Some of the dust from Ben Bernanke’s “QE3” announcement on 13 September has settled. The Federal Reserve is now committed to spending $40 billion a month on agency mortgage-backed securities – an open-ended plan. It is also extending extremely low interest rates (together zero interest rate policy and Operation Twist) until mid-2015 by buying an extra $45bn of longer-term securities (mostly government debt though this is not explicitly stated).

It appears there are two broad objectives: to support the housing market and therefore consumer confidence, and to finance the government deficit while locking in low long-term interest rates.

Experience tells us that the only increase in money supply finding its way into the economy is by welfare spending. The banks and also their credit-worthy customers are simply risk-averse. They either leave this money with the Fed in the form of excess reserves, or they speculate with it in capital markets. It is no accident that derivatives have expanded dramatically in recent years, and large amounts of QE money have been recycled into other more dynamic economies offering higher returns. Banks think they do better by not lending money to cash-strapped Americans and their businesses.

The financial system is now going to have up to $2.3 trillion in cash added to it by mid-2015. If the economy is reluctant to absorb this extra money, where will it go? Derivatives are already a mature game, and the more dynamic economies are slowing down. And so long as capital asset prices continue to exceed their productive value, it won’t go into the economy except by way of government spending. It is not just the Fed printing money: all the other major central banks are similarly expanding their money quantities.

This extra money will be an embarrassment for banks everywhere: what will they do with it? The search for good non-cyclical returns is on, and two possibilities stand out: one for the traders, which is agricultural commodities and energy; and one for treasury departments, which is gold.

It will not have escaped the notice of bank traders that demand and prices for grains, and therefore the whole agricultural complex, is increasing, the result of growing populations in Asia and Latin America with rising life-style expectations. Similarly, energy demand is certain to increase during the northern hemisphere’s winter, leading to higher fuel prices. And if bank traders funnel just some of the Fed’s QE into these avenues, the price rises should be dramatic, the more so as the trend gathers pace.

Gold will catch the attention of bank treasury officers, because of the impending changes in Basel III rules that upgrade gold to the equivalent of cash for balance sheet purposes. At the moment few banks other than the 40 or so bullion banks have any gold on their balance sheets, a situation that can only lead to a significant new source of buying for the metal.

The effect on the price should be dramatic, coinciding with rising fuel and food prices. And remember that banks are trend-chasers, always pushing prices well beyond reasonable levels.

After Helicopter Ben’s latest antics the only argument I can see for holding Dollars goes as follows….

“Mitt Romeny is going to win – and he has pledged to fire Helicopter Ben”.

But that is a rather high risk position to take.

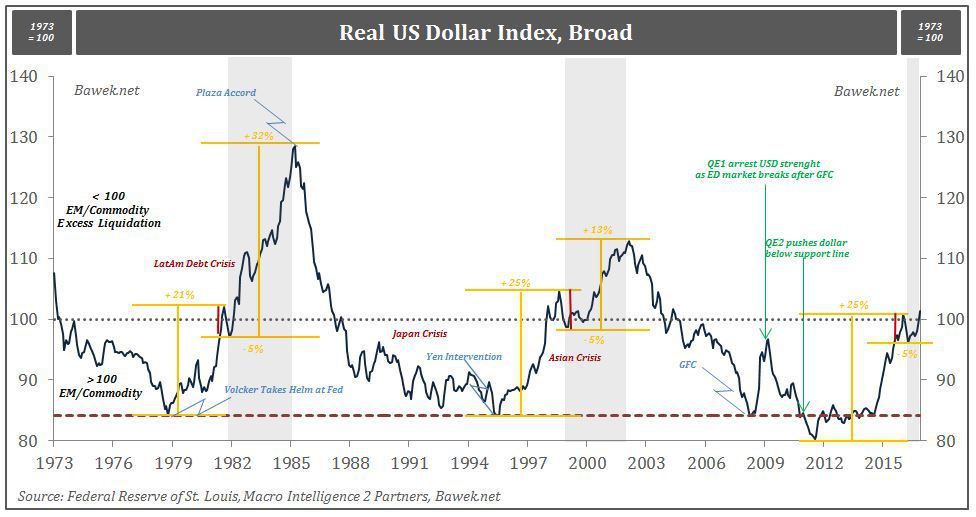

It assumes that Romney is going to win (what evidence is there for that?) and that he will be willing (and able) to get rid of Helecopter Ben – and will replace him with someone who will tighten the money supply (as Paul Volker did in the early 1980s).

If does not believe the above argument one should dump the Dollar. Indeed dump all fiat currencies – as the Pound, Euro (and so on) are all in the hands of people with a similar ideology to tht of Helicopter Ben.

That makes commodities (that can be used as money) very attractive – regardless of how “expensive” they presently are.

Food is vital for life – but it is hard to see how it can be used as money. So there are limits on it.

That points to such things as gold – physical gold (bought for cash – and for the long term), not the complex game playing with margins and mineing shares (and …..) that some people would suggest.

“You Austrian types are always into broad theory – give me a specific prediction”.

O.K. – if Obama wins on November 6th the Dollar will crash (as people dump it) and gold will go up (regardless of how “expensive” it is).