Inevitably, when yet another false dawn for the Sinomaniacs turned into a lowering twilight, the newswire reporting surrounding the latest Chinese PMI numbers included a few talking heads who expressed their ‘surprise’ at the deterioration in the gauge. A ‘surprise’? Really?

What actually never ceases to surprise is just how ‘surprised’ the mainstream always is – when it looks up from overlaying one handy, time-series squiggle over another in a spreadsheet and thereby pretending to know something – by how non-linear, how widely ramified, and often how intractable, the collapse of a credit bubble usually is. Now, we don’t expect the humdrum practitioners of the Macromancer’s art to posses much in the way of a PROPER economic understanding, but you’d think blind empiricists like they could at least pay attention to the actual evidence, once in a while.

The simple fact is that, having engineered an explosion of money and credit in the aftermath of the Lehman shock, the regime has now delivered an implosion and – guess what? – all those individuals, all those businesses, both well-grounded and speculative, public and private, honest and corrupted, who came to rely on ever-expanding nominal revenues to pay their bills and ever-appreciating assets against which to borrow to play the game have suddenly been confronted with the cessation of the monetary deluge which was the prime reason such a superficially happy state of affairs could exist in the first place.

What do you think the result of such a juddering dislocation should be?

What is even more inexcusable for the Sinopaths is that the very object of their uncritical admiration – the upper echelons of the Communist regime – have not once refrained from emphasising the message that the programme enacted in 2009-10 was the root of the problems with which they are wrestling today – overcapacity, irrational investment, overstretched finances, a vast monetary overhang, and the twin social evils of a get-rich-quick mentality and its darker side, the rampant corruption and disrespect for the rule of law which such a Gold Rush has engendered.

Yet these same admirers have managed to cling on to the screaming cognitive dissonance which holds, at one and the same time, that the Juggernaut which is the Chinese economy cannot possibly be subject to the same tedious quibbles to which its failed Western capitalist competitors have succumbed (shades of defeatist admiration of Mussolini’s 1930s Italy and Khrushchev’s 1950s Russia) but also believes that, if by some heavenly catastrophe, it does begin to teeter, the CCP will perform a rapid volte face and repeat the errors of three years ago a fortiori, presumably consigning all public mention of their subsequent self-criticism in that regard to the socialist Memory Hole, as they do!

Even though we focus here on China, we must recognise that it is not alone in its travails – Indian industrial production and GDP (if you must!) have both hit multi-year lows; Brazilian IP has been declining for the past year, to reach levels first seen in 2007; the Russian equivalent is perilously close to zero. As a result, the rupee has hit record lows, the real lost almost a fifth of its value in 12 weeks before staging a minor recovery, while the rouble has weakened more in the past month than in any like timeframe outside of the country’s 1998 collapse and the height of the GFC itself. These three supposed leaders make up the worst two and three of the bottom six global currencies since the global market rolled over at the start of March.

Why is this important? Well, according to the Pollyanna line which the sehr beruehmte Jim O’Neill was touting last week, ‘the BRICs create one new Greece every 11 1/2 weeks’. OK, but what if they are now UN-creating one every quarter, Jim? What does your ‘model’ say, then, pray?

While we wait for enlightenment from this latest scion of the Squid to have his name linked to the top job at a major central bank, let us just note that, six short years ago, China’s apparent consumption of copper was only a quarter of that indulged in by the rest of humanity. Three years ago, it was still only half but, briefly at the end of last year, the ratio touched nothing less than parity. Clearly building all those new Greece’s exerts a terrible strain on the totality of available mineral resources, when done the Chinese way, at least.

We say ‘apparent’ consumption, of course, because the estimate on which so much ‘modelling’ relies merely compares – absent all error bars, naturally – production and net imports with reported changes in inventories and so takes little account of the mountains of ‘grey’ stocks quietly tarnishing on the humid wharfsides of China’s ports while its owners parlay the cheap dollar credit they have raised thereon into a means with which to play for currency appreciation, curb lending returns, and rising real estate prices. Many of these expectations, it seems, have diminished almost as rapidly as has the marketable value of the copper holdings on which their L/Cs were first predicated, driving a certain – shall we say – reassessment of the strategy.

Even absent any further deterioration in the productive economy there, the twin subtleties of ‘reported’ and ‘apparent’ could yet come to haunt traders not just of copper, but of other metals, as well as of iron ore, coal, and crude. A dawning awareness of this would certainly explain why, after years of uncritical bullishness, one big miner after another is now scrambling to revise downward its capex plans and to deflate investor expectations – an emerging consensus not entirely marred by the glaring exception of an Xstrata whose board members seem to have the little matter of multi-million retention guarantees and lucrative, post-merger stock grants to monopolise their attention and cloud their objectivity (in their public pronouncements, at least).

Amid the soaring yield spreads and crashing core outright yields to be seen in Europe, the past week was notable for both an increased Latin anxiety and yet more stern, Teutonic declarations of rigour.

Notably, Buba head, Jens Weidmann, told Le Monde that it was hardly sound to imagine a severe distrust of government finances could be overcome by incurring even more debts. He was also suitably sarcastic about the special pleading being put forward for a softening of the fiscal pact, saying that to be ‘in favour of growth, is to be an advocate of world peace’ – i.e., it was a meaningless platitude when lacking any specific programme for the delivery of the Millennium. Concerning the new reconstruction bonds being proposed as a backdoor means of carrying out more pointless Keynesianism, he revealed that he was not entirely convinced that Europe’s problems could really be attributed to a lack of infrastructure. He must have read what we wrote on that particular topic last week!

It almost goes without saying that what everyone wants and expects is for someone, somewhere – in Frankfurt, Beijing, London, or Washington – to heed the calls for action and to fire up the printing presses and make everything right again.

One of the most vehement Anglophone advocates of this approach is that indefatigable doom-monger, Ambrose Evans-Pritchard of the UK Daily Telegraph. One often imagines him, wheeling back and forth outside Oxford Circus tube station while oblivious to the circumstances of the day, come wind or rain, clad in a dishevelled raincoat, belted with a fraying length of twine, borne down by a weighty sandwich board which declaims in bold type: ‘The End of the World is Nigh’,

AEP and his ilk are two-way calamatists who routinely decry all spending and borrowing as being likely to cause bubbles and busts until, err, things go wrong, and then they spin 180°to clamour for nothing other than more spending and borrowing – this time leavened with a comforting splash of central planning and bolted-horse regulation to correct for the ongoing ‘market failure’ – a.k.a. the effects of the gross market distortion previously caused by Leviathan’s itself when it unleashed the earlier credit cycle.

Deflation, depression and dictators stalk the land, they cry, so – quick! – find some means – any means – to rebuild the tumbled block-work of the boom years’ Babel of borrowing, for whatever has been so far essayed to restore it to its earlier hubristic heights has clearly been too feeble and too conventional to have had any effect. ‘Reinforce failure,’ they shout, in blind defiance of basic military principles and sound common-sense, both.

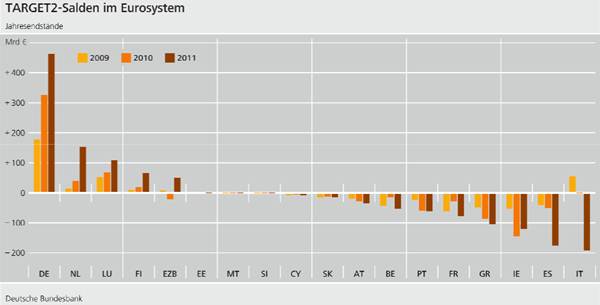

Desperate for a new inflation to camouflage the toxic legacy of the late one, they fret that people in the real world continue to defy the Mighty Oz’s at the world’s central banks and are selling rather more assets than they are buying. In fact, as I have not ceased to try to elucidate out in these writings, what has really happened is that, in contrast to the former reliance on those overbalanced, upper courses of the credit pyramid which had previously been performing some of the functions of money proper, the crash saw a rapid return to significance of that same money (to ‘Austrian’, or M1+, money, as you prefer). Subsequent to this, the scale of the banking sectors’ wounds – which were allowed to fester rather than being either cauterised or amputated in the casualty clearing station and so became progressively more gangrenous – led to a replacement of the normal process of ‘inside’, or commercial bank, money creation by ’outside’, central bank methods (QE, et al). Even in benighted Europe this ‘worked’ at first, until the bank-sovereign drowning pair started to pull each other under and all the ECB’s latter money pumping efforts became diverted into intermediating capital flight and credit withdrawal across the TARGET2 system (now knocking on €1 trillion of net balances).

Thus, (mainly interbank) credit may have contracted, banks may have been less virulent vectors of monetary manipulation than normal, and that money’s recipients may have displayed less than their usual haste in disposing of it again, but, nonetheless money supply has risen since the crash, and markedly so in more than one key jurisdiction.

Let us not forget that prices DID rise under this influence, and rose at faster and faster rates into the bargain, until stimulus was slowed or stopped or until other problems blew up and short-circuited it. But, if you had no understanding of these supply side shifts – and if you also were to ignore the impact on the demand side of the naturally increased willingness of private actors to hold onto a greater proportion of that newly created money amid all the turmoil they were facing – you and your fellow cranks could blindly plot some sort of exploding monetary base number against a relatively modest CPI change and scream, along with the AEP’s of this world – ‘Alas and alack! Nothing is working! We’re doomed to a liquidity trap! Print more, spend more, repeat the errors on a bigger scale – even declare war on Mars like that noted voice of reason and pillar of unimpeachable intellectual honesty, Mr. Krugman, told us to do!’

AEP and his ilk are so blinded by their genius at moving one conceptual economic aggregate from one square to another, so that one new act of balance sheet destruction can be conjured up in the reflation in order to compensate temporarily for the exhaustion of the balance sheets already ruined in the boom, that they have lost all sense of how the world actually works. Economies are not susceptible to such Grand Chessboard imaginings – Stalin and Mao should have shown us that: rather, they are grown from the ground up through individual social interaction. Wealth is not to be promulgated from on high, but to be painstakingly built up, one transaction, and one job at a time.

The real solution to our present woes is thus what Fritz Machlup in the 1930s called an ‘Auflockerung’ – an unlocking, or loosening, of those parts of the economy fixed in place by either a refusal to face reality or by ham-fisted government intervention and its ill-bred litter of perverse incentives. In the aftermath of the Boom, far too much of the pool of goods, capital and labour is currently stuck in the wrong hands, at the wrong prices. As William Hutt used to emphasise, the withholding of supply from the market which this represents makes everyone worse off, because the withholders can therefore express no demand for anyone else’s services – this is the real paradox of self-aggravating decline, not the under-consumptionist bogey of too much saving.

On this last issue, we can also take some pointers from Axel Leijonhofvud, that most thoughtful of Keynesians (if that is indeed what he is, since his own adoption of the label is typically justified by putting the best possible construction on Faustus’ own equivocating and often self-contradictory declarations while dismissing almost the whole canon of subsequent exegesis laid out by those who more convincingly claim to uphold their idol’s legacy).

In his attempt to reconcile the irreconcilable, Leijonhufvud long ago set out the concept of a ‘corridor’ of economic settings – albeit one of variable width – within which it was possible to ignore Keynes’ prescriptions and to allow time for the self-stabilising activities of the free market to smooth out any disturbances to good order which might arise. Outside this range, however, AL argued that matters had become so far deranged that to rely on laissez-faire was hopeless, if not foolish: here the instabilities and the incompatibilities of conflicting aims were such that the feedbacks became viciously positive – Here Be the Dragons of the Keynesian Multiplier!

In AL’s explanation for this, he focused on the fact that such straits were a place where not just the indolent, the improvident, or the plain incidental would suffer, but one whose difficult passage would take so long to effect that even the far-sighted, the frugal, and the initially fortunate would exhaust the buffers they had been prudent enough to lay down, long before any self-correcting tendencies could have time to become operative.

As time dragged on, reduced flows of income could no longer be made good by drawing down on savings, capital, or insurance. As distressed selling and reduced expectations of future income generation each acted to lower collateral values, the credit system would be pressured on all sides, limiting its ability to provide an intertemporal bridging mechanism.

Finally – though AL did not say so in specific terms – even the state would deplete its ability to support all the strugglers, deprived as it would be of taxes; too indiscriminate as it was in dispensing doles; so exhausted its treasury (assuming, indeed, that there still existed Pharaohs wise enough to employ each their own Joseph to first fill it during the salad days) and its sovereign guarantees increasingly seen to be of doubtful worth.

If this sounds like the Europe of today, we would very much agree. But that is not to move from a shared diagnosis to the recommendation of a similar treatment. This is not the place to resurrect the dead dilettante, but to keep the stake firmly planted in the heart of his cadaver, where it lies unmouldered in its crypt in Bloomsbury. I do agree that the system now needs a drastic intervention to move it back into AL’s ’corridor’ wherein normal, individual action can comfortably accomplish the rest of the needed convalescence swiftly enough not to wear out either capital reserves or political patience. The intervention I envisage, however, is more of a catharsis, a purgative of the malign outgrowths of past interventions, than a further infusion of methadone to ease their pain and pretend all is now well.

You see, what the redoubtable AL appears to have overlooked in his analysis is that, just as the now-toppled boom with whose consequences we are wrestling has invariably been either positively ignited or passively endorsed by the state, and just as it was only the state’s flawed interference in the market which allowed that boom to swell to so pernicious a size, so it is to me an incontestable assertion that the state’s interference with the liquidation of the boom – well-intentioned or otherwise – can only make things worse. In effect, what we Austrians charge is that in committing all of these sins, it was the state which drove the system outside the ‘corridor’ to begin with and that everything it has done since has acted against the very re-coordination – the very ‘recalculation’ – of prices, costs, and resource availability for the simultaneous fulfilment of consumer preferences and producer plans which would enable it to be pushed swiftly back in again. Look at China for a classic example of this misplaced arrogance in their ability to conduct ‘counter-cyclical stimulus’.

Think about what usually takes place when the state starts to combat the slump. It props up corporatist zombies long beyond their allotted span, weakening their better-run competitors in a horribly inverted Darwinism. It frustrates the beneficial capitalist transfer of titles from weak to strong hands. It permits a widespread violation of accounting norms and so perpetuates error and propagates a corrosive mistrust throughout the body economic. It slashes the income accruing to savings (and so drains the pool of this vital back-stop to non-inflationary investment all the faster). It chops and changes its policy responses in the wild attempt to be ‘pro-active, so shortening entrepreneurial horizons. It manipulates currencies and disrupts that very cross-border trade which has always been the source of so much of our prosperity.

It practises that most ruinous parody of ‘austerity’ which attempts to keep its own bloated apparatus as large as possible at the expense of the shrunken remnant of the self-reliant – and it therefore preferentially raises taxes to sap the income and expropriate the capital of those best placed to show the way forward once more. Rather than slashing all absolutely unnecessary spending – the state, until it destroys itself along with the prosperity of its subjects – attempts to keep its unwieldy establishment of patronage and purchased electoral power as insulated from the woes of those outside its web, insofar as it is able. ‘Work together, enrich the soldiers, and scorn all other men,’ indeed!

In all this, it arranges firstly that AL’s ‘corridor’ becomes far too narrow for anyone inside to remain there, and then ensures that the razor-wire-topped walls which to mark off that ‘corridor’ become far too high and imposing for anyone outside ever to regain its sanctuary.

It is all very well to propound the view that if we do not take radical action, we will end up in another Great Depression – as we heard whined incessantly by the Nomenklatura – but what we should ponder instead is why it was that that era’s first major implementation of a programme we might call Keynesian (even if our evil genius had not then written the Meisterwerk in which the policy took on the complexion of Holy Writ) managed to bind the vibrant, resource-rich, creditor nation of America into a much longer period of sub-par growth than was suffered by most of its less well-endowed neighbours.

We should consider why it was that the US could not recover as rapidly as it did after an initially more severe, post-WWI deflation; why the likes of Japan are still bumping along the bottom today, twenty-odd years after their great excesses were treated with unalleviated ‘pump-priming’. We should seek for reasons why four years of extraordinary and unorthodox fiscal and monetary manoeuvrings since our own troubles began have not put the West back on its feet, in time to stand steady before a similar resort to quackery brings the formerly dynamic emerging nations to a similar level of prostration in their turn?

Could it be that the answer is too much government, not too little? That the state’s fabled ‘stabilising’ potential only serves to stabilise the disease, not speed its remission, by chaining up resources that need to be redistributed and by freezing prices that need to adjust? That the much-lauded ‘courage’ of economic illiterates-cum-cynical opportunists like Roosevelt only deters the sort of bold, entrepreneurial response which is needed, even when Our Dear Leaders are not actively vilifying wealth creators as ‘economic royalists’ or ‘Kulaks’? That to endeavour to save the nest of corporatist parasites which is the modern banking system at the expense of the well-being of the wider citizenry, under the disguise of guarding against a ‘systemic’ breakdown, saves neither citizens, nor banks, nor ultimately the state itself?

Rather than declaiming, Canute-like, that ‘no strategic financial institution would be allowed to fail’ – ALL of them, of course being deemed strategic – and then subjecting first the easily-cowed Irish, then half the rest of the continent, to debt peonism in the attempt to make good on the boast, could it have turned out worse if all the state had done was to apply the law to the banks as fearlessly as it does to bakers, builders, or bookstores?

From the first day, we have never ceased to aver that these latest revelations of their enormities meant the banks should at last have been stripped of the thick hedge of legal positivist privileges behind which they harvest their vast rents. They should have been put straight away to the impartial examination of accountants, auditors, and the courts, where necessary. The bad would have failed; their (mis)managers would have been sacked – sans golden parachutes and fat pension pots. Their owners would have rightly been left empty-handed, their unsecured creditors made to pay the penalty for their credulity alongside them, and their remaining secured shareholders left to take equity stakes in whatever rump of the organisation survived such a cleansing.

Depositors could be have still been made whole (thus preventing a complete collapse of the money supply as well as arguably serving natural justice since the suspicion exists that, however legally unfounded it may have been, many of them were tacitly encouraged to believe they were only warehousing their funds, not acting as the bank’s creditors when they committed their monies to its safe-keeping.

Some time at the back-end of last year, when told on CNBC that the costs attached to this idea would be so enormous that they simply could not be borne, I replied that many banks were already trading at no more than 20-30% of book value, implying that the market had already drawn some far-reaching conclusions about the likely worth of the assets on their books. Instead of trying to performing an inflationary, market-distorting CPR on those dead assets, this verdict should have been carried out without delay and the most cancerous assets written down or off.

To the charge that the banks would then have needed far more new capital than it was possible ever to furnish, I pointed out that the typical Eurobank had around 40% of its assets (some €12.3 trillion) in the form of loans to other banks, in addition to which approaching 10% (€2.7 trillion) took the form of credits extended to Eurozone governments.

Why not take advantage of this and subject the first of these – a capital-sapping, risk-enhancing, economically otiose mountain of largely unnecessary duplication – to a mass, CDO-style, ‘tear-up’? Open a grand clearing bazaar – for a limited time only – and get all the banks to novate, net out, and otherwise cross cancel as may of the obligations they owe one another as possible (we might also get them to do the same to the 93% of the $650 trillion in outstanding derivatives that have no non-financial counterpart at the same time, so defusing that particular time-bomb, too).

Then get the governments to redeem their outstanding liabilities by giving the banks equity stakes in a sweeping privatisation programme which would reduce the formers’ indebtedness by enacting a much more benign form of ‘austerity’, (and would eventually increase the efficient use of the assets so disposed of) while lessening the latter’s choking vulnerability to their masters’ foibles. The shares, which have no real place on the balance sheet of an institution such as a bank, of course, could then be sold on, in turn, to people better suited to own them – or the bank could spin off a mutual fund-type structure in which to house them, far away from its core, short-term intermediation function. And, yes, your author is a firm advocate of separated banking/financial functions: asset management, debt underwriting, securities and foreign exchange broking – even proprietary trading – all have their place, but that place is not to be found just down the corridor from a depository warehouse. Nor are any of these activities to be undertaken under the aegis of a whole range of explicit and implicit government backstops.

Free banking, yes: but free to fail as well as to flourish, emphatically so!

It was gratifying to see John Hussman make a series of parallel arguments this last week, when he derided the inconsistency of the present orthodoxy. As he wrote:-

That’s what’s so frustrating about the discussion surrounding bank “failure” – a $15 trillion stock market can lose 20% ($3 trillion) and it’s just a run-of-the-mill bear market. But let bank bondholders face a similar loss, and the banks cry that the whole financial system will go down. We’ll finally get some economic traction when global leaders have the sense to take bloated, mismanaged banks into receivership, mark down the assets to their actual value, restructure the repayment terms with homeowners and other borrowers, haircut the liabilities enough to make the resulting entities solvent, and then return them to the private market under a regulatory structure that splits traditional lending from securities trading. That prospect is getting closer.

Amen to that!

To wade tentatively out in to very treacherous waters and risk being called a statist, there is one – and only one – area for proposing a kind of ‘active defence’ (as opposed to an orgy of activism) on the part of the authorities while all the above reforms are being undertaken, fraught though even this minimalism is with the risk of the steps being misconstrued, with the ever-present dangers of mission creep, and with all of the ‘pretence of knowledge’ problems that come with the task’s enactment.

This is a compromise based on the weary recognition that we sometimes have to move away from the realm of the theoretically pure to the polluted sphere of the pragmatic. We do, sadly, have a central bank with which to reckon and it has allowed others to erect an unstable credit structure on top of its own ethereal emissions. When this edifice collapses, it could therefore be plausibly argued that – in order to prevent the ‘secondary depression’ from spiralling into some sort of pecuniary singularity – the CB should act to preserve a strictly-limited monetary core of demand deposits and currency. Preserve it, maintain it, assure a primary quantity of its provision – but not grow it, expand it, or target its future rate of increase: this far and no further.

To re-emphasize this point, the task in hand must be categorically distinguished from all ideas of pursuing some sort of ‘higher level’ tinkering, such as that of trying to maintain levels of, or restore some estimate trend growth to nominal GDP.

The latter of these proposals – in truth, just another variant of top-down inflationism – is espoused by several disparate schools of modern monetary cranks, but the former – the maintenance of the level in order to counter shifts in ‘velocity’ – is also something the far more reputable Fractional Free Bankers endorse, albeit, in their case, by a bottom-up, spontaneous means, and not by a ukase from the Tsars of Threadneedle St. If it were to be practised, however, it is hard to see why it should be based on trying to steer, by monetary means, such a horribly flawed and tardily released measure as GDP, at all. Far better to look at total economy spending – as best approximated by its flipside, business revenues. That would be to use what is not only a more timely and less manipulated measure, but one which does not, by definition, leave out 60% of higher-order economic activity – and the most variable 60%, to boot – as a focus on Kuznetzian, end-goods GDP does.

But, in truth, all of this strikes me as fundamentally flawed. Whatever the target datum, the problem still remains that if we have had a bubble in which we have overstretched the productive structure compared to the ‘pool of funding’ – i.e. we have engendered mass error in our undertakings and some good fraction of the firms contributing to that prior revenue flow have, as a result, been revealed to be unviable and so need to disappear, taking their contribution to the transaction tally with them as they do. If we are simultaneously trying to keep that overall flow number UP (much less growing it as most NGDP types want to do), we are again pushing money in a different direction from the one the real economy is trying to take – we are once more making it a source of disco-ordination rather than a medium which transmits crucial relative price signals and circulates goods and services as neutrally as possible.

Better to have flexible prices, rigorous accounting, and an unshrinkable money core against which to come to rest! This will allow real balance effects to take hold eventually and will guarantee that prices find a bedrock below which they cannot fall by themselves acting to diminish the money supply.

At that point, the CB can then make amends for its malign impact and proven incompetence by ringfencing that money stock and promptly abolishing itself.

Beyond this, policy should therefore be focused exclusively on the reality of micro adjustment and not succumb to the illusion of macro manipulation. It should balance genuine and immediate PUBLIC austerity with significant cuts in taxes so as to restore people’s income, but, more importantly so as to give them back the discretion to manage their own affairs, according to the unique circumstances of which they, not some federal bureaucrat, are best cognisant. If as fearsomely efficient an institution as the German General Staff can recognise its own limits of operational control and devolve a good deal of decision making down the most local level, via the doctrine of Auftragstaktik, so can our less stiff-necked, civilian masters. If they want more scope than that, let them all go and boot up Second Life or the Sims or something instead, where they can play out their Platonic fantasies of directing history in the round without doing any harm to their fellow men as they do.

Our platform would also act to restore the self-esteem and the sense of self-responsibility of the ordinary man and woman and so reverse some of the debilitating demoralisation they have undergone at the hands of the Nanny State. It would confer the added advantage of letting everyone know the worst at once and so would encourage them to get on with working their way back out of the slough instead of condemning them to long, grinding years of sub-par performance relieved only by intermittent bursts of arbitrary exactions and newly-imposed restrictions from on high.

Ron Paul often points out, correctly, that, in the US, the federal deficit has gone from a pre-crash base of around $450 billion a year – which was already then deemed to be unsustainable – to two and even three times that, with spending up likewise from $3 trillion per year to $3.6 trillion. As he rhetorically asks, was the place a depopulated wasteland just four years ago before all that extra dole was ladled out – and, if not, why do we think we risk pulling civilisation down around our ears if we trim back even to normal peacetime levels of profligacy? UK state spending, for any of my compatriots here inclined to feel smug, is still a sixth higher than when the wheels came off the Boom, for all the protests of better housekeeping.

To sum the moral of all this by means of an anecdote, your author was fortunate enough to appear on TV with a very unassuming, but highly convincing CEO of a British engineering software company the other day. The firm, he said, was thriving amid all the turbulence, as its latest results confirmed. But he soon admitted that he and his fellow executives did not know what to do with the excess cash they were accumulating. They were loath to spend it willy-nilly in the present climate and so were instead having to waste valuable entrepreneurial decision-making time trying to keep it safe from the potential effects of any or all of the often unforeseeable levels of currency, regulatory, or political upheaval.

The key word he – and his many peers – keep re-iterating is ‘uncertainty’ – and that uncertainty is in large part the bastard child of swivel-eyed activists in office, with their delusions of grandeur and their fatal conceit of being able to decree what, where, and when their millions of compatriots should and should not do in order to rectify the awful consequences of the mistakes, they themselves, these Ivory Tower absolutists and Jack-in-office Jacobins, have visited upon us all.

As the old gag goes, the best advice is: ‘Don’t just do something – sit there!’

While I agree with this assessment I have to take issue with privitisation of national assets particularly the NHS. The NHS has been created by taxpayer money and and taking over friendly societies it isn’t an example of the state taking over industries depriving individuals of their assets.

If the government cannot afford to run the NHS it should hand the assets to not for profit companies to be run in competition with other healthcare providers. Healthcare is not like farming and industry it maintains the ability to create wealth it is paid for with wealth created elsewhere if run for profit it simply redistributes wealth, often away from the poor, vulnerable and miss-fortunate.

“The NHS has been created by taxpayer money …”

(depriving individuals of their assets)

“… and taking over friendly societies …”

(depriving individuals of their assets)

“… it isn’t an example of the state taking over industries depriving individuals of their assets

I suspect there’s a comma missing after ‘industries’, but let’s not pretend that the creation of the NHS was cost-free.

Taxpayers were robbed to create it, and they are robbed to sustain it.