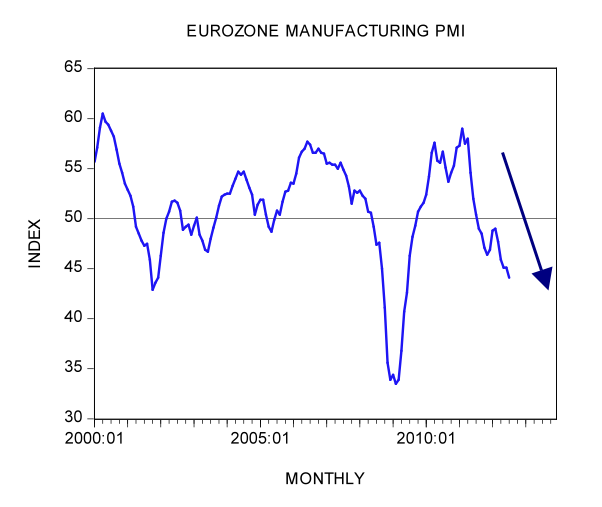

Recently we have noticed that many more commentators and various important experts have been advocating aggressive monetary pumping by the European Central Bank to fix the economic crisis. Latest Euro-zone economic data continues to display weakness. The IFO institute German business climate index fell to 103.3 in July from 105.2 in June and 113 in July last year. Manufacturing activity as depicted by the Euro-zone purchasing management index (PMI) fell to 44.1 in July from 45.1 in the month before and 50.4 in July last year.

In the July 20, 2012 edition of the International Herald Tribune a columnist Anatole Kaletsky wondered why it is that Britain, Japan and the United States, despite their huge debts and other economic problems, have not succumbed to the financial crises that are threatening national bankruptcy in Greece, Italy and Spain?

According to Kaletsky the ability to print money has allowed the British, Japanese and US governments to run whatever deficits they wanted and to offer their banks unlimited support without suffering the sky-high interest rates that are driving Greece, Italy and Spain toward bankruptcy. Kaletsky then argues that in some circumstances, the financing of deficits by central banks can be extremely dangerous because it can cause rapid inflation. However at present he holds,

The world today is not threatened by inflation and overspending, as it was in the 1970’s and 1980’s. Instead, the danger is generally thought to be deflation caused by inadequate investment, weak consumer spending and falling wages, as in the 1930’s.

Hence concludes Kaletsky

A policy of money printing that would rightly have been denounced as counterproductive and irresponsible 40 years ago is now both necessary and prudent.

Kaletsky is of the view that if the ECB were to follow this advice, the euro crisis would soon be resolved. He warns that failing to lift the money printer will sink the Eurozone further.

Mr Kaletsky is in a supposedly good company here, on Wednesday 18 of July 2012 the International Monetary Fund issued a report publicly urging the European Central Bank (ECB) to implement a sizeable program of money printing by buying government bonds in order to fix the economic crisis.

Similarly, a famous Harvard professor of economics, Martin Feldstein, in his article in the Financial Times on 24 July 2012 supports aggressive monetary pumping by the ECB.

The Harvard professor is of the view that strong monetary pumping will lead to a strong depreciation of the Euro versus other currencies, which in turn will boost the Euro-zone’s exports. This in turn will ignite overall economic activity in the Euro area, argues our professor.

The main message from various experts and various influential columnists, as one can see, is that in order to solve the euro crisis the answer is to print money.

Accepting this way of thinking, on Thursday July 26,2012 The European Central Bank (ECB) president Mario Draghi said that ECB policy makers will do whatever is needed to preserve the euro. At the Global Investment Conference in London he said,

Within our mandate the ECB is ready to do whatever it takes to preserve the euro … Believe me, it will be enough.

In short what the ECB president is telling us that he is going to loosen further the ECB’s monetary stance. This means that he could lower the ECB policy rate further – currently at 0.75% – perhaps to zero. The president might consider lifting the pace of money pumping by boosting the ECB balance sheet (buying government bonds of countries such as Italy and Spain). Note that the yearly rate of growth of the ECB balance sheet stood at 57.1% in July versus minus 2.1% in July last year.

The underlying thinking here is that with more money in the hands of individuals, spending on goods and services will go up and this, via the famous Keynesian multiplier, is going to amplify the overall production of goods and services.

Likewise, through the depreciation of the Euro, the increase in the demand for exports will set in motion an overall increase in the production of goods and services in the Euro-zone.

What we have here is the view that demand triggers supply, i.e. the production of goods and services. At present it is held that the demand is somewhat scarce and prevents the emergence of economic prosperity.

In this way of thinking, if individuals are reluctant to increase their demand for goods and services then the government and the central bank must step in to boost demand in order to revive the economy – note that in this way of thinking spending by one individual becomes income for another individual. Hence, the more that is spent, the greater the income becomes.

Why is this way of thinking erroneous?

It is overlooked here that without funding it is not possible to exercise any demand. For instance I have a desire for a luxurious car such as a Mercedes 600 yet my means are sufficient only to secure a bicycle. Obviously, then, it will be difficult for me to secure the Mercedes 600 without the necessary means. Contrary to popular thinking, means are not something that can be printed, they have to be produced.

For instance, if a baker wants to secure apples he has to produce and save enough bread for this. Let us say that to secure 1 kilogram of apples the baker must have at his disposal 8 loaves of bread. (Let us say he has produced 10 loaves, consumed 2 loaves, and saved 8 loaves).

If he wants to secure a car he might need to have 100 loaves of bread for that. If, however, he can only produce 10 loaves then he would have difficulty to purchase the car.

To be able to do so he would need to invest his saved bread in the upgrading of his oven. He would have to pay the oven maker his saved bread. With a better oven he is now in the position to lift the production of bread. This will enable the baker to save more and secure goods that previously he couldn’t afford.

Note that what made it possible is real savings, i.e. saved bread that enabled the baker to boost the production of bread. Also note that if the baker would only increase his demand whilst his savings is still 8 loaves of bread, it will not result in an increase in the production of bread.

Similarly if the central bank was to print money it cannot boost the production of goods without previous investment in the infrastructure. The printing of money would only boost demand, which is not supported by a previous production of real wealth, i.e. final goods and services.

Likewise, a depreciation of the currency in response to monetary pumping will lead temporarily to a boost in exports by diverting real funding from other activities. However, over time this will make things much worse. (To accommodate the increase in foreign demand one must have the infrastructure for that).

One could of course argue that currently in the Eurozone there are plenty of idle resources, which could be employed. It is overlooked here that the employment of so-called idle resources requires real funding. If the current infrastructure is not capable of generating a sufficient amount of real funding it will be impossible to accommodate an increase in the demand for goods and services. (Note that resources are made idle in the first instance on account of policies that resulted in the misallocation of resources and the depletion of the pool of real funding).

Contrary to popular thinking, printing money cannot replace non-existent real funding. Money is just a medium of exchange; it is not the means of real payment. Individuals are paying for goods with other goods; all that money does here is to facilitate the payment of one good for another good.

Consequently, printing more money doesn’t generate more real funding but rather leads to an exchange of nothing for something, i.e. to the depletion of the pool of real funding. It leads to a diversion of real funding from those individuals that have contributed to the pool of real wealth to those who made no contribution whatsoever.

So how then can the Euro-zone crisis be solved?

We suggest that this has to be done through an increase, as much as possible, of the pool of real funding – the increase in this pool is the key to the increase in overall wealth and hence in the increase in the well being of individuals.

This means that what is required here is to seal off all the channels that undermine the formation of real funding and hence real wealth.

We hold that the key channels that weaken this formation are government outlays and the central bank’s loose monetary policies.

This means that one needs to seal off all the loopholes of monetary pumping and to cut government outlays to the bone. Observe that cutting government outlays makes it possible to lower all sort of taxes on individuals.

This enlarges the amount of scarce funding in the hands of the private sector. (Note that the focus should be on cutting government outlays and not on cutting the deficit as such). As a result of this more real funding will now be in the hands of wealth generators, which we suggest will get things going in no time.

It must be understood that no central bank or government tampering with markets can make the overall “pie” bigger – all that these policies as a rule generate is a redistribution of a given “pie”. Note that over time these policies lead to a weakening in the formation of real funding and economic impoverishment.

Summary and conclusion

What is required to solve the Euro-zone crisis is to allow as soon as possible wealth generators to get on with the job of wealth creation. For this to occur the government and the central bank must reduce their interference with markets – the sooner this happens, the faster a true sustainable economic recovery will emerge.

Actually Mr A.K. has advised lower interest rates (i.e. an increase in the amount of credit money) for many years – whatever the circumstances.

When I looked at newspapers more than I do now, there was AK in the Times arguing (whatever the situation) for lower interest rates (i.e. credit bubble finance). I do not know whether it was because his employer (Rupert Murdoch) relied on debt to buy various enterprises (and therefore wanted a “cheap money” policy) or whether AK really believed this stufff – but it does not actually matter.

If a man tells you the world is flat it is not of primary importance whether he really believes the world is flat, or whether he has some corrupt reason for saying so. What is of primary importance is that the world is NOT flat.

As for this stuff…..

I see so at a time of the largest credit bubble in the history of the world, with Central Bank interest rates at basically zero, and (over on the fiscal side) out of control government spending and the biggest peace time deficits in history…..

All is well – just carry on creating money (from NOTHING) to pay for the Welfare States (now bigger than they have ever been – having gone from a few percent of GDP 50 years ago to approaching half the entire economy now, and set to grow till civil society is utterly exterminated).

All is well because the “price level” (how AK defines “inflation” is the nice dodge that Irving Fisher made popular) is not rising (even though it is – although rigged government price indexes try to hide this).

The Welfare States are perfectly sustainable no matter how big they are – because one can always print (or create by computer) more “money” to pay for them (the perfect union of monetary and fiscal policy).

And, no doubt, when the whole thing collapses AK will just (like Max Keiser – Putin’s boy is another one who thinks that any sized Welfare State can be financed) blame the bankers and demand more regulations.

I have an “anger problem” (what used to be called a short temper) and the “red mist” is rising before my eyes – so I will stop here.

Fair play to the Devil – you are missing a vital point here = Jobs. It is a Baker with a Job as a Baker that enabled him to save in the first place. In the context of the FACT that ‘they’ are not going to abandon their monetary system, print Euro to Dollar/Euro parity makes excellent short term sense. Domestically produced goods in the periphery nations will not rise in price i.e. Wine and Olive Oil .. only imported goods will. Wage inflation in the Northern Member States will create Jobs in the massively unemployed and thus penniless periphery.

As long as the USD is not backed by any real asset, yes they CAN print as they like. I’m sorry that it doesn’t fit the Austrian desires of this illustrious website – but that as they say is THAT.

The Euro will not collapse, no one will leave the Union, they will print and spend and the crisis will pass. Just like every other crisis has passed.

Again I would like to stress the integral point that is universally missed on this website = USD is what the rest of the World is denominated in. As long as it remains the de facto currency of exchange, nothing will change.

Some time ago A.Macleod wrote an article “The unseen hand” about inappropriate methods governments use to measure growth. Since entrepreneurial activity is a real indicator of economic growth.

This article also points out the argument in favor to entrepreneurial activity, instead of political activity, as a precondition for economic growth.

And the same as the previous commentator I would also bet on political activity, instead of political constraint, as a further steps to be taken to promote economic growth because in accordance with growth indicators governments use, Austrian business cycle theory growth prospects do not really fit in government models, as it has been explained by Jesus Huerta de Soto in Money, Bank Credit, and Economic Cycles, sub-chapter “National Income Accounting is inadequate to reflect the different stages in the Business cycle” and elsewhere in his book, explaining how Keynesian model puts an emphasis on political activity as an instrument to promote consumption which has the largest influence on growth figures governments use, and also explaining, also, how Friedman’s used figures “conceal nearly half of the total gross national output, which includes the value of intermediate products“.

Therefore you can’t expect politicians to follow Austrian School theories as long as government figures show that those entrepreneurs clever in using inflationary money’s short-term benefits and smart in diminishing its long term’s negative effects is exactly that market segment which is the first indicator of economic growth. Therefore those intermediate productions phases (forming production infrastructure) most severely affected by missallocation of resources as a result of excessive money supply, are not taken into consideration in growth figures.

Janis Klumel.

I agree that de Soto’s book is a classic.

He shows the three areas of knowledge one must have to write such a work.

Knowledge of history.

Knowlege of law (both Roman Law tradition and Common Law).

And knowledge of economics – i.e. economic law (so called economic theory – which is actually the iron laws of logic).

Without deep knowledge of all three of these areas, such a book would be impossible to write.