In this podcast, Brian and I discuss the difficulties in making the case for Austrian economics, the difficulties in reading the case for Austrian economics, the importance of the term “Austrianism”, how things are going and how best to deal with socialists (answer: agree on the problem: disagree on the solution).

We also manage to get into a bit of a pickle over whether TARP and the Stimulus were Keynesian or Monetarist. If there are members of the commentariat who could enlighten us we would be grateful.

Here is a link to Brian’s piece on the importance of being Number Two.

Subscribe to our podcast via the icon below:

The music featured in this podcast is from Kopeika, by et_.

The thing is that modern “Montaristism” (the modern Chicago School – as opposed to the old pre World War II Chicago School of economic thought) shares many of the assumptions of “Keynesianism”.

After all it was Milton Friedman who said that, in the face of a major economic slump, the government could always “throw money from helecopters”.

M.F. was not being ironic – he was not trying to show the absurdity of “modern economics” (with its fallacy of “effective demand” and so on), he actually meant it.

It was also Milton Friedman who declared Irving Fisher the “greatest American economist” of the 20th century.

Who was Irving Fisher?

Irving Fisher (of Yale – not Chicago) was a man who argued that “inflation” was not a rise in the money supply (the defintion before his time) but was a “rise in the price level”.

This “price level” to be determined by a government “price index”. And an increase in the money supply is to be declared O.K. as long as the price index does not show rises over time.

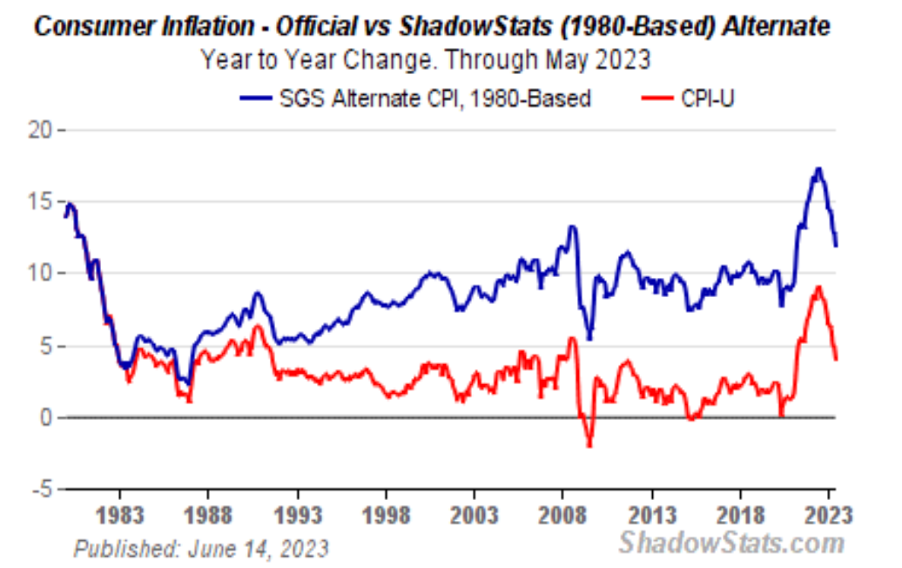

Now no comments about how rigged these government indexes (for price rises, or unemployment or….) are in places like Argentina or the United States – let us make the heroic assumption that government is honest.

Irving Fisher’s economics still does not work. For an increase in the money supply intended to produce a “boom” (i.e. increase lending at interest rates lower than real savers would demand for their money) will indeed produce this “boom” – but it will also produce a BUST.

The bust bit always came as a shock to Fisher.

The bust of 1921 came as a terrible shock to him – whereas it was just what Austrian School economists were waiting for.

The same was true in 1929 – to Irving Fisher the economy was doing fine, even after the crash he kept predicting the economy would carry on the boom.

And the Alan Greenspan of the 1920s – Benjamin Strong of the New York Federal Reserve.

To Milton Friedman this hopeless man (see Anderson’s “Economics and the Public Welfare” about him – bu the way, in many ways Anderson is a moderate) was wonderful – he produced a wonderful boom with people getting better off and …

Miltin Friedman was a great man – for example his life long campaign against the corrupt folly of “occupational licensing” deserves the highest praise. As does his campaign against high taxes and government spending, and against regulation generally.

But on monetary policy he was, at least for most of his life, no good. Never understanding that it is the credit bubble “boom” that INEVITABLY leads to the bust – and demanding hair-of-the-dog policies of monetary expansion in the face of any credit money (“broad money”) bust.

He was also NOT “empirical”.

Who predicted the bust of 1921 and that of 1929?

The Austrian School.

Who was totally shocked by both?

Irving Fisher.

Yet, to Friedman, the Austrians were wrong – and it was Fisher who was the great economist.

That is not being “empirical”.

Sorry people – but there are no short cuts to long term prosperty.

Whether banks or governments try to lend out more money than REAL SAVERS would it will produce, in the end, bad consequenes.

Nor does people spending more (“increasing effective demand”) mean that people will get more wealthy (that is putting the cart before the horse).

Unless economics gets back to such things as “Say’s Law” (supported by such people as W.H. Hutt as well the Austrian School) then there is no hope for the subject – at least not the version of economics that is taught in most schools and universities.