Defining terms

Economists have a word for recessions that occur prior to a previous GDP peak: A depression. Yes, when the normal economic growth and business cycle course of events fails to materialise, with each peak in activity surpassing the former, you are no longer in recession, however severe. You are in a depression. Well, now that leading economic indicators the world over point to a severe slowdown ahead, to paraphrase US Treasury Secretary Tim Geithner: “Welcome to the Depression”.[1]

It has been some time since the world experienced a depression. The US and much of Europe experienced one in the 1930s. Great Britain led the way already in the 1920s. Prior to that, to find a depression not confined to one country but that spanned much of the globe, you need to go well back into the 19th century.

Economists have a habit of associating depressions with deflation, monetary and price. Let’s quickly define these terms too: Monetary deflation is a general contraction in money and credit, not merely a slowing of money and credit growth. Price deflation is a general decline in the price level for consumption goods, not merely a slowing of price increases.

It may seem obvious that an economic depression should be associated with both monetary and price deflation. After all, a prolonged period of weak economic growth implies weak demand and, hence, falling prices. But what about the monetary unit, the denominator of all prices? Recall that, during the 1930s, the US was still on the gold standard that had been abandoned by just about everyone else already in the 1920s. (Great Britain devalued and left the gold standard in 1931. The US would eventually devalue in 1934, although remain on the gold standard.) Through most of the 19th century, with the exception of the Civil War, ‘greenback’ period, the US was on the gold standard too, as was Europe.

What this implied was that the money supply was inelastic, that is, while economic policymakers might try to stimuluate demand in various ways to buffer a downturn, lowering interest rates and/or expanding the supply of money was not one of them. Indeed, under a gold standard, in the event that demand falls and an economy enters a recession, it is essentially automatic that the supply of money stays more or less constant and that the general price level falls. (The supply of credit, however, is likely to contract as unserviceable debts are restructured or defaulted on.) Once the price level falls sufficiently and bad debts are written off, economic growth then resumes.

As the world is no longer on a gold standard, we take it for granted today that policymakers will normally lower interest rates and expand the money supply in a recession and will do so rather more aggressively or even unconventionally in a severe recession or depression. But then why on earth do we still assume that depressions are deflationary? Indeed, based on available evidence, it would be more accurate to conclude that, if not on a gold standard, depressions are highly inflationary!

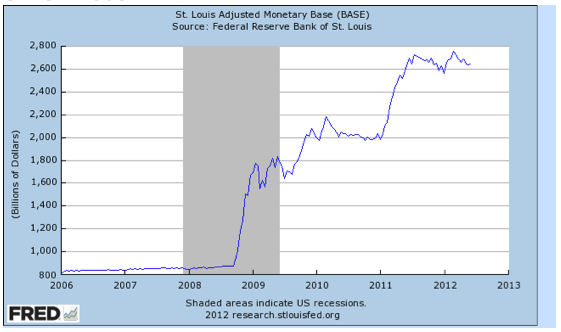

Don’t believe me? Well, let’s look at some charts of the US money supply, narrow and broad:

THE US MONETARY BASE HAS TREBLED SINCE 2008…

…AND BROAD MONEY GROWTH ACCELERATED IN 2008 AND AGAIN IN 2011

Now, the same cannot be said for bank credit, which contracted somewhat in 2009-10 before recovering in 2011, as we see in the chart below.

BANK CREDIT CONTRACTED IN 2009-10 BUT HAS SINCE RECOVERED

So, to be fair, we did observe credit deflation in 2009-10. But we did not observe monetary deflation, rather the opposite. Beginning in 2011, following on successive rounds of US monetary and fiscal stimulus, a general money and credit inflation has been observed and continues right up to the present.

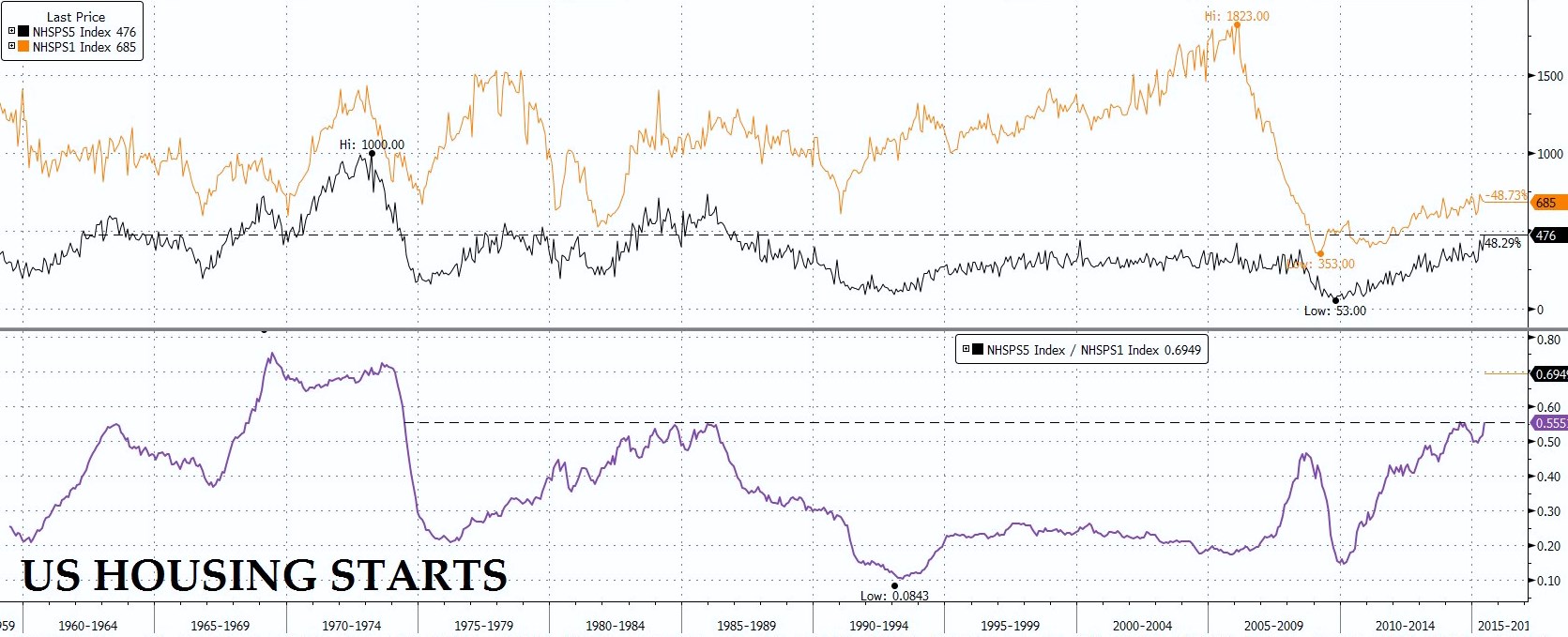

It should perhaps therefore be no surprise that, as we turn our discussion to price inflation and deflation, we have seen more of the former than the latter. In the next chart, we see what has been happening with both producer (commodity) and consumer prices.

BOTH CONSUMER AND COMMODITY PRICES HAVE RISEN SINCE 2008

Now if a Martian were to come round to earth to observe the economy and these various statistics, do you think they would conclude that depressions are inflationary or deflationary? The answer is obvious.

This is not to say that there is not deflationary pressure out there. By all means there is. The financial crisis of 2008-09 was a classic deflationary rush to the exit that, had it been left to unfold without policymaker intervention, would have collapsed a substantial portion of the global financial system. But for all those ‘deflationists’ out there who believe that, under elastic, fiat currency regimes, deflationary pressures result in either monetary or price deflation, please reconsider. The evidence points to exactly the opposite: under an elastic currency regime, depressions lead to monetary and price inflation, not deflation!

I know I’m not going to make many ‘deflationist’ friends with that comment. And there are some clever ‘deflationists’ who predicted the 2008-09 crisis. But it resulted in inflation. If we are going to approach investment strategy in the right way and reach the right conclusions, the facts are a good place to start.

Let’s consider now how the natural deflationary pressure associated with the 2008-09 crisis resulted in monetary and price inflation instead. As seen in the charts, as the crisis unfolded, the Fed expanded the monetary base. Economists, in particular Keynesians, often point out that expanding the monetary base might have little or no impact on broad money or credit growth and, hence, little or no impact on consumer prices. ‘Pushing on a string’ is a classic Keynesian metaphor. Here is another: You can lead a horse (bank) to water (liquidity) but you can’t make him drink (lend). And if banks don’t lend out some portion of their new reserves, there can be no growth in broad money aggregates or credit.

However, as shown in the charts above, US broad money growth not only didn’t decline but in fact accelerated in 2008-09. That doesn’t look much like pushing on a string (although, to be fair to the ‘deflationists’, money velocity—the ratio of broad to narrow money—declined). Credit contracted briefly but then recovered and is now rising past where it was in early 2008. That doesn’t look like pushing on a string either. Finally, the rate of consumer price inflation did decline for a time and, due to base effects, even went briefly negative. But it has since returned to a level that is more or less in line with the rate that prevailed prior to 2008-09. Once again, this does not look much like string-pushing.

So how was it that, notwithstanding the natural deflationary pressure on the economy, policymakers succeeded in preventing monetary and price deflation? Simple: They changed the rules. The Fed did not merely expand the monetary base in 2008-09. It also purchased toxic assets, guaranteed money market funds and underwrote bailouts to various financial firms and government agencies. Much of what the Fed did was borderline illegal, as per the Federal Reserve Act. Much of what the Treasury did was unprecedented (TARP, TALF, Merrill Lynch/BoA shotgun marriage, Fannie/Freddie conservatorship). Indeed, when President Obama overrode private sector contracts by executive order in the Chrysler restructuring, he became the first US president to do so since Lincoln. (And Lincoln did so amidst Civil War, when the rule book was thrown out entirely.)

Did the ‘deflationists’ see all that coming? Perhaps some did. Perhaps they felt that even these measures would not be sufficient to stem the deflationary tide. But they were. And guess what else? Policymakers have now learned a rather important lesson: If you want to prevent deflation, changing the rules is how you go about doing it.

There is thus strong evidence that, under an elastic, fiat currency regime, determined policymakers can prevent monetary and price deflation.[2] And this doesn’t merely apply to the US. Believe it or not, for all the talk of how Japan has failed to prevent deflation over the prior two decades, I would argue that, in fact, they have. Money supply growth has been positive. And the average rate of consumer price inflation in Japan over the past two decades has been… wait for it… positive 0.3%! That isn’t deflation, that is price stability, something that central bankers the world over claim to want, but seldom if ever achieve. Our friendly Martian observer, if given the opportunity to award a prize to the central bank that has come closest to achieving price stability in recent years, would quite possibly choose the much-maligned Bank of Japan.

A deflation-to-inflation roadmap to the future

Now that we have seen how, in practice, under an elastic, fiat currency regime, determined economic policymakers can prevent both money and price deflation, we need to consider how they are likely to respond to the current, building deflationary pressures associated with the apparent global economic slowdown getting underway.

First, we can assume that central banks will keep policy rates near zero. Second, we can assume that they will also continue to intervene in the bond market in various ways (eg quantitative easing or QE) to at a minimum prevent a rise in yields or more probably pull yields even lower. Third, in the event that one or more banks get into trouble, we can assume that policymakers will increase existing or provide new guarantees as required to prevent a general run on the banks. Or can we?

In the euro-area, when it comes to bank guarantees, things get more complex. As we know, there has been a run occurring on Greek banks for some time, with depositors fleeing to stronger banks elsewhere in the euro-area and also to Switzerland, placing upward pressure on the Swiss franc.

The euro-area bank run has subsequently spread to Spain, Portugal and even Italy. Given that the global economy is re-entering a downturn that fits our earlier definition of a depression, it is difficult to see what, short of guarantees, is going to stop these euro-area regional bank runs.

The problem is that the countries in question, Spain, Portugal and Italy, not only have large accumulated sovereign debt burdens but their cost of issuing new debt—to provide guarantees to their banks—is prohibitively high. As such, either the guarantees will have to come from elsewhere—Germany in particular, where borrowing costs are near record lows—or those countries will either have to allow their banks to collapse or, alternatively, leave the euro-area, re-introduce national currencies, and print these as required to guarantee bank deposits.

German policymakers are well aware of this dilemma. Some of them clearly favour providing some form of euro-wide bank guarantee in order to hold the euro-area together. Others are not in favour. No one knows what Germany will do.

‘Deflationists’ claim that what is happening in the euro-area is deflationary. After all, bank runs imply a contraction in the money supply. Unless Germany chooses to provide guarantees, it is claimed, there is no stopping the deflation. Right? Wrong.

If Germany stands aside and allows the regional bank runs to continue, then one by one, each and every euro-area country that faces a deflationary collapse is going to re-write their rule book so as to prevent deflation. The US has done it. Japan has done it. Euro-area countries can do it. The simple, historical fact of the matter is that sovereign governments with elastic fiat currencies not only can but will act as required to prevent a deflationary collapse of their banks. And yes, this applies even to Germany, although in my opinion they will act only to save German banks from collapse, not euro-area banks in general. (This is not to imply that Germany won’t suffer massive economic pain in the event that much of the euro-area financial system melts down. Of course Germany will. And the Germans know it.)

Of course there is no free lunch. The cost of rescuing insolvent banks by printing money and providing guarantees is a sharp currency devaluation and the associated price inflation. Taking Greece as an example, economists calculate that, if Greece re-introduces the drachma, it will summarily devalue versus the euro by as much as 80%.

If Portugal re-introduces the escudo, perhaps it devalues by 60%. If Spain re-introduces the peseta, perhaps it drops by 40%. If Italy the lira, perhaps 30%. I don’t know. No one knows. But I tell you this: those currencies will all decline dramatically. Banks outside those countries will take massive hits and in many cases become insolvent and require guarantees of their own. (French, German and the larger UK banks are no doubt in the front line here.)

This implies that the pressure to provide guarantees and devalue is going to spread not only to Germany and France but also outside the euro-area. Don’t think for one moment that large US banks are not exposed. This crisis is no more confined to Europe than the US subprime crisis was ‘contained’ within the US financial system. It will spread to the US and by extension essentially everywhere.

As the deflationary pressures emanating from the euro-area spread around the world they will reinforce deflationary pressures elsewhere and trigger massive, inflationary policy responses. Let’s not forget the crisis in US state and municipal finances which continues to get worse. How about the fact that the UK is already back in recession? That the Chinese, Indian and Brazilian economies are slowing rapidly and may also enter outright recession at some point? That Australia is a bubble waiting to pop, and it surely will if most of its major trading partners continue to slow?

Before this is over, every affected country around the world will re-write their policymaking rule book as required to prevent a general monetary and price deflation. How can I be so certain? Because the economic and financial linkages are demonstrably so large and there is not a single country out there on the gold standard, unable to devalue.

In many cases, preventing deflation will be straightforward: Just devalue versus your larger trading partners. But as we move from the relatively smaller to larger economies around the world, it gets rather more complicated. How do you devalue versus an economy that is devaluing versus you? What about the US, the largest economy in the world and the issuer of the primary reserve currency? Now how is that going to work?

Well, as it happens, the US has the biggest arrow in the devaluation quiver. The very fact that the dollar is the world’s primary reserve currency makes it easier for the US to devalue. Why? Because the world is overweight US assets and the US is underweight global assets. This is what happens when the issuer of the reserve currency runs a large, chronic trade deficit with the rest of the world.

Indeed, this is what happened on a smaller scale in the late 1960s/early 1970s, back when the Bretton Woods system of fixed exchange rates around a dollar gold standard was in place. The US moved from surplus into deficit and the rest of the world accumulated US assets. However, as one country after another chose to cash in their US assets for gold, the US eventually suspended gold convertibility in August 1971. The dollar subsequently declined.

The relatively more competitive economies of the day, including Germany, were willing to allow their currencies to rise versus the dollar. But most resisted currency strength to some extent by holding interest rates down and/or printing money. As a result, with most countries seeking to limit currency strength, they found they were not, for the most part, devaluing against each other. Rather, they were devaluing versus things. Versus commodities.

The price of gold rose. So did that of oil. So did that of food, clothing and shelter generally. There was no deflation. Money supply growth was positive. So was credit growth. World stock markets generally moved higher due to the inflation but commodity prices rose by far more. History is about to repeat, only on a far larger scale.

The inflationary endgame

I don’t for one moment deny the deflationary pressures building around the world. They are massive. They are pulling down asset and commodity prices. They are going to wipe out a material portion of the world’s accumulated real wealth over the coming few years. But these deflationary pressures will, in one country after another, trigger even more massive inflationary policy responses. As in 2008-09, these responses will be effective. They will prevent material monetary and price deflation and in most countries trigger monetary, commodity and general consumer price inflation. A key lesson of the Great Depression is that, under a gold standard, depressions are deflationary. A key lesson of the Second Great Depression—as the current one will be referred to in the history books—is that, under an elastic, fiat currency standard, depressions are inflationary. Investors who have already learned this lesson have a clear advantage over their ‘deflationist’ counterparts and either already have or are preparing to position themselves accordingly.

This is not a suggestion that now is the time to go ‘all-in’ and bet the farm on the inflationary endgame. I do not know when, where or in what form policymakers will take the next inflationary step. Perhaps Germany will blink. Perhaps the US Fed will lose patience with Germany and extend a lifeline directly to distressed European banks. (Think I’m crazy? Guess what those cross-border ‘swap’ arrangements are all about.) Perhaps China will decide to start buying distressed euro bank debt. But absent a return to the gold standard, the banks will not be allowed to fail. And there will be inflation.

[1] For those who don’t recall, Secretary Geithner penned an op-ed in the Wall Street Journal back in August 2010, titled Welcome to the Recovery. I was not alone at the time in thinking this was either demonstrable ignorance or a sick joke. With Geither now expressing his desire to leave the administration, I lean toward the former view. This link to the article is here.

[2] Some readers may recall that Fed Chairman Ben Bernanke made precisely this claim in a famous speech from 2002, Deflation: Making sure ‘it’ doesn’t happen here. Well, he has now had the opportunity to put his deflation-preventing theories to the test. The link to the speech is here.

This article was previously published in The Amphora Report, Vol 3, 15 June 2012.

Of course the so called depression of late 19th century Britain and the United States was actually a time of generally RISING output and real wages (living standards).

Yes there were booms and busts – but the average person (in both the United States and in Britain) lived better in the 1890s than they had done in 1870s.

In Britain farming really was in trouble (so if one concentrates on farming and leaves out the vast majority of people who lived in town and cities) then the 1880s really were a time of rising problems.

But the United States does not really have even that excuse – the terrible 1880s were actually a period of successful COLLECTIVIST PROPAGANDA (for example the work “Looking Backward” by Francis Bellamy – the first best selling socialist work in American publishing history).

People kept people told that things were terrible and getting worse – when (in reality) things were LESS terrible than in the past and getting BETTER.

Falling prices are NOT an automatically bad thing – quite the contrary, if output is expanding (and it was) then falling prices are a healthy thing (they indicate there is not an out of control credit money bubble keeping prices up in spite of rising output.

As for now – whether prices go up or down one thing is for sure.

We will have falling output (dramatically fallng output) and falling real living standards (dramatically falling living standards).

This economic decline will not be a good thing.

Interesting article.

I’m inclined to agree that as long as central bankers exist, they will err on the side of inflation.

I noticed that your credit graph is for “Commercial and Industrial” loans. Is it a similar picture for consumer loans?

Anything Central Bankers do is “erring on the side of inflation” the whole point of having a Central Bank is to get “lower interest rates” – first for government borrowing, then for bank subsidies (the various forms of sweetheart loans and corporate welfare that is the stock-in-trade of Central Banks and their supporters such as the Economist magazine and the rest of the international “liberal” elite).

If Central Banks did not do this (i.e. engage in credit money expansion for the benefit of governments, banks and other politically connected enterprises) there would be no reason for them to exist.

And when the credit-money bubble (whose creation was backed by Central Bankers – such as Benjamin Strong in the 1920s or Alan Greenspan in recent years) finally bursts?

The establishment economists (followers of Irving Fisher and Milton Friedman as well as J.M. Keynes) scream for the Central Banks to increase “narrow money” in order to prop up the bank “broad money” (i.e. the bank credit bubble – the “money” that has been lent out but that was NOT REAL SAVINGS).

Otherwise there will be a terrible “deflation” and the “collapse of the financial system and the economy”.

And how did this credit-money bubble (this “boom” which inevitablly leads to a bust) get formed in the first place?

Shut up! Do not ask such questions! That is, de facto, the response one gets.

Establishment “economics” (Chicago as well as Cambridge) is not really economics at all – it is a mixture of government (and corporate welfare) self interest, and magical hocus pocus.

Want to have “cheap money”? Want to have loans at a cheaper rate of interest than greedy real savers would demand? We have the way – just trust us! That is the message of establishment “economics” and its media defenders.

If it were not about to destroy the world (at least the world as we have known it) it would acually be amusing.

@Paul Marks Utterly True

Mr Blackwell, I hope that people remember the errors that have been (and are being) committed in our time.

Clearly remember the errors (understand them) – so that the errors are not repeated in the future.

Alas many people are spending a lot of time and effort to try and make sure that the population do NOT understand what has been done (and is being done).

Hence I am filled with both rage and despair. Both emotions a human being should resist.