Sept. 17 (Bloomberg) — Private investors in China, the world’s largest metals user, have stockpiled “substantial” quantities of copper as the government ramps up stimulus spending to spur the economy, according to Sucden Financial Ltd.

Pig farmers and other speculators may have amassed more than 50,000 metric tons, Jeremy Goldwyn, who oversees business development in Asia for London-based Sucden, wrote in an e- mailed report after a visit to China. That’s about half the level of inventories tallied by the Shanghai Futures Exchange, which stood last week at a two-year high of 97,396 tons.

Many of us will have chuckled over the story that Chinese farmers are piling up base metals next to the barnyard muck-heap and as we do we will all be guilty of condescending to those sucked into a speculative whirl created when hot money met the Asian gambling instinct, forgetful of the fact that – though we have a penchant for intangibles rather than things you can stub your toe on – we are just as much at fault ourselves and for the very same reasons, to boot.

For, if we look behind the surface, we must see that our Oriental Farmer Giles’ actions are not exactly an irrational response to the vast monetary over-supply prevalent in a China where prospectively profitable outlets for all that ‘stimulus’ money are in decidedly short supply. The result is a ‘Flucht in die Sachwerte’ as Mises put it – a “flight to real values”.

We can already see that the brief stock market pullback which occurred when they feathered the throttle earlier this summer has completely terrified the Chinese authorities – helping them realize they have what Hayek called a ‘tiger by the tail’. By this we mean that they know no good can come of holding to their present course, but that they are also aware they will be instantly eaten alive if they dare to let go. As a result, PboC Vice Governor Su Ning was on the newswires today talking of continuing the present ‘moderately loose policy’ – i.e., naked inflationism – out into 2010. Heaven help us all!

But no illusions of Occidental superiority should be allowed to intrude, for we cannot expect our worthy central bankers to be any less pusillanimous when their turn comes to act – for all the current rumour-mongering about tough talk behind closed doors at the Fed.

As we said almost from Day One of the crisis, Bernanke’s utter misreading of the 1930s has fixed the Fed’s ‘mistake’ of 1937 just a large in his sights as that of 1930. Needless to say, while they focus on the drama of that one, blighted decade, he and his peers completely neglect the whole sad chronicle of mistakes committed during the years 1913-1929 and 1938-2009, as its flawed doctrines and political biddability have combined to gut the far more pure ‘capitalism’ which preceded the Fed’s establishment and which have promoted in its place the pandemonium of bank-led, crony corporatist welfare we practice so disastrously today.

At present, the main difficulty we face in our own work is that of not being too repetitive in laying out what he have been saying since the Crisis started (and hinting at long before then): namely, that Government activism + central bank accommodation = more money despite lowered levels of direct commercial bank lending to the private sector and that this, in turn, is enough to set the stage for an ill-founded revival in real-side activity.

This, of course, is already proving enough to bedazzle the intellectual goldfish who teem in our waters and it is certainly providing plentiful ammunition for our recently state-sponsored stock promoting class – this even though the upswing is becoming ever more dependent on a government interventionism littered with ‘broken windows’ and scarred with the smoking craters of economic collateral damage. Furthermore – and much sooner than anyone really credits it – it will also result in higher goods prices despite the presence of the so-called ‘output gaps’ (i.e., the many abandoned factories, deserted shipyards, uncompetitive vehicle assembly lines, and dust-blown construction sites) which, despite their evident disutility, are deemed to offer a safety valve, according to the tenets of Keynesian Groupthink.

As a result, it is very likely – if not quite fully guaranteed – that we have, as predicted, avoided our 1931-33 reprise. So, let’s hand it to those recidivist drunk drivers, Ben and Merv and Jean-Claude, for being canny enough to ferry some of their victims straight to the local hospital in the hope of impressing the judge at their hearing.

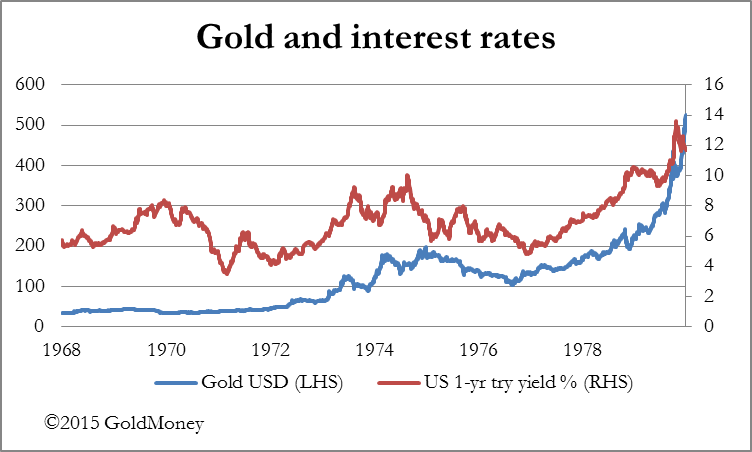

The sad truth is that, whether we are spared our mini-1937 moment as the stimulus is wound down (if only in real, not nominal, magnitude, and probably not in its application, per se), or whether the avid desire to avoid the stutter of a ‘double-dip’ is to forego all meaningful attempt at Cold Turkey, the central bankers’ much-acclaimed ‘success’ implies that we will fully realise our impoverishment amid a re-run of the stagflationary 1970s instead.

This will come about as a direct result of the way in which the over-extension of monetary loosening and the intensification of an already gross degree of state interference will impede the necessary healing processes of private entrepreneurialism while fostering both a divisive economic nationalism across borders and a febrile social factionalism within them.

To sum it up in a quote:-

“We are currently in a market where government bonds, corporate bonds, industrial commodities, precious metals, major and emerging market stocks are ALL rising while the volatilities and risk spreads associated with of most of the above are falling. This is not a bull market for gold and silver – it’s a bear market for paper currencies, led by the USD and driven by a deliberate, rapid inflation of the narrow money supply almost everywhere you look. Do not expect this policy to be reversed anytime soon”