Yet another book bemoaning the credit binge – and wondering what to do about it – has hit my desk. Richard Duncan’s effort, The New Depression: The Breakdown of the Paper Money Economy, is a book that contains a fascinating and powerful diagnosis of how we got to our current pass. But in his understandable enthusiasm to show how to head off disaster, he makes an astonishing proposal at the end that made my jaw drop.

This 179-page book, published by John Wiley & Sons, lays out statistics so eye-wateringly shocking that make the book worthwhile on those grounds alone. There are lots of tables and charts which ram home just how leveraged the Western economy has become. Take this item as early as page 2:

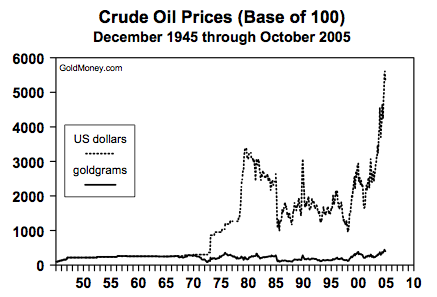

It is immediately apparent that credit expanded dramatically both in absolute terms and relative to gold in the banking system and to the money supply. In 1968, the ratio of credit to gold was 128 times and the ratio of credit to the money supply was 2.4 times. By 2007, those ratios had expanded to more than 4,000 times and 6.6 times, respectively. Notice, also, the extraordinary expansion of the ratio of credit to GDP. In 1968, credit exceeded GDP by 1.5 times. In 2007, the amount of credit in the economy had grown to 3.4 times total economic output.

Duncan blames a number of factors for the West’s credit hangover: central bank hubris (foreign as well as domestic), fractional reserve banking and reduced reserve ratios; the severance of a link between money and gold (a theme I have written about before); high public spending, and some – not all – financial deregulation. While I might quibble with some of the finer details, Duncan is undoubtedly effective in putting across the facts. I like his chapter (4) where he says monetarists such as the late Milton Friedman made the mistake of not taking sufficient account of credit when they sought to explain the impact of money supply growth in an economy. For as Duncan says, under modern fractional banking, and the disintermediation of banks from financial transactions, there is little difference these days between credit and money.

For example (page 57):

Meanwhile, because of financial innovation, credit has become more like money. Most credit instruments have long met the three criteria that define money. They can serve as a medium of exchange, they are a store of value, and they are a unit of account. In the past, however, they were not liquid. Now they are.

Anyway, as the book proceeds to the various ghastly scenarios (depression, stagnation, high inflation), Duncan states (page 133): “the economic process itself is no longer driven by saving and investment. Instead, it is driven by borrowing and consumption”. It is hard to argue with that, given the foregoing.

But then he recites the argument, which has also been stated by the likes of Paul Krugman, that events such as the Second World War and the enormous expansion of state power and spending associated with them, helped end the Great Depression of the 1930s. (This ignores the fact that in 1920-21, in the aftermath of the First World War, there was a brief, sharp recession and equally sharp recovery with no state-led stimulus.) In other words, Duncan is sceptical about the idea that, as suggested by the late “Austrian” economist Murray Rothbard, we could have resolved the credit bubble of the 1920s and subsequent crash by letting prices find their own level without state intervention. And so we get to this idea of Duncan’s: a massive US government programme to invest in solar power on the same sort of scale of ambition as the old space programme of the 1960s. Oh boy.

Consider:

The government could cap its spending on current programmes and spend more, instead, on investment programmes that could be made to quickly to pay for themselves.

First of all, it would surely require far more than a cap on current spending to make room for investment on whatever “investments” Duncan has in mind. We would need serious cuts, including a willingness to touch the controversial areas of Social Security and Medicare (and their non-US versions). In the US, the country has already had a “stimulus” programme of almost $900 billion, and controversial energy projects such as the failed Solyndra project, to show for it. Government-led “investments”, as even the least cynical observer of such things could show, often deliver poor rates of return. If an investment is worthwhile, then why not let private entrepreneurs and investors engage in it with their own money? The 1960s space programme, for example, certainly achieved great things, but it is questionable whether it helped re-boot the US economy. It may even have derailed it from more useful long-term projects.

Nevertheless, despite my concerns that Duncan is groping for a statist, big-government solution to our deranged economic world, he is to be congratulated for laying out the challenges so starkly. The days of living in a fool’s paradise of easy credit must surely be over.

This article was previously published at WealthBriefing.com. It is reproduced here with the author’s permission.

They still don’t get it. Any of them.

Reduce government spending and reduce taxes in order to promote growth, The latter is what the private sector does so well and its product is what the government spends (so badly).

This cannot be difficult to understand so I guess we must assume their vision is never to place the interests of Country ahead of Government (and the banks of course)and never to place the long term interests of the economy ahead of short term political ambition.

The “prosperity” of World War II was a myth.

Capital consumption (eating seed corn – as it were) is not a good form of “prosperity” and the figures are largely fake anyway.

As Robert Higgs (and others) have pointed out, govermment figures work on the assumption that offical prices are real prices – actually “Black Market” prices are the real prices.

Once that is factored in, World War II living standards (including in the United States) are shown to be much lower.

Mass unemployment vanished in World War II because of real wage rate reductions – what had happened in every credit-money bubble bust in the United States, from 1819 to 1921, but had not been ALLOWED to happen in the 1930s (due to the devotion of both President Roosvelt and President Herbert “The Forgotten Progressive” Hoover, to the “demand” fallacy).

As for “deregulation” causing the expansion of credit-money in the years running up to 2008.

Errr this rather leaves out the role of Alan Greenspan – who “saved the world” (i.e. saved the credit-money bubble) again and again, year after year, each time by making it BIGGER.

Those who actually want to know what happened (either specifically in the GOVERNMENT INTERVENTION DOMINATED housing market, or in the economy generally) in the United States would do well to read “Housing; Boom and Bust” by Thomas Sowell, and “Meltdown” by Thomas Woods.

Neither “deregulation” or lost Atlantis communicating via Fairy Rings, had much to do with anything.

As for the idea of government spending even more money.

The Federal government of the United States has a an offical debt of more than 16 trillion (trillion) Dollars – its unfunded obligations are vastly greater than that.

And it is borrowing about a trillion (trillion) a year.

Someone who suggests spending more is……

Well – is misguided.