The LIBOR scandal has been hogging headlines of late, with questions raised again about the extent to which big banks are now a law unto themselves; the focus on Barclays obscures the fact that other banks are likely to be found guilty of the same offence. The practice has been going on seemingly since at least 2005. The scandal has not only attracted fines, but it exposes the banks concerned to customer refunds and civil actions of amounts potentially in multiples of their core capital.

It lends support to the view that banks have lost sight of their responsibilities to their customers. This was the inevitable outcome of London’s “big bang” in the early 1980s, when the banks muscled in on securities-trading and derivative markets. The reason the rot started in London was that the Glass-Steagall Act restricted the ability of commercial banks to mix investment and banking activities in the US, so Wall Street was ready to “move” to London. The Conservative government in the UK took the hint and forced the London Stock Exchange to open up its membership to banks.

Self-regulation for securities was thrown out of the window and replaced by state regulation. Banking continued to be regulated by the Bank of England until Tony Blair’s Labour government passed that function to the Financial Services Authority, which by then was regulating securities and insurance. The justification for state control of financial services is and always was the protection of the public. The reality has been a devil’s pact, with state interests being traded for benefits for the banks. The state has been funded, and the banks have become rich. The idea that this can have been achieved without market manipulation by both parties working together is simply naïve.

Manipulating central banks are actually the worst offenders, usually depressing interest rates hundreds of basis points below where they would otherwise be, and by contrast anything commercial banks do on their own is small beer. The deliberate mispricing of the cost of borrowing is after all necessary to generate demand for money and credit. All interest rate manipulation has winners and losers, and the idea that agents of the state can manipulate rates without having a moral case to answer is no more than a statist point of view.

The importance of the LIBOR problem is it forces people to reflect more on the nature of modern banking: many were already forming the view that it is thoroughly rotten. By all accounts, Barclays, which has now lost key executives, was not the greatest sinner. We are left wondering how many more senior bankers at other banks will be removed from office, and who in their right mind will replace them. The attraction of being an executive director of a large commercial bank has always been about power; the power has now gone and there are other ways of wielding financial muscle out of the limelight.

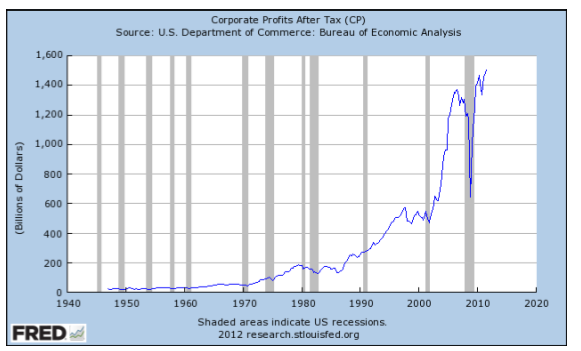

The likely result of LIBOR-gate is that banking itself is in decline. Bureaucracy is driving out talent and banks are becoming less profitable. The British Government, which is dependent on the banking system for funding and underwrites the whole system, will be the ultimate loser.

This article was previously published at GoldMoney.com.

Sorry, guys, but did you mean to say that the manipulation by the government – often private central banks actually – was done AS WELL as by the private capitalist bankers who actually control all money issuance and make a gain from the cost-of-money manipulations?

And did you accidentally overlook all of that private, greed-driven manipulation by those private bankers in order to groundlessly blame government regulation for the decline of banking?

Some things are pretty funny up here.

Thanks.

Hey Joe: Do you not see the contradiction in your first sentence? “Private central banks?”

Reply to George

Thanks for the heads-up on the contradiction in my first – rather long – sentence.

I think my error must be in trying to make a distinction between the private central bankers (the ‘guys’ who own the stock of the myriad of private central bankcorporations) and the other private bankcorporations that also ran the interest rate scam.

I think you’re right.

They are cut from exactly the same cloth.

So, no distinction there.

My bad.

And then, there are the publicly-owned stock corporations that also serve as central banks, the sort of quasi-public central banks.

Oh, and thanks George for helping me discover tonight the

http://www.publiccentralbank.com website.

I’m curious enough to go spend a few minutes over there.

Or, did you mean some other contradiction?

Thanks.