Could a bank exist independent of state support, and could it act as a bastion of liberty?

I recently came across the original quarto edition of the “Act of Parliament For Erecting a Bank in Scotland, Edinburgh, July 17th 1695.”

I have scanned it and you can download it here.

Reading this charter is a most wonderful experience as it shows that at the emergence of banking, the spirited founders of this bank distrusted their government (the King and his Ministers) so much that they forbade dealings with them!

If you were found guilty of lending any money to or doing any business with the government, you had to pay a penalty of three times the value of the transaction, a fifth of which would go to the person who informed on you, with the rest donated to good public causes.

Oh, if banks could only operate like that today, the governments of the world would have to fund their business by taxation only. This would force them to say to all their citizens “vote for me, I am going to take £X from A,B & C people and give to X,Y & Z more deserving causes”. Knowing the cost fully, the people would then judge on the merits of what was proposed, rather than trust the promise that this mysterious entity called the government, seeming to exist over and above its people, with its own money, will be the font of all goodness.

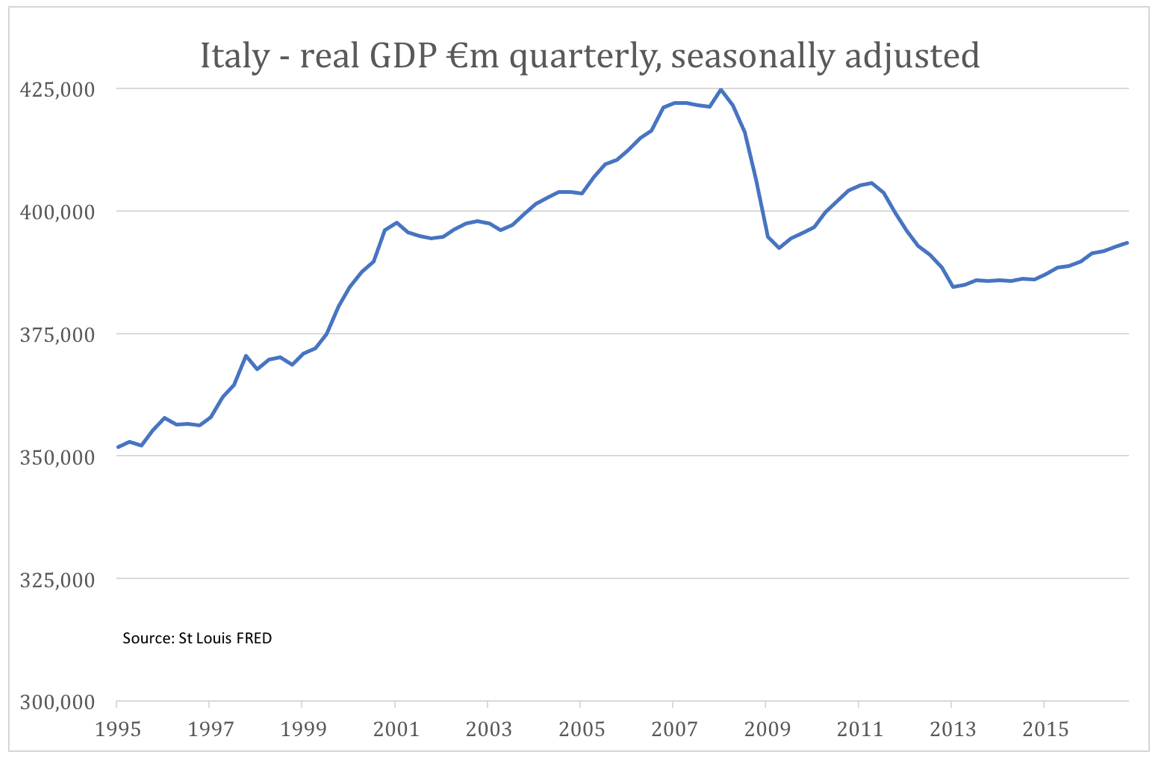

The recent €1 trillion money printing binge by the ECB and the attendant purchases of government bonds would not have been allowed in days gone by. This banditry was rightly viewed as contrary to interests of the people.

If you can be patient with the language, you will enjoy reading this act. Here is the text from the last page:

That it shall not be lawful nor allowable for the said Company, Governor, Deputy -Governor, Directors, or Managers thereof, upon any Ground or Pretence whatsoever, directly nor indirectly, to use, exerce, or follow any other Commerce, Traffick, or Trade with the joint Stock to imployed in the said Bank, or any Part thereof, or Profits arising therefrae, excepting the Trade of lending and borrowing Money upon Interest, and negotiating Bills of Ex-change allenarly and no other. Providing also, Likeas it is hereby expressly Provided, Enacted and Declared,That in case the Governor, Deputy-Governor, Directors, or other Managers of the said Company, shall at any Time happen to purchase for the Use and Behoof of the said Company any Lands, Rents, or other Heritage belonging to His Majeity, His Heirs and Successors, or shall advance or lend to His Majesty, His Heirs or Successors, any Sums of Money in borrowing, or by Way of Anticipation upon any Part, Branch or Fund of the ordinary Rent or Casualties of the Crown, or of any Supply, Cess, Excise, Custom, Pole-Tax, or any other Supply or Taxation already granted, or which shall happen to be granted at any Time hereafter to His Majesty and his foresaids, any Manner of Way whatsoever, excepting these Parts, Branches, or Funds of the saids Rents, Casualties, or Impositions foresaids, upon which a Credit of Loan shall happen to be granted by Act of Parliament allenarly ; then and in that Case, the said Governor, Deputy-Governor, Directors, or other Managers, one or more of the said Company who shall consent, agree to, or approve of the said Purchase, Advance or Lending to His Majesty and His foresaids, and ilk ane of them so agreeing and approving, and being found guilty thereof according to Law, shall be liable for every such Fault, in the Triple of the Value of the Purchase so made, or the sums so lent, whereof a fifth Part shall belong to the Informer, and the Remainder to be disposed of towards such publick uses, as shall be appointed by Parliament and not otherwise. And it is likewise hereby Provided, That all Foreigners who shall join as Partners of this Bank, shall thereby be and become naturalized Scots-men, to all Intents and Purposes whatsoever.

Extracted forth of the Records or Parliament by TARBAT Cl-Regifiri.

A brilliant idea, Toby!

Prior to the recent Royal Bank of Scotland debacle the Scots (John Law excepted) were always known for their sensible approach to money matters, in particular their abhorrence of debt.

Fred Goodwin, hugely influenced by media and advisers South of the border managed to destroy that hard earned and well deserved reputation. Don’t be deceived though here in the broadlands of Scotland people in general remain,in relative terms, cautious by nature and many,myself included saw the financial bubble happen and refused to be drawn in – so deleveraging here post the bust is not such a big problem.

Here’s a Scottish author’s (Clark McGinn)recent definition of Banking ..

“Banking what is it?

It’s playing with other people’s money. To lend to anyone you take a bit of your own capital and borrow money ( either from depositors who tend to leave their money with you,from bondholders who expect to receive income and be paid in a few years or from the wholesale markets effectively for a few weeks or months)

Just as the people the banks lend to have to pay interest regularly and repay the whole amount one day,so do the banks on their wholesale funding.

Forget that and you run a huge risk ”

….from “Out of Pocket” Luath Press .ISBN 1906307822

At the time Clark wrote the book he was the Senior Director of an asset finance team in a large UK bank.

In short No,the current greed in all the levels of banking has evolved into what we have today,visavi todays headline on bar bill,it would be almost a perfect world if the above act could be reinstated,but we must adjust to progress!!!!!!.

Great bit of research Toby.

However there are several issues here. And it’s important to distinguish them.

First, re your third paragraph, almost everyone will agree that political parties’ election promises should be accurately costed and that they should stick to those promises. That’s a bit utopian, but no one can quarrel with the basic idea.

Second, re the idea that government spending should be funded just by tax (rather than tax and borrowing): agreed. Milton Friedman proposed a zero government borrowing regime. See paragraph starting “Under the proposal…” (p.247) here:

http://nb.vse.cz/~BARTONP/mae911/friedman.pdf

Plus I had a go at demolishing all the arguments for government borrowing here:

http://mpra.ub.uni-muenchen.de/23785/

Third, re the idea that artificially low interest loans to commercial banks by central banks, there are TWO objectives here. One is to provide stimulus for the economy as a whole, and the second is to rescue incompetently run corporations which ought really to be allowed to go bust.

I don’t approve of lame duck subsidies, and I’m pretty sure you don’t either.

As to providing stimulus, that is where we disagree I think. I say that where the economy has spare capacity, governement should provide simulus, and conversely, if inflation looms, government should do the opposite, i.e. rein in demand. I.e. I think that stimulus is needed from time to time, but it certainly should not the provided via Wall Street crooks and fraudsters, with the crooks and fraudsters taking their cut.

“Stimulus” should be described as what it is – creating money (from nothing) and then either the government spending it, or having private individuals and/or enterprises spend it.

“Inflation” is not a rise in prices (that was the Fisher mistake of the 1920s – not seeing real inflation because he was obsessed with price indexes) – it is a rise in the money supply (“stimulus” is inflation). It creates a credit bubble (such as that of the late 1920s, the Ben Strong bubble, or that of more recent years – the Alan Greenspan credit money bubble) such bubble “booms” inevitably burst.

As for “spare capacity” – if you mean unemployment, then the cause of it is not lack of “stimulus” it is blockages on the movement of the price of labour (wages).

Even with a major credit money bust (as in 1921 – the bursting of the First World War credit money bubble) unemployment will quickly fall IF IT IS ALLOWED TO DO SO (i.e. without unions or other government backed messing up of the labour market).

Warren Harding (for all his other faults) did not try and “keep up demand” by preventing the fall of wages in 1921 – Herbert “The Forgotten Progressive” Hoover worked night and day to keep up wages in the face of the bust of 1929.

Rather different consequences from the two lines of policy.

As for the present policy of endless “monetary and fiscal stimulus”, they will be terrible.

As will be seen in (at the latest) 2013.

Ralph Musgrave – where do you think that the inflation (monetary inflation that is) and ‘spare capacity’ in the economy come from if not from prior attempts at ‘stimulus’ by government?! A proper reading of Austrian Business Cycle theory and economic history would suggest to me that such phenomena, beyond a tolerable degree normal to a free economy, are caused by governments.

In reality, one cannot have a ‘correct’ amount of stimulus – firstly, there is a knowledge problem that the government can’t overcome, it can’t know how and where resources ought to be allocated. Even if it could do so, governments and Central Banks experience serious public choice problems which means their attempts at resource allocation are sub-optimal.

Left to themselves, markets are self-correcting in the long-term, it is only the prior ‘stimuli’ of government – usually monetary – that breaks them and then requires (or rather, influential groups demand) further injections of ‘stimulus’. The whole idea that governments can effectively control and direct the economy to get just the requisite amount of demand is nonsense – can you please show me where it has worked? I can see no example of this happening effectively. Instead the invariable result is stagnation or a vicious boom-bust cycle.