoing political farce that is the euro zone, they have missed the much larger story: the west is threatening to turn into Japan.

“My intent,” warns Mr Gross, “is to alert you, the reader, to the significant costs that may be ahead for a global economy and financial marketplace still functioning under the assumption that cheap and abundant central bank credit is always a positive dynamic. When interest rates approach the zero bound they may transition from historically stimulative to potentially destimulative / regressive influences.. when rational or irrational fear persuades an investor to be more concerned about the return of her money than on her money then liquidity can be trapped in a mattress, a bank account or a five basis point Treasury bill.. When all yields approach the zero bound, however, as in Japan for the past 10 years, and now in the US [and elsewhere], then the dynamics may change.. Most short to intermediate Treasury yields.. are dangerously close to the zero bound which imply little if any room to fall: no margin, no air, underneath those bond yields and therefore limited, if any, price appreciation. What incentive does a bank have to buy two-year Treasuries at 0.20% when they can park overnight reserves with the Fed at 0.25% ? What incentives do investment managers or even individual investors have to take price risk with a five, 10- or 30-year Treasury when there are multiples of downside price risk compared to appreciation ?

..Developed economies where these low yields reside may suffer accordingly. It may, as well, induce inflationary distortions that give a rise to commodities and gold as store of value alternatives when there is little value left in paper.

Where, asks Mr Gross, does credit go when it dies ? “It delevers, it slows and inhibits economic growth, and it turns economic theory upside down.. A 30-50 year virtuous [we take issue with his use of the word virtuous] cycle of credit expansion which has produced outsize paranormal returns for financial assets – bonds, stocks, real estate and commodities alike – is now delevering because of excessive “risk” and the “price” of money at the zero bound.”

His conclusion: that we are witnessing the death of abundance and the birth of a period of austerity for what may be a very long time. (And it comes to something when even a bond guy deigns to acknowledge the bullish backdrop for gold as a store of value.)

In a perceptive recent column for the FT, “Low rates: the drug we can all do without”, Satyajit Das pointed out that low rates actively discourage savings, “creating a disincentive for the capital accumulation that would reduce overall debt levels”. Since we are also trying to navigate through the biggest debt crisis in world history, policymakers appear to be saying to investors that the beatings will continue until morale improves. Artificially low rates are also literally punishing for defined benefit pension funds; Das suggests that for every 1% fall in US rates, pension fund liabilities increase by roughly $180 billion. And low rates feed asset price inflation and fundamentally distort asset prices, encourage mispricing of risk, and create further asset bubbles – like the one currently inflating in, irony of ironies, western market government debt.

Not all bankers are necessarily evil. Central bankers, on the other hand.. And yet the most dangerous monetary experiments in world history are barely even reported, much less remarked upon. Evidently they don’t make for a very good story.

This article was previously published at The price of everything.

A good article, except for this bit:

“at least the bank had a regulator”

We would be much better off if all regulation was done by the free market.

Another close to a hundred billion money creation (from NOTHING) by the Bank of Japan today.

The Federal Reserve system.

The Bank of England.

The European Central Bank.

The Bank of Japan.

The Bank of Switzerland.

They are all controlled by people educated in the same Keynesian insanity.